designer491

Pfizer (NYSE:NYSE:PFE) is one of the largest pharmaceutical companies that continues to increase its share of the COVID-19 treatment market. Seizing the momentum, the company continues to reinvest the revenue from the sales of the COVID-19 portfolio into the acquisition of drug development and commercialization assets aimed at improving the quality of life of millions of patients around the world. While AbbVie (NYSE:NYSE:ABBV) maintains its leadership position in the treatment of inflammatory diseases, it aims to offset the future decline in Humira sales by switching patients to more effective drugs and accelerating developments in the oncology portfolio. AbbVie and Pfizer have a strong portfolio of product candidates, high business margins above the average for the pharmaceutical industry, and growing revenues, amid market weakness, making both companies candidates to be considered by investors with a long-term investment strategy. However, I believe only one of these companies has great potential in the long term and will be able to show a more significant increase in share prices in the next five years.

Financial position of AbbVie vs. Pfizer

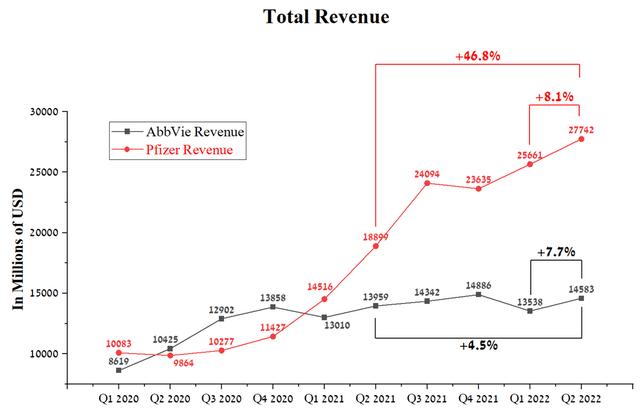

AbbVie’s revenue was $14,583 million in Q2 2022, up 7.7% QoQ. At the same time, Pfizer showed similar dynamics, which earned $27,742 million in Q2 2022, showing an increase of 8.1% compared to Q1 2022.

Source: Author’s elaboration, based on Seeking Alpha

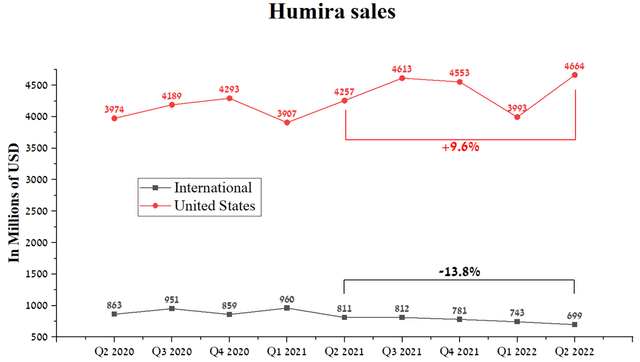

On an annualized basis, Pfizer is ahead in terms of revenue growth, which was 46.8% compared to AbbVie’s 4.5% increase. Pfizer was able to achieve this through multi-billion dollar sales of a COVID-19 vaccine and antiviral drug. But with an eye to the future, I expect the sales of these products to slow down as the coronavirus moves from pandemic to endemic. While for AbbVie, the limiting factor that slows down a more significant increase in revenue is the sale of Humira biosimilars in Europe, and already in mid-2023 they will be available for sale in the United States. Realizing this, the company is trying to move Humira patients to two more effective drugs, namely Skyrizi and Rinvoq, which, like Humira, are used to treat certain inflammatory diseases in adults.

