Slaven Vlasic

As the market looks to welcome rebound momentum again, my advice for investors is not to ignore small caps. Small-cap growth stocks have been among the hardest-hit stocks all year, and many are trading at incredibly low valuations.

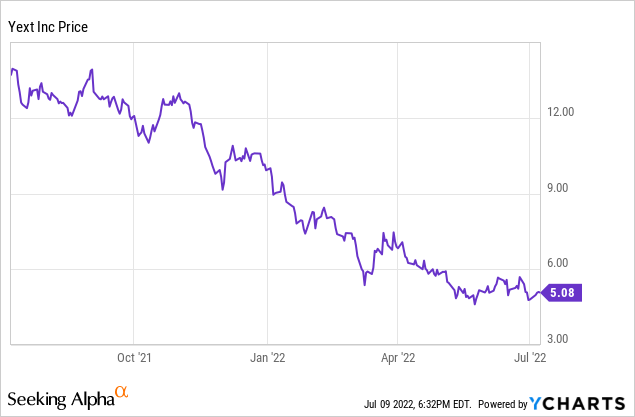

Look no further than Yext (NYSE:YEXT) for one of the cheapest stocks in the tech sector at the moment. Now, Yext has also been plagued by sales growth saturation issues plus a changeover in leadership, but I think the stock’s ~50% fall year to date severely undervalues a company that still operates a unique and powerful technology base.

Yext has never been a major hit with investors – during the growth-boom years, it wasn’t growing quickly enough to keep up with hotter tech peers, and during this year’s massive correction, Yext’s red ink also made investors nervous. Yet, due purely to valuation, I’m still staying bullish on Yext. I’ll be clear here: I don’t think Yext is necessarily the highest-quality software company on the market, but I do think its collection of merits is a worth way more than where it’s currently trading.

Here is a refreshed view of what I believe to be the new bullish thesis for Yext:

- Broad evolution of its platform greatly increases Yext’s available market. Yext started out with just its location data platform, but over the past few years, it has morphed into a very versatile software vendor. Yext Answers and the embedded AI search technologies are a very nascent opportunity. Listing/reviews tools and webpage creators are other complementary, yet not overlapping, products. It has also built a new tool called Extractive Question Answering, which can answer questions against long-form documents and other pieces of unstructured data.

- Still growing, albeit modestly. Though Yext has a reputation for being stagnant, the company is still managing to grow post-pandemic, with single-digit revenue growth and double-digit growth in customer counts. “Land and expand” is still a powerful tool for Yext, which now has a full portfolio of products to cross-sell to its customers.

- Recurring revenue. Nearly the entirety of Yext’s revenue base is recurring revenue. We may have forgotten this fact amid general fear of tech in 2022, but recurring revenue is a powerful base of business, and it’s highly coveted by acquirers.

- Easy to swallow for potential buyers. And speaking of which, Yext’s <$400 million enterprise value makes the company quite an easy acquisition target, especially for a larger “portfolio” software company looking to add an extra ~$400 million in recurring revenue. In particular, I think Alphabet (GOOG) is quite a synergistic buyer, especially given Yext’s original focus on location-based data and Google Maps.

At its current share price near $5, Yext has a market cap of just $628 million, making it one of the smallest stocks in the software sector. Note as well that the company is executing quite a large buyback program relative to its size ($45 million left to go on a total $100 million authorization). After netting off the $248 million of cash on Yext’s most recent balance sheet, the company’s resulting enterprise value is just $380 million.

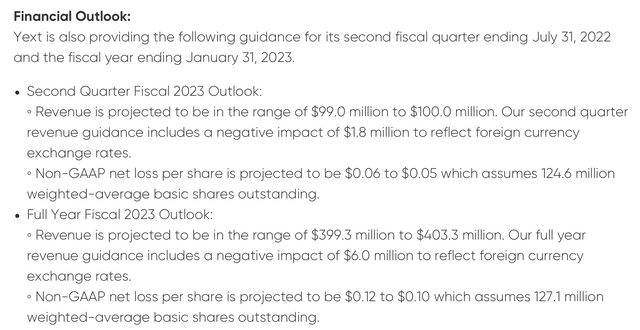

For the current fiscal year, meanwhile, Yext has guided to revenue of $399.3-$403.3 million, representing 2-3% y/y growth. (Note that this is a cut from a prior outlook of $403.3-$407.3 million, but bakes in a $6 million impact of FX movement – so on a constant currency basis, this does represent a slight $2 million bump to Yext’s prior guidance).

Yext guidance update (Yext Q1 earnings release)

Against the midpoint of Yext’s new revenue range, the company trades at just 0.9x EV/FY23 revenue.

