jutawat Rawichot/iStock via Getty Images

PBF Energy Inc. (NYSE:PBF), or the “Company,” is one of the largest independent petroleum refiners and suppliers of unbranded transportation fuels, heating oil, petrochemical feedstocks, lubricants and other petroleum products in the United States that are sold into the spot market throughout the country, and to Canada, Mexico and other international destinations.

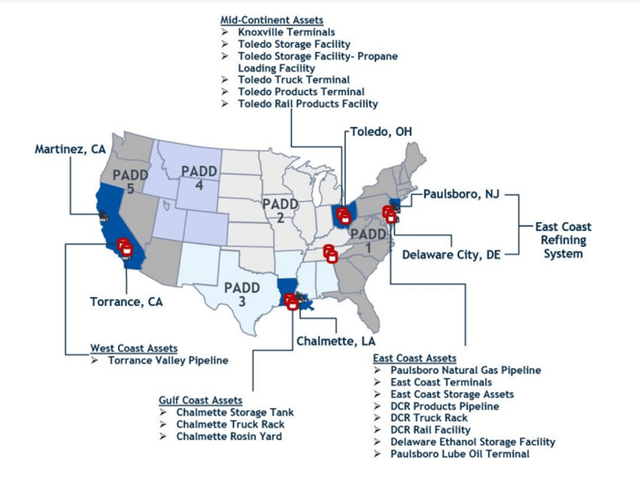

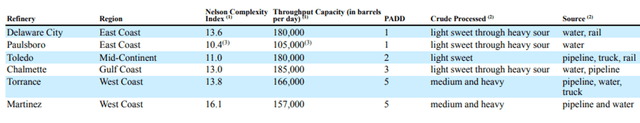

As of December 31, 2021, the Company owned and operated six domestic oil refineries and related assets. Its refineries have a combined processing capacity of approximately 1,000,000 barrels per day (b/d), and a weighted-average Nelson Complexity Index of 13.2, on a scale of 1 to 20.

The Company also owns a 49.9 % stake in PBF Logistics (PBFX), a publicly-traded, Delaware MLP formed by PBF Energy to own or lease, operate, develop and acquire crude oil and refined products terminals, pipelines, storage facilities and similar logistics assets. On June 24th, PBF said it may deliver a non-binding offer to acquire the remainder of PBFX it doesn’t already own.

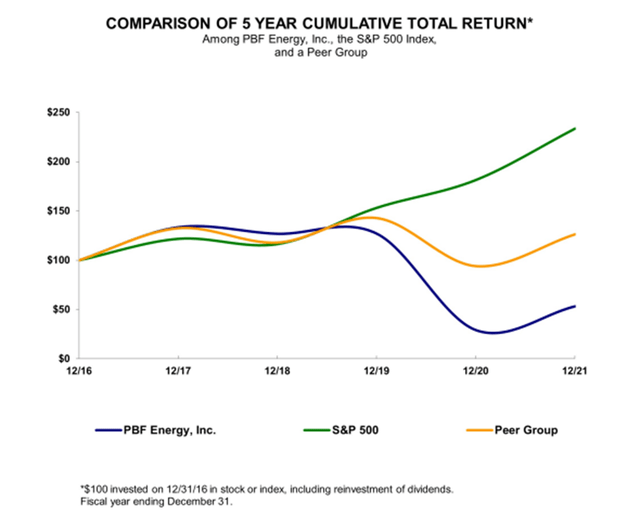

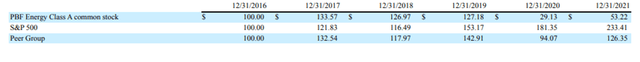

Over the past 5 years ending 2021, the cumulative total return on PBF has underperformed the S&P 500 Index and its peer group, consisting of CVR Energy Inc. (CVI), Delek US Holdings Inc. (DK), HollyFrontier Corp (HFC), Marathon Petroleum Corp (MPC), Phillips 66 (PSX) and Valero Energy Corp (VLO).

In the year-to-date, PBF’s total return has been 116%, as compared to -18% for the SP500TR.

