KingWu/E+ via Getty Images

Ideally speaking, when investors buy into a company, they would like the company in question to be a high-quality operator at an attractive price. Unfortunately, the market is not always as inefficient as we might like it to be. Sometimes, to get a real bargain, we have to settle for a firm that has a lower level of quality to it. This can be rather risky and can always come back to bite us should we sacrifice quality for price too much. But in this rapidly changing market, the good news is that bargains are easier to come by than they were previously. A great example of this can be seen by looking at Yellow Corporation (NASDAQ:YELL), a provider of less-than-truckload transportation services with a rather small market capitalization of $204.4 million. In addition to suffering from volatile financial results in recent years, the company has a significant amount of debt on hand, with net debt totaling $1.28 billion. Normally, I would prefer to stay away from a company this leveraged. But considering how far the stock has fallen and based not only on recent financial performance but also projected financial performance, I do think now might be a good time to consider taking up a steak in the business.

The picture has improved

The last article I wrote about Yellow Corporation was published in May of this year. In that article, I was updating investors about the share price surge the company saw in response to some executives at the company buying up a sizable amount of stock. I was also impressed with the upbeat financial performance the company had achieved, even at a time when its share price was declining. But given the risk involved in the firm, I ultimately held my rating flat at a ‘hold’. Since then, however, shares have fallen by 6.8%, coming in slightly better than the 7.4% decline by the S&P 500. Given that a ‘hold’ rating by me denotes a situation where I think the stock should more or less follow the broader market, I would call this assessment back then a win.

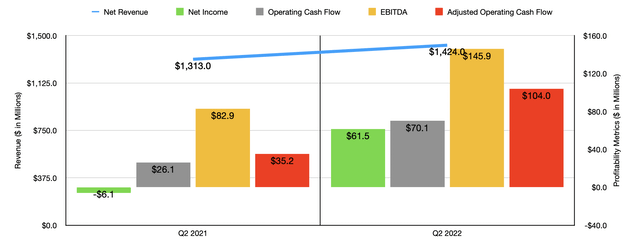

Author – SEC EDGAR Data

Even though shares of Yellow Corporation have fallen, that’s not to say that the fundamental condition of the company has worsened. In fact, by every measure, things have only gotten better. To see what I mean, we need only look at the most recent data available. This is the data covering the second quarter of the company’s 2022 fiscal year, the only quarter for which data is now available that was not available when I last wrote about the enterprise. During that time, sales came in at $1.42 billion. This was 8.5% higher than the $1.31 billion generated the same time one year earlier. You would think that such an increase would be driven by a rise in shipment volume. But this was not the case. In fact, during the second quarter of the year, the total number of shipments dropped from 4.55 million last year to 3.82 million this year. The increase, then, was driven by higher pricing. The amount of picked-up revenue per shipment generated by the company totaled $367. That compares to the $287 generated only one year earlier.

Higher pricing in an asset-intensive business with low margins can be incredibly beneficial for shareholders. For instance, as a result of this change in pricing, Yellow Corporation saw its bottom line go from a net loss of $6.1 million in the second quarter of 2021 to a net profit of $61.5 million the same time this year. Operating cash flow went from $26.1 million to $70.1 million. If we adjust for changes in working capital, the picture would have been even better, with the metric climbing from $35.2 million to $104 million. And finally, we also saw an improvement when it came to EBITDA, with the metric increasing from $82.9 million to $145.9 million.

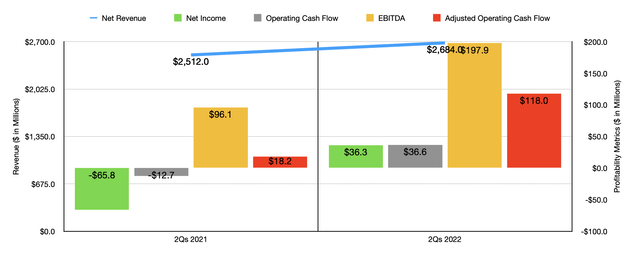

Author – SEC EDGAR Data

The strength experienced in the second quarter of the year was not a one-time thing. For the first half of the year as a whole, we saw the company perform well. Revenue of $2.68 billion came in higher than the $2.51 billion generated in the first half of 2021. Year over year, the company went from a net loss of $65.8 million to a net profit of $36.3 million. Operating cash flow went from negative $12.7 million to positive $36.6 million. If we adjust for changes in working capital, the metric would have still risen, climbing from $18.2 million to $118 million. And EBITDA during this time increased from $96.1 million to $197.9 million.

