Justin Sullivan/Getty Images News

Thesis

We updated in our pre-earnings article on NVIDIA Corporation (NASDAQ:NVDA) that investors should be wary about adding the accelerated computing behemoth, given the challenging dynamics coupled with its embedded growth premium.

However, we have observed constructive price action on NVDA’s medium-term trend over the past three weeks. Furthermore, the post-Q2 market reaction also seems constructive, as we posit that Nvidia’s near-term headwinds have been adequately de-risked.

Investors should note that management proffered sanguine guidance that suggests Nvidia’s significant inventory writedowns in Q2 are likely a one-off event, given its massive prepayments last year. Therefore, its profitability profile should improve markedly through FY24.

We posit that NVDA should likely remain in the penalty box for a while, as the market remains tentative over the current semi industry downturn. However, we are confident that its June/July lows should hold robustly, in line with our assessment of the broad market bottom.

Our valuation analysis on NVDA suggests it’s still priced at a premium, indicating the market’s confidence in management’s ability to execute its growth thesis. Notwithstanding, its valuation also seems more reasonable now, coupled with the expected improvement in its operating profile moving ahead.

Therefore, we urge investors to capitalize on the current malaise to add more positions before NVDA’s underlying metrics emerge from its nadir a few quarters from now.

Nvidia De-risked Its Q2 For A Massive Reset

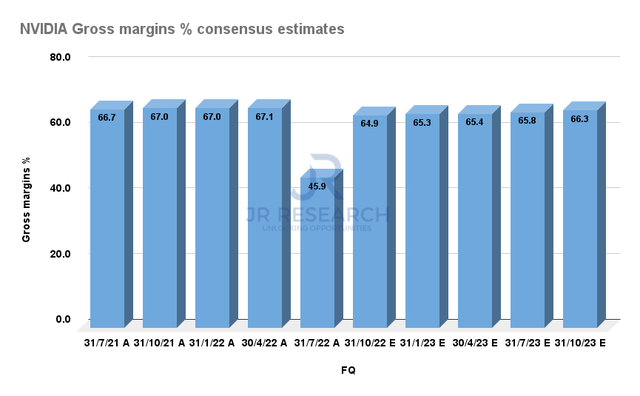

Nvidia adjusted gross margins % consensus estimates (S&P Cap IQ)

As seen above, the company used Q2 as an opportunity to write down its inventory massively, which impacted its adjusted gross margins. As a result, Nvidia posted an adjusted gross margin of 45.9%, down from its corporate average of about 67% over the past four quarters.

Notwithstanding, management articulated that it’s using the opportunity to correct channel inventories and “price-position” its current GPU series, given the upcoming launches of its next-gen graphics cards. Therefore, we postulate the company astutely used Q2 as an opportunity to reset market expectations and provide a clean slate for its upcoming launch. Management also alluded to it in its earnings commentary:

Gross margin includes $1.22 billion in charges for inventory and related reserves based on revised expectations of future demand and $122 million for warranty reserves. We believe our long-term gross margin profile is intact. And so this [writedown] was an opportunity for us to resize, given the macroeconomic conditions, what we needed in terms of supply. So our expectations were higher, and we took this opportunity to write them down to what our current expectations are. We’ve reduced sell-in to let channel inventory correct, and we’ve implemented programs with our partners to price-position the products in the channel in preparation for our next generation. All of this, we anticipate, were working towards a path to being in a good shape going into next year, okay? So that’s what our game plan is. (Nvidia FQ2’23 earnings call)

Investors Need To Look Ahead For A Better FY24

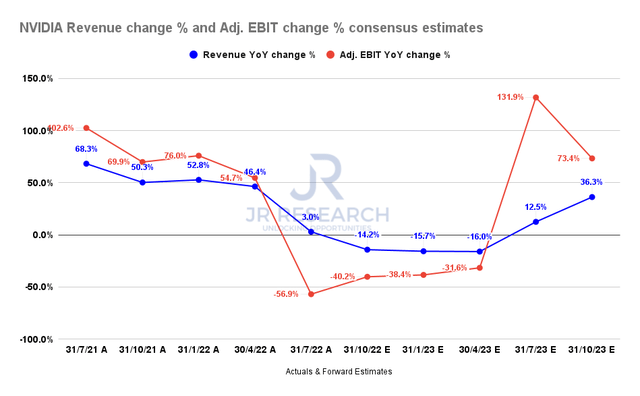

Nvidia revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Furthermore, the consensus estimates (bullish) suggest that Nvidia would take at least the next three quarters to work through its current downturn before recovering its growth profile through FY24.

