Just_Super/E+ via Getty Images

Magic Software Enterprises Ltd. (NASDAQ:MGIC) remains part of our coverage, as it drives the high-tech exposures within our perennial watchlist stock of Asseco Poland (OTCPK:ASOZF), which controls MGIC through Formula Systems (FORTY). Providing cloud integration and management services, it continues to benefit secularly from trends in digitalization. Unlike larger tier-1 cloud players, it does appear that MGIC is seeing no pressures or disappointments in terms of sales growth. While there is some slowdown in the velocity of signings apparently, demand is unprecedented and continues to drive profitability growth despite some mix challenges. Moreover, the receivables are not bloating further despite solid revenue growth, indicating that the growth isn’t coming incrementally from eased customer credit terms.

Q1 Breakdown

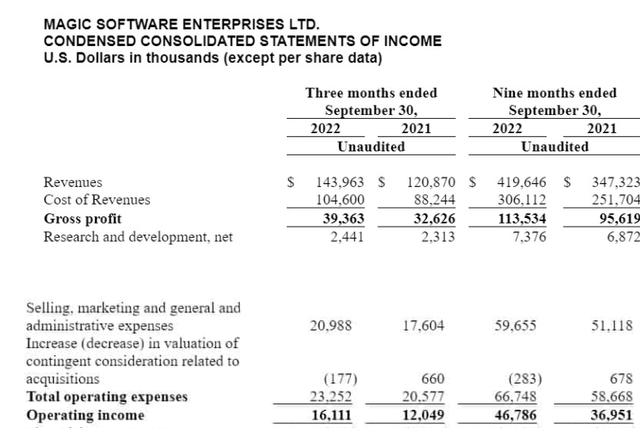

Pressure from a higher mix of professional services which drives down gross margins was already reflected from GM pressure nearing the end of last year, and the YoY declines were pretty limited. Therefore, the 19.1% revenue growth, which again is comprehensive of pretty meaningful 5-10% declines in the Shekel relative to the USD YoY which is the major non-NA exposure in terms of geography, contributed to substantial operating income growth of 33.7%. Constant currency growth was around 23%, which shows that despite the pressures that we expected for enterprise tech, which were founded among larger players, they were unfounded in tier-2 cloud integration and transition companies.

While in the same period of 2021, 21% of our revenues were attributable to our Software Solutions segment, with a gross margin of approximately 64% and 79% related to our professional services with a gross margin of approximately 20%.

Asaf Berenstin, CEO of MGIC, on mix pressure from professional services growing in the mix.

While professional services have grown in the mix in part due to acquisitions which have now been lapped, but also general demand for professional services over software as companies move to the cloud, the general tenor of growth looks stable. Management reports that there has been a slight slowdown in the expedience of signings of agreements, but overall there is no sign at all of any real slowdown in these markets.

It takes a little bit more time to sign the agreement. So we do the scope and we work with the client, and we are fully engaged with them. But to conclude the signature, takes a little bit more time. That’s it.

Asaf Berenstin, CEO of MGIC.

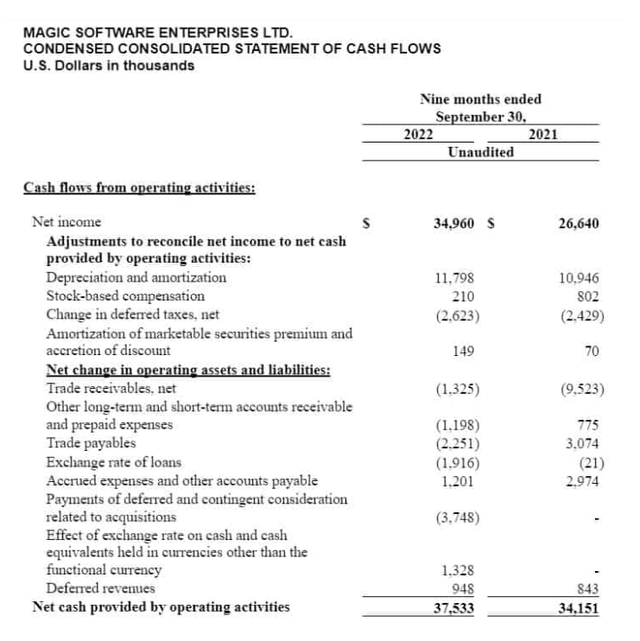

Another thing we take note of is the situation with the receivables. Last year, there was a sudden jump in receivables. This looked bad, as loosened customer credit terms may have driven the observed sales, which could be used to cover us in slowing markets. However, receivable growth has started to lag sales growth, which continues unabated. Receivables need to be continued to be monitored because the jump was massive. So long as there aren’t further major jumps and that there are some quarters of revenue growth to shrink them further, we’re satisfied with the current state of affairs.

Bottom Line

In principle, the earnings growth justifies the Magic multiple. A 20x P/E reflects the sort of growth that we are seeing in earnings, which are up almost 33%. MGIC operates in markets where fruit hangs lower and there is continued potential for earnings growth, and it is demonstrating advantages in momentum compared to some of the larger cloud transition players. Receivables growth also hasn’t continued to an alarming degree, so we don’t have to question the quality of the top line in its large, incremental strides. Nonetheless, a multiple like that can’t compete with the other ideas we’re following in the current market that offer so much more value potential. Magic Software Enterprises Ltd. thus is a pass individually, and Asseco remains just on the watchlist as we look for easier wins in the market.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment