Spencer Platt

While some companies today continue to try and fit all of their operations under one roof, many have found it beneficial to outsource certain functions to businesses that have established themselves as experts in their respective spaces. A great example of this can be seen when looking at functions like advertising, marketing, and corporate communications services. One company that provides these on behalf of its clients is Omnicom Group (NYSE:OMC). During these uncertain times, it’s reasonable to expect the company to experience some volatility when it comes to financial performance. And in response to this volatility, you might expect shares to underperform the broader market. However, given how cheap shares of the enterprise already are, downside has been limited and the future looks rather bright. This is especially true after looking at the most recent data covering the third quarter of the company’s 2022 fiscal year that was just released on October 18th.

Omnicom Q3 earnings – A reaffirming quarter

After the market closed on October 18th, the management team at Omnicom Group announced financial results covering the third quarter of the company’s 2022 fiscal year. What we saw was continued volatility but results that beat analysts’ expectations enough to create some additional optimism in the market. In after-hours trading, shares rose by roughly 2.4% after the company reported revenue of $3.44 billion. In addition to coming in 0.2% above what the company reported the same quarter last year, the amount of revenue also beat the $3.34 billion analysts anticipated to the tune of 3.1%.

Although the year-over-year improvement that the company saw may seem negligible, it’s important to dissect the data to better understand it. Actual organic revenue growth in the quarter was 7.5%, driven by double-digit organic growth in the precision marketing, public relations, and commerce and brand consulting operations of the company. The precision marketing portions of the enterprise saw revenue jump by 16.3%, while public relations revenue grew by 12.6%. Under the commerce and brand consulting category, organic revenue increased by 11.1%. The company benefited from strength across all geographic regions, with Latin America leading the way at 13.1%, followed by the 12.2% increase experienced across Africa and the Middle East.

The pain for the company then actually came from net divestitures costing the company $32.7 million in sales. This related mostly to the company’s disposition of its operations in Russia during the first quarter of 2022. In addition to this, the company was also impacted significantly, to the tune of $216.6 million, from foreign currency translation. What this all demonstrates is that there is significant demand growth for what the company offers. If it weren’t for foreign currency issues and the aforementioned sale, revenue growth would have been quite impressive.

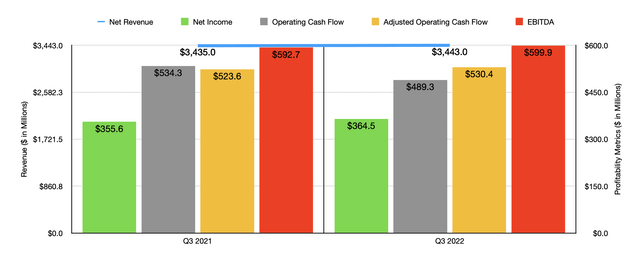

We should also pay attention to the bottom line. During the quarter, the company generated earnings per share of $1.77. This came in higher than the $1.65 in earnings reported in the third quarter of 2021. It also beat the $1.64 in earnings that analysts were anticipating. Even on an adjusted basis, analysts thought that earnings would be $1.71. In absolute dollar terms, the company ended up generating net profits of $364.5 million. That’s up slightly from the $355.6 million reported the same quarter last year. On top of benefiting from the increase in revenue, the company also saw certain costs decline. Occupancy and other costs, for instance, actually fell from 8.3% of sales to 8.2%. Selling, general, and administrative costs dropped by 9.1% in all. Naturally, these changes also helped other bottom line figures. Although operating cash flow dropped from $534.3 million in the third quarter of 2021 to $489.3 million the same time this year, that picture changes if we adjust for working capital. On that basis, the metric would have risen from $523.6 million to $530.4 million, while EBITDA increased from $592.7 million to $599.9 million.

