Davel5957/iStock via Getty Images

Recently, I started a position in Armada Hoffler Properties, Inc. (NYSE:AHH), a REIT that focuses on the Mid-Atlantic and Southeastern United States. There are 3 main reasons that I decided to invest in the company: the increasing importance of multifamily buildings, the strong local ties, and its position in the current environment. In this article, I will elaborate on the aforementioned reasons, and provide my estimated fair value.

The increasing importance of Multifamily buildings

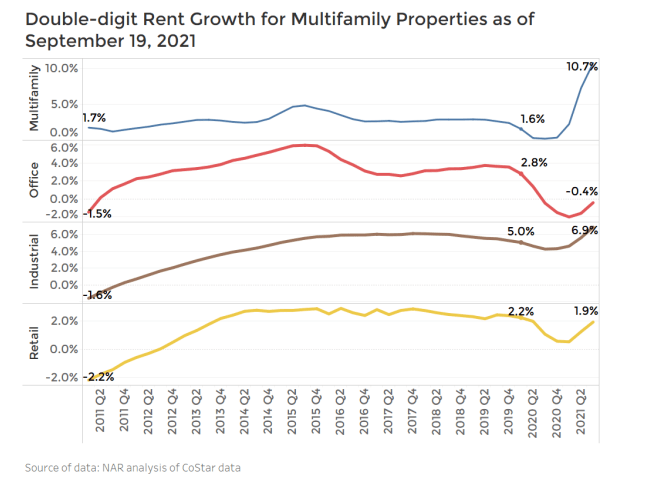

Armada Hoffler is a REIT that owns office, retail and multifamily buildings. Recently, the focus of the company has been on multifamily buildings. Multifamily buildings usually have a higher cap rate than office and retail buildings and rent increases faster.

Overview rent growth commercial real estate (National Association of Realtors)

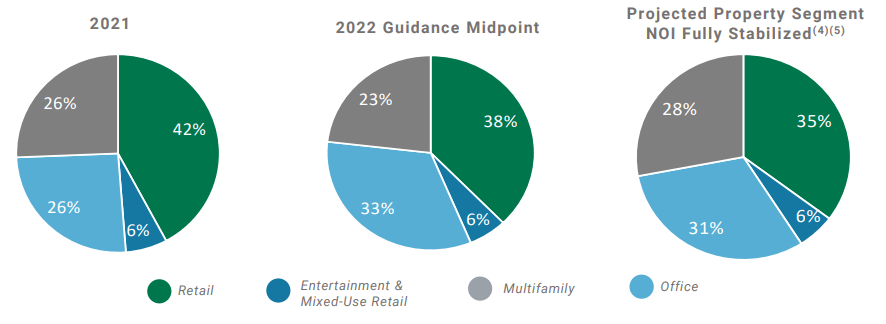

In the 2022 outlook, the company stated that it expects a decrease in multifamily as a % of total NOI, but this is mainly due to the sale of the student housing assets (not included in the graph below) and acquiring larger ownership in the Exelon building (which mainly consists of office sf). I am not against the sale of the student housing assets as these tend to operate at lower margins. The reason for this is that they have a higher turnover than conventional multifamily buildings. Furthermore, student housing can be heavily influenced by school policies, as could be seen at the start of the pandemic.

Overview guidance AHH (Armada Hoffler Guidance presentation)

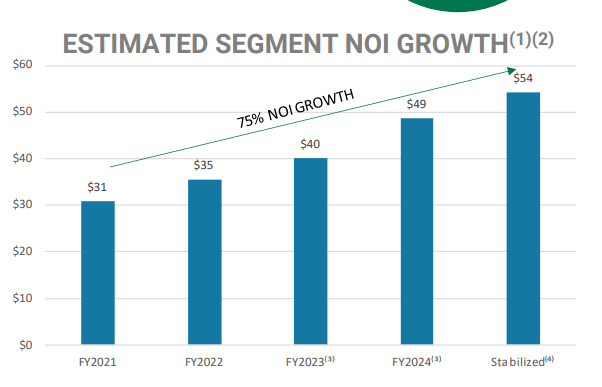

In its most recent outlook, the company said that it is guiding for 55% unit growth when the portfolio is stabilized. This is mainly due to the pipeline of the company, which consists for approximately 60% of developments that include a multifamily aspect. Subsequently, the company expects NOI from the multifamily division to increase by 75% after the completion of all the projects.

Estimated NOI Growth Multifamily (Armada Hoffler Guidance presentation)

The reason I like the focus on multifamily units is that these assets are more stable, and provide a basic necessity to people. During the pandemic, some companies have gotten rid of their office leases and stores went bankrupt or focused on eCommerce, but people still had to live somewhere. Additionally, by building multifamily units near their office and retail buildings, and by creating mixed-use buildings, I estimate the value of their retail and office buildings to increase.

Government and local market ties

In the summer of 2000, the city of Virginia Beach and Armada Hoffler embarked on a public-private partnership. The strong ties between Armada Hoffler and Virginia Beach have made the company a preferred supplier. Being a preferred supplier leads to benefits that are hard to replicate by other companies, especially if you have been and still keep delivering on your promises.

