Daniel Grizelj/DigitalVision via Getty Images

As the emphasis on meeting net zero target grows for governments and corporations alike, Origin Materials (NASDAQ:ORGN) could be the solution for many companies looking to accelerate their net zero plans or to begin their ESG journey.

Investment thesis

Origin is a leader in its own right and I think the company is positioned for success. Here are some of the points that makes up the investment case for the company:

- Origin has a superior proprietary platform technology that enables its customers to meet their net zero ambitions while maintaining their performance and cost of the products.

- The patent portfolio developed over the decade ensures that Origin has a high barrier to entry and competitors are far behind it.

- The current off-take agreements and partnerships have resulted in Origin selling out their capacity in the long term, from Origin 1 to Origin 4.

- Origin looks set to meet operational deadlines and targets for Origin 1 while Origin 2 remains on track.

Overview

Origin sees itself as the world’s leading carbon negative materials company. It aims to help the world transition from the traditional petroleum based materials to decarbonized materials. There are many end uses for Origin’s carbon negative materials, like for packaging, tires and plastics, amongst many other use cases. The company has a rather simple but at the same time unique concept, driven by a decade of research and development and is currently commercializing its technology and reaping the benefits of its efforts in the past.

Leading, proprietary platform technology

Origin’s platform technology enables the utilization of the carbon found in biomass, and carbon is also captured during the process, which leads to carbon negative materials.

The company’s proprietary technology enables the conversion of biomass into chloromethylfurfural (“CMF”) and hydrothermal carbon (“HTC”), which are both to be used as building block chemicals that are very versatile in being able to be used for many use cases. With the use of its technology, the chemicals produced are superior to petroleum based chemicals in that there are lower carbon emissions and footprint, while maintaining the same performance and cost.

The are several benefits of using plant-based carbon or biomass as a feedstock. The first is that it is abundant given that timber and forest residues are very easy to find in the US. This source of feedstock from wood also ensures long term sustainability given the renewable nature of the feedstock and the amount of wood waste and residues that can be used in the US. Furthermore, the price of this particular feedstock has been relatively low and stable, ranging between $9.30 to $10.10 between 2015 to 2020. Lastly, it is also important that the pulpwood feedstock derived from biomass is not used as a food source and as such there are fewer demand forces at work that might influence pricing, as compared to competitors that use agricultural or vegetable oil feedstocks

I think that Origin’s platform technology stands out from its ability to directly rival competitors that currently use petroleum based processes by being able to maintain the performance and price points, but at the same time provide additional benefits over other low carbon feedstocks by utilizing a more abundant and low cost sustainable feedstock and being able to achieve lower unit costs. Furthermore the building block approach makes its technology rather easy to be applied to a wide range of uses and products that can directly replace those currently using petroleum-based materials.

Significant barriers to entry

In terms of the protection of Origin’s key technology, the company has taken steps to ensure that their processes and systems are protected by patents, which expire more than 10 years from now between 2032 to 2034. These patents range from the methods to prepare as well as the compositions of CMF, to the systems and process used to purify CMF.

As such, I think that Origin has successfully, over the decade, created significant barriers to entry with its portfolio of patents. Competitors are currently unable to replicate the company’s quality or efficiency as a result of the barriers to entry put in place and as such, I am of the view that competitors are unlikely to be able to compete meaningfully in the near term with these patents lasting until beyond 2032.

Significant customers and sell out of future capacity

One of the key signs that Origin is a leading carbon negative materials company is the sheer demand that it is seeing despite the fact that it has yet to begin production in its first facility, Origin 1. (I will elaborate more on the commercialization progress in the next section)

In the recent 1Q22, the company announced that it has $7.4 billion in off-take agreements and partnerships. These are with large, global companies like LVMH (OTCPK:LVMUY) (OTCPK:LVMHF), PepsiCo (PEP) and Ford (F) among others. You can see that Origin has a stellar group of global and established customers that have signed up to be its customer or partner, a clear testimony to the quality and confidence of Origin’s carbon negative materials.

Some of Origin’s major customers (1Q22 Origin slides)

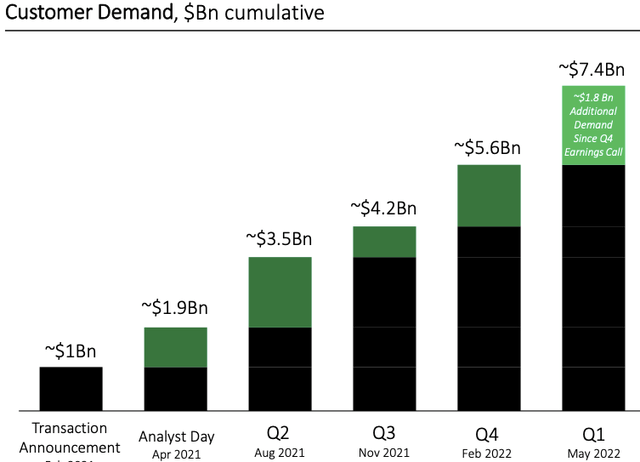

Furthermore, as can be seen below, the pace of customer demand is showing no signs of slowing down, growing almost 290% from a year ago as the awareness of Origin’s products grows.