Source: Author’s elaboration, based on quarterly securities reports

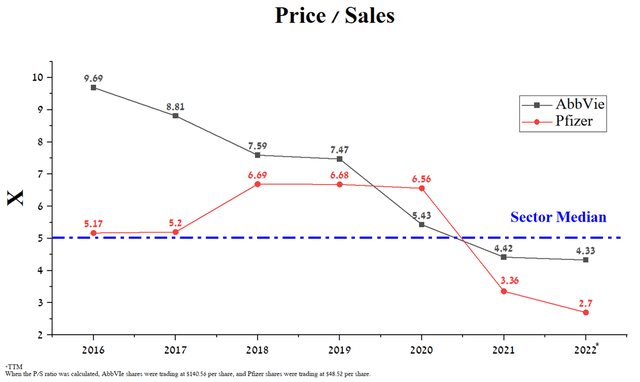

The price/sales ratio of both companies is lower than the average value for the healthcare sector, which indicates that they are undervalued by Wall Street. Currently, Pfizer’s ratio is 2.7x, which is 37.6% lower than AbbVie’s, showing that Pfizer is an even more undervalued asset in the pharmaceutical industry.

Source: Author’s elaboration, based on Seeking Alpha

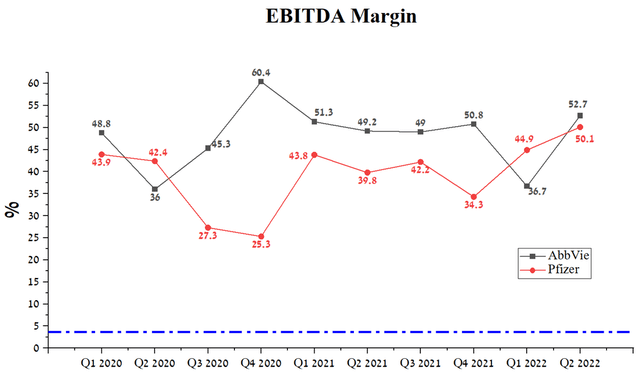

The EBITDA margin of both companies is at a significantly higher level relative to competitors, which indicates the ability of the management of AbbVie and Pfizer to effectively manage the business in times of military conflict in Eastern Europe, rising inflation, and the introduction of restrictive measures in China amid an increase in COVID-19 cases.

Source: Author’s elaboration, based on Seeking Alpha

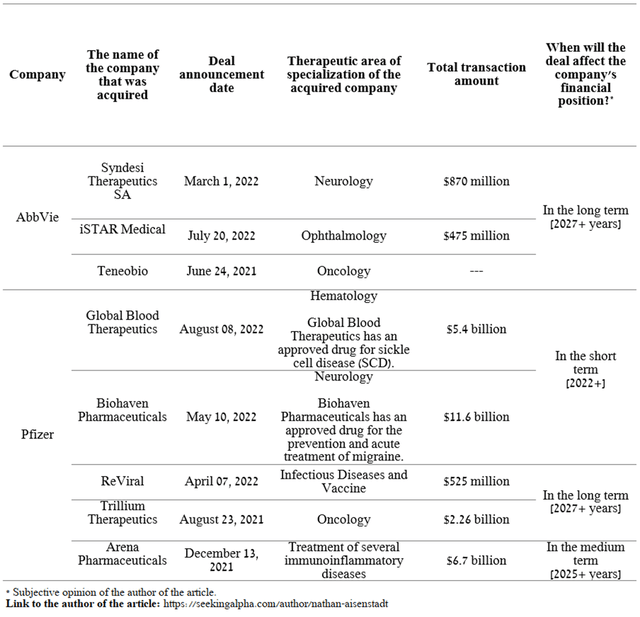

The favorable dynamics of EBITDA growth contribute to the aggressive policy of M&A and R&A transactions necessary to increase the share of companies in the most promising therapeutic areas. So over the past year, Pfizer and AbbVie have acquired the following companies, some of which have approved medicines that will contribute to the growth of financial indicators.

