ISMODE

Investment Thesis

Since our previous publication, YETI (NYSE:YETI) shares have lost more than 40% of their market capitalization. Slowing sales growth, declining margins, supply chain problems, and rising inventories have forced analysts to revise their estimates regarding the company’s prospects. In our opinion, all headwinds are priced in. YETI remains a growth company with significant potential for international expansion, and the brand’s pricing power will allow the firm to maintain high profitability in the long term. According to our estimate, YETI is trading at a significant discount to fair market value. We rate the share as a Buy.

Still A Growth Company

Last year was a breakthrough year for YETI. The company has shown a high growth rate both in the USA and abroad. The removal of COVID-19 restrictions allowed the company to exceed the forecasts of management and analysts. As a result, both Wall Street’s expectations and our expectations were somewhat overstated. Now it seems obvious, but then the market lacked skepticism. However, skepticism is more than reflected by the current price.

Considering that sales grew by only 17.3% in 2019 and that revenue has increased by more than 50% ever since, the expected growth rate in the range of 15-17% is quite consistent with the pre-pandemic trajectory of the company. And this is despite inflation and a decline in consumer activity, which is primarily reflected in consumer discretionary stocks.

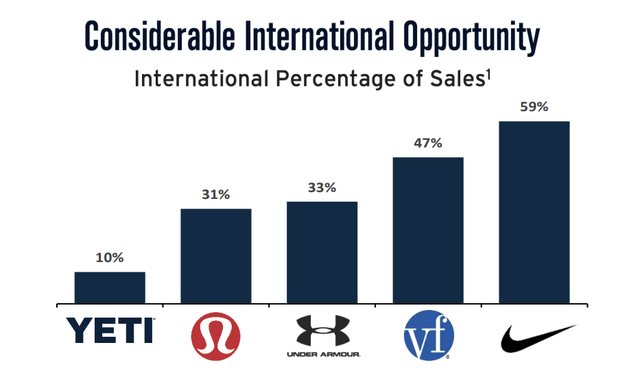

We expect YETI to remain a growth story. Firstly, the company has a strong positioning in the Sports & Outdoor market, which, according to Statista forecasts, will grow at a CAGR of 10.24% in the coming years. Secondly, YETI has the potential for global expansion, and the company’s management is betting on this. Indeed, YETI has made significant progress in recent years: the share of international sales in total revenue has grown from 6.2% in 2020 to 9.2% in 2021. And although the latest quarterly report did not meet Wall Street’s expectations, it demonstrated the merit of our judgments: international sales increased by 35% year-over-year to $48.1 million, and their share in six months was ~12% against ~10% a year earlier.

Given the still low share of international sales in the revenue structure relative to other large consumer discretionary companies, as well as the similarity of consumer culture in the target markets (USA, EU, UK, and Canada), we remain optimistic about the international opportunities of YETI.

Inventory And Logistics

An increase in the inventory balance is a red flag for any company, as it affects cash flow, and may also indicate a decrease in demand. It seems that the current stocks of YETI are caused only by problems in the supply chain, as their structure looks like this: on-hand inventory (44%); in-transit inventory (30%); inbound freight cost (25%).

On-hand inventory is goods ready for sale, and they are valued at $215m, which is 12% of the trailing twelve months’ revenue and corresponds to the average level over the past 6 years. Thus, we expect a decrease in the inventory balance and net working capital as the supply chain is restored.

Problems in the supply chain also lead to an increase in the cost of goods sold and a decrease in marginality. However, here YETI has an advantage relative to other consumer discretionary companies, namely pricing power.

Pricing Power

The pricing power of the company is due to the long and painstaking work on the public positioning of its brand. From the very beginning of its existence, since 2006, YETI has adhered to one marketing strategy. 15 years ago, the company started selling coolers for $300 at an average market price of $50-100, but at the same time, their product was much better. Coolers and mugs of the company can be compared with Apple products or Mercedes cars.

Many celebrities speak positively about the quality of YETI, for example, Kim Kardashian in her Instagram stories or Jason Momoa for GQ with the words: “I’ll tell you the technology I travel with: a really good YETI cooler and lots of ice. And Guinness.” Forbes and The New York Times named the YETI Tundra Haul Cooler the best of coolers, and CNN named the YETI Rambler 26 Ounces mug the best tested. There are a lot of positive articles about the company’s products on narrowly focused or mass Internet resources. On Amazon, YETI’s product ratings range from 4 to 5 stars, with thousands of orders and a lot of positive reviews.

