B4LLS

Zuora (NYSE:ZUO) is a software company that helps other companies set up their own subscription business. The company was a pioneer in the industry and its founder Tien Tzuo, even wrote a book on the subscription industry called “Subscribed”. Zuora effectively became a thought leader in the industry and then used its clout to win major clients. Subscription models are my favorite type of business model as they generate consistent revenue, are easy to upsell, and are also a low-friction payment method for the customer.

Zuora effectively offers an enterprise-grade subscription and revenue management solution to companies. Companies can build their own subscription service with various software tools but of course, it’s easier to just use Zuora. In my previous post on Zuora, I discussed its product and business model in detail. But in this post I’m going to break down its recent financials and valuation, let’s dive in.

Third Quarter Financials

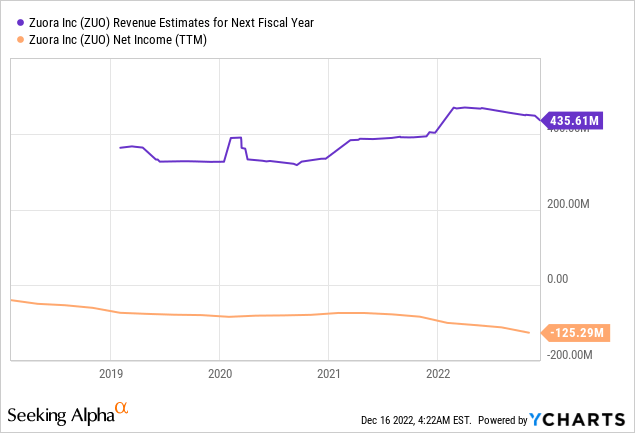

Zuora reported strong financial results for the third quarter of the fiscal year 2023. Revenue was $101.1 million which beat analyst expectations by $861,000 year over year and increased by 13% year over year. This revenue was slightly impacted by unfavorable foreign exchange headwinds, as it increased by 17% year over year on a constant currency basis. Zuora makes the majority (86%) of its revenue from subscription services… as you would expect. In this case, Subscription revenue was $86.6 million which increased by 17% year over year or 20% on a constant currency basis, which is solid.

Zuora also reported $359.7 million in Annual Recurring Revenue [ARR] which increased by 19% year over year and is consistent with the prior year despite economic challenges.

A key metric to analyze is “transaction volume” which is an indicator of its customer’s usage of Zuora solutions. In this case, the company reported $21.5 billion in transaction volume which increased by 15% year over year or 17% on a constant currency basis.

The company has also continued to grow “upmarket” increasing its customers with at or above $100,000 in average contract value [ACV], by 6.9% year over year to 770 customers. These larger customers represent 95% of the company’s business which is substantial. Overall, this is positive as a fewer number of larger customers tends to be easier to manage. In addition, large enterprises tend to have high contract value. In the third quarter alone, the company closed six deals with an average contract value [ACV] of $500,000 or more, with two deals over $1 million.

Its new customer wins include a range of companies across many industries. From camera manufacturer Canon to Michelin the tire company, and Suzuki Motor Corporation. Another notable customer win was Enercare which is one of Canada’s largest energy solutions companies. Zuora replaced Enercare’s existing billing system and offered new features such as product subscriptions, rental and maintenance plans for its products.

Zuora continues to offer strong value to its customers with a dollar-based retention rate of 109%, which means buyers are staying with the platform and spending more.

Acquisition of Zephr

Zuora has recently acquired the subscription experience company Zephr for $44 million in cash. Zephr specializes in subscription solutions for the digital publishing and media industry. For example, one of its clients is News Corp Australia which reported a 13% year-over-year increase in subscriber growth thanks to the usage of Zephr. Zuora plans to use Zephr as a cross-sell tool and a foothold with a greater number of media and publishing clients. Overall I see the synergies, but given the macroeconomic environment, I think it would have made more sense to delay acquisitions unless the business got a really good deal, which is hard to calculate.

Profitability and Expenses

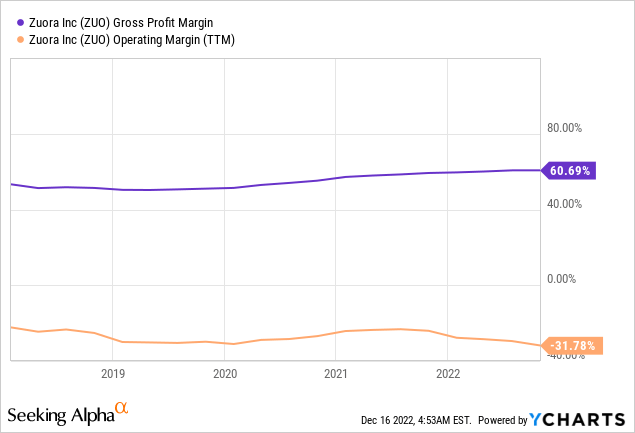

Zuora reported a non-GAAP subscription gross margin of 79%, which was high but it did decline by 90 basis points year over year. A positive is this was driven by infrastructure investments and thus will likely not be a negative long term.