Source: Author’s elaboration, based on quarterly securities reports

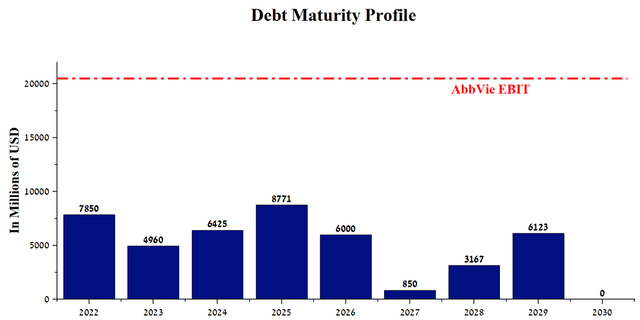

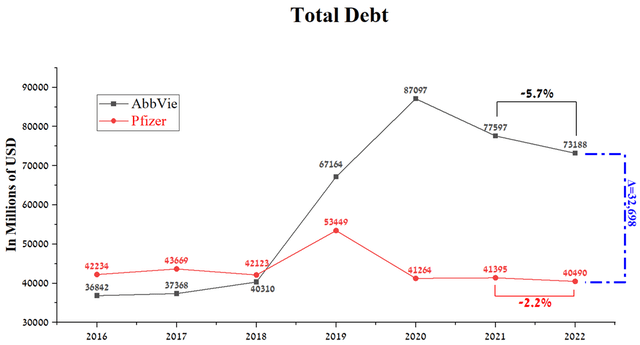

AbbVie’s total debt is about $73.2 billion, and the main reason for this large amount is financing the $63 billion acquisition of Allergan through loans and issuance of senior bonds during the 2019-2020 period. At the same time, the company’s Total/EBITDA ratio was equal to 2.69x, and given that the amount of redemptions on senior bonds is significantly lower than EBIT, I do not see any risks with AbbVie’s debt servicing.

Source: Author’s elaboration, based on quarterly securities reports

Pfizer’s total debt is about $40.5 billion at the end of Q2 2022, down 2.2% from 2021. However, the difference in total debt between the two companies is about $32.7 billion, and this huge difference contributes to higher investment interest in Pfizer due to lower debt service costs.

Source: Author’s elaboration, based on Seeking Alpha

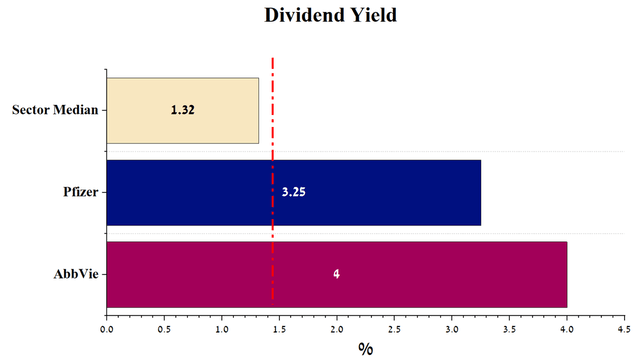

But at the same time, AbbVie is in a better position than Pfizer in terms of dividend yield. Thus, AbbVie’s dividend yield is 4%, which is slightly higher than Pfizer’s dividend yield of 3.25%. This indicator of both companies significantly exceeds the average value for the healthcare industry, and thus AbbVie and Pfizer maintain an increased investment interest of pension funds and institutional investors.

Source: Author’s elaboration, based on Seeking Alpha

Let’s move on to discussing the Inflation Reduction Act, which was approved on August 16, 2022, whose goal is to curb inflation by reducing drug prices, reducing the deficit, and increasing investment in energy production, etc. This bill will bring many changes to the pharmaceutical industry and should be taken into account when evaluating revenue growth, net income and other financial indicators of AbbVie and Pfizer.

