cemagraphics

Note: This is an update of an article that was available on BPIQ.com on 7/11/22, and an updated version is available on BPIQ.com for Amp subscribers.

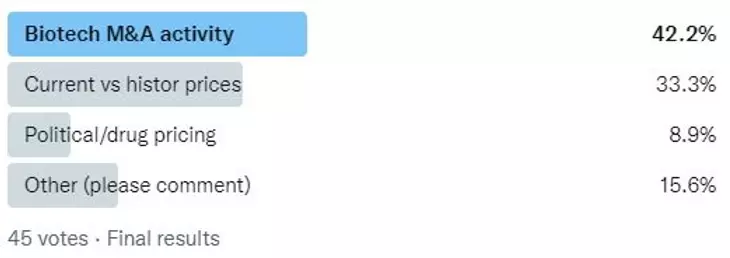

Since their peak in February 2021, biotech stocks were on a steady downward trajectory until about 1 month ago. Since then, biotech stocks have enjoyed an impressive 33% runup (Table 1). However, biotech stocks are still down ~40% as reflected in the SPDR S&P Biotech ETF (NYSEARCA:XBI) and ~16% (IBB) since January 1, 2021, and ~27% and ~17%, respectively, since Jan 1, 2022 (Table 1). In this article, we analyze what likely drove down biotech stocks over the past 18 months, and has likely driven up biotech stocks over the past month. Then we address the key question for biotech investors: Is this just a temporary increase that will be short-lived, or can biotech stocks keep running from here?

Table 1. Returns of XBI vs. other ETFs/indices from the indicated date to 7/8/22

*XBI (More weighted to small cap biotechs than IBB)**IBB (More weighted to medium and large cap biotechs that XBI)***Dow Jones Industrial****INX (S&P 500)

We have been communicating since XBI fell into the low $70s and then $60s that the bottom was likely near based on historical prices and patterns (See Fig. 1). From its meteoric rise from mid 2020 to early 2021, XBI exhibited a meteoric fall through mid-June 2022. The broad Nasdaq similarly has had a tough 2022, but the Dow Jones has held up much better (Fig. 1). It is noteworthy that volume has been markedly higher for XBI in 2022 (Fig. 1 bars at bottom), whereas the broad NASDAQ and DJI have not seen similar volume increases in 2022 (data not shown). On a month-by-month basis, it is apparent that XBI underperformed the broader NASDAQ, the DJI, and the S&P 500 in all but 2 months between Feb 2021 and May 2022 (data not shown).

Fig. 1. 5 yr performance XBI vs. Nasdaq and DJI*

BPIQ.com BPIQ.com

*Analysis used Yahoo finance

Key for Fig. 1: black = XBI, purple = Nasdaq, magenta = DJI, bars at bottom = XBI volume

So what has driven the huge slide in biotech stocks, especially the more smid-cap weighted XBI ETF, since Feb 2021 and in 2022? First let’s look at what drives public smid-cap stock prices. In our view the following factors play a key role in public smid-cap biotech stock prices broadly:1) Present valuations vs. historical valuations; 2) Concerns about the economy/broader market; 3) U.S. drug pricing reform discussions/progress; 4) High profile clinical trial and FDA readouts (positive or negative); and 5) Biotech M&A activity.

So what likely drove the biotech stock downturn from Feb 2021 to June 2022? January 2021 saw a major change in the U.S. political environment to a new congress and president with much more drug-pricing control focus, at a time when biotech stock prices were near all-time highs and arguably over-inflated. In fact, in November 2021 the House passed Build Back Better legislation, which included drug pricing control provisions (read “Explaining the Prescription Drug Provisions in the Build Back Better Act” Kff.org 11/23/21). And the senate has been discussing a similar bill with respect to drug pricing control (Read July 1 Forbes article). To be clear, this article and these facts are in no way intended to endorse any political agenda or party. However, Jan 2021 raised the tough factual scenario for biotech stocks of over-inflated prices and a change in Washington where drug pricing regulation was likely going to come into focus again.

In addition to the political environment raising drug pricing reform concerns for biotech stocks, biotech stocks were likely hurt by the negative press and controversy around the FDA’s approval in June 2021 around Biogen’s Alzheimer’s drug Aduhelm (“Why Biogen’s Alzheimer’s drug Aduhelm is so controversial“), which eventually was discontinued. More Alzheimer’s drug development controversy around data integrity and SAVA’s simifulam (see this April 2022 Seeking Alpha article) likely didn’t help matters. And finally, biotech M&A activity was very slow in Q1 2022 (Fierce article), with biotech corporate development teams likely struggling to figure out how to deal with the massive changes in valuations between record highs in Feb 2021 and near-record 5-yr lows in May 2022.

