hapabapa

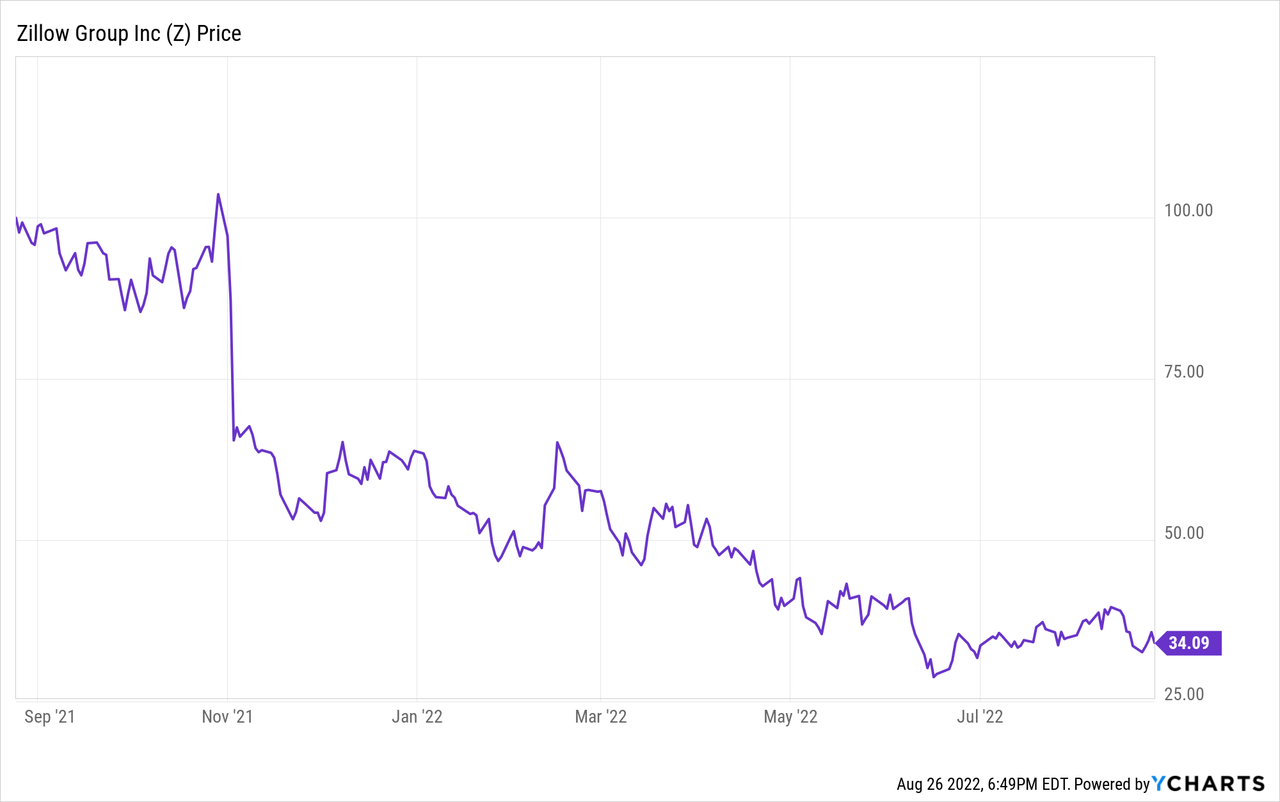

Zillow’s (NASDAQ:Z) (NASDAQ:ZG) stock price chart over the past year has been nearly a vertical line down. Given that, it has admittedly been hard to trust that this real estate internet titan has a path forward, but I continue to be an unabashed believer in this name. The market has been in too much of a knee-jerk state over the past year, and any whiff of bad news sends stocks spiraling down far further than fundamentals should permit.

Year to date, shares of Zillow have lost nearly 50% of their value. Losses extended after the company recently released Q2 results, which, admittedly, carried only bad news (though nothing too unexpected, given current macro conditions). While there might be short-term pain here, I continue to believe in Zillow’s long-term prospects and remain bullish on the name.

Zillow, of course, is not immune to the gyrations of the real estate industry – which is and always has been massively cyclical. The company’s main revenue stream, Premier Agent, relies directly on real estate agents successfully closing real estate transactions. All the cards in the deck are stacked against real estate right now: rates are rising, the Fed is becoming more hawkish, inventory remains tight, and housing affordability remains a nationwide challenge. On top of this, the looming risk of a recession, as well as widespread layoffs and hiring freezes, are causing many would-be homebuyers to step to the sidelines.