Impact of the Inflation Reduction Act

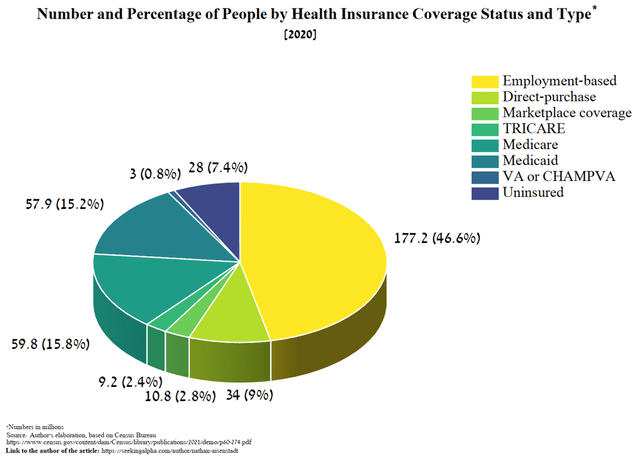

Despite the stormy speeches of President Biden and the subsequent headlines about the revolution in US healthcare, the main changes as a result of the passage of the Inflation Reduction Act will affect only 18% of Americans, namely Medicare recipients and people who buy ACA marketplace insurance plans.

Source: Author’s elaboration, based on Census Bureau

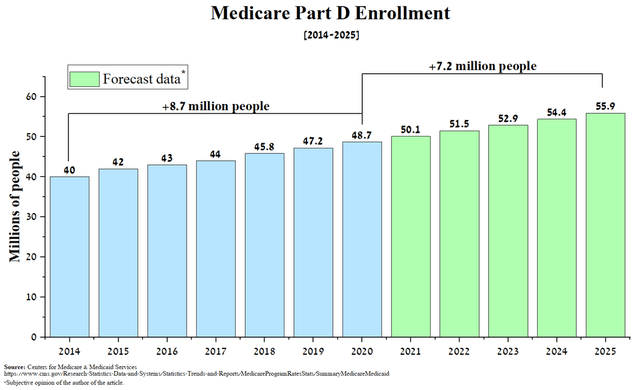

Key provisions of the bill will make major changes to Medicare. Medicare is a health insurance program that is only available to certain groups of people, namely adults over 65, young people with disabilities, and those with end-stage kidney disease. At the end of 2020, a total of 48.7 million people with Medicare were enrolled in plans that provide Medicare Part D prescription drug benefits. The number of Medicare recipients is increasing by an average of 2.5% year on year. In my estimation, this trend will continue in the future due to the many benefits of this program, such as an aging population and reduced mortality among COVID-19 patients. Given the increase in the number of people in Medicare Part D and changes in this program in accordance with the Inflation Reduction Act, pharmaceutical and insurance companies may find themselves in the role of the loser and will seek to restructure the business model to level the emerging risks.

Source: Author’s elaboration, based on CMS

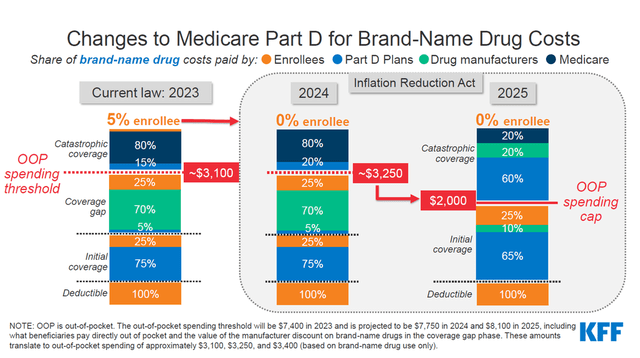

I believe that AbbVie and Pfizer will feel the impact of key changes to Medicare Part D prescription drug coverage starting in 2025. This will not only hurt the margins of these two companies, but also slow down the industry as a whole.

