Melpomenem

As fast as China announced it was loosening restrictions around its zero-Covid policy, a surge in cases led to new lockdowns. In the US a railroad union is taking issue with a new labor agreement that runs the risk of a national strike in December. Both headlines depressed the major market averages yesterday at their openings, and they were never able to recover. The past several trading days feels like a period of consolidation before the market musters the strength to break above its 200-day moving average, which it failed to do on the first attempt.

Finviz

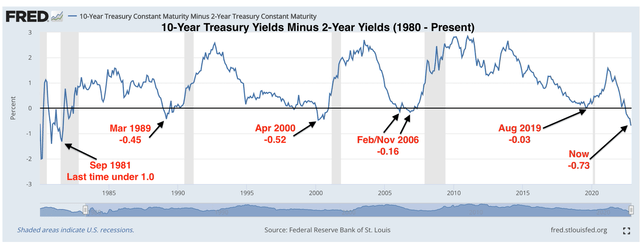

Understandably, there’s growing trepidation about the inversion of the Treasury yield curve between 2-year and 10-year maturities, because it now stands at more than 70 basis points, which is the widest spread since October 1980. The 2-year yield is a reflection of where the market believes the Fed’s policy rate will be in the near term, while the 10-year is the market’s view of the neutral rate, which is neither stimulative or restrictive. The market is telling the Fed that its policy is already extremely restrictive. Inversions consistently preceded recessions in the past, as the chart below clearly shows, but not immediately. Fed officials are aware of this, which is why I think the central bank will end its rate-hike cycle in December and allow an already restrictive short-term rate to do its work in 2023.

DataTrek

As we approach the December meeting, I also think we will start to hear Fed officials become increasingly less hawkish. It may have started over the weekend during a speech by Atlanta Fed President Raphael Bostic, who suggested another 75-100 basis points of additional tightening might do the job. That implies a terminal rate of 4.5-5.0%, which is below consensus expectations. He also said “I do not think we should continue raising rates until the inflation level has gotten down to 2 percent. Because of the lag dynamics I discussed earlier, this would guarantee an overshoot and a deep recession.” Obviously, I couldn’t agree more, as I explained yesterday in my football analogy.

As for the recession that the bond market is now forecasting, dare I say that this time is different? Instead, let me point out that this economy is much different than the ones we had prior to the past five recessions. We do not have the excesses in the real economy that recessions are designed to expunge. Additionally, the recovery that followed the recession in 2020 was fueled from the bottom up, as the bottom quartile of households saw a higher percentage increase in wages and net worth than any other demographic. I can’t remember that happening in the past. It has helped sustain real consumer spending growth through this inflationary period. Another major difference is that we do not have an excess of employment as much as we have an excess of job openings. The job openings can be eliminated with much less damage to the real economy than a significant increase in the unemployment rate.

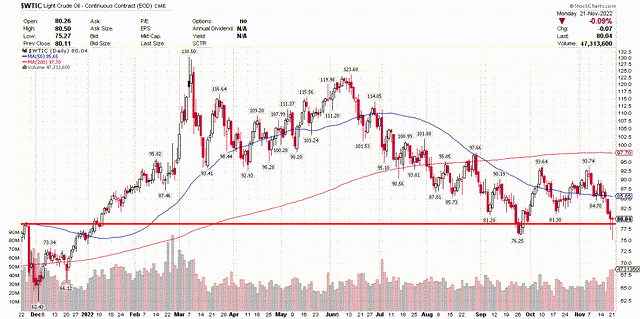

Lastly, I don’t think enough attention is being paid to the price of oil, which is very close to being unchanged on a year-over-year basis. That has a huge impact on the rate of inflation. Provided the price remains level, the comparisons become increasingly difficult as we get into February and March, resulting in significant year-over-year declines that will weigh heavily on the headline inflation numbers. That should help accelerate the decline in inflation that is impacting consumers and businesses, as well as take pressure off the Fed to tighten more aggressively.

Stockcharts

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment