GeorgeRudy/iStock via Getty Images

Co-produced with Treading Softly

February has arrived and with it, our fascination with romance and love. For many, the love found in a Nicolas Sparks novel is all they dream of in the wintry evenings when outside is harsh, cold, and chilly.

I have always found it interesting that we have a holiday focused on love following on the heels of a holiday focused on gift-giving and the turn of the new year. Perhaps some of that gift-giving spawned a newfound love connection.

Love, and the search for it, have been around as long as humanity has walked the earth. It’s often what can separate humanity from other creatures, we yearn for understanding and connection.

I look forward to enjoying my retirement years with my beautiful wife of many years. We have seen High Dividend Opportunities grow from only a handful of members to over 5100 members. She has tolerated me burning the candle at all hours searching for dividend opportunities. We’ve seen lives changed by changing the perspective countless retirees have on retirement. I don’t know if anyone has fallen in love in our chat rooms, well, with each other I mean, we all have fallen in love with dividends!

So for this month of love, I have two high yield opportunities you’re going to fall in love with. These income catalysts will provide you with extremely high levels of income to boost your portfolio’s income output and provide you with outstanding income.

Pick #1: OXLC – Yield 11.5%

Oxford Lane Capital (NASDAQ:OXLC) reported earnings on January 28th and it was everything we could have wanted. GAAP net investment income came in at $0.29/share for the quarter. Core net investment income at $0.44/share. However you measure it, OXLC’s $0.225/quarter in dividends is easily covered.

What is the difference between GAAP income and OXLC’s “Core” earnings? There is a material difference between what GAAP accounting records as income and actual cash-flows.

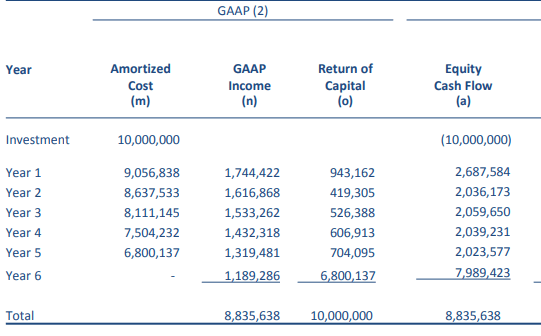

Here’s a presentation from Eagle Point Credit Co. (NYSE:ECC) that is useful to illustrate the difference. The “GAAP Income” column shows what is reported as earnings, while the “Equity Cash Flow” column shows the actual pace of cash flows. Note how GAAP calls a large portion of the cash flow “return of capital”, even though the final lump-sum payment accounts for nearly 80% of the original capital.

Eagle Point

For GAAP accounting, an “effective yield” is determined which utilizes assumed cash flows, default rates, recovery rates, prepayment rates, and reinvestment yield. Any cash flow above and beyond the “effective yield” is considered return of capital. As a result, there can be a large disparity between the actual cash flow coming in and the interest income reported by GAAP. This is especially true as the “effective yield” assumption will change over time. For example, in Q2 2020, OXLC’s average effective yield was calculated at 13.3% as default assumptions climbed. Today, the effective yield is 16.2% as the expected number of defaults never materialized. The cash that OXLC is actually receiving is a 29% yield!

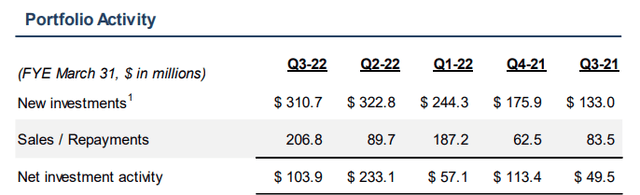

Since some of the cash flow is principal repayments, we want to make sure that OXLC is still growing. This means taking some cash flow and reinvesting it. OXLC is growing at a rapid pace, with over $1 billion in new investments over the past year. That is twice the amount of positions that have been sold or repaid:

– Source: OXLC Investor Presentation – Q4 2021

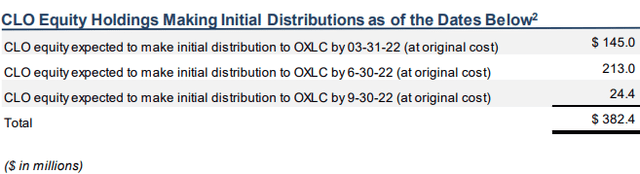

The best part is, that OXLC’s earnings are going to be rising in the next few quarters. OXLC has $382.4 million in investments that have not yet made their first payment. The bulk of these will start paying in the next two quarters.

In other words, the capital is already deployed and is already reflected in the current share count and the current debt. We’re just waiting for the first checks to come in!

How often can you look at a company that is yielding over 11% and describe its payout as “conservative” relative to its earnings? The payout is almost “miserly” in relation to its cash flow! Add on to that, we can expect earnings to grow 10-15% within the next two quarters as the already deployed capital starts generating cash flow. OXLC is firing on all cylinders, and that’s why it made the list as one of our “Picks of the Year”. It is living up to all of our expectations!

Pick #2: SAR – Yield 7.8%

Most BDCs haven’t been caught up in the market sell-off, however, a few have. Saratoga Investment Corp (NYSE:SAR) is a smaller BDC (Business Development Company) that got caught up in the sell-off and is now trading at a 10% discount to NAV.

Like many BDCs, SAR invests in middle-market companies with a combination of debt and equity investments.