Changes from 2025

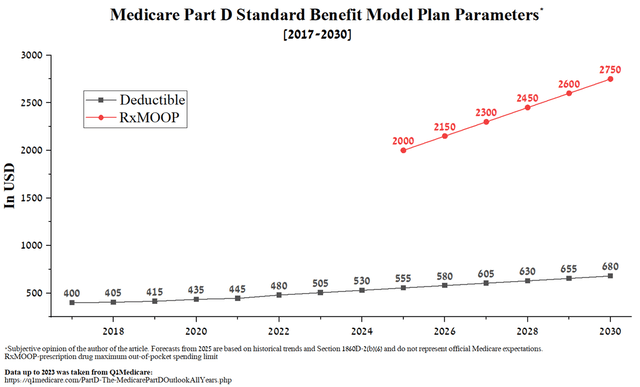

Starting in 2025, a new Medicare Part D plan structure will be introduced, consisting of an initial deductible and an initial coverage phase that will continue until December 31 of each year or until the Medicare beneficiary reaches the $2,000 limit on out-of-pocket drug costs (RxMOOP).

Source: Kaiser Family Foundation (KFF)

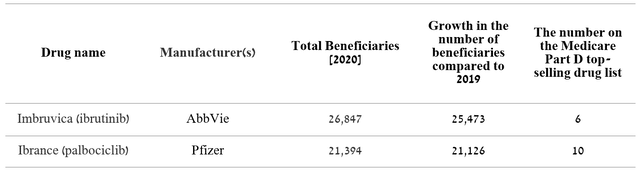

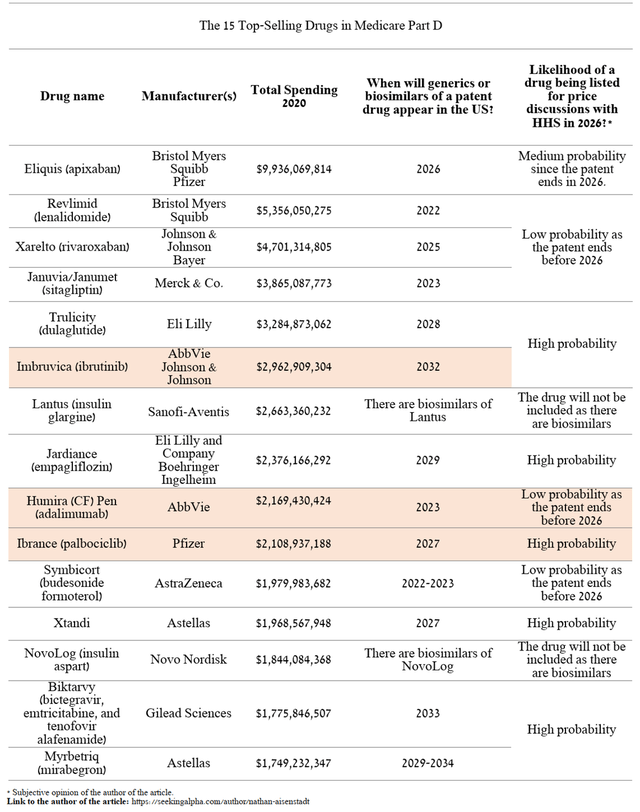

At first glance, this bill will help reduce the financial burden on beneficiaries who take expensive drugs for diseases such as cancer or diabetes. In 2020, the top 25 costliest medicines under Medicare Part D included AbbVie’s cancer drug Imbruvica, which was received by 26,847 Americans, up 5.4% from 2019. While in 10th place is Pfizer’s cancer drug Ibrance, which received 21,394 patients, which is slightly higher than in 2019.

