zoranm/E+ via Getty Images

Whether you like it or not, the future will be very much focused on data. At the end of the day, data is incredibly valuable because of what it tells us and the decisions we can make from it. It stands to reason, then, that there would eventually develop a large number of companies dedicated to working with data in some way, shape, or form. One interesting prospect in this space there has been growing at a nice clip in recent years is Zebra Technologies Corporation (NASDAQ:ZBRA). The company has its hands in a variety of niche markets, with all of its operations centered around two operating segments. Unlike many other data-oriented firms, however, Zebra Technologies captures most of its revenue not from providing data services, but instead from producing physical products that use, analyze, and manipulate data. Long term, the company is likely to do quite well for itself. In addition, shares of the business, while not exactly cheap, do look reasonably priced and they are especially cheap compared to similar firms. Overall, the company likely does offer decent upside potential for long-term investors. And as such, I have decided to rate the enterprise a soft ‘buy’ for now, reflecting my belief that it will probably outperform the market, if only slightly, for the foreseeable future.

Zebra Technologies – Data is everything

To best understand Zebra Technologies, investors would be wise to break the company’s operations down into its two operating segments. The first of these is its Asset Intelligence & Tracking segment. This unit is responsible for a variety of functions. One example falls under the barcode and card printing category. Through this, the company produces printers that, in turn, produce high-quality labels, wristbands, tickets, receipts, and plastic cards on demand. These printers are used for a wide variety of activities, such as routing and tracking, patient safety, transaction processing, personal identification, product authentication, and more. According to management, they use thermal printing technology in their printers that results in the creation of images by heating certain pixels of an electrical print head to produce an image of a ribbon or heat-sensitive substrate. They also provide dye-sublimination thermal card printers under this unit. Other supplies the company produces include customized thermal labels, receipts, ribbons, plastic cards, and even RFID tags that can be used with their printers. The company also generates revenue from providing services associated with these products, and other activities. It’s worth noting that this is the smaller of the two segments. Last year, it accounted for just 29.9% of the company’s revenue and 33% of its profits.

Next in line, we have the Enterprise Visibility & Mobility segment. Under this umbrella, the company has a few different product categories. The first of these is the mobile computing category. Through this, the company sells enterprise-grade mobile computing products and accessories that have a variety of use cases. These can be used in industrial applications for things like inventory management in warehouses and distribution centers, field service, post and parcel tracking, and more. Its mobile computing products largely focus on the Android operating system, and they often incorporate barcode scanning, GPS, and RFID features within them. Another product category is referred to as data capture, RFID, fixed industrial scanning, and machine vision. Through this, the company sells barcode scanners, RFID readers, industrial machine vision cameras, and fixed industrial scanners. Through this segment, the company also provides various services associated with these products, plus it provides workflow optimization solutions centered around software, robotic automation, and more. Last year, this segment accounted for 70.1% of the company’s revenue and 67% of its profits.

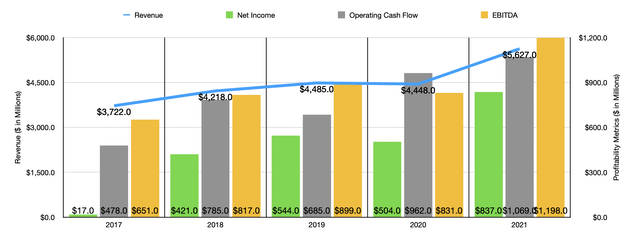

Over the past few years, the management team at Zebra Technologies has done a really good job growing the company. Revenue increased from $3.72 billion in 2017 to $5.63 billion in 2021. This increase in sales has been driven by a number of factors, including organic growth. In fact, organic growth has been the single largest source of expansion recently. In 2021, for instance, sales were 26.5% higher than what they were just one year earlier. Management said that overall organic net sales increased by 23.2% that year. The rest of the increase, meanwhile, was associated with favorable currency changes and acquisitions.

On the bottom line, the picture for the company has also improved over the years. Net income has increased from $17 million in 2017 to $837 million last year. Of course, we should also pay attention to other profitability metrics as well. Consider operating cash flow which, between 2017 and 2021, ballooned from $478 million to $1.07 billion. Over that same window of time, EBITDA for the company expanded from $651 million to just under $1.20 billion.

