bfk92

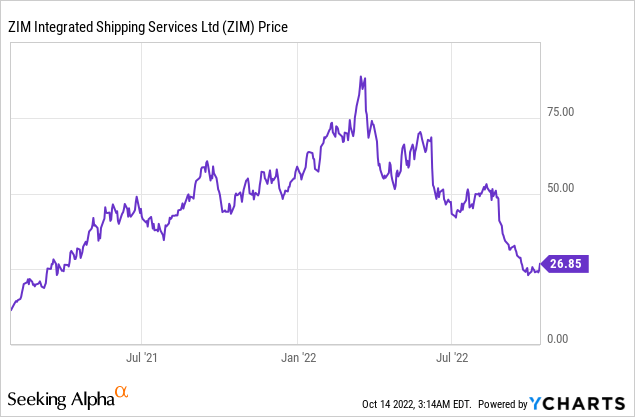

ZIM Integrated Shipping (NYSE:ZIM) is a global shipping company that has continually reinvented itself since its founding in 1945. The company had its IPO on the New York Stock Exchange at an optimum time (January 2021) as inflation spiked and freight rates rose. ZIM took full advantage of this with its flexible approach to shipping and generated monster cash flows as a result. The stock price rose by over 600% to its all-time highs of $84 per share in March 2022 and made many “ZIMillionaires” as a result. However, since then shipping rates have started to normalize and the stock price got butchered by 68%. But now the sell-off seems to have gone too far as the stock has popped by ~9% in the past 24 hours alone. In this post I’m going to dive into the possible catalysts for this rebound, look at the technicals and even reveal a few unique facts about ZIM which haven’t been discussed previously, let’s dive in.

Potential Inflation Catalyst – New Data

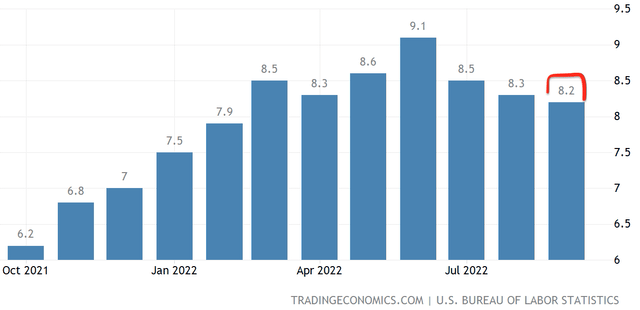

The first potential catalyst for the stock’s movement I will dive into is the latest inflation data released on the 13th of October for the month of September 2022. Despite the negative headlines on mainstream news this data actually shows a downward trend for inflation which was recorded at 8.2% for the month of September, down from 8.3% in August and 8.5% in July. This is a positive sign and shows the Fed’s unpopular rate hikes are working by slowing down the economy and thus inflation. However, inflation is not just about the cold hard numbers it is also about “expected inflation”, in this case, inflation was higher than the market forecasts of 8.1% and is still much higher than the Feds 2% target.

Inflation Rates (TradingEconomics)

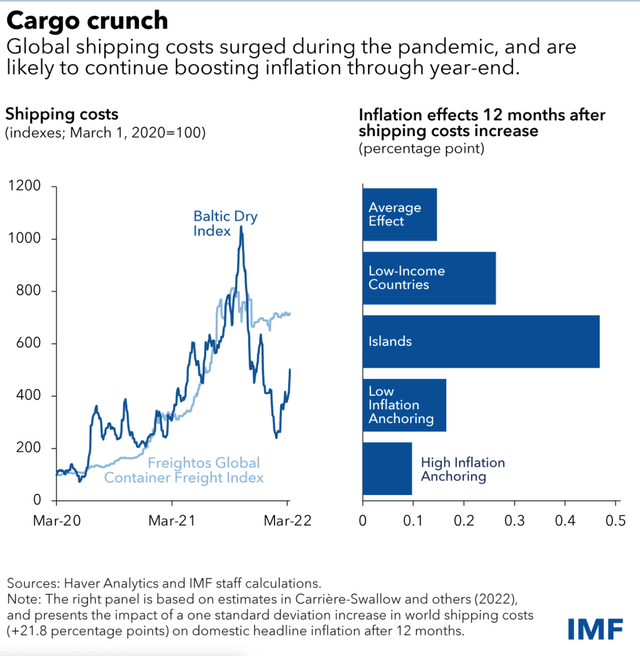

How does inflation relate to stocks? Generally higher interest rates mean higher discount rates and this is usually bad for stocks (especially growth stocks). But it should be noted that a report from the IMF indicated that higher shipping rates generally result in higher inflation, as 80% of the world’s goods travel by sea. Zim has historically performed well during a high-inflation environment but this was mainly due to congested terminals and higher spot shipping prices.