Pace of customer demand (Origin 1Q22 slides)

This huge demand that Origin is seeing means that the company has already sold out of its capacity for Origin 1, 2, 3 and 4. To give some context, Origin 1 has not yet even began production and Origin 2 is only expected to be operational by 2025. This sell out of capacity means that Origin has significant leverage in being able to price future agreements and the company is even able to prioritize customers with higher margins given that demand far outstrips supply at the current stage.

Furthermore, I looked into the company’s recent reports to look into some of the major off-take agreements that the company has gotten into. These typically have terms between 5 years to 10 years. and includes global companies like Danone (OTCQX:DANOY), PepsiCo and Nestle (OTCPK:NSRGY). The PepsiCo off-take agreement specifies an initial 5 year term from Origin 1 with an option to add another 5 years from Origin 2. There is a clause that states that PepsiCo might terminate the agreement if Origin does not begin operations or product delivery for Origin 1 by end 2022, which in my view could be a risk but the company is looking to be on track to be operational for Origin 1 by then. Similarly, for Danone, the company has agreed for an initial 5 year term from Origin 1 and an option to add up to another 10 years from Origin 2. Lastly, for Nestle, the agreement is for an initial 5 year term for specified but not disclosed amounts from Origin 1. All 3 companies are also Origin’s investors.

Operational milestones on track

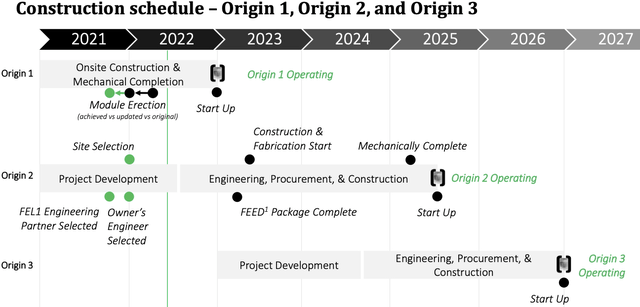

Origin 1 is expected to be up and running by end of 2022, while Origin 2 and Origin 3 is expected to be operational in the middle of 2025 and end 2026 respectively.

Construction schedule (Origin 1Q22 slides)

With Origin 1, while the timeline remains on track for completion by the end of the year, there are challenges in the form of a more difficult supply chain situation as well as rising inflation that has caused the company to increase its capital budget expectations for Origin 1 by $15 million to $20 million. The capital budget for Origin 1 continues to be funded from the available cash that the company has.

For Origin 2, the company recently said that the capital expectations and timeline for the project are still unchanged and they expect to start detailed engineering work in 2023 and start operations for Origin 2 by mid 2025.

Valuation

Since I expect that Origin will only begin larger scale production in 2025, my projections for the company goes beyond 2025 to forecast up to Origin 3. My revenue forecasts for the company for 2025 is $440 million, implying an EV/Sales ratio of 0.81x based on the current enterprise value of the company. Given that I expect Origin’s revenues to continue to grow at a CAGR of 80% from 2025 to 2030 due to the ramp up of Origin 2 and 3, I applied a 2025F EV/Sales multiple of 3x. This, in my view, is rather conservative if Origin is able to ramp up well on its Origin 1 and 2.

Thus, my target price for Origin is $12.33, implying an upside of 125% from current levels.

Risks

Early stage risks

The company is in the early stages of development, having not yet begun operations in its first Origin 1 facility. There are heavy requirements needed for capital expenditures for the construction of Origin 1 to 4, as well as the continual need for research and development. As such, the company will likely continue to be unprofitable in the near term at least, with larger scale production only starting in 2025. During that time, there are risks that due to the unprofitable nature of the company in the near term, this could bring about financial risks in the near term if funding is inadequate for the expansion of the company in the near term before scale builds up.

Operational delays

Another risk is that the production facilities may not be operational according to the suggested timeline. If this happens, this may lead to previously agreed off-take agreements being terminated if certain timeline conditions stated by customers are not met. This could be detrimental to the reputation and confidence in the company’s ability to meet operational targets and deadlines and hinder future business opportunities.

Concentration risks in the near term

Management has included this as a risk in the financial reports. The risk is that Origin may be heavily dependent on a few large customers in the near term with the off-take agreements signed with these customers. As such, there is the risk that if any one of these material customers terminate their existing agreements, this could be detrimental to the company.

Competition

Origin’s competition comes from large chemical companies that continue to use petroleum based materials. These large chemical companies or new startup companies may compete with Origin by coming up with new technologies that could rival Origin’s current products.

Conclusion

To conclude, I think that things looks good for Origin at the moment. With its proprietary and leading platform technology, it is able to attract large customers into taking on long term off-take agreements, thereby ensuring that its planned production facilities have more demand than capacity. Also, it can protect this by ensuring high barriers to entry with its solid patent portfolio. Lastly, the company remains on track to starting operations in Origin 1, which will be a crucial deadline to watch to show the company’s execution capabilities. My target price for Origin is $12.33, implying an upside of 125% from current levels.

Be the first to comment