Lighthouse Films/DigitalVision via Getty Images

One of the biggest winners in the market on Monday was AMC Entertainment Holdings (NYSE:AMC). Shares of the theater chain soared more than 78% on the day, and rose further in the after-hours session, after online influencer Roaring Kitty tweeted for the first time in years, sending all of the “meme stocks” into a frenzy. Unfortunately for AMC investors, this sudden bounce is not likely to hold for the long term, as the company’s latest report last week shows the financial situation here continues to deteriorate.

Why I have been bearish for a while:

AMC was one of the hardest-hit companies during the pandemic, as consumers avoided going to the movies and capacity restrictions hit theaters over time. The company could have easily gone bankrupt during this tough time, but management used a series of debt and equity raises to stay afloat. I officially went to a sell rating back in August 2022, when shares were at a split-adjusted $130, as it was clear the company needed to raise more capital.

Since that time, AMC shares have collapsed as continuous cash burn has led to even more capital raises. The stock has more than doubled from its recent low, trading at around $6 in Monday’s after-hours session, leading to tremendous short-term gains for some lucky shareholders. However, this was a stock that during the original meme madness traded to over $726 on a split-adjusted basis (when excluding any proceeds from the APE Preferred Units), so anyone who has held since then has lost almost everything. The recent surge basically gets the stock back to the flat line for 2024.

Monday’s rally came after Keith Gill, known online as Roaring Kitty, tweeted an image of a man leaning forward in a chair. Gill’s posts on Reddit and other sites back in 2021 sparked a huge short squeeze in names like GameStop (GME) and AMC. With him posting online for the first time in years, shares of the highly shorted GameStop surged on Monday, and a number of former meme stocks soared as well, including AMC.

Last week’s quarterly report:

The huge rally overshadowed last week’s Q1 report from AMC, which wasn’t exactly a home run. Management celebrated the fact that it beat street estimates yet again, but this is a company that’s only missed on the top line twice in the past five years, and has had 13 straight adjusted bottom-line beats. Analysts haven’t exactly had a high bar when it comes to AMC expectations, and this was the smallest revenue beat in the past four quarters.

Revenues were actually down over the prior year period, as the first half of 2024 is being impacted by last year’s writer’s strike. The domestic box office is down more than 22% year-over-year due to limited releases, as a lot of studious have pushed back blockbuster films to later this year or 2025. For Q1 2024, AMC reported a GAAP operating loss of more than $108 million, slightly more than Q1 2023. The bottom line improved over the prior year period, but a chunk of that was due to a vendor dispute settlement gain of over $36 million. AMC detailed adjusted EBITDA of negative $31.6 million in the quarter, as compared to positive $7.1 million a year earlier.

More cash burn and dilution:

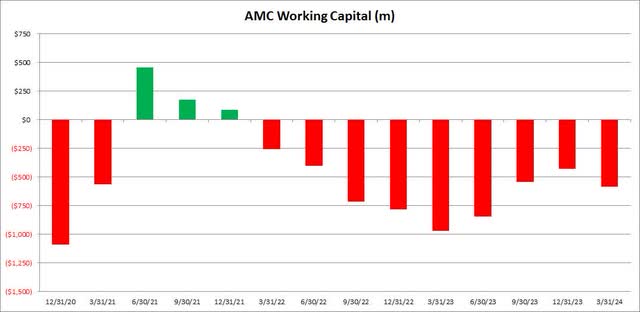

The company’s ongoing losses have led to major cash burn in recent years, putting an already strained balance sheet further in the hole. In the first quarter, AMC reported cash burn of $238.8 million, which was up slightly over the year ago period. The company finished the period with $624 million of total cash against $4.54 billion in total debt. Perhaps the worst part of last week’s report was that working capital went further negative on a sequential basis, as seen in the chart below. This $590 million hole meant that AMC had a lot more bills coming due in the next year than it had current assets on the balance sheet at the end of Q1.

AMC Working Capital (Company Filings)

Management has been celebrating for multiple quarters that it is bringing its debt pile down. While that is true to a point, it’s only because they have massively diluted investors over time. Just since the end of 2023, the outstanding share count went from around 260.5 million to nearly 295.6 million as of May 8th, as an ongoing equity sales program continues to bring in much-needed cash.

AMC still has about $150 million left on that plan, but even raising that full amount won’t plug the working capital deficit, let alone put a meaningful dent into the massive debt pile. As a reminder, the number of Class A shares outstanding before the pandemic, on a split-adjusted basis, was only about 5.2 million, so this is one of the greatest dilution stories in our market today. If this meme rally holds, it wouldn’t surprise me if management announces even more equity sales to raise more funds.

Valuation remains depressed:

AMC certainly trades like a distressed asset. Even with the large bounce during the day and further to $6 in Monday’s after-hours session, the stock goes for about 0.38 times expected 2024 revenues, as compared to 0.93 times for competitor Cinemark (CNK). Currently, Cinemark has a bit of debt as well, but it also has positive working capital, profits, and positive free cash flow. AMC analysts thought the stock was worth $4.42 as of Monday, which now implies meaningful downside from here, and that average price target has continued to go lower quarter after quarter.

Final thoughts/Recommendation:

AMC shares surged on Monday as the meme stock madness returned, but this is a company that’s still in significant financial distress. The company still has a nearly $4 billion net debt position, while working capital remains significantly in the red and worsened further in Q1. The cash burn remains large as theater weakness in the near term is leading to large losses, and management’s only option in the near term is to continue diluting investors tremendously.

Until AMC meaningfully improves its debt position and shows signs that it will stop diluting investors almost every quarter, the stock remains a sell in my opinion. Long-term investors should not buy into this meme stock madness, as history suggests we’re just seeing another bubble. While AMC might be a good trading vehicle currently, shares remain down more than 99% from their 2021 meme stock peak, and more dilution will likely push them back down again.

Be the first to comment