Shipping Rates and Inflation (IMF)

Are Ports Still Congested?

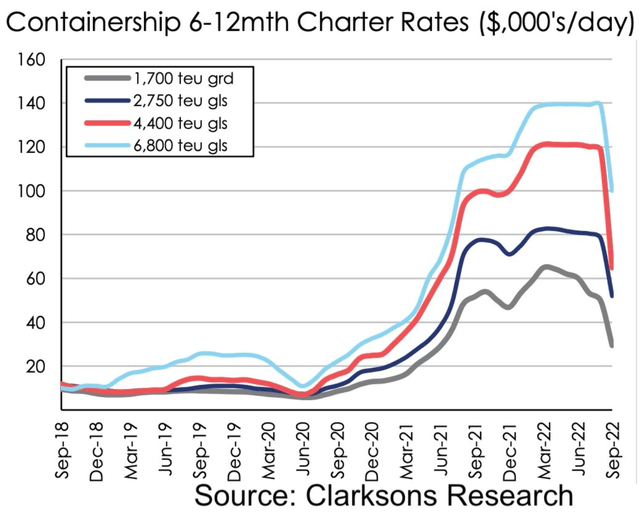

The data is limited on whether ports are still congested and the shipping rate prices, however, I did uncover a couple of sources. The first source indicates that Containership 6-12 month charter rates are in for a “hard landing” as rates plummet for containers of all sizes. These spot rates are on a sharp declining trend, which is not great news for Zim.

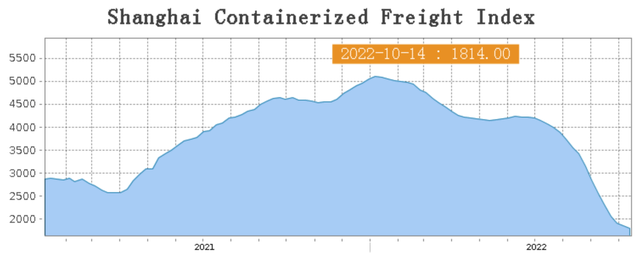

More recent data (October 14th 2022) shows a similar pattern on the Shanghai Containerized Freight index which is the cost of moving costs out of China. This reached a peak of over $5000 per TEU (twenty-foot equivalent unit) container in January 2021. However, this has now been sliced tremendously and is $1800 per TEU. But this is still higher than the pre-2020 average of $1000 per TEU.

Shanghai Containerized freight index (sse)

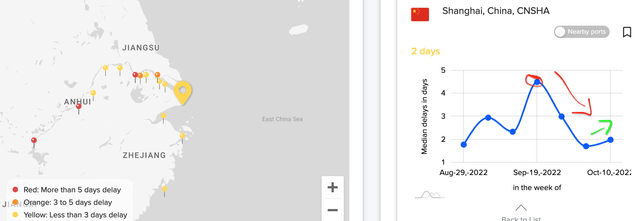

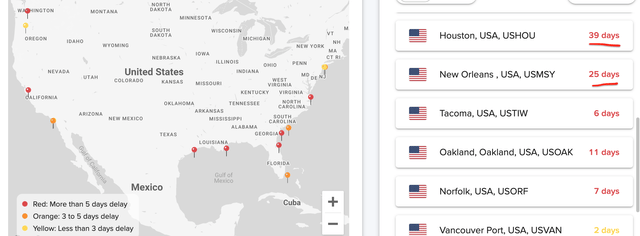

A study by McKinsey forecasts shipping to “normalize” but still be above pre-pandemic levels, this is exactly what we are seeing right now. However, I believe as we (the Fed) are artificially slowing down the economy somewhat, that we will see an over-correction before a turnaround. The recent +9% boost in stock for ZIM could be an indication of that and often the “wisdom of the crowds” can be a leading indicator of events, although this is speculation admittedly. For a more granular view of port congestion (real time data) shows for most ports in China, the delay is between 2 and 3 days (yellow). However, there are still a few ports with greater than 5 days delay (red). In addition, the port in Shanghai shown on the graph has recently increased its delay slightly (chart on right).

The US shows a different story with still many ports having over a 5-day delay (indicated by the red markers). Some ports such as Houston and New Orleans have massive delays of up to 39 days which is simply eye-watering. Thus my final conclusion on port congestion is it is better, but not fully normalized yet, which is good news for a stock such as ZIM if the company can translate this into higher rates.

