Amy Sussman/Getty Images Entertainment

Warner Bros. Discovery, Inc. (NASDAQ:WBD) has underperformed since its separation from AT&T (T). Since the split from AT&T, the company has seen its share price drop by almost 50%, pushing its market capitalization towards roughly $35 billion. As we’ll see throughout this article, despite this weakness, Warner Bros. Discovery is an undervalued investment.

Warner Bros. Discovery Competition

Warner Bros. Discovery operates in a competitive industry, but the company has been performing well.

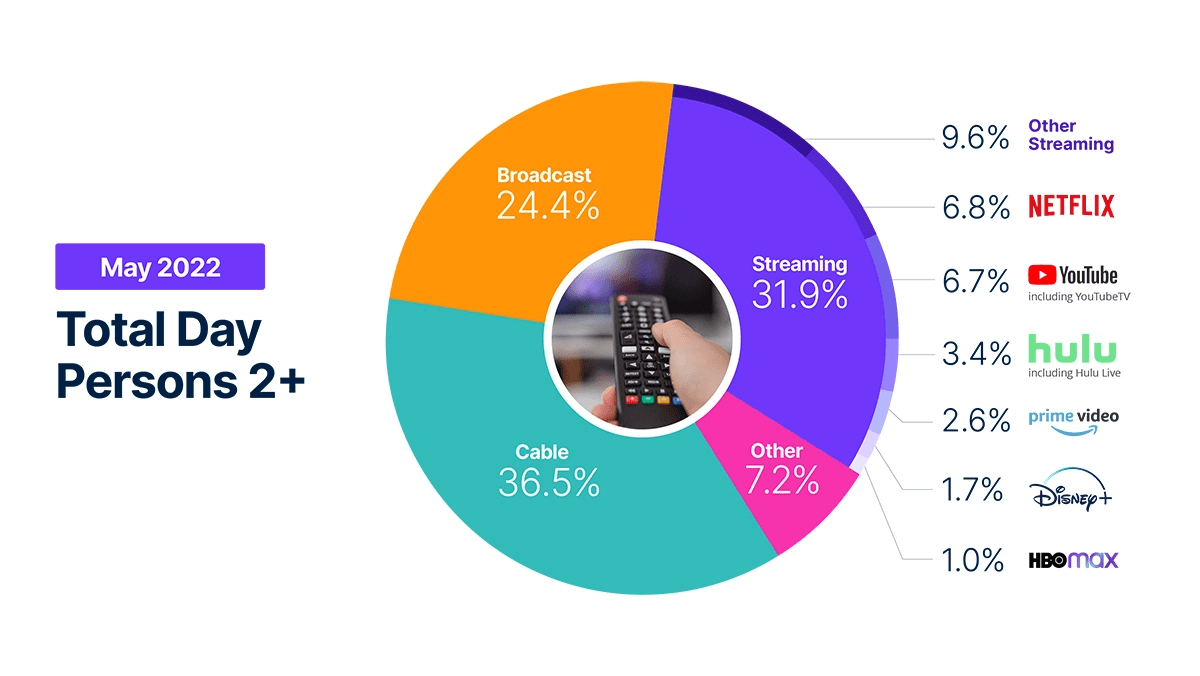

HBO Max has a 1.0% share of the streaming industry, making it one of the largest companies. That’s along with competitors such as Netflix (NFLX) (6.8%), YouTube/YouTube TV (GOOG, GOOGL) (6.7%), Disney (DIS) (5.1% total), and Prime Video (AMZN) (2.6%). In total, these large streaming companies control 21.2% of the overall industry and market.

| Company | Market Cap | Streaming Share | Market Cap $/% | Market Cap $/Revenue |

| Netflix (NFLX) | $85 billion | 6.8% | $12.5 billion | $2.86 |

| Google (GOOGL) | $220.0 billion (roughly – YouTube) | 6.7% | $32.8 billion | $7.64 |

| Disney (DIS) | $178.1 billion | 5.1% | $34.9 billion | $10.48 |

| Warner Bros. Discovery (WBD) | $34.7 billion | 1.0% | $34.7 billion | $0.77 (est.) |

So, what’s the takeaway here? There are a few ways to look at it. The first is that market cap is tough to compare because Disney, for example, has numerous other businesses. Warner Bros. Discovery has a substantial non-streaming business as well. Netflix is pure-play streaming with no theater releases or anything else.