Source: Author’s elaboration, based on CMS

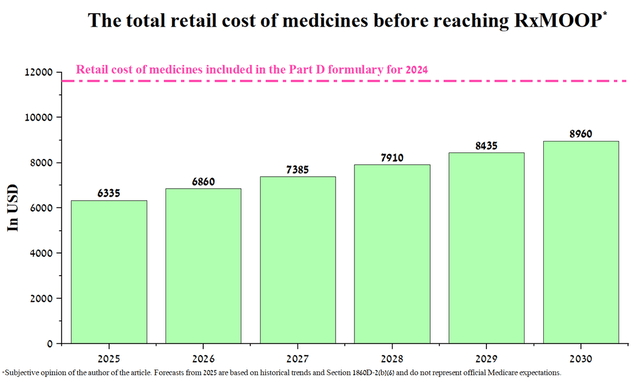

Under the changes, Medicare beneficiaries will not spend extra money after reaching the $2,000 maximum out-of-pocket spending limit for drugs on the Part D formulary (RxMOOP). That is, a member must purchase Medicare Part D drugs totaling $6,335 to reach RxMOOP, after which the insurance company pays 60% of the medicine cost. As a result of these changes, we see a huge decrease in the total drug retail cost required to reach RxMOOP in 2025 relative to 2024, which is $11,742.30. In addition, costs are being shifted from Medicare, which before the bill passed, paid 80% of the cost of drugs after reaching TrOOP to insurance companies.

Source: Created by author

Reading this bill, it may seem that it takes a significant burden from the government organization and also improves the situation of the average Medicare Part D beneficiary, but this is not entirely true. The reason for this is the continued growth year by year of Medicare Part D parameters, which include deductible, RxMOOP, etc. The Medicare Part D deductible is valued at $555 in 2025, and I estimate it will have an average annual increase of $25 bringing it up to $680 by 2030. An increase in the deductible and, as a result, RxMOOP will increase the retail cost of patent medicines included in the Part D formulary, after which the Medicare participant does not pay additional expenses. According to my calculation, RxMOOP will be $2,750 by 2030, or a person will need to buy drugs for a total cost of $8,960 by 2030, but this figure will still be $2,782.3 less than in 2023.

Source: Created by author

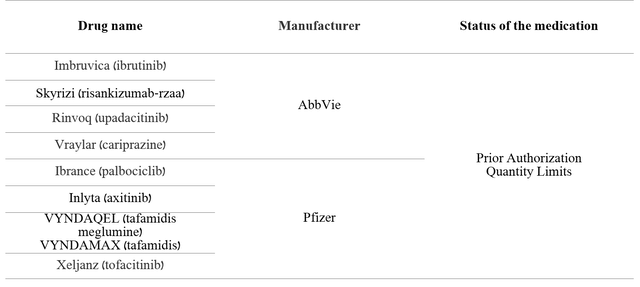

Given the shifting of costs from Medicare to insurance companies and a significant reduction in RxMOOP, insurers may tighten their approval policy for the choice of drugs with the status of “prior authorization” by the attending physician. The purpose of this decision will be to maintain the margins of the business. Prior authorization is a required approval of coverage that was introduced to control the cost of medical care so that insurance companies can determine whether a doctor’s choice is appropriate and decide whether to pay for a particular drug. In most of the Medicare Part D plans I reviewed, AbbVie and Pfizer’s key drugs have a “prior authorization” status.

Source: Author’s elaboration, based on Q1Medicare

Thus, from 2025 there will be a growing need for the attending physician to take into account more factors when choosing a course of treatment to convince health insurance companies that the increase in the effectiveness of an expensive patent medicine relative to the most effective generic is significant. As a result, changes in Medicare are likely to benefit generic companies such as Teva (NYSE:TEVA), Viatris (NASDAQ:VTRS), Organon (NYSE:OGN), which already have high-performance generics and biosimilars in their portfolios. Another consequence of the change in Medicare will be increased pressure on AbbVie and Pfizer from insurance companies to lower their costs. In my estimation, this bill will reduce the interest of large pharmaceutical companies to increase spending on R&D in certain therapeutic areas, necessary for the development of next-generation drugs that can significantly improve the quality of people. In the context of declining margins and revenues of large pharmaceutical companies, this will lead to a decrease in demand for services by the advertiser and, as a result, the revenue of companies such as Facebook may miss hundreds of millions of dollars every year. Starting in 2024, small pharmaceutical companies developing small-molecule product candidates may face a decline in investment from institutional investors whose money is needed for their operations and will eventually negatively impact the SPDR S&P Biotech ETF (XBI).