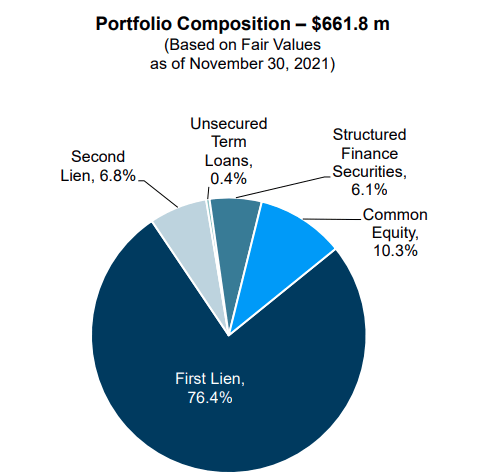

Saratoga Investment

– Source: SAR Shareholder Presentation – Jan. 6, 2022

The debt investments are primarily first-lien, and provide stable cash flow quarter to quarter. The equity investments provide upside potential if the borrower pays dividends, is bought by a peer, by private equity, goes public, or has another liquidity event. BDCs are more than just lenders, they are investors in their portfolio companies.

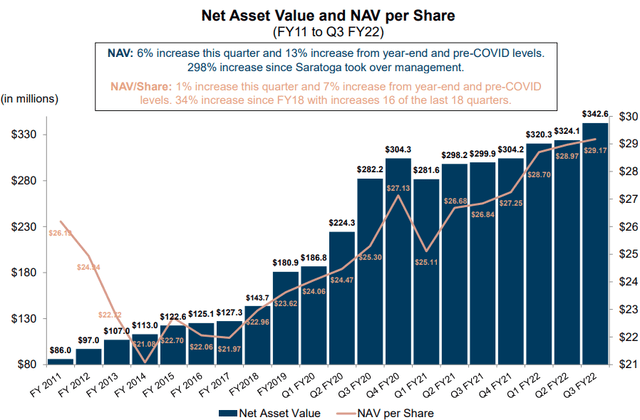

SAR has fully recovered from the impacts of COVID, with its NAV hitting new highs last quarter. NAV has grown consistently quarter to quarter since COVID.

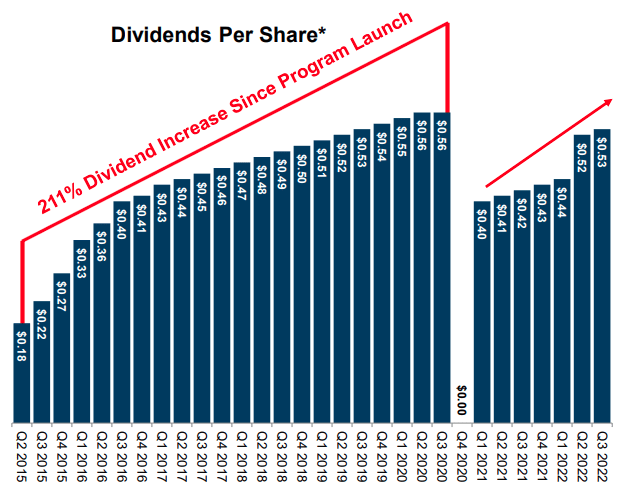

Additionally, SAR just raised its dividend in January to $0.53, up 2% from the prior quarter and up 26% from last January. SAR did reduce its dividend in response to COVID.

Saratoga Investment

In hindsight, that action might have been overly conservative considering that SAR didn’t experience any defaults. However, management decided it was important to preserve the balance sheet. SAR has resumed its pattern of raising the dividend every quarter, and NAV is growing aggressively.

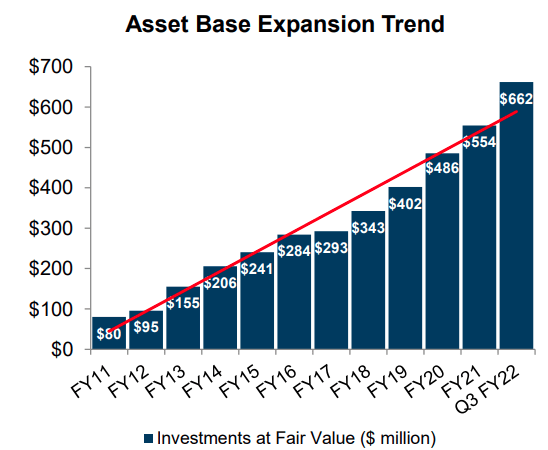

SAR’s conservative approach has allowed it to expand its asset base by 36% since COVID:

Saratoga Investments

A larger asset base is beneficial for BDCs, providing access to cheaper debt capital and improving economies of scale. SAR is a BDC that is growing rapidly, and management has demonstrated it is willing to share the wealth with regular dividend increases. If the market is willing to give us a chronic dividend grower at a discount, who are we to turn it down?

Dreamstime

Conclusion

By investing in companies that are at the forefront of the economic growth within the U.S. but are also well equipped to benefit from rising interest rates, we can have our income and enjoy capital gains simultaneously. This is an income investor’s dream – lots of immediate income, and capital gains over time.

So this February, find love in the most unlikely of places: The stock market. Fall in love with dividends and income, and you will see how each dividend is a piece of irrevocable returns that you can use to do whatever you want. Perhaps it’ll pay for that romantic night on the town or a candle-lit dinner at home, regardless of what you decide to do with the income, it’s yours to enjoy.

Retirement should be a time of enjoyment and flexibility, giving you time to truly express love for those in your life that you love, or for the hobbies you enjoy most.

Take a moment, investigate these opportunities and let them show you why we love the income they produce!

Be the first to comment