Sohl/E+ via Getty Images

My grandson turns two-months old on Sunday.

Two months! How time does fly.

On the one hand, it feels like Asher has been around for forever. On the other, how has it been two months already???

Before I know it, this little kiddo is going to be sitting down with me for a power lunch (his, not mine. I’ll be long-since retired) after he ends his prime-time TV show segment about how well real estate investment trusts (REITs) are doing in the year 2051.

He just has that face. Trust me. I can tell.

No bias at all over here!

Okay. Maybe a little bit when it comes to Asher. But I hope my regular readers know by now how hard I strive for objectivity in these articles.

Objectivity, especially during tough times, isn’t always easy, I admit. In fact, it feels close to impossible sometimes considering how personal our financial situations are.

We have lives to live with all the expenses they come with, after all, such as:

- Rent or a mortgage

- Utilities

- Food

- Transportation

- Saving up or actively paying for a child’s higher education

- General debt

- Medical expenses.

That’s to say nothing about wanting to enjoy life every now and again by eating out with friends or taking a vacation or buying a little something extra. All of which takes money.

And money is becoming more and more difficult to maintain.

Slow but Steady Compounding Wins the Race

I know there are many differing opinions here on Seeking Alpha. But here are three things I think we can all agree on:

- Saving money isn’t easy.

- Growing money isn’t easy.

- Our current economic environment isn’t helping.

But none of that means it’s impossible to save for retirement or – if you’re already there – enjoy your retirement. In the former case, it’s mainly a matter of patience.

Patience and being calm.

In the latter case, it’s a matter of owning the best dividend-paying stocks. But, today, I want to focus on those who aren’t retired yet… though very much hoping to get there someday.

That’s why I want to bring up the power of compounding.

I’m sure I’ve written about compounding since April 27, 2021. But that seems to be the last time I included the word in a title, with “Retirement Strategy: The Beauty of Compounding.”

Back then, I didn’t have Asher on my mind. I didn’t even know I would have a grandson at that point. I was still planning his mama’s wedding – another life event that ain’t exactly cheap, might I add.

I was also sitting “down with my son to explain the principles of value investing.” That’s because he:

“‘won $75,000 the other night while playing virtual slots.’ And a solid four weeks later, I’m proud to say that he hasn’t blown it yet.

“… I’ve been encouraging my son to avoid the temptation of trying to double his money… One of the best ways to teach anyone this lesson is to explain the power of compounding: the concept of getting interest on interest.”

There’s really nothing like it when it comes to growing your money. Even if it sometimes feels like it takes forever.

Compounding Expounded on in More Detail

I’ll quote Forbes writer Kate Ashford since I like the way she summarizes compounding:

“Compound interest is when the interest you earn on a balance in a savings or investing account is reinvested, earning you more interest. As a wise man once said, ‘Money makes money. And the money that money makes makes money.”

Essentially then, “Compound interest accelerates the growth of your savings and investments over time.” And as I write in my own article, it allows:

“… investors to essentially accrue income like a free ATM machine.

“As with most magic tricks though, it’s not so easy to put into practice. The rewards of compounding can’t be felt overnight. In fact, as I told my son, ‘It’s as boring as watching paint dry.’

“Compounding happens over time, so it requires a good degree of patience to eventually enjoy. But when investors figure out how to wait it out, they can create a mountain of wealth for their efforts.

“Or non-efforts, as it were.”

You take your dividends and reinvest them into the same stocks they came from. Which means you own more shares. Which means the next time those shares pay out… you get more dividends!

Now, those dividends are typically a matter of mere cents per share owned, which might not seem like much in the moment.

But:

“… the more you reinvest your dividends into the same stocks over time, the more you’re able to accelerate the income potential of your original investment.

“Your portfolio amplifies your working money and maximizes its earnings potential… just as long as you keep your hands off the principal and dividends.”