Changes from 2026

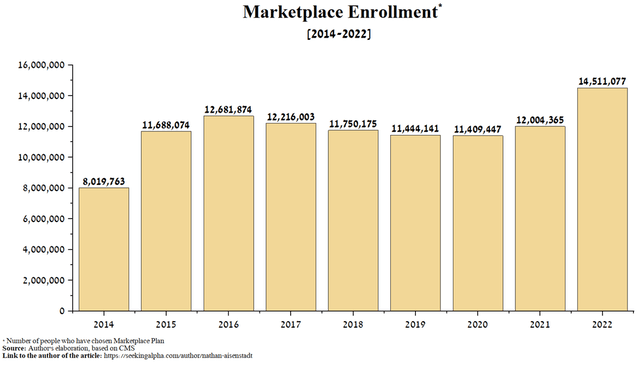

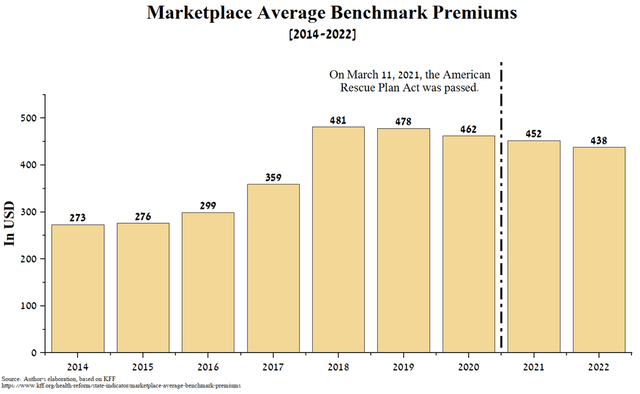

As part of the passed Inflation Reduction Act, subsidies are being extended for people who buy their health insurance on the Affordable Care Act’s Marketplace. The Health Insurance Marketplace is a platform that offers insurance plans for Americans living in the US who do not have health insurance. This platform presents the insurance plans of key insurance companies, including UnitedHealth Group (NYSE:UNH), Cigna Healthcare (NYSE:CI), Centene (NYSE:CNC), and Elevance Health (NYSE:ELV). The Affordable Care Act established the Marketplace to expand health coverage for millions of uninsured Americans. It should be noted that if a person is already covered by Medicare, they are not eligible for a Marketplace plan. Approximately 14.5 million people were enrolled in ACA Marketplace health plans in 2022, up 20.9% from 2021. One of the main reasons for this increase is the subsidies that have been allocated under the American Rescue Plan Act (ARPA).

Source: Author’s elaboration, based on CMS

The Inflation Reduction Act extends for another three years the subsidies that were introduced under ARPA and contributed to the reduction in the net insurance premiums of marketplace enrollees after 2020. The US government will spend $64 billion to finance these subsidies. The move will temporarily continue to curb expected premium increases for this open enrollment period, which begins November 1, 2022, just before the November Senate and House elections.

Source: Author’s elaboration, based on KFF

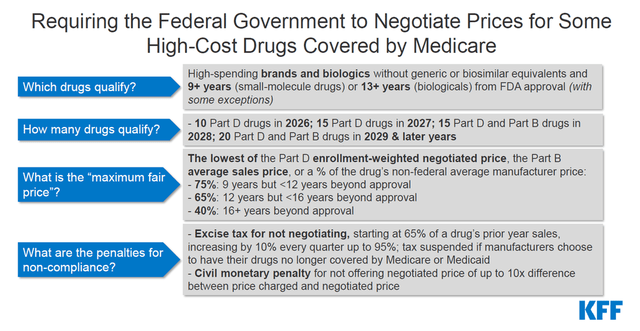

However, after subsidies expire at the end of 2025, from 2026 I expect insurance companies to increase the cost of a health plan by at least 15%, which will negatively affect the financial situation of millions of Marketplace participants. It should be noted that according to the Inflation Reduction Act, the annual maximum increase in insurance premiums equal to 6% applies only to Medicare Part D. Thus, insurers and, as a result, pharmaceutical companies will partially offset the losses from the tightening of Medicare policy. Another change is allowing the federal government to negotiate the prices of the highest-cost drugs in Medicare Part D. But, as with any bill, there are conditions under which HHS cannot list a drug on the price negotiation list.

