maybefalse

Elevator Pitch

I assign a Hold investment rating to Youdao, Inc.’s (NYSE:DAO) stock. Youdao describes itself as a “technology-focused intelligent learning company in China” that offers “learning content, applications and solutions to users of all ages” in its media releases.

DAO isn’t a Sell even though the company didn’t perform well in Q2 2022, as Youdao is expected to achieve top line expansion and smaller losses in Q3 2022. Youdao isn’t a Buy, given that its shares are expensive on a forward P/E basis, and the company has yet to officially disclose any plans to mitigate the risk of delisting. As such, Youdao deserves a Hold rating based on my mixed view of the company’s shares.

Revenue Decline And Wider Losses For DAO In The Recent Quarter

Youdao announced the company’s Q2 2022 results on August 18, 2022 before trading hours.

DAO’s revenue declined by -2% YoY from RMB980 million in the second quarter of 2021 to RMB956 million in the most recent quarter. The top line contraction for Youdao in the second quarter of this year is mainly attributable to the weak performance of its learning services business segment, which contributed more than half or 59% of the company’s total revenue.

The learning services business saw its segment revenue decrease by -7% YoY from RMB608 million in Q2 2021 to RMB564 million in Q2 2022. Youdao highlighted at its Q2 2022 earnings briefing on August 18, 2022 that “the decrease in demand (for the company’s vocational and adult learning courses) due to the resurgence of COVID-19” in Mainland China was the key factor that resulted in lower revenue on a YoY basis for the company’s learning services segment.

On top of a contraction in its top line for the recent quarter, DAO’s loss from operations also widened from -RMB255 million in Q2 2021 to -RMB455 million for Q2 2022. Youdao’s wider losses for the second quarter of this year on a YoY basis was the result of weaker gross profit margin and an increase in operating costs.

The company’s gross profit margin decreased by -820 basis points from 51.0% in Q2 2021 to 42.8% in Q2 2022. The lower revenue contribution from the learning services business in the recent quarter as highlighted above also hurt Youdao’s profitability, as the learning services segment boasted the highest gross margin (52.2% for Q2 2022) among the company’s various business segments. In other words, an unfavorable sales mix led to a contraction in Youdao’s gross profit margin for Q2 2022.

DAO’s operating expenses rose by +15% YoY from RMB755 million in the second quarter of the previous year to RMB865 million in the second quarter of the current year, even though its revenue had decreased over the same period. Specifically, Youdao noted at the company’s Q2 2022 investor call that “we are continuously strengthening our technical and R&D (Research & Development) investment to maintain our advantages in technology”, and this was reflected in a +42% YoY spike in R&D costs to RMB208 million in Q2 2022.

Spotlight On The Smart Devices Business

The smart devices business segment is the second largest revenue contributor for Youdao after learning services, and accounted for a quarter of DAO’s Q2 2022 top line. The performance of Youdao’s smart devices segment in the recent quarter was mixed, with revenue expansion being offset by lower profitability.

On the positive side of things, the smart devices business segment delivered a reasonably decent sales growth of +16% YoY to reach RMB240 million in revenue for the recent quarter.

There is a long growth runway for smart (learning) devices in China, and Youdao continues to introduce new products to the market to capitalize on strong demand in this space. At its second-quarter results call, DAO cited research from market research firm Frost & Sullivan which predicted that China’s smart learning devices market will expand by a CAGR of +17% to RMB145 billion in five years’ time.

Earlier on August 10, 2022, the company issued a media release announcing two key new products, namely “Youdao Dictionary Pen X5 and Youdao Smart Learning Pad.” The launch of a new model for its dictionary pen product series is particularly significant, as DAO’s dictionary pens have been the best-selling brand in its product category at one of China’s key e-commerce sales event, the 618 Shopping Festival, for the past three years as indicated by management comments at the recent quarterly investor briefing.

On the negative side of things, the gross profit margin for DAO’s smart devices segment went down significantly from 43.0% in Q2 2021 to 30.6% in Q2 2022. In my opinion, there were two key reasons for the decrease in the smart devices business’ gross margin in the recent quarter.

Firstly, some of Youdao’s older products in the smart devices segment might carry lower gross margins and became a drag on the business’ overall profit margins. DAO mentioned at its recent quarterly results briefing that “the release of our new product series, such as X5 and Learning Pad” could drive “better profitability in our smart devices category.” This is an indirect acknowledgement that older products are less profitable for the company and the smart devices segment specifically.

Secondly, DAO is relying more on offline distribution (as opposed to online distribution) to penetrate Tier-3 and Tier-4 Chinese cities. There are higher expenses associated with offline distribution as compared to online distribution, and the company’s expansion in lower-tier cities has depressed the smart devices segment’s profitability.

Positive Near-Term Outlook

The market is anticipating that Youdao will see a revenue recovery and register narrower losses in the third quarter of 2022, and I am of the view that these expectations are realistic.

Based on the sell-side’s consensus financial forecasts obtained from S&P Capital IQ, Youdao’s top line is projected to jump +45% QoQ from RMB956 million in Q2 2022 to RMB1,387 million in Q3 2022. For the smart devices business segment, the new product introductions as discussed in the preceding section should be a key sales growth driver. Separately, a progressive and gradual easing of pandemic lockdowns and restrictions in Mainland China since June 2022 is expected to have increased demand for courses offered by the learning services business segment.

As per S&P Capital IQ data, the sell-side analysts also predict that DAO’s operating losses will narrow from -RMB455 million in the second quarter of 2022 to -RMB207 million for the third quarter of this year, which seems reasonable. The profit margins of Youdao’s learning services and smart devices business segments are expected to improve in Q3 2022 as a result of the positive effects of operating leverage and a more optimal mix of higher-margin new products, respectively.

Share Price And Valuations

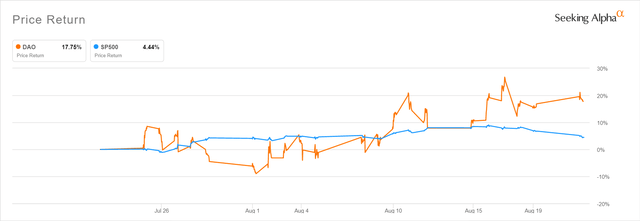

Youdao’s stock price went up by +17.8% in the last month, and its shares outperformed the S&P 500 which only increased by +4.4% over the same period. It seems that the market has already priced in the improvement in financial performance for DAO in the third quarter.

DAO’s Share Price Performance In The Past One Month

Also, DAO’s current valuations are rather demanding. Based on its last done stock price of $5.24 as of August 22, 2022, Youdao is now valued by the market at a consensus forward FY 2024 normalized P/E multiple of 47.9 times as per S&P Capital IQ’s valuation data. The sell-side forecasts that Youdao will stay loss-making for FY 2022 and FY 2023.

It is hard to argue that Youdao deserves a valuation premium when delisting risks are still an issue for the US-listed Chinese company. On May 5, 2022, DAO published a press release noting that it “will continue to monitor market developments and evaluate all strategic options” in connection with the risk of being compelled to delist from the US due to a potential failure to comply with the “Holding Foreign Companies Accountable Act” with respect to audit access matters. Notably, Youdao has yet to formally announce any secondary listing plans to potentially allow its shareholders to convert their US-listed to shares tradable on another exchange, if and when the US delisting materializes.

Closing Thoughts

I have a Neutral view of Youdao’s shares. On one hand, there are signs pointing to a strong recovery for DAO in the third quarter of 2022. On the other hand, DAO’s valuations are unattractive, and the risk of delisting is a key negative.

Be the first to comment