Management also suggested that predicting whether the slowdown in enterprise spending could curb demand for its data center segment is challenging. Furthermore, the marked deceleration in China’s hyperscaler demand has impacted the cadence of its data center growth.

But, we posit that Nvidia’s slowdown is an expected normalization of its extended growth cadence over the last two years, exacerbated by the current macroeconomic headwinds.

Therefore, after this necessary period of digestion in demand, the secular tailwinds underpinning data center, automotive, pro visualization, and gaming segment should help Nvidia outperform. Consequently, we are not unduly concerned with the cyclical downturn, as it should correct itself when the macro headwinds subsequently improve. Furthermore, the market is a forward discounting mechanism. Therefore, we are confident the battering seen in NVDA since its November highs have de-risked its valuation adequately to position it for a medium-term re-rating.

NVDA’s Valuation Has Likely Bottomed In July

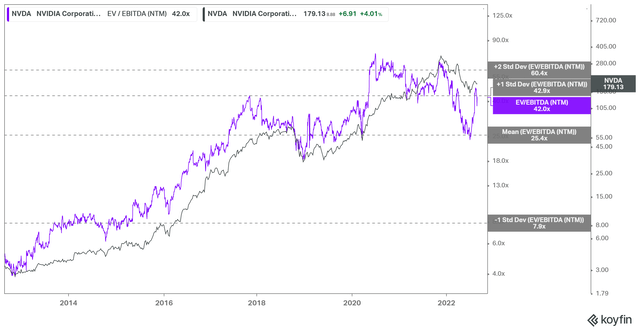

NVDA EV/NTM EBITDA valuation trend (Koyfin)

As seen above, NVDA’s NTM EBITDA multiples likely bottomed out in July, in line with its 10Y mean. Notably, it has consistently found support at its 10Y mean over the past few years. Notwithstanding, Nvidia bears could argue that NVDA’s recent valuations were discernibly higher than its pre-2018 days.

However, Nvidia’s growth profile has shifted dramatically from those days, as its TAM and verticals in accelerated computing have expanded considerably. Previously, it was mainly a consumer gaming company. However, it’s now a critical player for accelerated computing in data centers, hyperscalers, gaming, and cloud gaming. In addition, with the expansion in its pro viz segment (including Omniverse) and its automotive pipeline, Nvidia is now a full-fledged computing company that deserves a premium valuation.

While its recent revised EBITDA estimates have impacted its EBITDA multiples, we urge investors to look ahead as it laps the current downturn.

Is NVDA Stock A Buy, Sell, Or Hold?

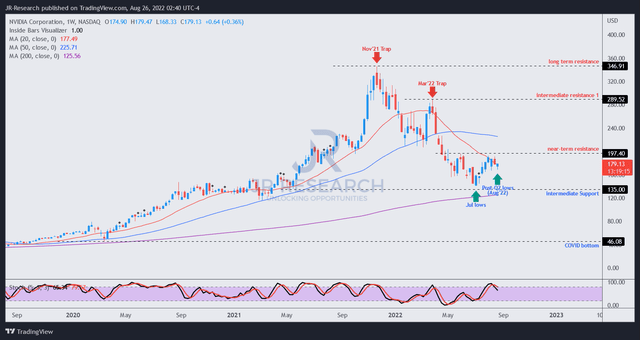

NVDA price chart (weekly) (TradingView)

We gleaned that NVDA’s initial post-Q2 sell-off has been denied by the market so far, which is constructive for the recovery of its buying momentum. While still early, it corroborates our conviction that NVDA has likely staged its medium-term bottom in July.

Therefore, we encourage investors to capitalize on potential downside volatility in the near term to add more positions before Nvidia emerges from its current downturn.

As such, we revise our rating on NVDA from Hold to Buy.

Be the first to comment