SHansche

In the past month, ZIM Integrated Shipping Services (NYSE:ZIM) stock price increased by 10%. However, year to date, ZIM stock price is down by more than 50% as container freight rates plunged. Due to lower freight rates, ZIM has decreased its full-year 2022 guidance in its 3Q 2022 financial results. The Drewry World Container Index is now 73% below its peak of $10377 in September 2021. However, container freight rates are still significantly higher than the pre-pandemic levels. As port congestion is decreasing, container freight rates will decrease further. On the other hand, charter rates plunged alongside freight rates. Thus, due to the company’s chartering strategy, ZIM can adjust its operations whenever it is needed and remain profitable. It is important to know that in the past six months, despite decreased freight rates, the number of ZIM’s chartered ships has increased. Moreover, as a result of strong financial results in the past few quarters, ZIM was able to improve its leverage ratios significantly and now the company is well-positioned to make profits even with the lower freight rates. The stock is a hold.

Quarterly results

In its 3Q 2022 financial results, ZIM reported carried volume of 842 thousand TEUs, compared with the 2Q 2022 carried volume of 856 thousand TEUs. The company’s average freight rate decreased from $3596/TEU in 2Q 2022 to $3353/TEU in 3Q 2022. ZIM reported revenues of $3228 million for the third quarter of 2022, lower than 2Q 2022 revenues of $3429 million in 2Q 2022. The operating income of the company decreased from $1764 million in 2Q 2022 to $1544 million in 3Q 2022. In 3Q 2022, ZIM reported net income and adjusted EBITDA of $1166 million (down 13% QoQ) and $1934 million (down 8% QoQ), respectively. ZIM’s earnings per diluted share decreased from $11.07 in 2Q 2022 to $9.66 in 3Q 2022. The company’s free cash flow of $1626 million in 3Q 2022, was $13 million lower than in 2Q 2022. Furthermore, ZIM revised its 2022 full-year guidance. The company now expects its 2022 adjusted EBITDA to be between $7.4 to $7.7 billion, compared with 2022 adjusted EBITDA of $7.8 to $8.2 billion which was previously anticipated. ZIM declared a dividend of approximately $354 million, or $2.95 per share, representing approximately 30% of its third-quarter net income. “Driven by macroeconomic and geopolitical uncertainties, the near-term outlook for container shipping has shifted and the normalization in freight rates has begun,” the CEO commented.

“The proactive steps we have taken over the past two years, combined with our balance sheet strength, have transformed ZIM and significantly enhanced our resilience both commercially and operationally, to best position our Company for the new normal,” he continued.

The market outlook

Port congestion around the world is declining, making container freight rates reach normal prices at a faster pace. Before the pandemic, only 3% of global container ships were facing port congestion problems. As a result of the COVID-19 lockdowns, in January 2022, 14% of global container ships were held up due to port congestion. Now, port congestion affects 8% of vessels.

In the past few months, the trade disruptions caused by the war in Ukraine and the western countries’ sanctions against Russia, China’s lower exports as a result of its zero-COVID19 policy, and increased interest rates in the United States, helped container freight rates to decrease faster than before. However, it is important to know that in September 2022, China’s export increased by 10% (MoM), implying that China is easing COVID-19 rules. Recently, China has reduced quarantine periods. However, we cannot say that the Chinese government’s zero-COVID policy has ended. The freight rates could be supported the under following conditions: the easing of lockdowns in China, ending the war in Ukraine, and lower interest rates in the United States. However, with the current market conditions, container freight rates may decrease further.

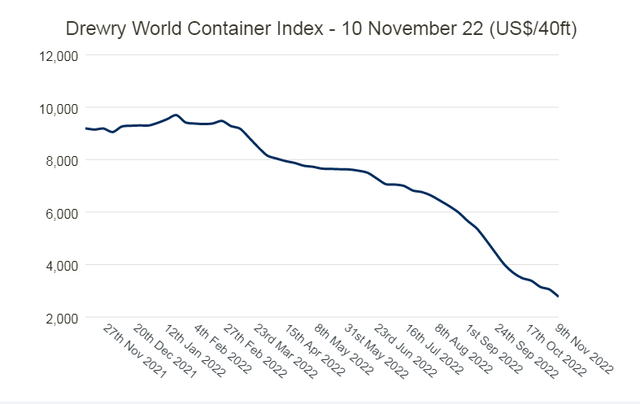

Figure 1 shows that due to the 37th consecutive weekly decrease, the Drewry World Container Index was $2773 per 40ft in the week ending 10 November 2022, down by 70% compared with the same week last year. According to Figure 2, the freight rates for trade routes from Shanghai plunged during the past year. However, the freight rate for New York to Rotterdam increased by 11% and the freight rate for Rotterdam to New York increased by 17% during the past year. Now, the Drewry WCI Composite Index is 26% lower than the five-year average of $3759; however, it is still more than 100% higher than pre-pandemic levels.

