Mlenny/E+ via Getty Images

Investment Thesis: SK Telecom (NYSE:SKM) has long-term growth potential on the basis of continued growth in ARPU and subscriptions, as well as continued development of AI capabilities.

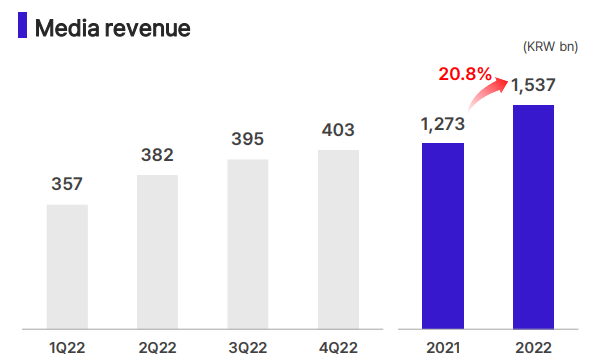

In a previous article back in December, I made the argument that despite modest growth in ARPU (average revenue per user) – SK Telecom seems to have a favourable long-term outlook owing to strong performance across the Media segment, as well as significant growth in cash levels and a drop in long-term debt.

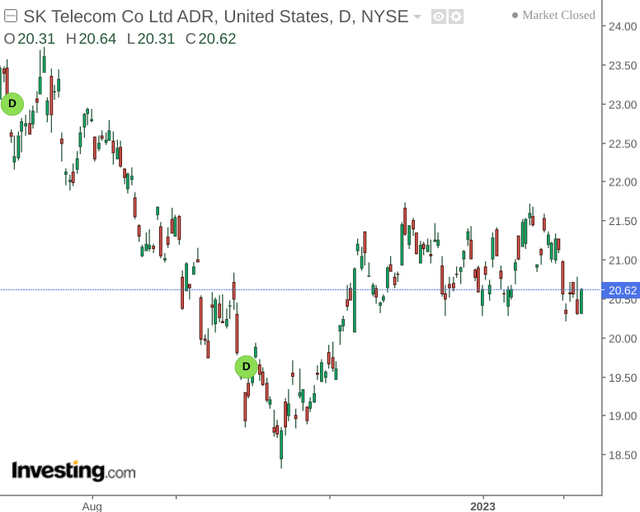

Over the past couple of months, we have seen the stock trade in a largely stationary manner:

The purpose of this article is to assess whether my long-term view on the stock still holds in light of recent performance.

Performance

When looking at performance for the full-year 2022, we can see that revenue across the Media segment continued to perform strongly – up by 20.8% on that of the previous year:

SK Telecom: Investor Briefing – Annual Earnings for FY2022

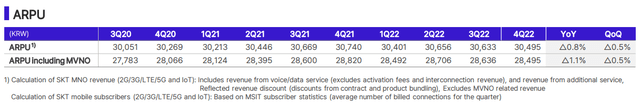

Additionally, while ARPU was down on that of the previous quarter, we can see that this metric is up by 0.8% on a year-on-year basis.

SK Telecom: Investor Briefing – Annual Earnings for FY2022

From this standpoint, performance on a yearly basis continued to remain encouraging.

When looking at EBITDA trends, we can see that while we saw a slight reduction in EBITDA in 4Q22 as compared to the previous quarter. However, both EBITDA and the EBITDA margin were up on that of last year overall.

| 1Q21 | 2Q21 | 3Q21 | 4Q21 | 2021 | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 2022 | |

| EBITDA | 303.5 | 296.7 | 319 | 302 | 1221.3 | 321.2 | 320.1 | 320.2 | 314.4 | 1275.9 |

| EBITDA margin | 31.40% | 29.80% | 31.10% | 28.50% | 30.20% | 31.30% | 31.00% | 30.70% | 29.90% | 30.70% |

Source: SK Telecom: Investor Briefing – Annual Earnings for FY2022

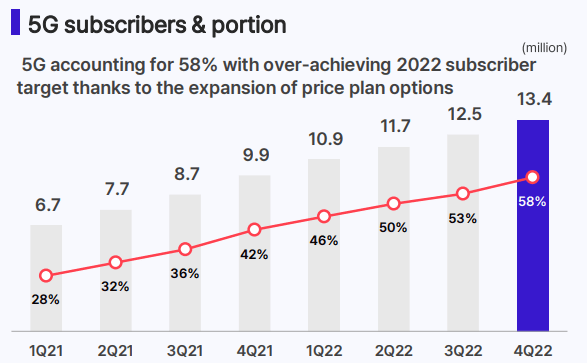

Moreover, while I had previously expressed a concern that the growth in demand for 5G services may start to level off from here – there have been no indications of this so far – with subscribers having grown by 5% since the last quarter and up to 58% from that of 42% for the same quarter in the previous year.

SK Telecom: Investor Briefing – Annual Earnings for FY2022

From a balance sheet standpoint, we can see that cash to bonds payable and long-term borrowings remain higher than that of the same quarter last year – albeit with a significant decrease from that of the previous quarter.

| (KRW bn) | 01/12/21 | 01/03/22 | 01/06/22 | 01/09/22 | 01/12/22 |

| Cash and cash equivalents | 407.7 | 436.7 | 649.4 | 583.6 | 368.0 |

| Long-term borrowings and notes payable | 1255.1 | 1326.3 | 1245.2 | 852.4 | 846.3 |

| Cash to bonds payable and long-term borrowings | 32.48% | 32.93% | 52.15% | 68.47% | 43.48% |

Source: Figures sourced from SK Telecom Investor Briefing: Annual Earnings for FY2022. Cash to long-term borrowings and notes payable ratio calculated by author.

However, long-term borrowings in its own right have still seen a slight decrease from that of the last quarter – and significantly lower than that of the previous year.

Taking the above points into account, the fact that EBITDA has continued to see growth and long-term borrowings have been decreasing is encouraging.

Looking Forward

Going forward, it is unclear as to whether the stock will continue to trade in a stationary manner in the short- to medium-term, owing to potential concerns as to whether revenue and subscription activity will continue to see meaningful rises given inflationary and macroeconomic pressures.

However, I take the view that the performance we have seen to date has been encouraging.

Increasing attention will be given to SK Telecom and its ambitions in the AI space, with the company targeting a market capitalisation of over $28 billion by 2026 – which is reportedly almost four times that of its existing market cap. The purpose of such investment is to diversify away from traditional telco revenues – which have been coming under pressure across the industry as a whole.

In particular, the company is utilising AI to invest significantly into the Media segment – with initiatives such as an AI-enabled media player which seeks to enhance search personalization capabilities as well as strengthening its content power by integrating media-related assets such as IPTV and T Commerce to increase its content capabilities. Should we see Media revenue continue to see strong growth as a result of these initiatives, then this could be a catalyst for further long-term upside.

Conclusion

To conclude, SK Telecom has seen encouraging performance in the most recent quarter. Additionally, given the company’s investment in AI to boost its capabilities across Media and other segments – I see long-term growth potential for this stock.

Be the first to comment