Fast-forward to July 11, 2022 (when the analysis for this article was performed) and biotech stocks have started to show some life again. As mentioned above and shown in Table 1, the smid-cap biotech index XBI is up 33% since mid-June. And XBI beat the performance of the overall NASDAQ, S&P 500 and DJI in June and thus far in July (data not shown). So what has been responsible for the resurgence in biotech stocks? Attractive valuations vs the broader market combined with economic worries likely play key roles. While biotech stocks hovered near 5 yr lows in May, the broader markets were not far off all-time highs.

The rising inflation and the worries of a recession have likely hurt the broader market, making biotech stocks an attractive investment option again, since they should be less effected by a general economic downturn. And our M&A analysis on BPIQ.com showed a pick up of M&A activity to 6 smid-cap biopharma M&A deals at some stage in May 2022. However, the biggest factor is likely discussion of a possible change in Congress to Republican control of one of the chambers in the upcoming mid-term elections. The current Congress and Administration have very poor approval ratings (read “Usual Midterm Indicators Very Unfavorable for Democrats“). And thus, the prospect of a Congress that is less active and effective at passing drug pricing reform is a positive factor for biotech stocks.

So what do the coming months and the rest of 2022 hold for biotech stocks? Of course, nobody knows the answer to that question. However, the factors that have likely led to the recent uptick likely remain place: Even after their recent resurgence, the values of biotech stocks still remain historically low (Table 2). In fact, biotech stocks are still less than 20% above their all-time lows vs. all-time highs (data not shown). Whereas other indices remain at higher relative levels. And concerns over company performance given the concerning economic situation in the U.S. and globally, likely will continue to weigh on investors, thus, continuing to make biotech a nice, economy-proof choice.

However, possibly the biggest factor driving biotech valuations for the rest of 2022 are the mid-term elections (will the democrats retain control of both sides of Congress) and progress on drug pricing reform bills. And there is an effort by the current Congress to pass drug reform before the mid-term elections (See this Forbes article, “Drug Prices Make Headlines Again As Senate Democrats Push Forward Pricing Reforms“). These events will likely play a big part in the future of biotech stocks in 2022 and whether this biotech resurgence is a short-lived blip or sustainable.

July 18, 2022 update:

Despite their resurgence since mid-June, in the last trading week (7/11-7/15/22), smid-cap biotechs reverted to a pattern of underperforming the broader markets (XBI -2.4% whereas broader ETFs/indices were -1.65 to +3.2%: See BPIQ Pulse: Weekly Moves tweet 7/11-7/15). In our view, it is not a coincidence that XBI sunk back into negative returns. Over the past 1.5 weeks the U.S. Senate continued to drive towards passing drug pricing reform legislation (see, e.g., “Dems unveil bill for Medicare drug price negotiations” Benefitspro.com 7/11/22). The situation in the Senate still seems very much in flux, as Republicans have threatened that if Democrats continue to try to push that drug pricing reform bill through in the coming weeks/months using budget reconciliation, they would stop supporting a different bill aimed at helping U.S. semi-conductor companies better compete with Chinese companies (See “Tech Investment Bill to Counter China Hits New Hurdle” Wall Street Journal 7/2/22).

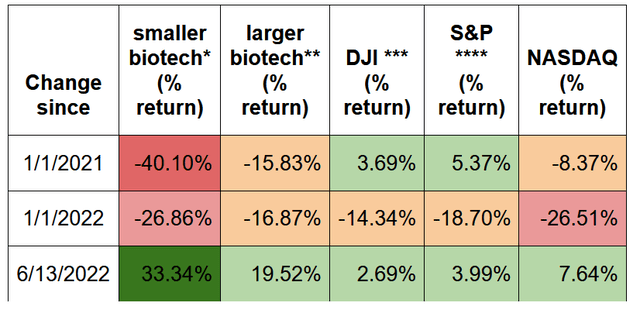

From a biopharma investor standpoint, some investors may not realize the connection between their biotech account values and drug pricing reform legislation. This is suggested by our recent Twitter poll where we asked investors what they thought was the biggest factor moving smid-cap biopharma stocks (Figure 1). Our view is that the political environment in Washington with respect to drug price reform legislation is a major, if not the largest factor influencing biotech stocks since January 2021.

FIG. 1 From our tweet 7/14/22 here: “Biotech stocks are +31% $XBI/+17% $IBB since 6/13 but still -28%/-19% ytd. What is the major reason/driver? Read our views“:

BPIQ.com

A hope on the horizon for biopharma investors is that a more biopharma friendly Congress might result from the mid-term elections this fall. In the meantime, we may continue to see XBI float around the $75-85 price range if drug pricing legislation continues to have the potential of moving forward in Congress, possibly dropping lower if significant “progress” is made on that legislation. Furthermore, polls regarding the mid-term elections will be published and likely will effect biotech stock prices, too, as they provide an update on what Congress is likely to look like next year. Thus, for biotech companies without a major catalyst event this year, their stock price for the remainder of 2022 may depend largely on what happens in Washington.

Be the first to comment