bjdlzx

(Note: This article was originally posted in the marketplace newsletter on October 19, 2022 and has been updated as needed.)

Permian Resources (NYSE:PR) is a company that recently came into being with the merger of a private company, Colgate Energy, and a public company, Centennial Resource Development (CDEV). The new CEOs of the company will be coming from the private side of this merger. So, a public track-record is not really available. However, it does appear that the compensation will heavily favor a management that builds the company successfully.

Management appears to want to be a consolidator in an area that does have some fragmented and less than optimal sized operators. That is a pretty good strategy for shareholders as this type of consolidation often happens with properties that limited market appeal and so sell at a discount.

Against that, the management team appears to have a lot of investment and consulting experience. That can be a handicap if management does not adjust to the “hands-on” that is often necessary with management and assimilating acquisitions.

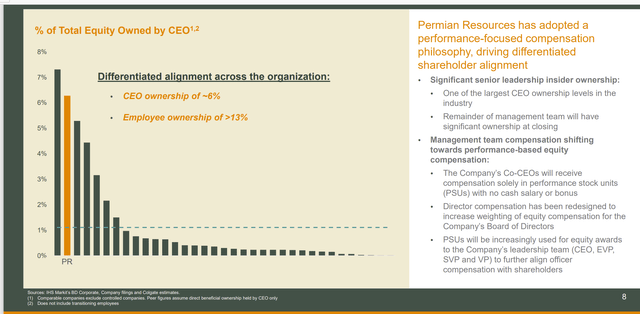

Compensation

The compensation packages presented to shareholders appear attractive for a number of reasons. The big reason is management is unlikely to get paid much if management does not produce for shareholders. We will have to see how the board executes this type of strategy for confirmation on this. But at least at the start it looks good.

Permian Resources CEO Compensation Measures And Description (Permian Resources Presentation At Barclays CEO Energy-Power Conference September 2022)

These CEOs are going to be paid solely in stock. There is no cash salary or bonus. This is comparable to Kinder Morgan (KMI) whose Chairman of the Board has long worked for $1 per year. Executed correctly, this will be a powerful incentive to produce for shareholders.

The background of the management team appears to favor a strategy of building a company that is attractive to potential acquirers for the right price. The fact that a private company chose to go public in this fashion is yet another vote from knowledgeable insiders that want to “get in on the action” as opposed to a group of insiders selling out. So, this does not appear to be the time to sell companies in this industry.

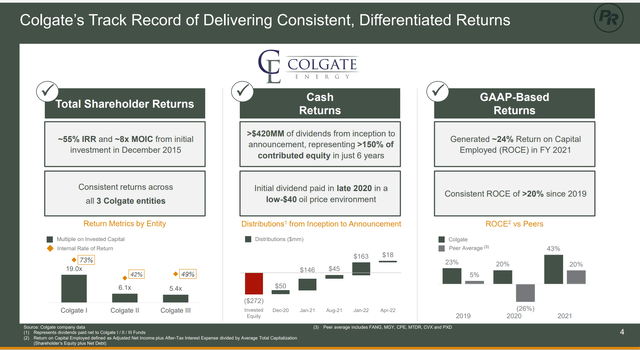

Private Company Record

The private record revealed to shareholders and the public appears to be attractive.

Permian Resources Presentation Of Prior Private Company Results (Permian Resources Presentation At Barclays CEO Energy-Power Conference September 2022)

The fact that investors received their total investment back within a four-year period is impressive when one considers that one of those years was fiscal year 2020. That cash return backs up the superior return claim in the next box. Similarly, the claimed IRR also has some standing when the cash to give back to private shareholders is available. The whole picture points to good management.

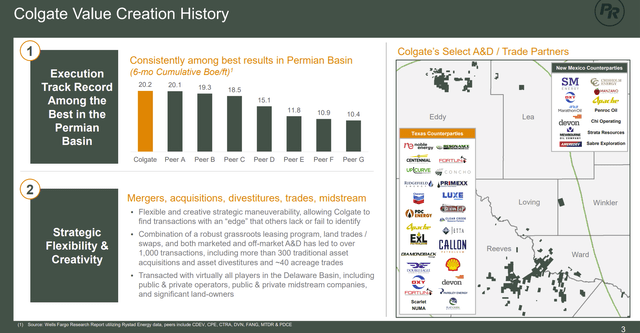

Location Location Location

In many ways, this industry takes after the real estate industry in that location often results in a competitive moat that offers a long-lasting competitive advantage. Both companies have that location advantage.

