HT Ganzo

Over recent months, there have been numerous developments in the nuclear industry that point to strong future growth in uranium demand. And this is something that will undoubtedly benefit the stock prices of all the major players in the industry. The industry is relatively small as there are few publicly traded uranium stocks, but those that do trade can have important differences.

Therefore, any investor wishing to gain exposure to the sector without having to get into the analytical work of comparing individual uranium producers should consider the North Shore Global Uranium Mining ETF (NYSEARCA:URNM). In this article, I’ll provide an overview of recent industry developments as well as discuss some important characteristics of the fund.

U.S. Market

In the U.S., nuclear has been having a good run as of late. The recent decision by California lawmakers to extend the life of the Diablo Canyon nuclear plant is a strong indication of a renewed interest in nuclear power by lawmakers and the general public. Changes such as these may help stem the tide of plant closures that have seen the fleet of nuclear reactors in the U.S. fall from 104 ten years ago to 92 today. In fact, the number of nuclear installations may slowly start to increase if efforts to reopen closed plants such as the Palisades Nuclear Plant in Michigan are successful, and there’s even talk by the Department of Energy (“DOE”) of converting hundreds of former coal-fired power plants to nuclear facilities.

But while that’s all very good, maintaining the fleet at current levels or even growing it slowly through the reopening of a few closed plants won’t be enough to power uranium prices very high. And as for the DOE’s coal-to-nuclear study, I’m not going to get my hopes up. In fact, I wouldn’t be surprised if we never heard about it again.

I think to get a better understanding of the true scale of changes currently occurring in the nuclear and uranium industries, one has to look to international markets. That’s where the action is, and that’s where the bulk of future demand growth is going to come from.

Europe

For very obvious reasons, this past summer was a period of self-reflection for many European governments as they re-evaluated their long-term energy strategies. And whether they like it or not, nuclear is going to be part of those strategies.

Some countries have gladly embraced nuclear power and are actively making plans to build out capacity and increase its share of their energy mix. This group includes the UK, Poland, and Romania. Earlier this year, the UK government alone announced that it was aiming to eventually get 25% of the country’s electricity from nuclear power, and £20bn has already been allocated towards the construction of the Sizewell C reactor on the coast of Suffolk.

Even Germany, who years ago basically handed over control of its energy policy to the Kremlin, has grudgingly agreed to keep its last two reactors online.

Asia

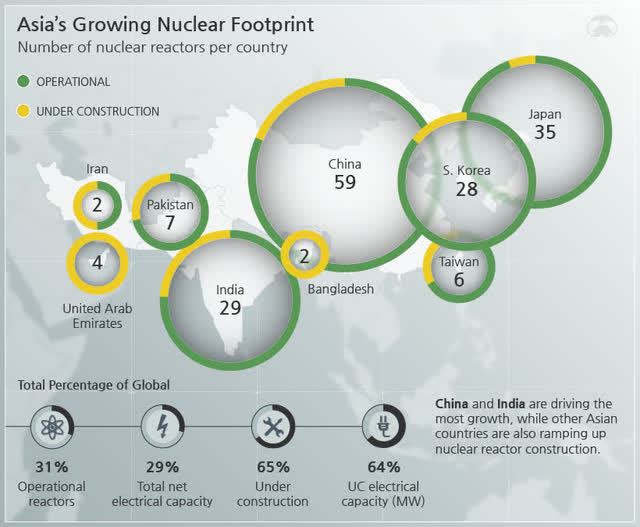

Over in Asia, the outlook is even better. As can be seen in the graph below, most countries in this part of the world had never really given up on nuclear in the first place. Reactor construction has been ongoing and capacity continues to grow.

The only major holdouts were South Korea and Japan. But recent elections in South Korea changed all that as the new president, Yoon Suk-yeol, has adopted a strong pro-nuclear policy and plans to source 30% of the country’s energy from nuclear power by 2030. Japan’s stance has also shifted as public opinion there has become decidedly more pro-nuclear. In a major shift to the country’s energy policy, the Japanese government recently announced that it would reopen facilities closed after the Fukushima disaster and even look to build new reactors.

URNM

Granted, many of these plans will take time to realize, but the eventual combined impact of planned capacity additions on the uranium market should be notable. Over time, uranium prices should trend upwards as nuclear generating capacity is added and uranium demand grows. And that brings us to URNM.

This is an excellent fund for any investor wishing to gain exposure to the uranium sector. The fund is structured as an exchange-traded fund (“ETF”), currently has 35 holdings including all the major players in the space, and has a reasonable 0.85% expense ratio (reasonable for the uranium sector).

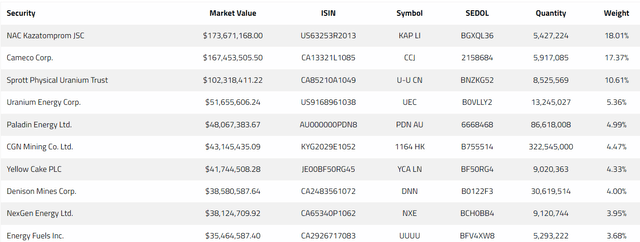

It’s a good investment for an investor who wants exposure to the sector without having to get into the analysis of individual uranium miners. Owning the fund also shields an investor from a lot of company-specific risk. For example, if there were to be a major accident at Kazatomprom (KAP.LI) that interrupted production, it is highly likely that Cameco Corporation’s (CCJ) share price would soar. An owner of the fund would therefore take a loss on Kazatomprom, which makes up 18% of the fund, and take a gain on Cameco, which makes up an almost identical 17.4% of the fund. The gain and loss may not cancel each other out completely, but the two positions do hedge away a measure of risk.

URNM Top 10 Holdings (sprottetfs.com)

Takeaway

The uranium sector’s future prospects look very promising. Public opinion is shifting, and all over the world, governments are beginning to understand that nuclear will have to become a greater part of the energy mix. Investors wishing to benefit from that trend may want to consider URNM, a fund that covers the sector well and whose unit price looks set to rise along with it.

Risk

The main risk that comes from investing in the fund is another nuclear disaster. Such a scenario would result in nuclear energy becoming a harder sell to the general public and either slow down or even stop its widespread adoption. This would obviously have a very negative impact on the sector and should be kept in mind by any potential investors.

Be the first to comment