Sundry Photography/iStock Editorial via Getty Images

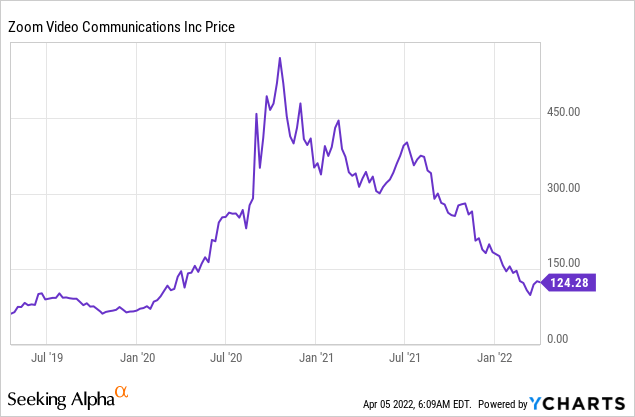

Zoom Video Communications, Inc. (NASDAQ:ZM) is a company we all started to know well in the pandemic years. In that period, ZM stock price has seen tremendous growth (more than 400%) and arrived at its maximum price of about $570 per share.

From that moment, the stock price started to slowly return to the price we see now (around $125 when I am writing), returning to pre-pandemic price levels.

But the macroeconomic situation is now entirely different from 2 years ago. So how is it possible that a company that has had tremendous growth in the last two years has a price comparable to its price before it grew to these levels?

So, in this article, we will analyze the changes, competitors and Zoom projection in the following years to see if the actual price represents the absolute value of the company or if the stock is undervalued.

Macroeconomic View: Pre-Pandemic Vs Post-Pandemic

It is clear to everybody that the world is entirely different from 2 years ago.

Covid-19 has changed the way people relate to each other, contributing to the spread of long-distance relationships and connections.

In addition, the world of work has seen some changes, the most important of which is undoubtedly that of remote work. People have realized that it is not always necessary to physically go to the workplace to work efficiently, but this can also be done remotely. And this trend seems to be continuing even now that the healthcare emergency has passed, as it provides remote workers with a great deal of flexibility and savings in terms of travel time and monetary terms for the cost of transportation. Along with other platforms such as Microsoft (MSFT) Teams and Cisco (CSCO) Webex, Zoom has taken advantage of this trend to provide the tools needed to stay connected remotely and has seen tremendous growth in the number of users.

If we also add the latest developments globally with the Russia – Ukraine conflict and all the implications of the case, including the increase in raw material prices (including crude oil and indirectly the increase of the cost of fuel), we see that the situation is profoundly different.

Sector Overview

Zoom has several competitors, the most notable of which are Microsoft Teams and Cisco Webex.

The three companies offer different products and target different types of customers. The big difference lies in the fact that Webex and Teams are more oriented to enterprise use with very structured platforms with many additions aimed at business use. At the same time, Zoom has different target customers: retail and private.

Zoom has a competitive advantage in prices: it can offer its services at significantly lower prices than its competitors. That was explained in the last conference call by the CFO Kelly Steckelberg:

I would say that Zoom has always been disruptive in pricing and contact center is absolutely different. If you look across the market in how we price Meetings, how we price in Phone, we introduced it. We’re approximately half the price of any of our competitors’ list price. And that continues to be the case with contact center as well.

I mean, over time, we absolutely will continue to add features and functionality with exact same approach that we took for Zoom Phone in terms of the launch and how it grew over time and expanded the features and functionality. The same is true with Contact Center. But you should not take the price as reflecting anything in terms of the quality of that product.

So, Zoom’s ability to attract many individual customers is also because the cost of Zoom products is lower than the prices of Webex and Teams.

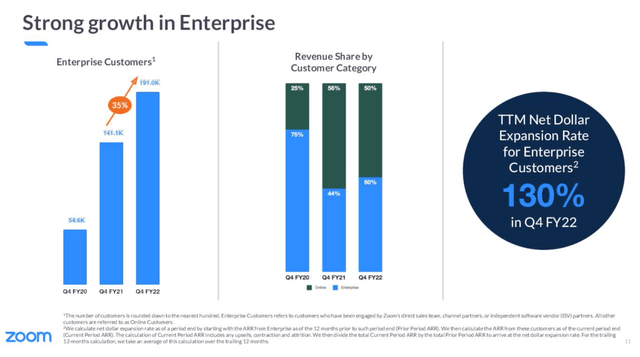

Zoom Video Communications, Inc. 2021 Q4 – Results – Earnings Call Presentation

Business Risks And Potential

With the incredible growth that the remote communications industry has had, it’s safe to say that now the drive is no longer in a significant growth phase, but this growth is levelling off to an average level of growth rates.

In particular, we can say that the video conferencing market is now an established business with an estimated CAGR of the sector of about 11% from 2022 to 2028. We see it from different research from Grand View Research and Fortune Business Insights. In particular, the increase in remote work will positively impact ZM’s business.

The main risk of a business like Zoom’s one, is first of all, that the platform sees a decrease in the number of customers caused both by macro trends (return of people to see each other in person) and by movements in the specific sector with the prevalence of other companies (Webex or Teams for example).

Another aspect is the gross margin of Zoom because the company has a very high gross margin (74% in 2021) and aims to reach 80% at maturity. A 6% bump in margin is not bad, but at the same time, it is not huge. The only way to improve profitability would be to cut OpEx and in particular to increase revenue, and Zoom will be struggling with that in 2022.

We believe that it will not be easy for the company to expand and grow its business. The company will have to either make acquisitions – something similar to what ZM’s management tried with Five9 (FIVN) – or make agreements to make its product more and more complete through integrations with other software and services. Therefore, we believe that the remote video communications sector is a well-established one. Consequently, it is unlikely that Zoom (or any other competitor) will be able to disrupt it further by introducing new products in the short term.

Valuations And Conclusions

We made an estimate based on the characteristics of the industry, Zoom, competitors and the global situation. Specifically, the two fundamental assumptions we considered are:

- Growth of ZM’s revenues with a CAGR of 11% YoY: we have considered growth in line with the sector’s growth as a consolidated sector. We do not believe that the company can overperform and increase its market share excessively.

- Gross margin at maturity of 80% (currently about 74%) and decrease in OpEx. These figures align with the service offered and we believe that they can be achieved without great difficulty.

Our target price sits at about $130/share. So, the actual price ($124) is below our target price by a few percentage points. We believe there is not an adequate margin of safety to enter a long position, and overall, the stock seems appropriately valued.

For us, Zoom is a company with an interesting business but without the significant growth prospects of a few years ago. We will continue to monitor the company as, should the price drop continue, it could become a better opportunity.

Be the first to comment