One additional non-macro downside that investors may be digesting is that Zillow decided to essentially top-up stock-based comp for its employees. Due to Zillow’s falling share price, the company noted that for many employees compensation is no longer meeting expectations or falls below market standards. The one-time reset is expected to cause 2% dilution to the company’s overall market cap, which it intends to correct over time via share repurchases.

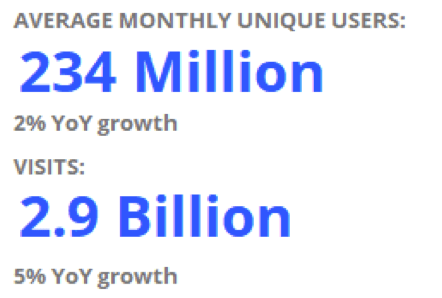

But amid all this noise, we still have to acknowledge what Zillow is: the premier site for real estate data and research. To put the case in point here, even though Zillow’s revenue started declining in Q2 driven by lower transactional activity, average monthly visitors as well as total site visits still grew by 2% y/y and 5% y/y , respectively. The fact that nearly 3 billion people visit Zillow.com or one of its subsidiary sites per quarter is a staggering datapoint reflecting the company’s near-monopoly over online real estate data.

Zillow visits data (Zillow Q2 shareholder letter)

Here is my full long-term bull case for Zillow:

- Exit from iBuying shines the spotlight on margin-rich IMT segment. In 2021, Zillow’s core IMT segment (which generates fees from real estate agents finding clients on the Zillow site) saw its adjusted EBITDA margins expand to 45%, up from 38% in 2020. That indicates a revenue stream that is nearly pure profit and very minimal overhead, and directly correlated with the uptick in real estate activity. To me, removing the distraction from iBuying and its horrendous quarterly losses will have the effect of expanding valuation multiples for Zillow’s profitable core business.

- Across Zillow, Trulia, StreetEasy, and Hotpads, virtually every American consumer thinking about buying or renting a home will come across one of the Zillow Group’s websites. Zillow has built an ecosystem rich with real estate data that has become the forefront of online real estate for users. Zillow traffic reached a record high of 10.2 billion visits (+6% y/y) in 2021. In 2022, site visits are still growing at a mid-single digit page

- Zillow is a platform that can add a whole suite of additional monetizable services. With all this traffic, Zillow’s ability to generate tertiary revenue is broad. Currently, the majority of Zillow’s business comes from advertising fees paid by real estate agents, but the company is also expanding into distributing mortgage products as well. In the future, Zillow could offer a full suite of “after-market” home add-ons, including house insurance, moving services, furnishing/interior decoration services, and others.

- Cash rich. Unlike other struggling tech companies facing the mouth of a potential recession, Zillow’s years of profitability have left the company in a strong position. Zillow currently has ~$3.5 billion of cash (and ~$1.8 billion in net cash, after considering debt) on its books.

Longer term, Zillow isn’t going anywhere. Stay long here and use the dip as a buying opportunity.

Q2 download

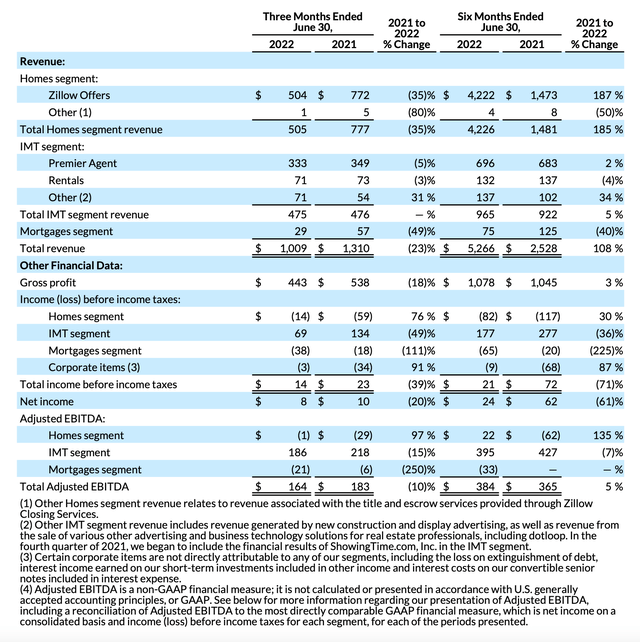

Let’s now go through Zillow’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Zillow Q2 results (Zillow Q2 shareholder letter)

Zillow’s total revenue fell -23% y/y to $1.01 billion in the quarter, largely driven by the company’s continued unwinding of the Zillow Offers/”Homes Segment” business, which saw revenue decline -35% y/y to $505 million.