ZIM Business Model

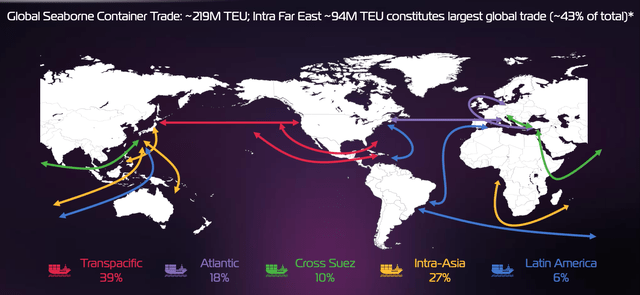

ZIM is a global container shipping company that operates worldwide with a “niche” route strategy. The most popular route the company runs is the transpacific route between Asia and the USA which makes up 39% of the trade and why I dived into details of port delays at those ports above. However, the company also operates between Europe and the USA with 18% of its trade flowing between the two regions. In addition, the company operates “Intra-Asia” routes (27% of shipping) and even Latin America (6% of shipping).

ZIM Integrated Shipping (Investor presentation)

In my previous post on ZIM I covered the company in more detail so here is a quick review. ZIM has an “Asset Light” business model, which focused on charter shipping. The company has recently scored a partnership with the two largest shipping companies in the world, Maersk Line and MSC. This is a smart strategy and it helps to reduce the Boom-Bust volatility that the industry is known for.

ZIM is building 46 new-built vessels, with 28 being Liquefied Natural Gas [LNG] powered. These are more energy efficient and have a lower cost structure than competitors. ZIM has also entered into a 10-year agreement with Shell (SHEL) to supply its vessels with LNG fuel.

ZIM Business Strategy (Investor Presentation)

ZIM is also a technology powerhouse and even has a venture capital arm that backs shipping-related tech startups in the field of AI and even blockchain.

A key element I haven’t discussed in past posts on ZIM is the company culture at ZIM Integrated Shipping. A company is just a collection of people, processes and systems. If people find value in what they do (and enjoy it) then they often work more productively and are less likely to leave. The high cost to find, train and hire talent is a key issue many companies face, and thus retaining talent can be a competitive advantage. The shipping industry is often characterized by an “old-fashioned” and rigid culture, which is usually not enticing to the modern workforce. However, ZIM has flipped this model on its head, just because an industry is historic doesn’t mean its culture has to be.

A review on Glassdoor for ZIM shows they have a strong 4.4 out of 5-star rating. With many employees highlighting the “employee focus” and “work-life balance” as positives. As a comparison, the world’s largest shipping company Maersk has a 4.2-star rating on Glassdoor.

ZIM employee reviews (Glassdoor)

I also researched the company’s LinkedIn and saw many team BBQs, events, and even a pool party (yes really). ZIM has the culture of a tech company which is a strong positive sign. As a comparison, peer Danaos (DAC) looks fairly traditional online. It is not a surprise to see that ZIM was certified as a “Great Place to Work” in Canada, but I imagine this is also true of the other offices.

Brief Financial Review

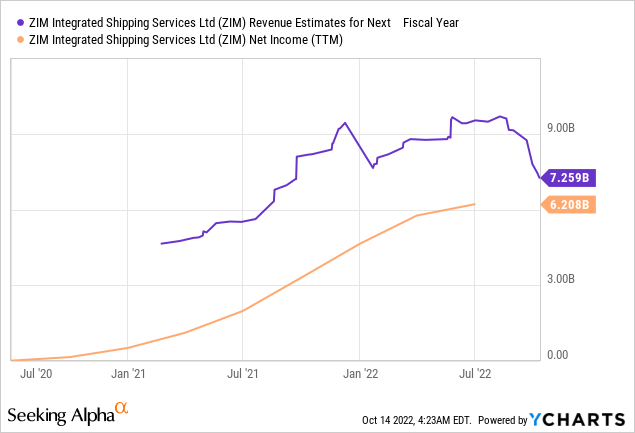

The financial analysis for ZIM was covered deeply in my prior post. Here is a quick review again, for the second quarter of 2022;

Revenues were $3.43 billion, which increased rapid 50% year over year, but came in below analyst estimates by $278 million. Earnings Per Share [EPS] were $11.07 per share, but this did miss analyst expectations by $2.18 per share as freight rates corrected. The company generates a strong EBIT margin of ~60.3%, which is above than the industry average of 57.2%.

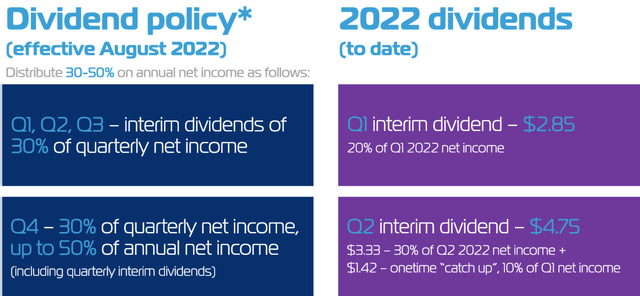

ZIM offers a huge dividend which has made the stock very popular with investors. Management outlined plans to distribute 30-50% of the company’s net income.