That’s the power we want to tap into today, keeping in mind that time really does fly in the end. So there’s no time like now.

Digital Realty Pays Digital Dollars

(Source: DLR Website)

Digital Realty Trust, Inc. (DLR) is a global provider of cloud and carrier-neutral data center and interconnection solutions. Its portfolio consists of 291 data center facilities across 25 countries on six continents.

In short, it’s a global giant.

We’re talking about 35.8 million square feet of space with another 8.1 million under development. And there’s another 2.6 million held for future development.

As we all know, more and more companies are looking to have more data readily accessible from anywhere. That was true before the shutdowns, but 2020 put this trend into warp speed.

So, data centers are in intense demand from both large and small businesses alike. In DLR’s case, top tenants include:

Q1 revenue grew 3.4% over the same period in 2021 to $1.1 billion thanks in part to record bookings. And since that strong demand remains – regardless of macro-economic future activity – sales should move higher still.

Digital Realty’s backlog grew from $346 million in Q4-21 to $395 million in Q1-22, after all… a 14% increase in just one quarter.

The company’s global footprint allows it to access low-cost capital in Europe.

It recently took advantage of favorable market conditions to lock in €750 million at 1.375% for 10.5 years. And it also completed a dual tranche Swiss bond offering, raising CHF250 million at a blended coupon of approximately 1.25%.

DLR has always maintained a strong balance sheet. Its solid credit metrics include a leverage ratio of 6.3x and fixed-charge coverage of 5.5x.

Its weighted average debt maturity is over six years. And its weighted average coupon is just 2.2%.

Over 90% of debt is fixed-rate, which works well for this environment. Plus, 99% of debt is unsecured, providing the greatest flexibility for capital recycling.

Digital Realty Continued…

On the year, shares of DLR are down 26% after hitting a new 52-week high at 2021’s close. Analysts are expecting DLR to deliver adjusted funds from operations (AFFO) of $7.00 in 2023.

On a forward-looking basis, DLR shares trade at a forward p/AFFO multiple of 18.9x. Compare that to a five-year average of 20.9x, suggesting this blue-chip REIT is available at a discount.

DLR yields a 3.6% dividend and has been increasing that payout for 17 consecutive years now. Over the past five, it’s grown at an average annual rate of 5.6%.

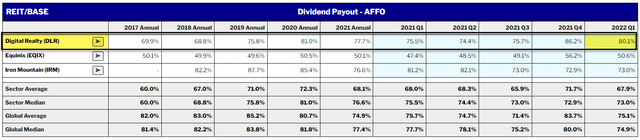

DLR also has a solid payout ratio, as viewed below:

(Source: REIT Base)

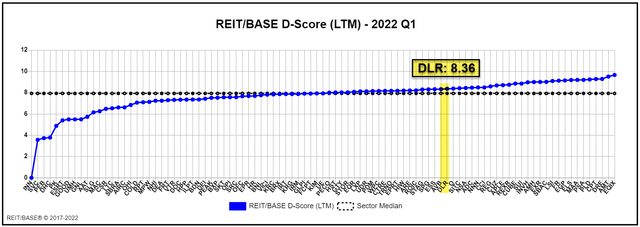

As for its dividend safety score of 8.36 out of 10, that ranks in the top 33% of the iREIT 100 coverage spectrum.

(Source: REIT Base)

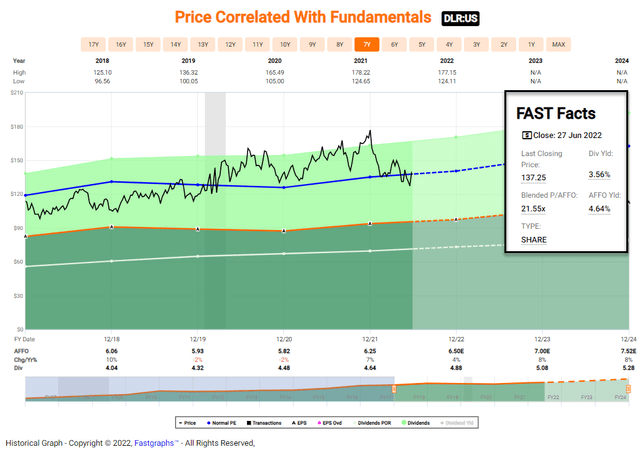

Finally, as shown below, shares are trading at fair value and around 10% below our Buy target price. Analysts forecast AFFO to grow by 8% in 2023 and 2024, which are very solid numbers.

