Banphote Kamolsanei

Investment Thesis – Exemplary Dividends Ahead Despite Drastic Correction

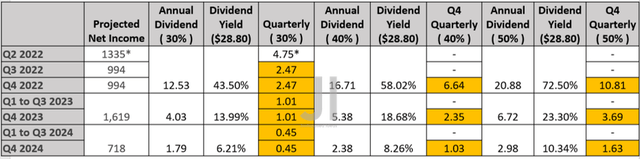

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) has drastically updated its dividend policy in FQ2’22, as one may read here. In short, the first three-quarters of dividend payouts will be capped at ~30% of the company’s net quarterly income. Here comes the smacker – the cumulative annual dividend payout may reflect up to 50% of its annual net incomes, triggering a loaded Q4 payout indeed.

We have done a detailed calculation based on these changes and have come to one important realization. Even though its forward payouts will obviously be lower than the previously unsustainable $17 dividend payout for FQ4’21, these revised numbers still reflect a more-than-impressive dividend yield ahead. Here we go:

ZIM Projected Dividend Payout

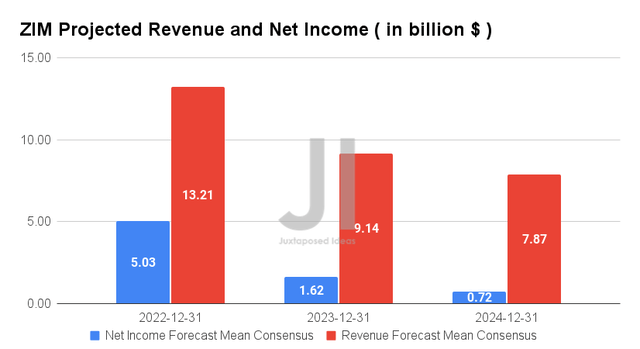

With $2.85 paid in FQ1’22 and $4.75 in FQ2’22, we are looking at a conservative $2.47 quarterly payouts and 43.5% yields for FQ3’22 and FQ4’22, based on the lower estimate of 30% from its projected net incomes of $5.03B for FY2022. However, if we were to refer to its previous 50% loaded payout in FQ4’21 and the updated policy moving forward, ZIM investors may potentially see up to $20.88 paid out for the whole year. That would trigger a very handsome $10.81 of dividend payouts by FQ4’22. Impressive indeed, given the dividend yields of 72.5% then.

In the meantime, for FY2023’s projected net incomes of $1.61B, we will naturally see a much lower dividend payout of $1.01 for the first three quarters with up to $3.69 by FQ4’23. This indicates an excellent dividend yield of 23.3% then. For FY2024, we may see $0.45 every quarterly with up to $1.63 for FQ4’24, triggering a decent 10.34% yield then.

Though ZIM’s falling dividend yields may appear discouraging, we must also highlight that no company would be able to sustain these elevated payouts once freight rates fall. Furthermore, even the conservative 6.21% dividend yields by FY2024 ( based on a 30% payout ) are comparatively better than its peers at a mean of 3.3% thus far. Therefore, signifying the stocks’ massive returns over the next few years. Investors, do not miss this gold mine during a time of economic uncertainties like now.

Note: These calculations are based on ZIM’s 120.44M diluted shares outstanding in FQ2’22, its stock price of $28.80 at the time of writing, and consensus estimates of its projected net incomes through FY2024. Therefore, depending on the fluctuation in freight rates, actual earnings, share count, and differing applications in company policy ahead, these projected numbers may vary from the actual results.

ZIM Is Still On A Winning Streak Despite Macro Headwinds

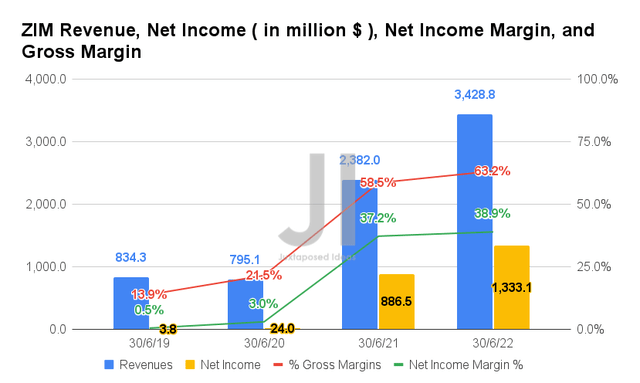

In FQ2’22, ZIM reported revenues of $3.42B and gross margins of 63.2%, representing an excellent increase of 43.69% and 4.7 percentage points YoY, respectively. This has directly contributed to the growth in its profitability, with net incomes of $1.33B and net income margins of 38.9% in the latest quarter. It indicates a tremendous increase of 51.13% and 1.7 percentage points YoY, respectively.

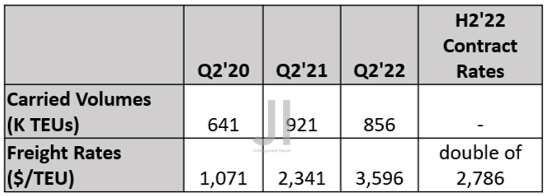

ZIM Carried Volumes/ Charter Rates

S&P Capital IQ

These exemplary growths were mostly attributed to the record high freight rates thus far, with ZIM reporting $3.59K/ TEU by FQ2’22. It represented a tremendous increase of 53.6% YoY or 335.76% from FQ2’20 levels. With the company affirming another record high number for H2’22 contract rates, double 2021’s rate of $2.78K, we expect to see more exemplary earnings for the next two quarters, if not through H1’23.