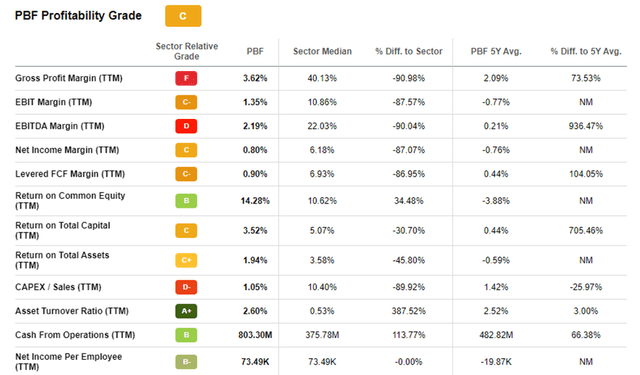

Seeking Alpha has graded PBF’s profitable as a “C,” relative to other companies in the Energy sector.

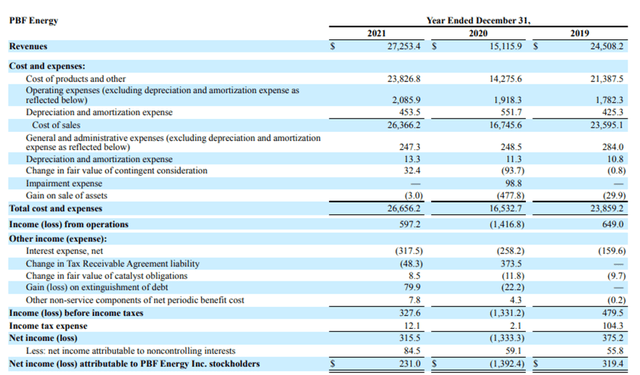

For 2019, 2020 and 2021, PBF posted a Net Income of $375.2 million, -$ 1,333.3 million, and $315.5 million, respectively.

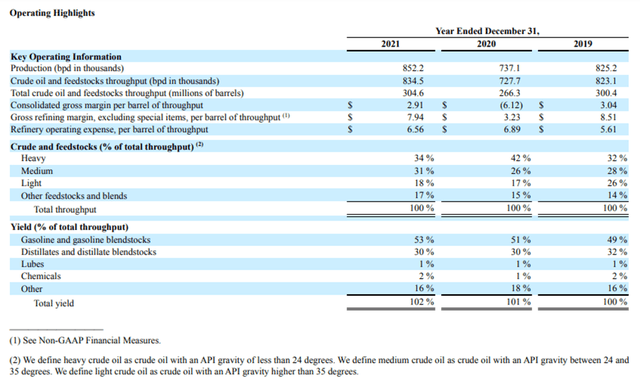

That was based on gross refinery margins of $8.5/bbl, $3.23/bbl and $7.94/bbl, respectively.

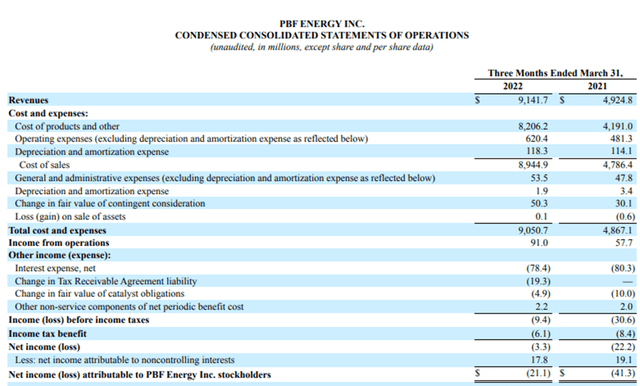

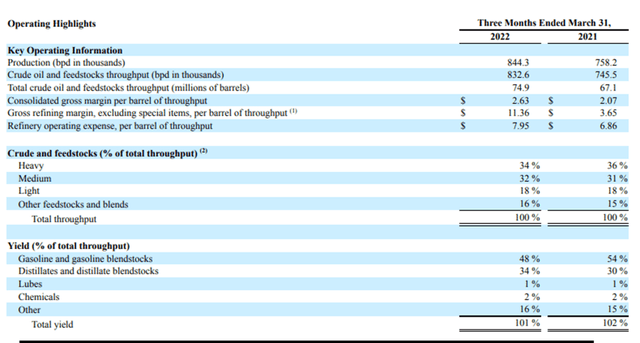

For Q1’22, PBF posted a loss in Net Income of $3.3 million, as compared to a loss of $33.2 million in 1Q21.

