chonticha wat/iStock via Getty Images

I like owning gold as a store of value, as money, and as systematic insurance. It’s the only currency that has repeatedly survived hegemonic collapse. As mentioned earlier, gold is a:

Looooooongstanding Store of Value

Gold and silver have a history as a store of value that can be measured in millennia. Yes, it’s a convention, but a convention so powerful and longstanding that it has become a useful assumption. We can assume the pull of gold on man as we can assume the pull of gravity.

Gold is Money

I like owning productive land and operating businesses too, but it’s also nice to have a store of value that is unchanging. I do not think of the value of gold and silver as denominated in US$ or any other fiat currency; instead, I think of the value of gold as denominated in gold. Neither its supply nor its demand changes much over the scope of time that’s relevant to me. One can deny that gold is money, but if gold isn’t money, then nothing is. I would submit that it holds more of the qualities of money as historically and properly understood than any widespread paper currency in circulation today.

Systemic Insurance

I could be justly accused of being so safety conscious that I am on one side or the other of paranoia. I take dramatically elaborate measures to maximize financial and physical security. I rather enjoy the topic, so there’s little downside, but I assume away very bad things happening, prepare for them, and then anything else is just upside to enjoy. To that end, there are many things that can be insured against. However, there’s not a particular way to buy systemic insurance via financial instruments. If our integrated, complex, tightly coupled modern world breaks down – even for a short period of time – one may want systemic insurance.

Is it Really Necessary?

I think that the best way to think about it is that dozens of preeminent civilizations have crashed throughout human history and it was almost always fast and almost always unexpected. While there were no opinion polls at the time, my sense is that few members of previous hegemons would have expected their demise. But that does not stop the demise and such a demise looks like a multigenerational decline in wealth, security, and technology. For the most part, no one expected it and no one was prepared.

This Time is Different – We are in a New Era

Following the Spanish Influenza pandemic and World War II, western civilization has been in a golden era without events that have revealed systemic vulnerabilities by wiping out major swaths of populations. This has a superficial as well as a more substantive impact on our thinking about our system’s weaknesses. Superficially, it has worked so far and so the appearance of stability has lulled people into a sense of complacency. More substantively, it has leached from modern society all of the skills and the stuff necessary for a basic level of survival in any environment but the one we have recently created.

We’re the living in the least adaptable, most evolutionarily precarious civilization ever. If things went horribly wrong, American frontiersmen in the late 1800s were perfectly acquainted with the skill and the use of the technology of earlier civilizations. If necessary, they would be perfectly passable Iron Age workers. Likewise, you could toss an Iron Age worker into the Bronze Age or even the Stone Age without causing too much trouble. Such a technological retracement would elicit a few shrugs before they got back to work. But if their technology was turned off, what on Earth would most modern office workers do?

If we were forced to lose our most recent and most tightly coupled technology even for a few short years, we would not be able to smoothly transition to an earlier technological level – we don’t have the skills and we don’t have the stuff. On average, we have fewer of the practical skills that our grandparents had than any previous known generation. At the same time, we require all of our most advanced infrastructure and logistics to support our current population density. That density would decline precipitously in a matter of months (and this would not be the ideal way to solve the problem).

Precisely when it’s most countercultural and most variant is when it’s most relevant to have contingency plans for systemic risk. I think that it’s sensible for professional people to know at least one trade skill in case their chosen profession becomes obsolete and irrelevant. Even with a trade, it’s sensible to know enough primitive skills to be able to survive civilization-level retrenchment. And finally, it’s sensible to have a means of trade and store of value. The means of trade and store of value that have bridged prior hegemonic collapse have been gold and silver.

Own Gold

In short, own gold. Own gold in inverse proportion to your faith in our central government and central bank carrying out sensible fiscal and monetary policies. If you anticipate frugality and prudence, then it might not be necessary as you can hold US dollars with confidence that they won’t be debased. But if you observe profligacy and corruption – perennially stacking up debt on one side while favoring inflation to ease the cost of that debt on the other – then you will need something else and gold is your best bet. Other faddish alternatives have come and gone but gold has stored wealth for millennia.

Gold Fields

One good way to invest in gold is via Gold Fields (GFI).

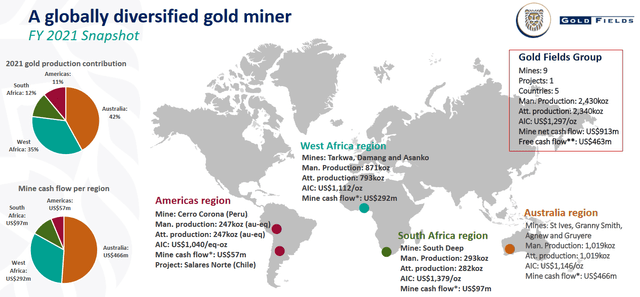

Across their nine mines in five countries, their all-in costs for mining gold is $1,297 per ounce with that gold currently trading at $1,825.89 per ounce.

Yamana

While GFI costs are at a discount to gold’s spot price, you can do even better by getting GFI at a discount via Yamana Gold (NYSE:AUY). Gold Fields is buying them for 0.6 GFI per AUY. It requires approvals from both shareholders as well as approvals from the South African Reserve Bank, Competition Canada, and Investment Canada. The $0.76 net spread offers a 44% IRR if the deal closes by November. The discount is the equivalent of your buying gold at an all-in cost of $1,126 per ounce or around 62% of the spot.

Conclusion

Unless you trust the administration and fed to protect the value of the US dollar, then you should own gold. GFI is a good way to do so indirectly and AUY is a good way to back into GFI at a discounted price.

TL; DR

Buy AUY.

Be the first to comment