JHVEPhoto

Citigroup (NYSE:C) recently reported its second quarter earnings and beat estimates for revenue and earnings. Rising interest rates and uncertainty caused demand for fixed income investments to increase, directly benefiting the bank’s sales and trading revenue. Its smaller focus on investment banking and strong consumer spending are causing it to outperform its peers, despite its dividend freeze and buyback pause. Management is exiting less profitable operations overseas and is in talks with Expobank to sell its Russian operations. The stock also appears to be trading far below its fair value, making it an extremely attractive pick among investors.

Citigroup Q2 Earnings: Beats Expectations And Saw Great Growth In Trading

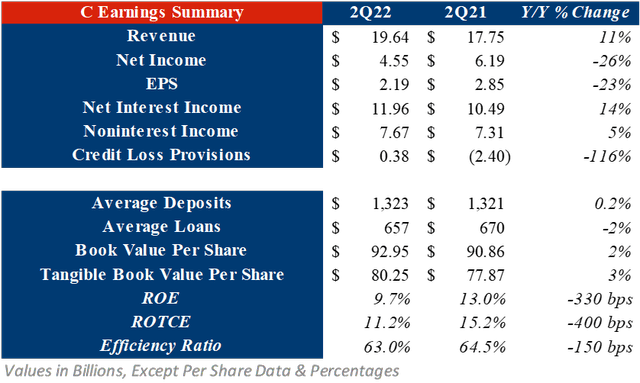

At the time of reporting its earnings, Citigroup was the only bank to beat estimates for revenue and earnings. Total revenue experienced great growth and was reported at $19.64 billion, up 11% Y/Y and beating estimates by 8%. This is due to net interest income rising 14% Y/Y and noninterest income rising 5% Y/Y. However, a rise in provisions for credit losses and higher investments into the business caused EPS to come in at $2.19, down 26% Y/Y but still beating estimates by 30%. Overall, Citigroup reported better-than-expected earnings and is showing great signs for the future.

C 2Q22 Earnings Summary (Created by Author)

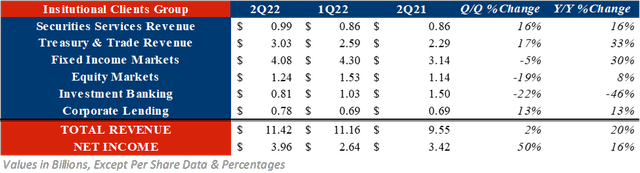

To see how Citigroup performed and what could take place in the future, we can break down its earnings by each segment. Its first and largest segment is Institutional Clients Group which increased its revenue to $11.42 billion. This calculates to growth rates of 2% Q/Q and 20% Y/Y mainly due to higher trading volumes.

Securities Services revenue was up 16% both Q/Q and Y/Y due to higher interest rates and corporate volumes. The higher rates caused its net interest income to rise to $301 million, up 41% Y/Y. Similarly, Treasury and Trade Solutions revenue was up 17% Q/Q and 33% Y/Y. Once again, this was caused by net interest income being up 42% Y/Y to $2.03 billion.

Revenue from Markets was also up since 2Q21 mainly due to high demand for fixed income investments. Citigroup’s revenue from Fixed Income Markets grew 30% Y/Y due to higher demand for fixed income, currencies, and commodities investments. Revenue from Equity Markets grew slower by 8% Y/Y mainly due to outperformance by derivatives being offset by lower activity and balances.

Similar to the banks before it, Citi’s investment banking revenue was down heavily. In its second quarter, the division’s revenue fell 22% Q/Q and 46% Y/Y due to geopolitical uncertainty and the market downturn. However, it was offset by corporate lending revenue being up 13% both Q/Q and Y/Y because of higher interest rates. With the bear market likely to continue, and a recession possibly already here, Citi’s investment banking revenue will likely continue to struggle.

The overall higher revenue caused the segment’s net income to increase by 50% Q/Q and 16% Y/Y. However, its earnings was partially offset by higher operating expenses from reinvestment into the bank, as well as credit benefits decreasing from by $520 million since last year. Overall, rising rates and balances will likely continue to make the Institutional Clients Group thrive despite the fall in investment banking revenue.

ICG Segment Breakdown (Created by Author)

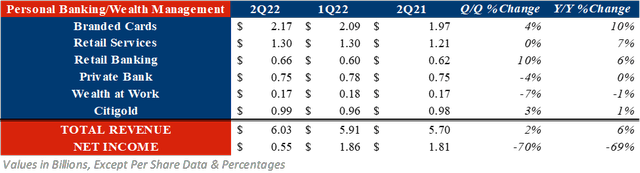

Citi’s next segment is Private Banking and Wealth Management, which saw much slower revenue growth of 2% Q/Q and 6% Y/Y to $6.03 billion. This is due to net interest income increasing to $5.6 billion in the quarter, up 3% Q/Q and 12% Y/Y. However, noninterest revenue fell 12% Q/Q and 35% Y/Y to $460 million.

Similar to Bank of America’s (BAC) earnings, consumer spending remained strong. Credit card spend raised 22% Q/Q and 11% Y/Y to $26 billion. New accounts also rose 21% Q/Q, but fell 6% Y/Y. This growth, as well as higher interest rates, allowed revenue from Branded Cards to rise to $2.2 billion. Retail Banking revenues were also up 10% Q/Q and 6% Y/Y due to growth in deposits and rates. Retail Services performed slightly worse and was flat Q/Q but grew 7% Y/Y for the same reasons.

Total revenue from wealth management came in at $1.9 billion. This is about flat on a quarterly and annual basis. The absence of growth is due to investment fee headwinds, especially in Asia, being offset by higher loan balances and deposits.