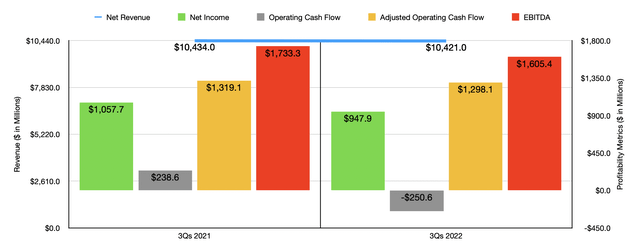

Thanks to this strong quarter during what should be considered uncertain times, the company’s results for the 2022 fiscal year as a whole are looking better than they otherwise did. During the first three quarters, sales came in at $10.42 billion. That’s barely lower than the $10.43 billion reported the same time last year. Factoring in the foreign currency translation and asset sale, and revenue certainly would have increased year over year. Profits, on the other hand, have still been a bit weaker. Now income fell from $1.06 billion in the first nine months of the company’s 2021 fiscal year to $947.9 million to the same time this year. Operating cash flow went from a positive $238.6 million to a negative $250.6 million. If we adjust for changes in working capital, it still would have fallen, dropping from $1.32 billion to $1.30 billion. And over that same window of time, we saw EBITDA drop from $1.73 billion to $1.61 billion. When compared to how the third quarter ended up on its own, this demonstrates that financial performance of the company is strengthening.

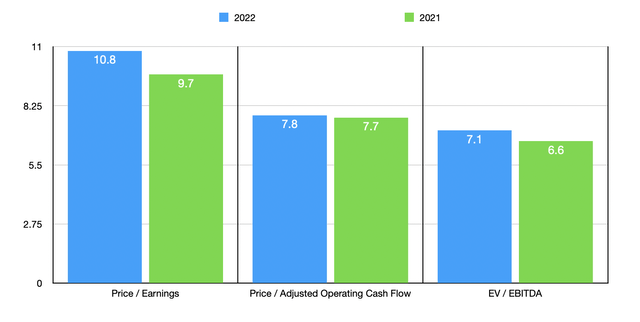

We don’t really know what to expect for the rest of 2022. But if we annualize results experienced so far this year, we should anticipate net income of $1.26 billion, adjusted operating cash flow of $1.76 billion, and EBITDA of $2.23 billion. This would imply that the company is trading at a forward price to earnings multiple of 10.8, at a forward price to adjusted operating cash flow multiple of 7.8, and at a forward EV to EBITDA multiple of 7.1. If financial performance reverts back to what we saw in the 2021 fiscal year, these numbers would be 9.7, 7.7, and 6.6, respectively. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 14.2 to a high of 316. In this case, using the projected figures for 2022, Omnicom Group would be the cheapest of the group. Using the price to operating cash flow approach, the range was between 7 and 120.7 for the four companies with positive results. Two of the four companies are cheaper than our prospect. And finally, using the EV to EBITDA approach, the range is between 6.1 and 259.5. In this case, only one of the companies was cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Omnicom Group | 10.8 | 7.8 | 7.1 |

| Publicis Groupe S.A. (OTCQX:PUBGY) | 14.2 | 8.4 | 6.1 |

| The Interpublic Group of Companies (IPG) | 15.7 | 7.2 | 8.7 |

| WPP plc (WPP) | 21.1 | 7.0 | 7.9 |

| The Trade Desk (TTD) | 316.0 | 120.7 | 259.5 |

| Stagwell Inc. (STGW) | 29.6 | N/A | 13.9 |

Takeaway

What data we have available today is definitely encouraging. Although it’s likely that 2022 as a whole will end up being less attractive than 2021 was, results in the third quarter on their own were impressive. Management exceeded analysts’ expectations and shares of the company do look cheap even if the rest of this year ends up being weak. Due to all of these factors, I would still rate the company the ‘buy’ I assigned it in an article that I published in April of this year, after which shares continue to outperform the broader market, falling by 10.8% compared to the 15.2% seen by the broader market. Considering that a ‘buy’ rating in my book refers to a scenario where the company should outperform the broader market, as measured by the S&P 500, I consider this a win so far. And absent something changing materially for the worse, I expect this trend to continue moving forward.

Be the first to comment