Secondly, the company has been active in the same region (mainly Virginia and Maryland) for a long time and is also very active in the community, employees of the company have served as members of the board of visitors of the University of Virginia and Chairman of the Virginia Port Authority. This broadens the network of the individuals and thus of the company. A broad network can be advantageous in business as most of the time it is not about who you are but whom you know. As an example, Armada Hoffler does a lot of off-market deals, which are hard to replicate for other investors as they do not have the same ties to the local market. Off-market deals usually have more favorable terms and thus can be a huge advantage for the company. As an example during Q4 CEO Lou Haddad mentioned the following:

It’s important to recognize that each of these purchases were off-market transactions. This approach requires patience and long-term relationships. We believe that we could sell each of these almost immediately at a meaningful profit.

Inflation and development arm

Over the past couple of months, we have seen high and prolonged levels of inflation. This makes the development of real estate more expensive and leads to fewer projects being completed. As supply decreases and demand remains, the value of real estate increases. I am not claiming that demand will stay at the same level. However, at the moment there is a huge shortage of (rental) apartments at all price levels. As an example, a study by Globe Street found that in most major metropolitan areas there is a shortage of apartments. One of the areas on the list was Virginia Beach, AHH’s largest market.

What is also important to keep in mind is that AHH has its own development arm. Having your own development arm provides the company with more flexibility and it can lower costs. For example, it could get a deal on construction material by buying in bulk.

Valuation

In order to value the company, I like to use a combination of multiple methods. First of all, I like to use a discounted AFFO, normal cash flows do not properly represent REIT earnings and thus a discounted AFFO is a better alternative. Based on the discounted AFFO, I will also estimate a price using the P/AFFO method. The last valuation method in this analysis is an estimate of the company’s NAV based on its net operating income.

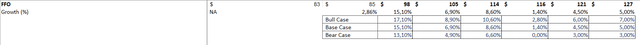

To get to the company’s AFFO I used the company’s FFO, made the adjustments mentioned in the annual report, and then took out maintenance CAPEX. The adjustments as a % of FFO have been used to estimate the adjustments for the future. The growth rates of FFO in the base case have been collected from TIKR and are based on the average of analysts. The bull and bear cases are based on the base case.

AHH FFO Growth assumptions (Author, TIKR)

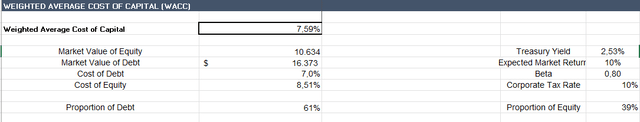

To discount future cash flows I estimated the company’s WACC based on the cost of debt over the past 2 years, the company’s beta, and my required rate of return (10%).

Armada Hoffler WACC estimations (Author, Yahoo Finance)

Based on the assumptions the calculated price based on the discounted AFFO was $14.77. The P/AFFO of the company was based on the same assumptions as mentioned above and assumes a re-rating of the company’s P/AFFO to 18, this is based on the increasing importance of multifamily in AHH’s portfolio and the company’s strong assets, leading to a price of $25.42.

The last step is to calculate the company’s NAV. To do this I will use the company’s NOI over the past year. The NOI can be easily found in the company’s 10-K and is divided per segment:

|

Segment |

NOI |

|

Office |

$28.8 million |

|

Retail |

$56.7 million |

|

Multifamily |

$37.3 million |

The cap rates that were used to estimate were based on the cap rates that were found here. Based on the fact that the majority of the company’s revenue comes from Virginia Beach, it got the highest weighting. Furthermore, as the company owns a lot of great buildings in great locations in their market, the cap rates that were used were a mix of A and B locations. In the end, I had a cap rate of 6.9 for the office segment, 6.5 for the retail segment, and 4 for the multifamily segment.

The total value based on the calculations was $2.23 billion. After subtracting net debt and dividing by the number of shares outstanding I had an estimated NAV of $18.50. This amount is in line with the mean of the estimated NAV of 4 analysts as listed on TIKR ($18.49).

Adding all of the aforementioned calculations together and then dividing the result by 3, gives me a total share price of $19.56. This would imply an undervaluation of approximately 33% at the current share price.

Risks

As with any investment, AHH does not come without risk. The main risks currently include:

-

Many of the company’s costs are fixed.

-

Given the high inflation, mezzanine loans could become a problem for the loanees.

-

The company has slightly higher debt levels, which could pose a problem when rates rise.

-

As supply chain constraints and high inflation run riot, retail tenants can be impacted and this could lead to bankruptcy.

Conclusion

Armada Hoffler Properties is an interesting and well-run REIT. The company is shifting its main focus to multifamily and this is beneficial for shareholders. The main reason for this is that there is a huge shortage in housing and that these generally trade for higher cap rates than retail and office buildings.

The company also has very strong ties with the local government and the local market which provides them with opportunities that other investors might not have. This is a barrier to entry as you cannot replicate this in a few months/years.

Last but not least, the company’s market is experiencing a shortage of rental apartments at all price levels. This will increase the rent and value of completed buildings.

From a valuation point of view, I estimate the company to be currently worth $19.56. This is approximately 33% higher than the current share price and is another positive for investors that are interested in AHH.

Be the first to comment