The Q1’22 loss was posted despite a gross refinery margin of $11.36/bbl, as opposed to a $3.65/bbl margin on 1Q21.

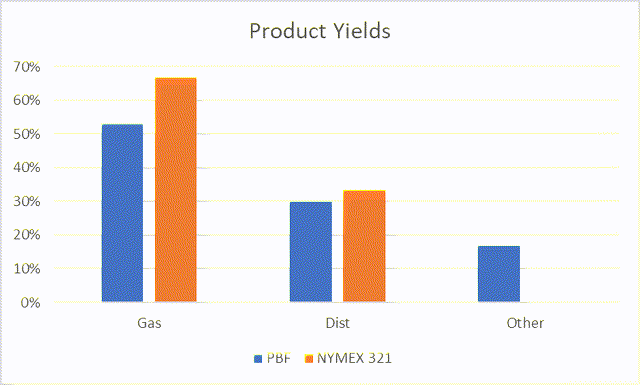

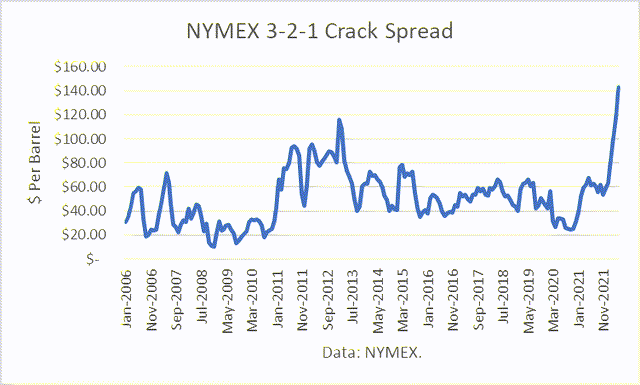

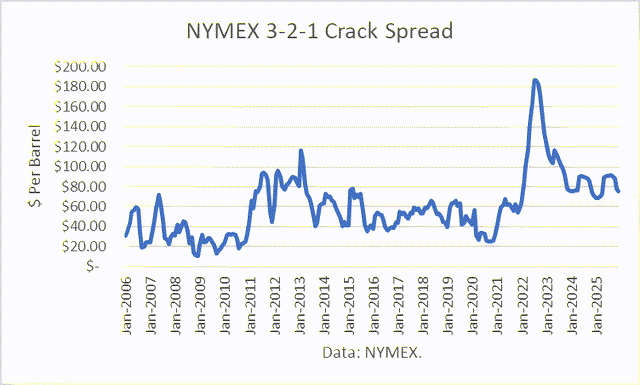

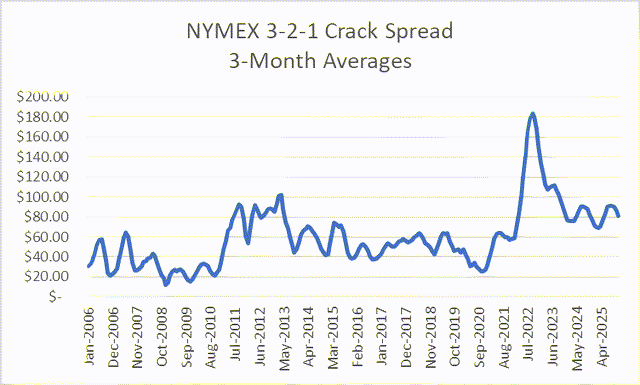

For the years ended 2021, 2020 and 2019, gasoline and distillates accounted for 86.2%, 84.7% and 86.8% of PBF’s revenues, respectively. More specifically, its product yields has approximated a 3-2-1 NMEX Crack Spread, defined as 2 RBOB gasoline contract values plus 1 heating oil contract value, minus 3 WTI crude contracts values.

