Drazen Zigic/iStock via Getty Images

Investment Thesis

When investing with a long-term horizon and aiming to select companies for your retirement portfolio, there are a huge number of figures to take into account. In this article, I have selected what I believe to be the 10 most important attributes you should examine before deciding to add a company to your investment portfolio for retirement.

To be eligible for your portfolio, companies should fulfil as many of the following characteristics as possible:

- Strong brand image

- Strong competitive advantages over its competitors

- High economic moat

- Relatively high market capitalization

- Relatively low dividend payout ratio

- Relatively high expected dividend growth rate

- Strong financials

- Relatively high free cash flow yield

- High profitability

- Attractive valuation.

Strong Brand Image

A strong brand image is an important characteristic of a company: it provides a significant competitive advantage. A strong brand image provides pricing power, which is important in times of high inflation, since it enables the company to pass on the higher costs to its customers. Furthermore, a strong brand image is usually associated with higher customer loyalty. As a result, the company’s future revenues and profits are more predictable compared to one with a weak brand image. Due to the fact that more accurate forecasts can be made for the company’s revenue and profit, you increase the probability of making a successful investment decision.

Strong Competitive Advantages over its Competitors

Strong competitive advantages over its competitors will help a company to stand out against their competitors in the long term. In the event that a company does not have competitive advantages, there is a greater risk of future bankruptcy. Identifying these advantages is crucial when analyzing companies and you should be aware of one or several competitive advantage(s) before making any investment decision. Competitive advantages can result from various factors, such as a strong brand image, cost advantages, special know-how, strong pricing power, a strong distribution network, etc.

High Economic Moat

The term economic moat refers to a sustainable competitive advantage that a company has over its competitors. It can be the result of a strong brand image, high switching costs, using a unique technology, having a wide and unique distribution network, or possessing economies of scale, etc. A high economic moat is very important for a company to maintain its competitive advantages over the long-term. By identifying companies with a high economic moat, you are increasing your chances of making a successful long-term investment decision.

Relatively High Market Capitalization

Companies with a higher market capitalization tend to be considered as less risky investments. This is because they usually have a more established competitive position as compared to companies with a lower market capitalization that are still in the initial growth phase. The market capitalization of a company is calculated by multiplying the stock’s current price by the total number of outstanding shares. Companies with a market capitalization higher than $10 billion are considered large-cap companies, between $3 billion and $10 billion is mid-cap and $3 billion or less is small-cap. Due to the fact it tends to be easier to calculate the revenue and profit forecasts of companies with a higher market capitalization (because they have a more established competitive position and the revenue growth and profit growth is more predictable), I would significantly overweight the large-cap stocks in comparison to mid-cap or small-cap when building an investment portfolio for retirement. In my opinion, doing so increases the probability of making successful investments over the long term.

Relatively Low Dividend Payout Ratio

The dividend payout ratio is another important figure when selecting companies to build your retirement portfolio: This is due to the fact that a company with a lower dividend payout ratio has more scope to increase its dividend over the long term. Furthermore, the lower the dividend payout ratio, the lower the probability of a dividend cut in the near future. For these reasons, a low dividend payout ratio is important, especially in the case that dividend income will represent a significant portion of your retirement income.

Relatively High Dividend Growth Rate

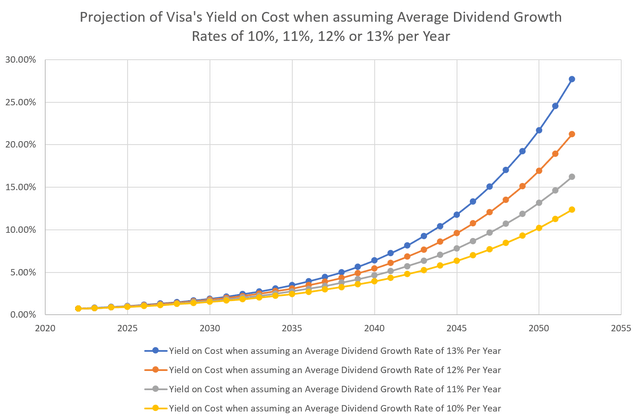

A high expected dividend growth rate for a company will contribute to achieving a higher yield on cost while having a long holding period. The yield on cost is a measure of dividend yield calculated by dividing a stock’s current dividend by the price that was paid for that stock. As an example, below you can find the yield on cost when investing in Visa (NYSE:V) at its current stock price. You can find different scenarios in order to see how you would benefit from investing in the company when assuming different dividend growth rates of 10%, 11%, 12% or 13% per year.

There are several figures which could indicate that a company could be able to show a high future dividend growth rate. One is the average dividend growth rate of the last 5 years. Another one, for example, is the average EPS diluted growth rate of the last 5 years.

Strong Financials

Strong financials are also important when looking for stocks to add to your investment portfolio for retirement. There are various indicators that show the financial strength of a company. You can use the credit ratings of the three main credit rating agencies: Moody’s, Standard & Poor’s, and Fitch. Considering Moody’s long-term credit ratings, the highest possible rating is Aaa. According to Moody’s, companies rated with an Aaa are judged to be of the highest quality and have minimal risk. Additional measures demonstrating the financial strength of a company include: the Debt to Equity (D/E) ratio (which is calculated by a company’s total liabilities divided by its shareholder equity) or the current ratio (which measures if the company has enough resources to meet its short-term obligations).

Relatively High Free Cash Flow Yield

The free cash flow yield of a company demonstrates the amount of cash that is left over after operating expenses and capital expenditures are accounted for. The higher the free cash flow of a company, the more dividend it could be able to pay. Additionally, the company could use its free cash flow to pay down debt or invest in its growth through the acquisition of other companies. A high free cash flow could also enable the company to buy back its own shares, which would also benefit the shareholder.

High profitability

A high profitability of a company is another indicator showing the competitive position it has in comparison to its competitors. The higher the profitability, the stronger its competitive position tends to be. There are different figures showing you the profitability of a company. One of which is the EBIT margin, which is also important in times of economic crisis. A high EBIT margin helps a company to generate profits even in economically difficult times and this reduces the likelihood that it may one day go bankrupt. Another indicator is the Return on Equity (ROE). The ROE is a measure of a company’s net income divided by its shareholders’ equity. It shows how much profit a company can generate in comparison to shareholders’ equity.

Attractive Valuation

An attractive valuation of a company is also important when looking at stocks for your retirement portfolio; the intrinsic value of the company should not be significantly below the price you pay for it. In the opposite case, even investing in an excellent company could result in a relatively bad investment.

There are different valuation methods that show us, if the valuation of a company is currently attractive. One of them is the Discounted Cash Flow [DCF] Model, which is used to calculate the intrinsic value of a company. Furthermore, there are different Relative Valuation Models, such as the P/E ratio. In order to see if the company is undervalued or overvalued, its current P/E ratio can be compared with the average P/E ratio of the last 5 Years. Additionally, it can be compared with the P/E ratio of the sector median. If the current P/E ratio is lower, it can be interpreted as an indicator that the company is currently undervalued.

Conclusion

Of course, there are more characteristics to consider when building your investment portfolio for retirement. But if you take into account the 10 company attributes and figures mentioned, I believe you’ll have a promising basis in order to analyze and successfully select companies.

Be the first to comment