Now, I’ll fully admit that Yext is a company undergoing a transition, and that its fundamentals are far from perfect – but its valuation is too low to ignore. We’ve seen plenty of underperforming software stocks get snapped up in acquisitions lately (recent examples include Zendesk (ZEN)), and I think the possibility of that outcome for Yext is worth buying the stock at less than one turn of revenues.

Don’t bet the farm here, but Yext is certainly worth a small position.

Q1 Download

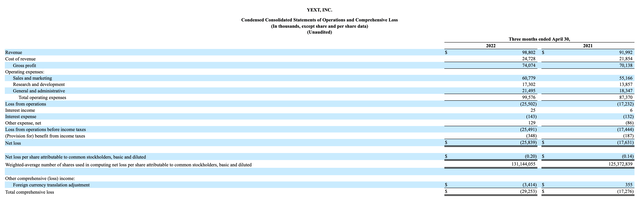

Let’s now cover Yext’s latest Q1 results in greater detail. The Q1 earnings summary is shown below:

Yext Q1 results (Yext Q1 earnings release)

Yext’s revenue in Q1 grew 7% y/y to $98.8 million, beating Wall Street’s expectations of $96.7 million (+5% y/y) by a two-point margin. We do note, however, that revenue did decelerate from 10% y/y growth in Q4, but unfavorable currency movements are partially to blame.

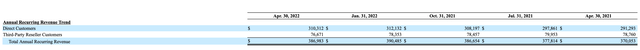

I won’t shy away from the fact that Yext’s results certainly aren’t perfect, and the one red flag worth mentioning is a slight sequential decline in ARR. ARR of $387.0 million in the quarter still did grow 5% y/y, but represented a ~$3.5 million slip quarter over quarter. For a company like Yext that does do business with many smaller companies, this churn isn’t overly surprising, but it is a concern if the trend continues.

Yext ARR (Yext Q1 earnings release)

What I do find promising in Yext, however, is the fact that the company’s new leadership under CEO Michael Walrath is focusing on operating efficiencies and boosting profitability, now that Yext is no longer in all-out growth mode (recall that at the time of its IPO, Yext was growing at a ~30% y/y pace)

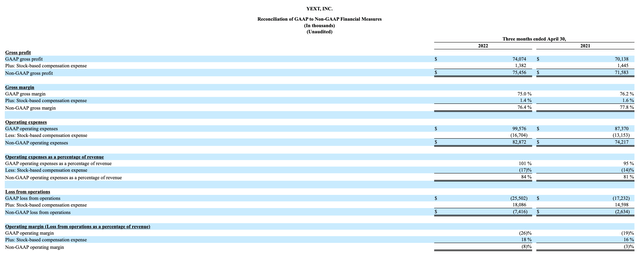

Yext margins (Yext Q1 earnings release)

At the moment, pro forma operating margins are down: Q1 stood at -8%, five points worse than the year-ago Q1 at -3%. But the company has vastly shifted its go-to-market strategy and is implementing cost-downs across the board, which will materialize into margin boosts in the coming quarters. Per Walrath’s prepared remarks on the Q1 earnings call:

We took actions to create operating efficiencies during the quarter, and we expect to realize these operating efficiencies in future periods as our full year guidance suggests. We are confident in our ability to continue to make the core business more efficient even as we face economic uncertainty, inflation and FX headwinds […]

We will continue to focus on operational efficiency. We spent most of the quarter reorganizing the business, resulting in a flatter organization. We worked on consolidating duplicate functions, increasing our leaders span of control and creating more accountability to improve operating efficiency. We are already seeing the results of our work, and our improved full year EPS guidance reflects the work we have done in the early part of our fiscal year.

We expect to continue to make progress on this front as we streamline the organization and focus on making sure our efforts are in the highest value areas. We view these operational efficiencies as directly linked to driving increased customer satisfaction. The complexity and size of our organization was getting in the way and a leaner, more focused organization will better serve our customer needs and grow those relationships over time.”

The key message here is that Yext is not sitting contently with its underperformance over the past several quarters. It’s making sweeping changes both to its cost structure and its go-to-market playbook. It’s worth noting as well that the company’s full-year EPS loss guidance went from -$0.19 to -$0.17, to a new range of -$0.12 to -$0.10, reflecting management’s confidence in the execution of these cost-down efforts.

Key Takeaways

Though Yext has fallen off most investors’ radars, the opportunity to buy this stock at <1x forward revenue is not one to be overlooked, especially as the company executes an ambitious overhaul of its strategy while buying back stock at a very low price. Stay long here and hold out for the rebound.

Be the first to comment