Source: Kaiser Family Foundation (KFF)

One of the main fears of large pharmaceutical companies, including AbbVie and Pfizer, is getting into the list of drugs for which the government will negotiate the maximum fair price. During the negotiation process, many factors will be taken into account, including the costs of the manufacturer for research and development, production and distribution, sales data, etc. As a result, the manufacturer and the federal government must agree on the final price for the drug. With strict rules in place to increase drug prices faster than inflation (CPI-U), one possible strategy for Pfizer and AbbVie to mitigate revenue losses would be to increase the initial starting price of new drugs. Thus, the tens of millions of Americans who are not covered by Medicare are at a disadvantage, with little to no protection from the current bill. Moving on to my analysis of the ten potential Medicare Part D drugs that HHS will negotiate price for in 2026, I first looked at the most expensive drugs in 2020.

Source: Author’s elaboration, based on CMS

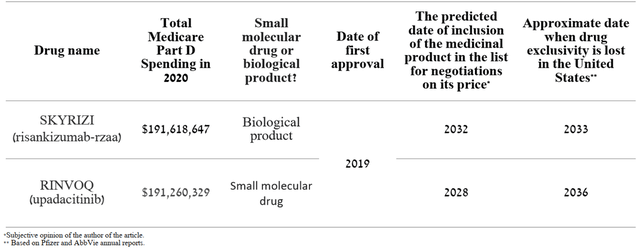

Thus, I believe that Bristol Myers Squibb’s Eliquis, Merck’s Januvia, Johnson & Johnson’s Xarelto, Pfizer’s Ibrance, AbbVie ‘s Imbruvica may be on the list of 10 medicines that will be subject to price negotiations with HHS. Given that AbbVie does not expect generic Imbruvica sales until 2032, the inclusion of the drug on this list in 2026 will have a negative impact on the company’s ability to show revenue growth of the oncology division. Understanding the emerging risks, AbbVie is betting on two drugs, namely Skyrizi and Rinvoq, which should become the new mega blockbusters in the pharmaceutical industry. Both of these drugs were first approved by the FDA in 2019, and given that Skyrizi is a biological product, it will not be able to get on the price negotiation list until 2032. Rinvoq (upadacitinib) as a small molecule JAK inhibitor has nine years from price negotiations.

Source: Author’s elaboration, based on CMS

As a result, I do not expect this bill to have a critical financial impact on AbbVie. Pfizer is in a similar situation, where only one drug is highly likely to be on the list of 10 drugs that will be subject to price negotiations with the HHS. However, the company’s other drugs are not in the top 25 in terms of Medicare costs or have been approved in the last 2-3 years and, as a result, will not be included in this list.

Conclusion

The health system, like any system, will strive to achieve a balance based on the basic parameters that built it and the people who use it. The Inflation Reduction Act only superficially updated some of the parameters that over the next five years will improve the situation of a small number of people and reduce pressure on the US budget, while doing little to help 82% of Americans. In my estimation, starting in 2027, drug costs, the inability of millions of people to pay medical expenses, and the multibillion-dollar excess profits of pharmaceutical companies will return to legislative levels. This bill has many shortcomings, possible strategies by which AbbVie and Pfizer, and insurance companies can reduce the impact of changes in Medicare on their financial situation. Both companies have one of the highest dividend yields in the pharmaceutical industry, which is more than 3%, an extensive portfolio of approved medicines, and high EBITDA, which, against the backdrop of continued market uncertainty, creates conditions for AbbVie and Pfizer to be considered as long-term assets. However, thanks to more diversified pipeline, lower total debt, and lower financials, I believe Pfizer is a better long-term asset than AbbVie.

Be the first to comment