Monthly NYMEX data show that the 3-2-1 Crack Spread has reached its highest level since the RBOB gasoline contract began trading. In May, it averaged $120.73/bbl, and in June-to-date it averaged $141.94/bbl. On Q1’22, it averaged $77.31/bbl.

Market Fundamentals

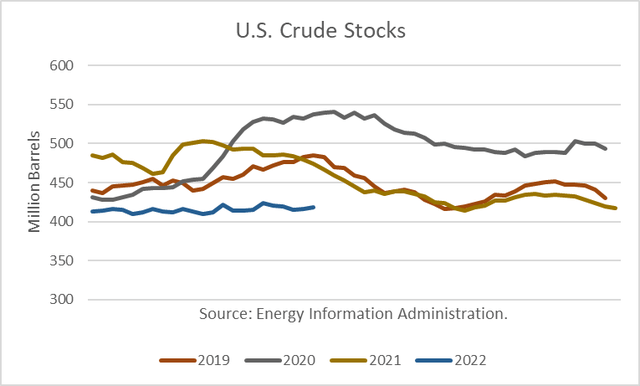

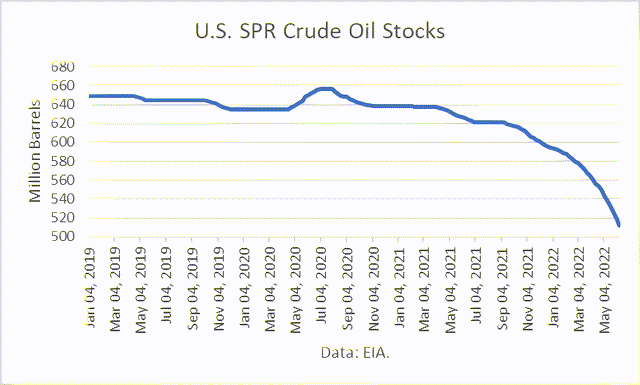

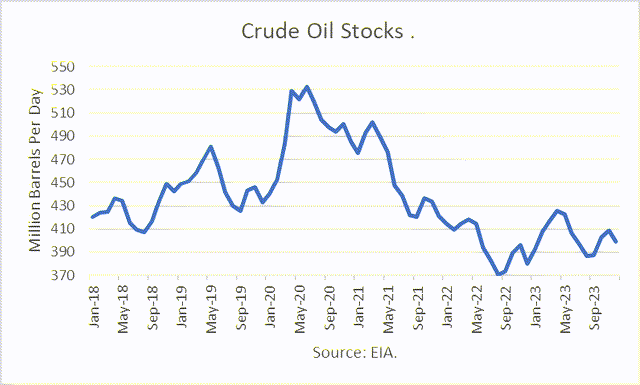

Commercial crude oil stocks have remained relatively flat in 2022, and near the low-end of the range over the past 4 years. That has resulted from the fact that the government stockpile has been utilized to meet part of the demand for U.S. crude supplies.

Since end-February, crude oil stocks in the U.S. Strategic Petroleum Reserve (“SPR”) have been drawn down about 68 million barrels, over 4.5 million barrels a week on average. President Biden had announced a 180-million barrel drawdown over 6 months.

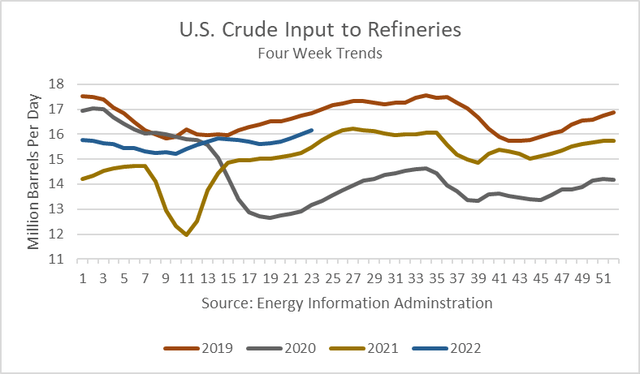

U.S. crude inputs to refineries have remained below 2019 levels, but are higher than in either 2020 or 2021. Last Wednesday, Biden had called on U.S. refiners to produce more gasoline and diesel fuels, as their profits have tripled during the war between Russia and Ukraine.