An important part of that is that Warner Bros. Discovery can use its other businesses to subsidize its costs for streaming, unlike Netflix, which needs to make all the money back from streaming. Another takeaway is in regards to many metrics, such as versus revenue, Warner Bros. Discovery is a cheap investment.

Warner Bros. Discovery 1Q 2022 Earnings

The combined company (taken from AT&T and Discovery investor reports without combination) had strong 1Q 2022 earnings.

WarnerMedia earned $8.7 billion in 1Q 2022 revenue, while Discovery earned $3.2 billion in revenue during the same time period. That brings their combined company revenue to $11.9 billion, or annualized at roughly $48 billion. With double-digit YoY increase from the prior year, that’s well in line for 2023E guidance of roughly $52 billion in revenue.

Discovery’s OIBDA increased by 23% YoY and the combined companies are also on track for $14 billion in 2023E adjusted EBITDA and ~$8.5 billion in free cash flow. This strong financial performance from the company’s 1Q 2022 earnings is something that we expect to continue to improve in the upcoming quarters for the companies.

Warner Bros. Discovery De-Leverage Plans

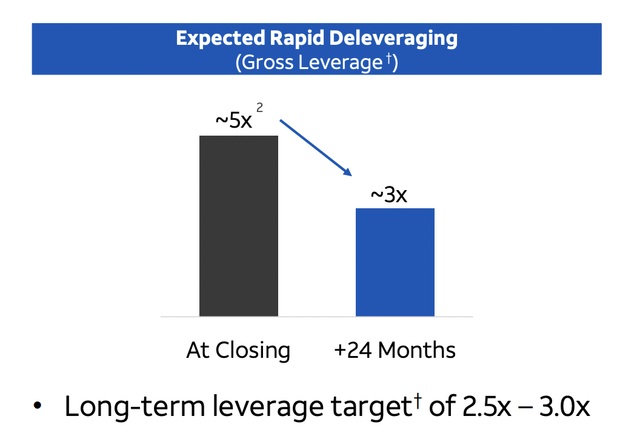

The first order of business, especially in a rising interest rate environment, for Warner Bros. Discovery is to improve the financial position.

The combined company has roughly $57 billion in debt, however, the long-term target is to get that towards 2.5x-3.0x by roughly YE 2024. That’ll be combined with roughly $15 billion in adjusted EBITDA, implying a debt target of ~$38-45 billion. That means in the company’s first 2 years, the company will aim to pay down at least $12 billion in debt.

That will save the company hundreds of millions in interest payments and is something that the company can cover with its free cash flow (“FCF”). $40 billion in long-term debt is a number that the company can comfortably afford, although it could pay it down further should it choose to do so. The debt paydown will improve the company’s FCF margins towards $10 billion in FCF.

Shareholder Return Potential

Putting this all together, Warner Bros. Discovery has the ability to drive substantial shareholder returns.

We expect for FY 2024 that the company will earn roughly $10 billion in FCF, supported by both growing earnings, and decreased interest payments. The company’s enterprise value at that time, assuming no stock price growth, will be its current $35 billion market capitalization and the company’s paid down debt of roughly $40 billion.

That means the company, with an impressive and reliable business, will be trading at a roughly 30% FCF yield and a 15% enterprise value yield. The company could pay down the debt to $0 in a mere 4 years, saving roughly $2 billion in annual interest payments (going to FCF) and still having the same market cap.

That means, should the company make it its goal, by 2028, the company could have $12-15 billion in FCF with no debt. Should its market cap remain at the same level, we’d like to see a rapid share repurchase program instead. The company has yet to guide for how it plans to spend its cash, however, regardless we expect strong returns.

Thesis Risk

In our view, the largest risk to the thesis is competition. The company has managed to hold its own, but streaming is becoming increasing fragmented. On the Google Play store, the largest competitors are torrent options. We expect the company to continue to outperform, however, competition and costs could delay that.

Conclusion

Warner Bros. is one of the best investments we’ve seen in a while. The company’s lack of a dividend has put strong post-AT&T spin-off selling pressure, combined with significant weakness in the overall markets. However, in our view, the almost $35 billion in lost market capitalization, is a substantial opportunity.

Warner Bros. has a unique ability to continue generating substantial shareholder returns. The company will initially pay down its debt, however, after that, we expect the company to focus on a variety of shareholder returns. We’d like to see the company aggressively repurchase shares, however, whatever it does, we expect strong returns.

Be the first to comment