fizkes/iStock via Getty Images

Investment Thesis

Zoom’s (NASDAQ:ZM) results disappoint. Not only are Zoom’s revenues maturing, but the crown jewel of the investment thesis, its profitability, is moving in the wrong direction too.

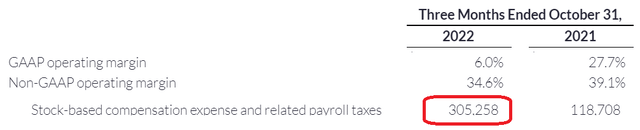

While at the same time, stock-based compensation continues to move rapidly higher. When Zoom’s management team is asked about this impact on the call, Zoom asserts that this program will stick around for a couple of years.

How should investors now think about their Zoom investment now? For my part, I’m not enthused.

Revenue Growth Rates Slow Down, As Expected

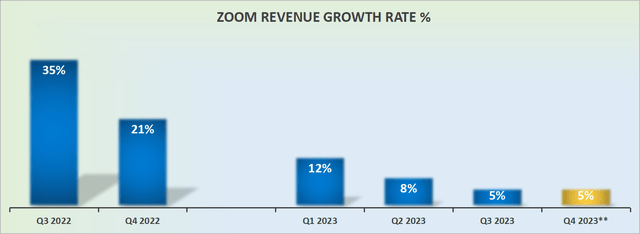

As you can see above, Zoom’s guidance for fiscal Q4 2023 points to 5% y/y revenue growth rates.

Going into the earnings call, I previously wrote:

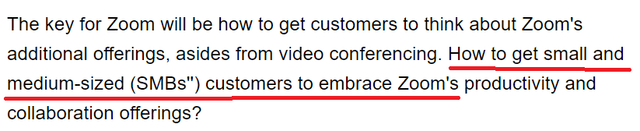

Above, you can see an excerpt from my prior article, where I noted that Zoom’s SMB customers would thin out over time.

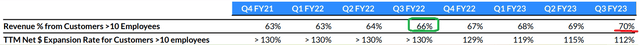

Indeed, as you can see above, in fiscal Q3 2022, Zoom’s SMB customers accounted for 34% of total revenues. This figure has now dipped to 30% of total revenues.

And I believe that this trend will continue as we move ahead to the next quarter, fiscal Q4 2023.

Profit Margins Move in the Wrong Direction

Looking out to fiscal Q4 2023, non-GAAP operating margins point to 29%. To give you some context, consider the following:

- FQ3 2022: 39%

- FQ4 2022: 39%

- FQ1 2023: 37%

- FQ2 2023: 36%

- FQ3 2023: 35%

Consequently, if we take fiscal Q4 2023 non-GAAP operating margins in the context that since last year, Zoom’s non-GAAP margins have been contracting, that goes some way to highlight the problem that Zoom faces.

In the first instance, the time when companies were getting rewarded for ”investing for growth” has come and gone.

And secondly, and equally weighty, if the company is reporting several quarters of compressing operating margins, while at the same time revenues are clearly not growing, this poses a substantial problem.

With that in mind, let’s discuss the other problem facing Zoom.

As I’ve maintained for a while, the problem with investing in tech companies right now is that their stocks are down substantially. And with the stock down so significantly, executives will need to substantially increase their stock-based compensation to retain talent.

When asked on the call about its elevated stock-based compensation, this is what the management team said:

[W]e believe that the Supplemental Grant (”SBC”) program is really important for the strategy of the company in terms of retaining our employees and keeping them focused and not having to worry about that.

As you can see above, while revenues were up 5% y/y, stock-based compensation was up 156% y/y.

ZM Stock Valuation — 20x non-GAAP EPS

Before getting stuck into Zoom valuation, I’ll momentarily divert our attention to discuss stock repurchases. This is what was said on the call:

Due to our share repurchase program, our Q3 weighted average share count has decreased year-over-year approximately 4 million shares to 302 million.

Indeed, in the past 9 months, Zoom has repurchased approximately $1 billion worth of stock. And yet, today, the stock continues to move lower and is showing no signs of slowing down.

For my part, I struggle to believe that Zoom couldn’t forecast how operating margins would come at the end of this year. Why did Zoom deploy more than $500 million to buy stock in Q3, when the core business is clearly struggling?

Presently the stock trades for approximately 20x non-GAAP EPS, while its non-GAAP earnings are flat, at best.

What’s more, the high end of fiscal Q4 2023 non-GAAP EPS points to $0.78. This compares with $1.29 in the same period a year ago.

The Bottom Line

Even though the stock is clearly down significantly from its highs, this hasn’t meant that the stock is undervalued.

A lot of people tell me that they don’t want to invest in commodity stocks because while they recognize those companies are cheap, they are worried about the cyclicality and volatility in their earnings.

And that point, I would push back and say, Zoom’s GAAP earnings are down 86% y/y.

Yes, I recognize that when looking at a tech company we shouldn’t get too caught up in thinking about stock-based compensation. But I think Zoom’s management team may be thinking about their own stock-based compensation.

At least with many commodity companies, they are priced at less than 6x times GAAP earnings. In sum, I believe there’s a better risk-reward elsewhere.

Be the first to comment