(FAST Graphs)

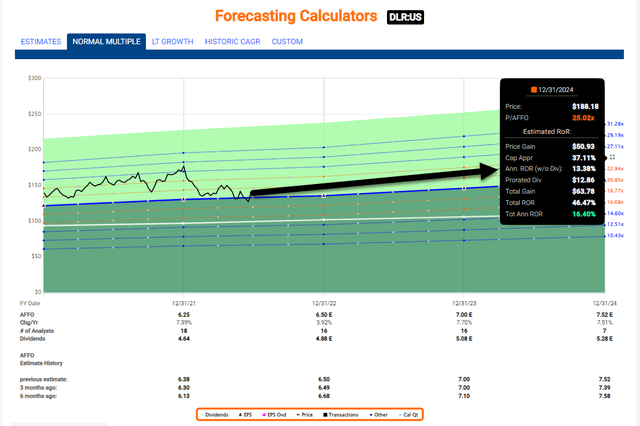

As shown below, iREIT forecasts DLR to return 16% over the next 12 months.

(FAST Graphs)

We’ve Got STAG Industrial in Our Sights

(STAG Website)

STAG Industrial, Inc. (STAG) has 551 properties within 40 states amounting to 110.1 million square feet of industrial space. The growth we’ve seen from the company has been staggering considering how it went public in 2011 with 93 properties.

Back then, 21% of its annual base rent came from flex and office properties. Whereas today, that’ figure is down to 0.1%, since STAG is now a solid industrial REIT.

During Q1, the company acquired 1.8 million square feet in additional buildings, with eight acquisitions in Q1 totaling $166.4 million at a cap rate near 5.0%.

Its top tenants include:

- Amazon (AMZN)

- American Tire Distribution

- FedEx (FDX)

- GXO Logistics (GXO)

- Ford Motor (F)

- Costco (COST).

Its top 10 make up 10.8% of total annualized base rent (“ABR”), while its top 20 make up 17.5%. So you can see it’s very well diversified.

Its largest tenant, Amazon, only makes up 3.2% of total ABR.

Now, you might have heard that Amazon is finding it doesn’t need as many warehouses as it thought it did. But that’s not such a bad thing.

With demand elsewhere being what it is and surging rental prices, STAG has a number of leases that are well below market rates. As such, Amazon walking away from some of them could provide STAG an opportunity to re-lease much more attractively.

In all, STAG has 11.4% of its leases coming due in 2023. Which, again, we’re not completely objecting to.

This REIT’s balance sheet is rated Baa3 by Moody’s and BBB by Fitch with:

- A net debt to run rate adjusted earnings before interest, taxes, depreciation, and amortization for real estate (EBITDAre) of 5.1x

- Q1-22 liquidity of $692 million

- 23% of debt maturing through 2024 and the company has

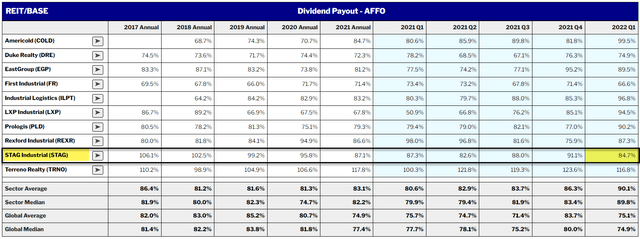

- An improving payout ratio (as shown below).

