We Are

Thesis

Thornburg Income Builder Opportunities Trust (NASDAQ:TBLD) is a new CEF from the Thornburg fund family. The vehicle is new, having IPO-ed in July 2021. The fund pursues a multi-asset strategy:

The Trust will invest at least 80% of its Managed Assets, directly or indirectly, in a broad range of income-producing securities. The Trust will invest in both equity and debt securities of companies located in the United States and around the globe. The Trust may invest in companies of any market capitalization and may invest in both U.S. and non-U.S. countries, including up to 20% of its Managed Assets at the time of investment in equity and debt securities of emerging market companies. The Trust’s global equity allocation is expected to represent 75% of Managed Assets and may vary over time between 50% to 90% of Managed Assets. The Trust’s global debt allocation is expected to represent 25% of Managed Assets and may vary over time between 10% to 50% of Managed Assets.

Currently, the CEF currently holds approximately 70% equities and 30% bonds, but it has the mandate and flexibility to change that allocation. In addition to the outright assets, the fund presents a nice, interesting written calls overlay:

The Trust’s options strategy is intended to generate current income from options premiums and to improve its risk-adjusted returns. The notional amount of the options strategy will be approximately 10% to 40% of the Trust’s Managed Assets.

We like this approach, because writing covered calls can provide for a buffer in down markets. It will be interesting to see how the fund allocates this option overlay when the market turns – i.e., in bull markets, writing covered calls can substantially reduce the upside of a portfolio. The fund is not perpetual but has a term structure:

The Trust does not intend to use leverage and has a 12-year term.

Given the fact the vehicle just IPO-ed, we are not very much concerned about its initial maturity date. Similarly to other equity CEFs, the vehicle does not currently have any leverage.

The fund is new and has lost value since issuance, given its pricing close to the market top. However, we like its build and its approach. Blending in an option overlay in a multi-asset structure is a nice risk management tool and a profit generator in a down market. The fund is working on establishing a track record, but the ingredients are there for a robust future. Although overweight tech currently on the equity side, the vehicle is choosing names with low P/E ratios.

Holdings

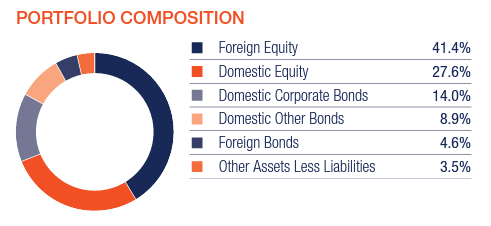

The CEF currently holds approximately 70% equities and 30% bonds:

Portfolio Composition (Fund Fact Sheet)

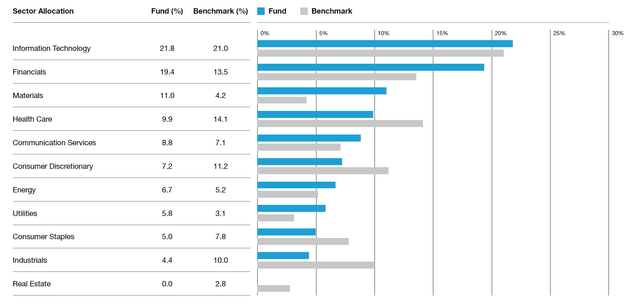

On the equity side, the fund is overweight technology:

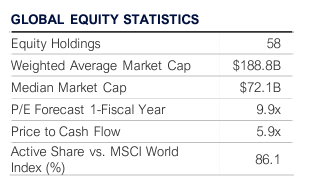

Although Tech is a sore point at the moment, the fund seems to do a good job in picking low P/E companies:

Statistics (Fund Fact Sheet)

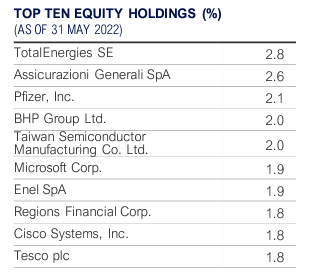

At a sub-10x P/E ratio, this looks like a very conservative build. Furthermore, we like the fact that the fund has only 58 holdings. When looking at the top fund concentrations, we like what we see:

Top Holdings (Fact Sheet)

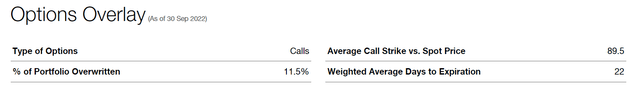

The fund runs larger positions in energy and materials companies, which have held up better in today’s environment. Furthermore, another aspect which is beneficial is the written options component:

Options Overlay (Fund Fact Sheet)

Around 11.5% of the portfolio has calls written against it. This is a conservative cash-generating strategy in a down market. As the market sells off, the written calls expire worthless and the fund pockets the premium. It would be interesting to see what the fund will do once the market turns – this strategy can cap the upside in a sustained up-swing in equity prices. We are a bit removed from that at the moment, though.