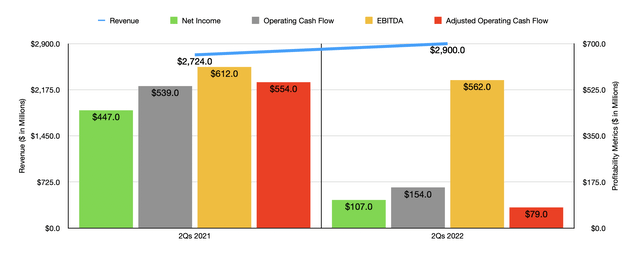

Naturally, we should also be paying attention to what’s taking place in the current fiscal year. For the first half of the year, revenue came in at $2.90 billion. That represents an increase of 6.5% over the $2.72 billion generated in the first half of 2021. Although revenue increased, the company has experienced some issues regarding profitability. Net income, for instance, dropped from $447 million to $107 million. The company did suffer some from a decline in its gross margin, a figure that declined from 48.2% of revenue in the first half of 2021 to 45.2% the same time this year. The bigger problem, however, it was a 56.7% increase in operating expenses. The single largest contributor on this front was a $372 million charge associated with certain patent-related litigations. Because of the nature of this and the fact that both it and its counterparty agreed to a mutual general release from all past claims asserted by both parties, investors should view this as a one-time thing. Naturally, this impacted other profitability metrics as well. Operating cash flow fell from $539 million to $154 million, while EBITDA declined slightly from $612 million to $562 million.

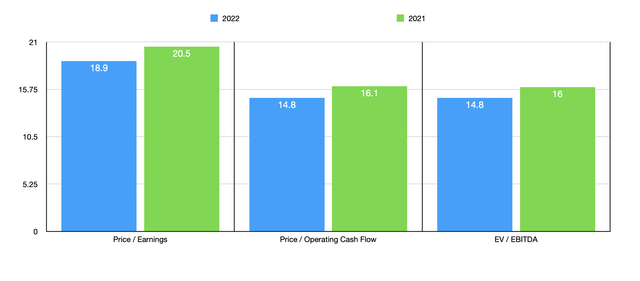

When it comes to the 2022 fiscal year as a whole, management expects revenue to climb by between 4% and 6%. Even with supply chain issues hitting the firm to the tune of $200 million, the company is anticipating an EBITDA margin of roughly 22%. This should translate to EBITDA of roughly $1.30 billion. If we assume that other profitability metrics will rise at a similar rate, then we should anticipate net income of $908.3 million and operating cash flow of $1.16 billion. All of this combined makes it simple to value the business. On a price-to-earnings basis, the company is trading at a forward multiple of 18.9. This is down from the 20.5 reading that we get if we use 2021 results. The price to operating cash flow multiple should drop from 16.1 to 14.8, while the EV to EBITDA multiples should decline from 16 to 14.8. To put this in perspective, I compared the company with five similar firms. On a price-to-earnings basis, these companies ranged from a low of 27.6 to a high of 93.9. Using the price to operating cash flow approach, the range was from 32.6 to 65.7. And using the EV to EBITDA approach, the range should be from 18.1 to 40.6. In all three cases, Zebra Technologies is the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Zebra Technologies | 20.5 | 16.1 | 16.0 |

| Trimble (TRMB) | 33.3 | 32.6 | 23.2 |

| Teledyne Technologies (TDY) | 27.6 | 39.3 | 18.1 |

| Cognex Corporation (CGNX) | 32.8 | 39.0 | 24.0 |

| Novanta (NOVT) | 93.9 | 65.7 | 40.6 |

| National Instruments Corporation (NATI) | 50.1 | 113.0 | 23.5 |

Takeaway

At this point in time, Zebra Technologies seems to be doing quite well for itself. Although revenue growth should be slow this year, profitability should continue to rise if we ignore one-time issues. While shares are not exactly cheap, they do look affordable for such a high-quality company with a nice track record. They are also especially cheap compared to similar firms. Because of all of this, I’ve decided to rate the business a soft ‘buy’ for now.

Be the first to comment