(Source: REIT Base)

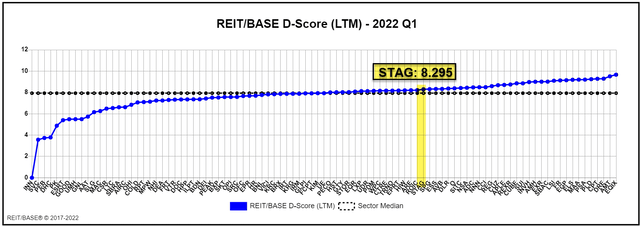

STAG’s dividend safety figure is 8.295 out of 10, and it’s in the top third of the iREIT 100.

(Source: REIT Base)

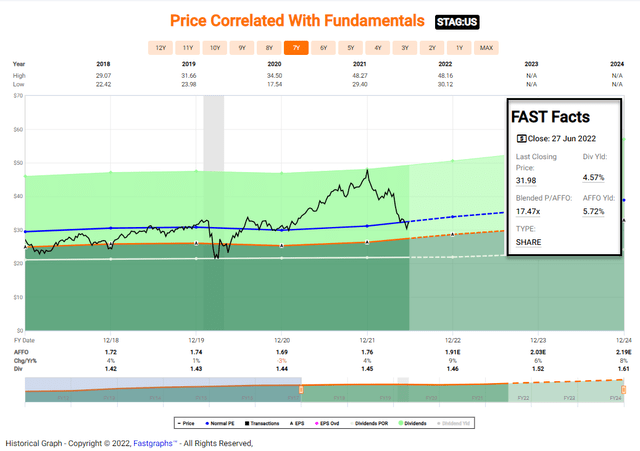

As seen below, STAG trades at $31.98 with a 17.5x p/AFFO – in line with the historical valuation range. The dividend yield is 4.6%, and analysts forecast growth of 6% in 2022 and 8% in 2023.

(FAST Graphs)

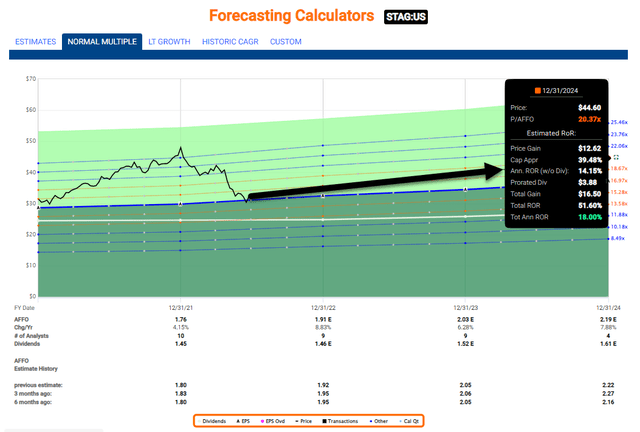

As viewed below, iREIT expects STAG to return 18% over the next 12-months.

(FAST Graphs)

Big Daddy’s REIT Portfolio

Every morning, I receive a phone call from my daughter, who fills me in on how my grandson is doing. Like I said in the beginning, he’s now two months old.

My, how time does fly.

(iPhone – Brad Thomas)

Before you know it, he’ll be going off to college, ready to become a REIT analyst (like his big daddy).

Regardless, it’s important for me to put Asher on solid financial footing. That’s why I created a new collection of REITs called The Big Daddy Portfolio.

So far, I have five stocks in it, including the two listed here. My objective is to accumulate at least $100,000 in value there over the next five years.

I can assure you that there will be no sucker yields listed. I’ll be utilizing iREIT on Alpha’s vast research tools to build a fortress portfolio that’s meant to last a lifetime.

As I’ll remind Asher when he gets old enough to understand, “You gotta make hay while the sun is shining.” And in the REIT world, it usually is.

Be the first to comment