It’s no secret that YETI has a strong brand, and this has a positive effect on the business as a whole. Today, the cost of the company’s coolers reaches $1.5 thousand, while the average price of competitors does not exceed $300-400. In recent conference calls, management has repeatedly mentioned that it is the strength of the brand that helps maintain marginality and mitigate the adverse impact of duties, GSP, freight costs, and others. Thanks to pricing and features of sales channels, it was possible to compensate for 170 basis points in Q4 21; 250 basis points in Q1 22, and 260 basis points in Q2 22. Thus, pricing power is one of the main factors that will allow YETI to return to past profitability as macroeconomic conditions normalize.

Valuation

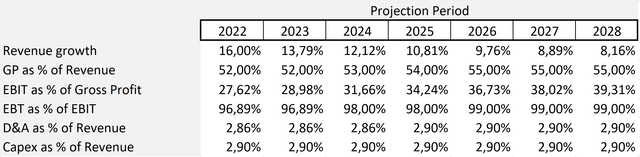

The DCF model is based on some assumptions. According to management’s expectations, by the end of the year, revenue will grow by 16% in the middle of the forecast range, which corresponds to ~$225.8m. We assume that the absolute revenue growth will remain at the current level until the end of the forecast period. This assumption looks quite conservative and below the consensus of Wall Street. We expect the gross margin at the end of this year to correspond to the low of the forecast range – 52%, with subsequent recovery as the supply chain improves. Over the past 4 years, the company has reduced operating expenses as a percentage of revenue by an average of 2.4 percentage points annually, we assume that this trend will continue. Future capital expenditures and D&A as a percentage of revenue are based on averages over the past four years. Our model does not take into account share repurchases. The assumptions are presented below:

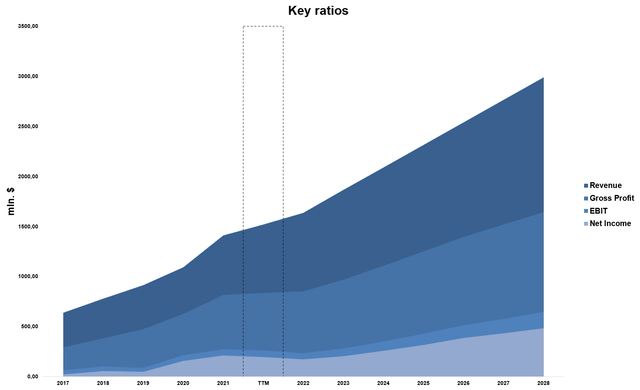

Based on assumptions, the expected dynamics of key financial indicators are presented below:

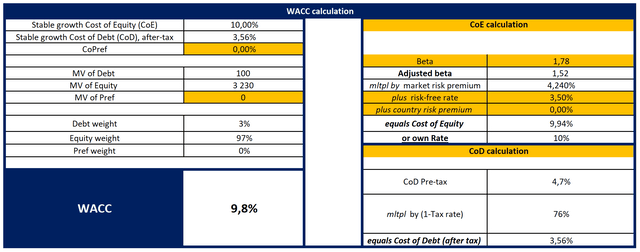

With the cost of equity equal to 10%, the Weighted Average Cost of capital (WACC) is 9.8%.

With a Terminal EV/EBITDA of 9.25x (the median of the consumer discretionary sector), the model projects a fair market value of $5.0 billion, or $57 per share, in line with Wall Street’s consensus estimate of $57.5. the upside potential we see is about 55%.

You can see the model here.

U.S. GSP As An Uncertainty Factor

U.S. Generalized System of Preferences is one of the very first programs aimed at increasing imports to the United States. Since 1974, it has been regularly extended and allowed less developed countries to trade duty-free with the United States. Since December 31, 2020, the program has not been extended by Congress.

Historically, YETI has always benefited and imported its products to America duty-free. There are a lot of discussions going on around the GSP, and separate bills were submitted by the 117th Congress. Many experts agree that the GSP will be extended, or separate programs will be developed within the WTO. However, if this does not happen, the YETI margin will be under pressure.

Conclusion

After explosive growth in 2021, YETI fell into the trap of past successes and failed to meet the expectations of the street for revenue and EPS. In our opinion, the reduction of these expectations is more than embedded in the price. We expect YETI to remain a growth story as the company has a strong positioning in the growing Sports & Outdoor market and also has the potential for global expansion. In addition, YETI has significant pricing power, which will allow it to maintain high profitability in the long term. We are bullish on YETI.

Be the first to comment