Figure 1 – Drewry World Container Index

Figure 2 – Freight rates across trade routes

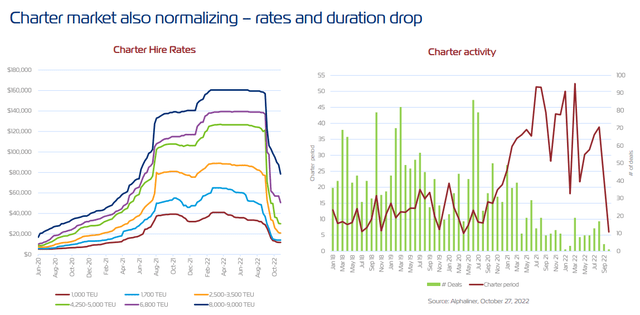

Furthermore, charter hire rates plunged in the past few months. Also, the number of chartering deals and the charter period decreased significantly in the past few months (see Figure 3). According to Alphaliner as of 16 November 2022, ZIM has 130 chartered ships, with a total capacity of 509508 TEUs. As of 12 June 2022, ZIM had 123 chartered ships, with a total capacity of 446288 TEUs. Thus, despite decreasing container freight rates, ZIM has increased its chartering activity as charter rates became more attractive.

Figure 3 – Charter market

The performance outlook

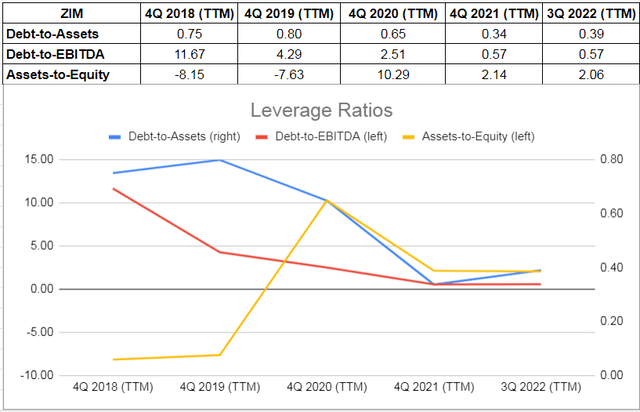

In this detailed analysis, I used some common leverage ratios that have significant comparability to ZIM’s debt. The proportions are calculated in comparison with previous years to be more helpful.

The debt-to-assets ratio measures the company’s debt capacity. This ratio indicates the proportion of assets that are being financed with debt. The higher the ratio, the greater the degree of leverage and financial risks. The company’s debt-to-asset ratio decreased from 0.80 in 2019 to 0.65 in 2020. In 2021, the company’s debt-to-asset ratio decreased by 48% to 0.34. On 30 September 2022, ZIM’s debt-to-asset ratio increased to 0.39. ZIM’s debt-to-EBITDA ratio (which helps determine the probability of defaulting on debt) dropped from 4.29 at the end of 2019 to 2.51 at the end of 2020. It decreased further to 0.57 at the end of 2021. On 30 September 2022, ZIM’s debt-to-EBITDA ratio was again 0.57. Finally, ZIM’s asset-to-equity ratio decreased from 10.29 at the end of 20120 to 2.14 at the end of 2021. The company’s asset-to-equity ratio decreased further to 2.06 on 30 September 2022. The decreasing assets-to-equity ratio indicates that the company has been using lower debt to finance its assets. As container freight rates are decreasing, ZIM’s leverage ratios will not improve as fast as they did in 2021 and the first half of 2022. However, due to the strong financial results in the past few quarters, ZIM improved its financial health and now the company is ready to remain profitable with normal freight rates. Thus, I expect the company to continue rewarding its shareholders and cover its current and future obligations (see Figure 4)

Figure 4 – ZIM’s leverage ratios

Summary

Compared with a year ago, freight rates are not attractive. However, compared with the pre-pandemic levels, freight rates are still high. As charter rates plunged too, ZIM’s chartering strategy means the company is able to adjust its operations based on freight rates and charter rates and remain profitable. Also, the company’s improved leverage ratios indicate that ZIM is financially healthy. However, we likely cannot expect ZIM’s quarterly results to be as strong as before going forward. The stock is a hold.

.

Be the first to comment