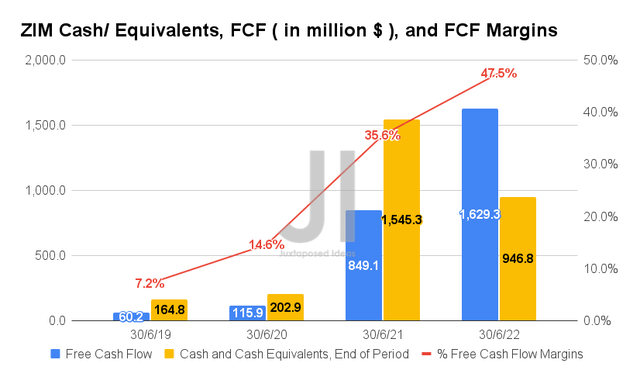

The elevated rates have also directly improved ZIM’s Free Cash Flow (“FCF”) generation thus far, with $1.62B and an FCF margin of 47.5% reported in FQ2’22. It indicated a monumental increase of 92.85% and 11.9 percentage points YoY, respectively. It is no wonder that the company has raised its dividend payouts to ~30% of the net quarterly income in the latest quarter, compared to 20% previously.

For now, ZIM appears well poised for growth and expansion ahead as well, with excellent cash and equivalents of $946.8M on its balance sheet. This is on top of the management’s deft deleveraging from FQ4’20 levels of $519.47M to $164.8M in FQ2’22 and the massive growth in the net PPE assets from $1.53B to $5.76B at the same time. Stellar indeed.

Mr. Market May Potentially Upgrade ZIM’s FY2023 Numbers By 10%

Over the next three years, ZIM is expected to report a drastic revenue and net income normalization as the freight rates are expected to fall from Q1’23 onwards. Nonetheless, it is essential to note that these numbers still represent an excellent adj. revenue CAGR of 19.06% and net income CAGR of 108.78%, respectively, between FY2019 and FY2024. Excellent indeed, given the massive improvement in its net income margins from -0.6% in FY2019, to 43.3% in FY2021, and finally settling at a comfortable 9.14% by FY2024, compared to other giants such as A.P. Møller – Mærsk A/S (OTCPK:AMKBY) at 6.3% and Evergreen Marine Corporation (Taiwan) Ltd at 17.1% by FY2024.

There is a good chance that these elevated freight rates may also hold through FQ1’23 or even through H1’23, given China’s insistence on Zero Covid Policy, congested ports globally, and sustained elevated demand over incoming supply. These would indicate an aggressive 20% upside from current levels, though conservatively speaking, more likely 10% to $10.15B of revenues in FY2023.

In the meantime, consensus estimates that ZIM will report revenues of $13.21B and net incomes of $5.03B in FY2022, representing an impressive increase of 23.22% and 8.4% YoY, respectively, despite the tougher YoY comparison. We shall see, though current trends look cautiously optimistic.

As discussed above, we also expect to see excellent dividend payouts ahead, due to the stable charter rates and 3% volume growth through FQ4’22. Thereby, potentially boosting ZIM’s stock valuations, despite the worsening macroeconomics and the Fed’s aggressive efforts in hiking interest rates through 2023.

Meanwhile, we encourage you to read our previous article on ZIM, which would help you better understand its position and market opportunities.

- ZIM Integrated Shipping: Charting New Growth And Territories – But Do Not Add

So, Is ZIM Stock A Buy, Sell, or Hold?

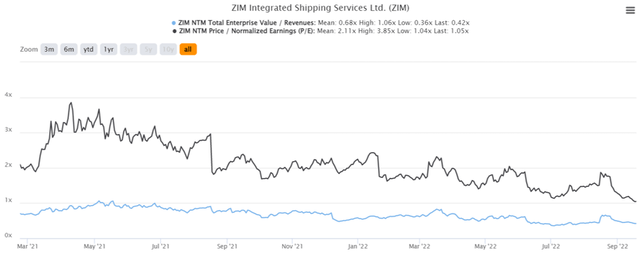

ZIM 2Y EV/Revenue and P/E Valuations

ZIM is currently trading at an EV/NTM Revenue of 0.42x and NTM P/E of 1.05x, lower than its 5Y mean of 0.68x and 2.11x, respectively. The stock is also trading at $28.80, down -68.43% from its 52 weeks high of $91.23, nearing its 52 weeks low of $28.33. Nonetheless, consensus estimates remain bullish about ZIM’s prospects, given their price target of $55.00 and a 90.97% upside from current prices.

ZIM 2Y Stock Price

We are of the opinion that current levels offer investors with an extremely attractive risk/ reward ratio, given the potentially rich dividend payout of $10.81 by FQ4’22. With the Feds set to hike interest rates by 75 basis points on 21 September (otherwise, a speculative 18% chance of a 100 basis points hike), we expect the stock market as a whole to continue declining over the next few days. The S&P 500 Index had already plunged by -19.61% in the first nine months of 2022, pointing to a time of maximum pain for highly opportunistic investors.

As a result, we encourage those with an upper tolerance for risk and volatility to add at current levels, due to the massive returns ahead. Otherwise, bottom fishing investors may potentially wait for mid $20s for an eye-popping 83.52% dividend yield.

Aye, aye, load up the boat!

Be the first to comment