Its non-GAAP operating income was $0.6 million, which was better than the $1.2 million operating loss in the prior year. This improvement was driven by revenue growth and more disciplined investments. The company has recently announced the layoff of 11% of its employees, in order to match the current macroeconomic climate. An issue with this is in the short term, the company needs to pay out $9.5 million for its employee severance package and transition-related costs. Moving forward, the company expects to save ~$29 million from a combination of actions, which should improve the bottom line substantially.

Zuora has a strong balance sheet with $401 million in cash and cash equivalents. In addition to total debt of $258 million, of which just $600,000 is current debt and thus manageable.

Advanced Valuation

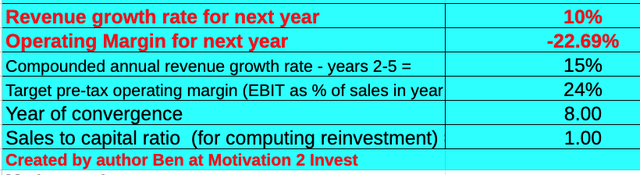

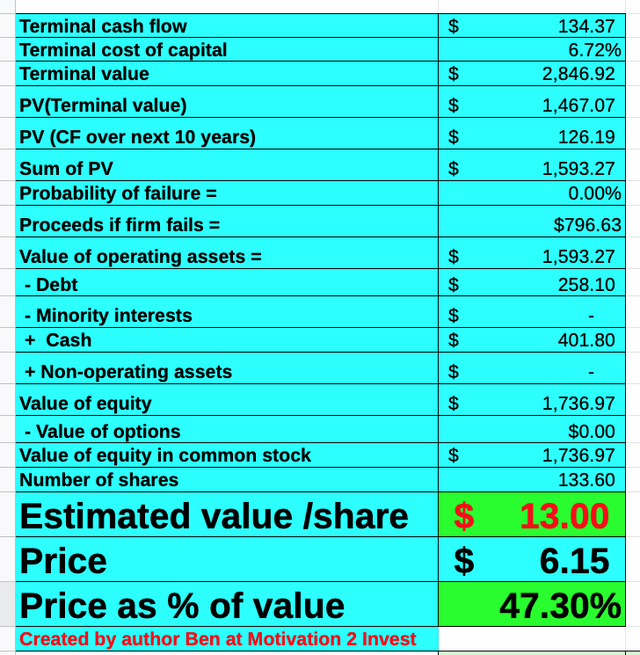

In order to value Zuora, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 10% revenue growth for next year, which I expect to be muted due to the uncertain macroeconomic environment. However, in years 2 to 5, I have forecasted a rebound to 15% per year over the next 2 to 5 years.

Zuora stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have capitalized R&D expenses which have lifted net income. In addition, I have forecasted its pre-tax operating margin to increase to 24% over the next 8 years, which is the average for the software industry.

Zuora stock valuation 1 (created by author Ben at Motivation 2 Invest)

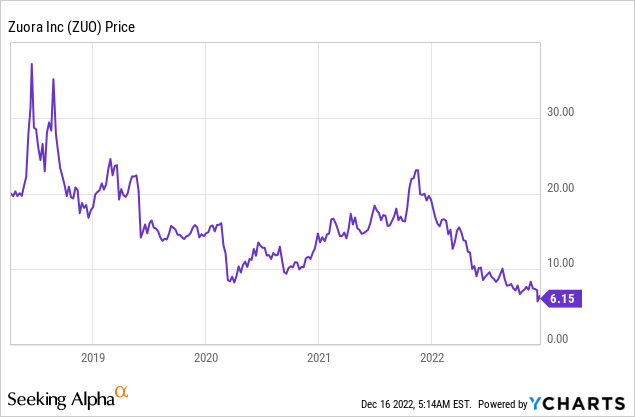

Given these factors I get a fair value of $13 per share, the stock is trading at $6.15 per share at the time of writing and thus is over 50% undervalued.

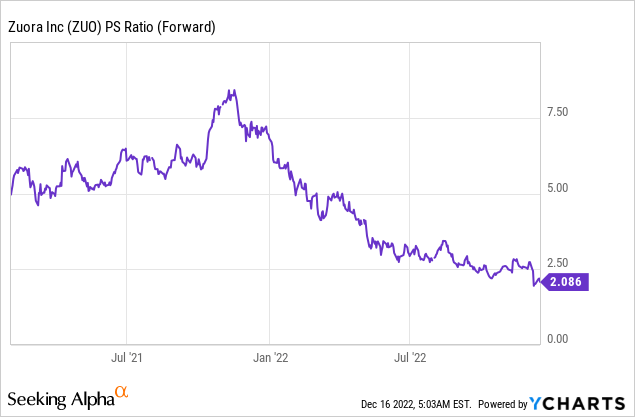

As an extra data point, Zuora trades at a Price to Sales ratio = 2, which is 61% cheaper than its 5-year average.

Risks

Recession/Longer Sales cycles

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. We have already seen Zuora and many tech companies execute layoffs as they aim to streamline the business for lower demand. Therefore I would expect slower growth in the short term, at least until economic conditions improve.

Final Thoughts

Zuora pioneered the subscription industry and has continued to grow its “high ticket” customer base. The business has continued to produce consistent financial results, growing steadily despite economic challenges. Its new acquisition will be an interesting one to watch as the potential for cross-selling is substantial. Zuora is undervalued intrinsically and relative to historic multiples at the time of writing and thus could be a great long-term investment.

Be the first to comment