ZIM Dividend (Q2 Earnings Report)

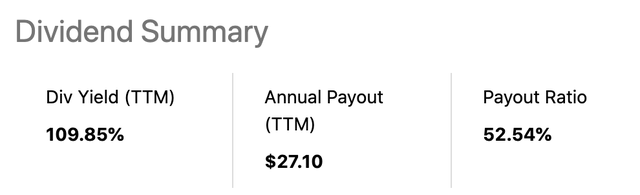

The Seeking Alpha dividend calculator indicates a dividend yield of over 109%, but I believe this may not be that accurate, so I will stick with the “conservative” 30% to 50% dividend yield.

Dividend Yield (Seeking Alpha)

Valuation?

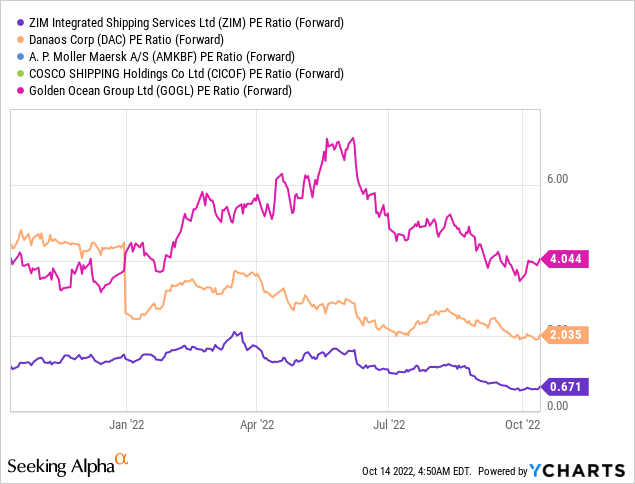

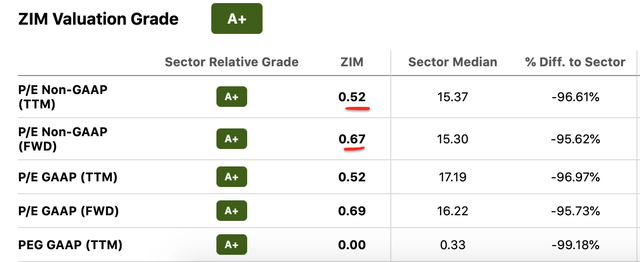

ZIM trades at a cheap forward P/E ratio of just 0.67, which is cheaper than historical levels that are between a PE = 1.7 and 2.1.

ZIM stock also trades at a cheaper P/E ratio than industry peers such as Danaos Corp (DAC) which trades at a PE ratio = 2. MAERSK (MAERSK-B) which trades at a PE ratio = 1.28 and COSCO (OTCPK:CICOY) which trades at a PE ratio = 1 (both not shown on the graph due to foreign data).

Technical Analysis

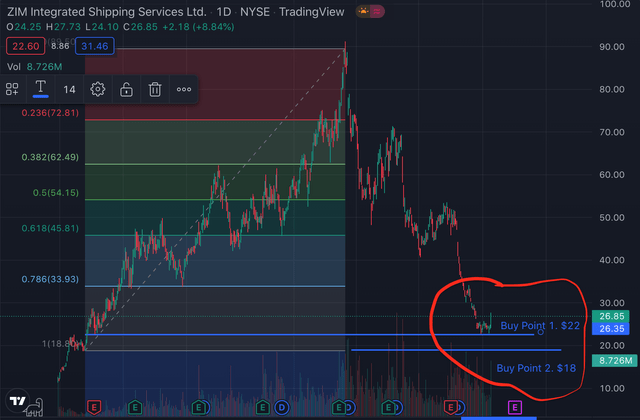

Technical analysis can be useful as a tool to help gauge sentiment and identify support lines. I have setup a “Fibonacci retracement” which uses a mathematical sequence of numbers to identify support and resistance lines. In this case, I have identified Buy Point 1 at ~$22 per share which is the support line the stock previously bounced off, but jumping by 9%. If the stock drops again it could fall to ~$18 per share which is the lowest support the stock price has traded at historically, in its short history as a public company.

ZIM technical analysis (TradingView)

Risks

Economic Slowdown and Lower Shipping Rates

ZIM has primarily made its vast revenue boost in the prior year through higher shipping rates. However, with the Fed continuing to raise rates and many analysts forecasting a recession, an economic slowdown is likely. With less demand for shipping, both rates and volume tend to fall which will impact ZIM and the industry. The only shining light is we are now entering the holiday season, which is the busiest time of the year for trade and shopping.

Final Thoughts

ZIM is a global container shipping company that is continually innovating to stay ahead. Management has executed strong but now the real test will come as shipping rates are correct. ZIM offers value at the current levels and its dividend should be enticing for investors for at least the next couple of quarters.

Be the first to comment