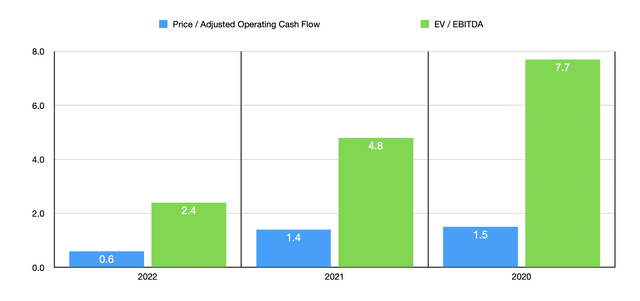

Author – SEC EDGAR Data

We don’t really know what to expect for the rest of the current fiscal year. But if we were to annualize results experienced so far, we would anticipate adjusted operating cash flow of $303.3 million and $630.1 million. This would imply a forward price to adjusted operating cash flow multiple of 0.6 and a forward EV to EBITDA multiple of 2.4. It would also bring the net leverage ratio for the company down to just over 2.0. By comparison, using data from the 2021 fiscal year, these multiples would be 1.4 and 4.8, respectively, with a net leverage ratio of 4.2. And should financial results revert back to what we experienced in the 2020 fiscal year, these numbers would be 1.5, 7.7, and 6.7, respectively. To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 3.9 to a high of 8.4. In this case, Yellow Corporation was the cheapest of the group. And using the EV to EBITDA approach, the range was between 3.4 and 6.9 with YELL being the second cheapest.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Yellow Corporation | 1.4 | 4.8 |

| U.S. Xpress Enterprises (USX) | 3.9 | 6.1 |

| Marten Transport (MRTN) | 8.4 | 6.9 |

| Covenant Logistics Corp (CVLG) | 6.1 | 3.4 |

| P.A.M. Transportation Services (PTSI) | 8.0 | 5.8 |

| Daseke (DSKE) | 4.7 | 5.4 |

Just like when I wrote my prior article on the business, I have no delusions about the future. At some point, especially if the economy weakens, financial performance will revert back to what it was in prior years. At that point, the company won’t look all that great. Having said that, it could take a little while before the picture comes full circle. For instance, in September, management announced results for the first two months, plus the first week or so, of the third quarter. They didn’t offer any revenue or profit assessments. But they did say that while shipments were down 15.6% year over year, pricing was still up, having come in 20.5% higher than it was one year earlier. This obviously bodes well when it comes to total results for the third quarter.

As for what analysts expect, the current call is for the company to generate revenue in the third quarter of $1.37 billion. That would be up from the $1.30 billion reported in the third quarter of 2021. Earnings per share, meanwhile, should be $0.56. That’s up from the $0.16 per share generated the same time last year. In absolute dollar terms, this would imply net income rising from $8.3 million in the third quarter of last year to $29.2 million the same time this year. No estimates have been given when it comes to other profitability metrics. But for context, operating cash flow in the third quarter last year was $22 million, while the adjusted figure for this was $62.3 million. Meanwhile, EBITDA totaled $94.4 million.

Takeaway

In the long run, I have some doubts about the fundamental condition of Yellow Corporation. In my mind, the company is still a mediocre business that has some risk when it comes to its debt. Having said that, recent financial performance has been great and shares are about as cheap as you can imagine. If management is smart and decides to use this excess cash flow in order to pay down debt, that could create permanent upside for shareholders even in the event that financial results revert back to what they were in prior years. How many quarters of additional strength we have is anybody’s guess. Given declining volume, I would make the case that we may only have the fourth quarter this year and possibly the first quarter of next year before pricing has to fall materially in order to account for changes in the state of the industry. But in that time, the excess cash flow the company can generate could be enough to put a nice dent in debt, helping to justify some upside to shares from where they are today. So while I do acknowledge that this is a particularly risky prospect, I do think that the upside potential is commensurate with that risk, leading me to increase my rating on the firm from a ‘hold’ to a soft ‘buy’.

Be the first to comment