The segment’s total net income came in at $553 million, a massive decrease of 70% Q/Q and 69% Y/Y. This is because of small revenue growth combined with higher credit loss provisions. In this quarter, credit loss provisions grew to $651 million, previously a benefit of $1.04 billion one year prior.

PBWM Segment Breakdown (Created by Author)

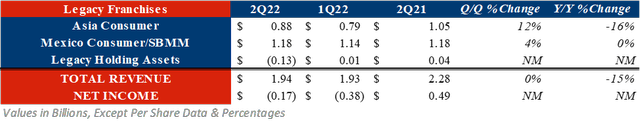

Citi’s final and smallest main segment is Legacy Franchises, which generated $1.94 billion in revenue. This is about flat on a quarterly basis but down 15% Y/Y. The fall in revenue is due to the sale of its Australian consumer bank, as well as lower activity in Asia. This lower revenue caused the segment to experience a net loss of $17 million. However, this is an increase from the prior quarter but far underperforms 2Q21’s income of $494 million.

Legacy Franchises Segment Breakdown (Created by Author)

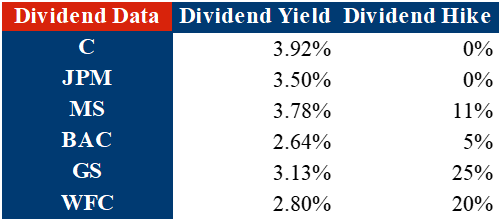

Citi Froze Its Dividend Hikes and Paused Its Share Buybacks

After the recent Stress Test, many of the largest banks displayed strong capital buffers and decided to increase dividends. However, Citigroup was not included in this trend. Instead, Citi and JPMorgan Chase (JPM) decided to freeze their dividend hikes to build their capital buffers. Currently, Citi has a Common Equity Tier 1 (CET1) ratio of 11.9%. The bank would like to increase this to 13% by 2Q23. To do so, Citigroup will not raise its dividend. However, it is important to note its already impressive dividend. As of writing this article, it pays a dividend yield of 3.92%. This is the highest of any of its peers even after the dividend hikes. Therefore, the dividend freeze is not detrimental to the stock.

Bank Dividend Data (Created by Author)

Along with freezing its dividend, Citigroup (and JPMorgan Chase) also paused its stock buyback program to further improve its CET1 ratio. Currently, there is no set data to restart the buyback as CEO Jane Fraser explained the bank is “committed to restarting them as soon as it is prudent to do so.” It is important to mention that analysts expected these changes to be made after the Stress Test results were released.

Citi is Selling Its Overseas Consumer Banks and Is Trying to Exit Russia

Citigroup is one of the largest international banks and has a much larger focus on foreign countries than its peers. However, this has not been very successful and is causing management to exit its consumer operations in many countries overseas. This includes sales in many Asian countries, Mexico, and more. The overall goal of these sales is to release about $7 billion of allocated tangible common equity after all exits are completed. The reasoning for selling its consumer banks is to focus more on wealth management due to its large growth and attractive business model. Citi will also be keeping its consumer banking operations in high-wealth areas such as London, Singapore, and more.

Citi is also looking to sell its operations in Russia. Over the past quarter, its exposure to Russia has increased by a net of $500 million. This is due to a $3.6 billion increase because of the appreciation of the Ruble, offset by a $3.1 billion reduction in local currency terms. Citi is attempting to exit its Russian consumer and commercial banking businesses in multiple ways, including portfolio sales.

Currently, Citi is in talks with Russian private lender Expobank because of its plan to expand its investment banking business in Russia. Not much is known about this deal due to Citi and Expobank keeping it private, however CEO Fraser mentioned the deal in a filing in May.

Citigroup Stock Valuation

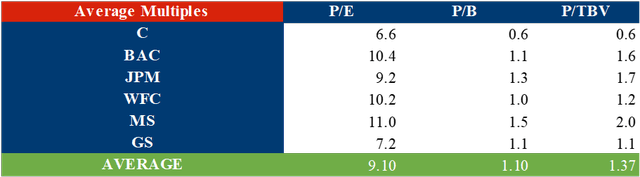

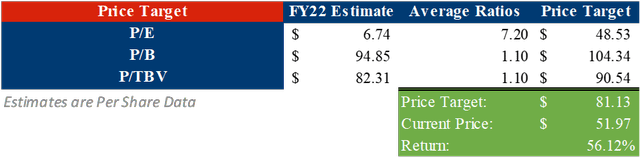

To find a fair value of Citigroup stock, a relative valuation can be made. By multiplying consensus analyst estimates for FY22 by the average valuation multiples for P/E, P/B, and P/TBV of Citi and its peers, a price target of $81.13 can be calculated. This implies an upside of 56.12% and could mean the stock is severely undervalued.

Bank Stocks Multiples (Created by Author)

Relative Valuation of C (Created by Author)

What Does This Mean for Investors?

Citigroup recently reported its second quarter earnings and beat estimates for both revenue and earnings. The bank experienced large demand for fixed income trading, and benefited heavily due to rising interest rates. Its smaller focus on investment banking allowed it to outperform many other banks during the current bear market. Consumer spending also remained strong, and its exit from foreign countries is proving to be beneficial. As expected, management froze dividends and paused buybacks to build its CET1 ratio. However, Citi already has a leading dividend yield among its peers meaning the freeze is not detrimental. Its talks to exit Russia are promising as Expobank is still interested at the right price. With all of this in mind, as well as its current share price, I believe applying a Strong Buy rating is appropriate at this time.

Be the first to comment