Interestingly, the company signed a new multi-year partnership with Opendoor to offer instant cash home offers to Zillow’s site visitors. This feature essentially replaces Zillow Offers’ previous functionality while putting all the balance sheet risk outside of the company. The partnership stipulates that Zillow gets a cut of any leads it sends to Opendoor, essentially giving the company a brand new “free” revenue stream that is highly synergistic with its existing web traffic.

The big disappointment in the quarter, however, was in the IMT (internet, media and technology) segment which will become Zillow’s mainline revenue stream after the Homes exit. Premier Agent, Zillow’s core revenue generator, saw a -5% y/y revenue decline – which is on the low end of the company’s expectations. This was driven, of course, by the weakening housing market.

Here’s some helpful commentary from Zillow’s CEO Rich Barton on what the company is seeing in the market (key points highlighted), taken from his prepared remarks on the Q2 earnings call:

As we previewed last quarter, the housing market is rebalancing after a pandemic-fueled couple of years that were characterized by low interest rates, strong customer demand and historically low inventory levels. We are in a very different market today. Affordability has become very challenging for buyers. The compounding of unprecedented home price appreciation over the past few years and a rapid increase in mortgage rates has resulted in new mortgage payments relative to income spiking back to near 2006 peak levels. This rapidly changing affordability picture has impacted home shoppers’ ability to find an affordable and an acceptable option, driving buyer sentiment to a 20-year low. Reduced buyer demand has cooled the previously red hot sellers’ market.

Across the industry, we are seeing price growth meaningfully soften on pending sales and new mortgage applications with for-sale inventory levels rising as homes spend more time on the market. Ultimately, when combining all of these factors, the housing industry total transaction dollar volume was flat year-over-year in Q2, while various leading indicators deteriorated. Despite demand indicators stabilizing in July compared to June, we expect second half 2022 total industry transaction volume to meaningfully contract year-over-year.

Despite a challenging housing environment that we cannot control, we are as confident as ever in what we can control, executing on a strategy and a product road map that we believe will drive outsized transaction share gains, outsized revenue per transaction and profitable growth over time. Earlier this year, we introduced a product road map in a set of 2025 financial targets that are oriented around increasing engagement, increasing transactions and increasing revenue per transaction. The path to achieving those targets and beginning to build out our vision involves product initiatives within 5 growth pillars: financing, touring, seller solutions, integrating our services and enhancing our partner network.”

Barton additionally noted that with macro headwinds bearing down on the company, the company is relieved that it made the decision to exit the Zillow Offers business, noting that without the balance sheet risk, Zillow is well-capitalized to weather a downturn.

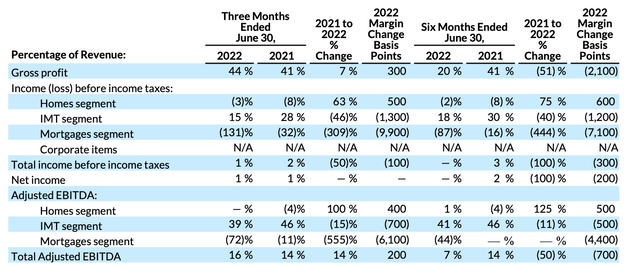

Additionally, we note that by shrinking losses in the Homes segment, Zillow’s overall EBITDA margins are up. Total adjusted EBITDA hit a 16% margin this quarter, up two points from 14% in the year-ago Q2; though the Premier Agent weakness did shrink IMT segment adjusted EBITDA by seven points.

Zillow adjusted EBITDA (Zillow Q2 shareholder letter)

Key takeaways

Investing in Zillow will require both a strong stomach for near-term volatility as well as an ability to “zoom out” and look at the incredible technology and data assets that it has built up and has the ability to monetize. Real estate won’t be in a downturn forever, and as long as Zillow remains the dominant site for real estate web traffic, real estate agents will continue to anchor on Zillow as their primary lead-gen platform. Continue scooping up this stock as it falls.

Be the first to comment