maybefalse/iStock Unreleased via Getty Images

Thesis

Alibaba Group Holding Limited (BABA, BABAF) stock surged more than 7% after reporting earnings, although the company reported a softer than expected September quarter – failing to meet analyst consensus estimates with regards to both revenues and earnings, but increasing shareholder distributions. Moreover, investors are surely disappointed to learn that Alibaba’s cloud business – the firm’s major growth driver – has expanded at the slowest pace on record.

As a function of valuation and negative market sentiment, I continue to believe that Alibaba stock deserves a “buy” rating. However, following a weaker than expected September quarter, I lower my EPS estimates for the company, and cut my target price for BABA to $126.67/share (versus $133.92/share prior).

Alibaba’s September Quarter Disappoints

Alibaba’s September quarter delivered a worse than expected business performance, as China’s zero-COVID strategy continued to pressure consumer sentiment and spending.

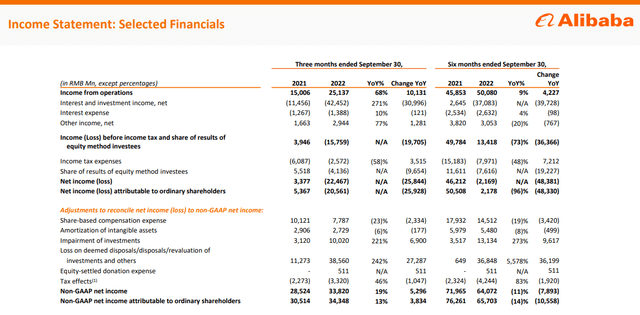

During the period from July to end of September, Alibaba’s revenue increased by only 3% year-over-year, to RMB207,176 million ($29,124 million). For reference, analysts had expected (mid-point consensus) that Alibaba would generate about $29.61 billion of revenue.

Operating income jumped by 68% year-over-year, to RMB25,137 million (US$3,534 million) – as Alibaba remained focused on operational discipline and also reduced share-based compensation expenses by approximately 23%.

Alibaba’s September Quarter 2022 Earnings Report

Although net profitability dipped into negative territory – a loss of RMB20,561 million (US$2,890 million) – investors should consider that the loss was primarily driven by write-downs of equity investments in two publicly-traded companies: Didi (DIDI) and GoTo.

Excluding any such write-downs and other non-GAAP adjustments, Alibaba’s profitability was RMB33,820 million (US$4,754 million), representing an increase of 19% versus the same period in 2021 (Non-GAAP diluted earnings per ADS of RMB12.92 ($1.82)).

Daniel Zhang, Alibaba’s current Chairman and CEO, commented:

We delivered solid results this past quarter despite ongoing macro environment challenges, which is a testament to our resilient business model and unmatched customer value proposition …

… The uncertainties of the global landscape have only reinforced our resolve to focus on building capacity that will yield sustainable, high-quality growth for our customers and our own business over the long term.

During the September quarter, Alibaba’s commerce business continued to stumble, which Alibaba CFO Toby Xu attributed to macro-challenges and cost-inflation.

… impact on consumption demand by the COVID-19 resurgence in China as well as slowing cross border commerce due to increasing logistics costs and foreign currency volatility

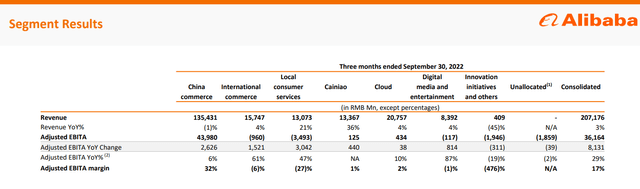

Alibaba’s “Commerce Segment,” which accounts for almost 70% of the company’s total sales, shrunk by about 1% year-over-year.

Moreover, the segment is likely to remain pressured also in the December quarter. Management commented that sales for the Single’s Day were approximately flat versus the same event in 2021. In addition, concerns are building surrounding Q4 delivery challenges, as reportedly 15% of delivery areas are impacted by COVID disruptions.

But arguably even more disappointing was Alibaba’s “Cloud Segment.” With only 4% year-over-year growth, Alibaba’s cloud business expanded at the slowest pace on record.

Alibaba’s September Quarter 2022 Earnings Report

More Share Repurchases

As of November 2022, Alibaba repurchased approximately $18 billion of our shares under the company’s existing $25 billion share repurchase program. In the September quarter alone, Alibaba disclosed that the company repurchased approximately 24.3 million of ADSs for a total of $2.1 billion worth of equity.

On the backdrop of a solid cash position ($68.2 billion as of November 2022) and healthy operating cash flow generation ($11.4 billion for the trailing twelve months), Alibaba announced to add an additional $15 billion to the current program, which is planned to be completed by the end of fiscal year 2025.

Valuation Still Attractive: Target Price Update

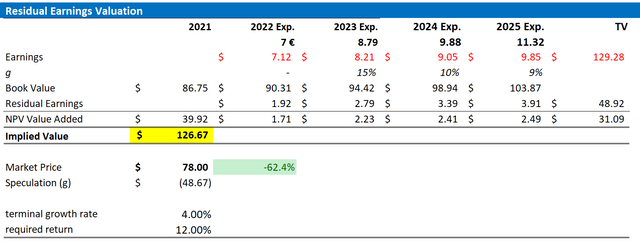

Following a somewhat disappointing September quarter, I adjust my residual earning model for BABA to account for preliminary consensus EPS downgrades. Moreover, I lower my terminal growth outlook for the company to 4%, versus 4.5% earlier. I continue to anchor on an 12% cost of equity – which reflects the heightened political and economic risk from investing in China-based companies.

Given the EPS updates as highlighted below, I now calculate a fair implied share price of $126.67, versus $133.92/share prior).

Analyst Consensus Estimates; Author’s Calculation

Below is also the updated sensitivity table.

Analyst Consensus Estimates; Author’s Calculation

Investment Risks

As I see it, there has been no major risk update since I last covered BABA stock. Thus, I would like to highlight what I have written before:

First, the economy in China is currently pressured by multiple headwinds including inflation, real-estate crisis and COVID-19 lockdowns. If the Chinese economy would slow more than what is expected and priced in, investors should adjust expectations for Alibaba’s short/mid-term business monetization accordingly.

Secondly, China’s internet/tech companies are strongly exposed to regulatory risk. While the worst seems to be behind us, the elevated risk exposure persists — and will arguably never completely fade.

Third, much of BABA’s share price volatility is currently driven by investor sentiment towards Chinese ADRs and risk assets. Thus, BABA stock price might show strong price volatility even though the company’s business fundamentals remain unchanged.

Conclusion

Despite a softer than expected September quarter, I continue to like Alibaba stock. In my opinion, investor sentiment towards China-based equities remains excessively bearish. And once the situations surrounding COVID eases further, businesses such as Alibaba are poised to rebound sharply. As Alibaba CEO Zhang said:

We believe that Covid will ultimately pass, that our society, our economy, and our lives will eventually return to normal, and that the massive potential of China as the world’s second-largest economy will be further unleashed.

That said, I would like to point out that BABA stock continues to trade cheap versus fundamentals. Although I lower my target price to $126.67/share, my valuation model still sees more than 60% upside.

Be the first to comment