Permian Resources Presentation Of Colgate Location Advantages (Permian Resources Presentation At Barclays CEO Energy-Power Conference September 2022)

The combined company has leases in basically the same locations. Management has given the results in drilling and corresponding production. The only thing needed in the future is how this translates into payback and cash flow. That was of course strongly hinted at in the returns to shareholders in the past.

The other thing about these companies is that each was financially very strong independently. So, the combined company will begin its existence with very conservative balance sheet ratios. That means that acquisitions are likely to be accretive by using a combination of stock and debt design to keep the debt ratio very low. That keeps future opportunities to take advantage of deals on the table.

Just based upon the location of current leases, this management is likely to be very picky about the location of future acquisitions. That would keep the profitability of the growing company high in addition to the low debt levels.

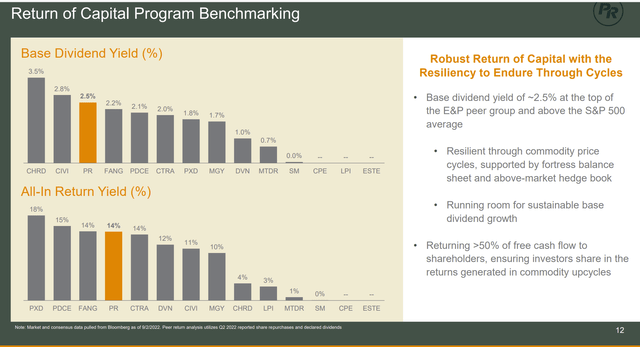

Shareholder Returns

The unusually profitable location of the leases allows for decent shareholder returns as well as reinvestment of some cash flow to grow the company.

Permian Resources Comparison Of Returns To Shareholders (Permian Resources Presentation At Barclays CEO Energy-Power Conference September 2022)

The shareholder returns are based upon a combination of a base dividend, a variable dividend and share repurchases that should equate to 50% of free cash flow. This is balancing the market demands for return of capital against the needs to grow a business that will likely be sold in the future for the right price.

Some of these companies will emphasize that return shown above in cash, whereas here there is likely to be a little more emphasis on share repurchases at the expense of cash returns.

The reason for that is this is essentially a new company in the eyes of the market and therefore is likely to be discounted until it is seasoned. In my opinion, it sounds like management intends to take advantage of that discount by repurchasing shares. Some companies like Pioneer Resources (PXD) really do not have a discounted stock price. So, it makes little to no sense to do a lot of stock repurchases when that is the case.

Key Takeaways

Permian Resources is a brand-new company led primarily by the co-CEOs of the private company. The first job is to optimize the combined company operations of the old Centennial Resource Development (CDEV) and Colgate Energy.

The CEO compensation package appears very favorable for shareholders at first glance. Similarly, the return to shareholders of a fixed and variable dividend combined with share repurchases appears to have a better balance than many programs out there right now.

Many managements are touting large returns to shareholders. But the market also values growth along with dividends. Some of the companies emphasizing dividends over future growth are liable to find their companies valued lower than companies that manage to do income, share repurchases, and decent growth.

The combined plan also points to the profitability of the company location. The location of the leases is likely to provide a long-term competitive moat for this company compared to much of the industry.

Management gives itself an additional growth avenue through the pursuit of accretive acquisitions that are very likely to keep the debt low through the use of both stock and debt.

Overall, this new company has a fair amount of experience and a decent size to offer an above average chance of success. Still, the company is new, and the new management untried. Shareholders and investors should not be surprised to see a valuation discount until a public track record is there. Right now, though, this company appears to be off to a good start and is worth consideration by a variety of investors that do not mind the new company risks.

Upcoming Quarterly Report

This first report is likely to have a lot of “noise” because the two companies completed their combination very recently. This first quarterly report will likely be close to useless for many even though it is worth reading to make sure that no serious problems appeared.

But even the next quarterly report could have a fair amount of optimization charges that are non-recurring. It may take time for the quarterly reports to “clean-up”.

An investment at this point would be some faith in management and the previous record of the public company. That has something going for it. Besides, the location is excellent. So that could provide some downside protection. Still, conservative investors may want a record of management running the combined company for a year or so.

Be the first to comment