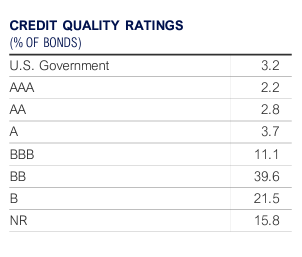

On the bond side, the fund invests in high-yield securities mainly:

Ratings (Fund Fact Sheet)

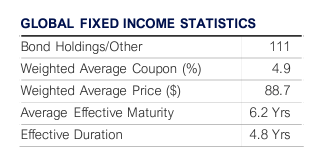

So we can assert that the main risk factors on the fixed income side are credit spreads rather than rates. The bond portfolio is fairly compact as well, with the fund providing quite detailed statistics:

Fixed Income Stats (Fund Fact Sheet)

We can see that the vehicle contains only 111 names, with a fairly front-ended effective maturity date of only 6.2 years.

Performance

The fund is down year to date:

YTD Performance (Seeking Alpha)

The vehicle is down more than the S&P 500 year to date due to the widening of the discount to NAV, but its performance is in line with the BlackRock Capital Allocation Trust (BCAT) move.

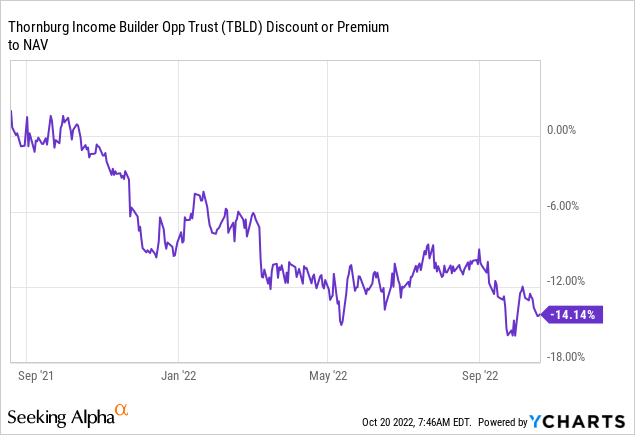

Premium/Discount to NAV

In its brief existence, the fund has always traded at a discount:

This is to be expected of a new CEF, especially a vehicle which was IPO-ed at the top of the market. If an investor looks at historic CEF performances, they will notice a funny commonality – they all tend to lose money in the first 1-2 years. A CEF usually prices at $20/share but usually ends up lower. Not all CEFs are created equal, of course, but since launch, the management team has had a certain pressure to allocate capital, irrespective of timing, which might not be optimal for the ultimate investor.

Reviewing very well-established managers such as PIMCO or BlackRock (BLK), especially on the fixed income side, gives a good glimpse into this incipient vehicle behavior. Again, our view here is that the manager experiences significant pressure to put cash to work in order to justify the charged fees, and in the process of doing so it invests at sub-optimal periods.

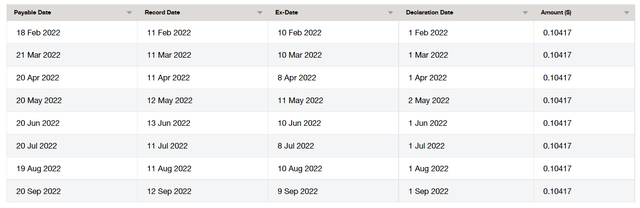

Distributions

The fund seems to have a managed distribution plan, although we could not find any detailed descriptions in the Annual and Semi-Annual reports regarding this feature:

We can notice the same amount being paid monthly, although the fund is not currently generating a 9.5% yield via its assets. The gut check is fairly simple – the fund has 70% equities which have generated losses in 2022 and a small yield of 1.5% to 2%. The bond side which represents 30% of the fund generates a coupon of, call it, roughly 6.5%. The math does not add up, hence we believe more than 50% of the current distributions are ROC. The fund does not provide publicly a Section 19a statement to present.

Conclusion

TBLD is a new multi-asset CEF. The vehicle is currently trading at a discount due to its lack of a track record and underperformance in the holdings. We like the fund’s composition and granularity, and the covered calls option overlay feature. From a fundamental perspective, the portfolio and approach are sound, but just like other CEFs which priced at the top of the market, TBLD was set to underperform initially. Given its lack of performance, the fund is currently utilizing a large amount of ROC to subsidize its 9.5% yield. The fund’s performance year to date is in line to a large extent with another multi-asset fund we wrote about, namely BCAT. We expect a much more robust 2023 for the fund and are keen to see the fund establish an identity and a track record so that analytics can be extracted regarding its risk/return profile.

Be the first to comment