“The crunch that families are facing deserves immediate action,” Biden wrote in the draft of a letter to oil refiners. “Your companies need to work with my Administration to bring forward concrete, near-term solutions that address the crisis.”

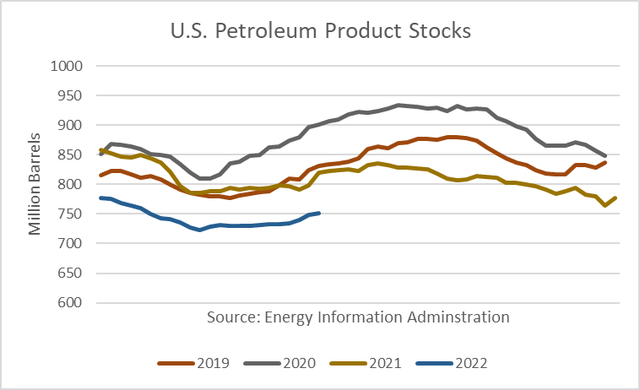

Total U.S. petroleum product stocks have remained at their seasonal lows over a 4-year period.

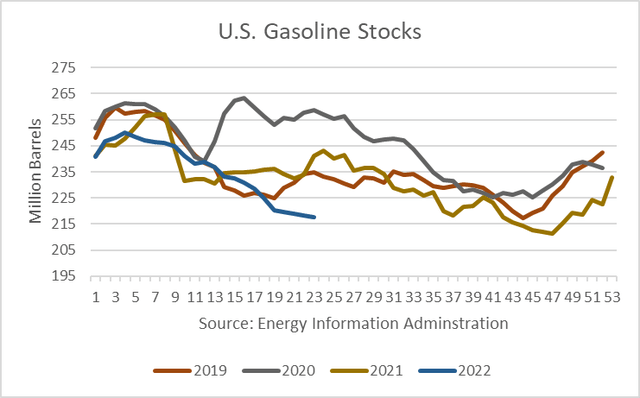

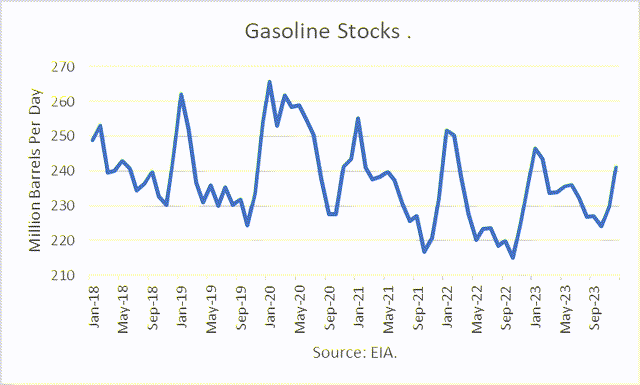

U.S. gasoline stocks remain low during this first part of the summer driving season.

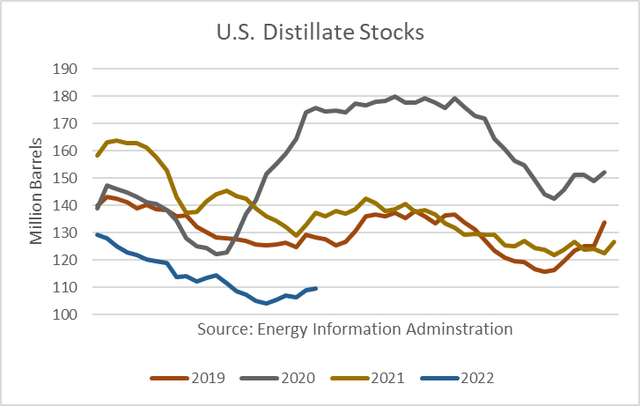

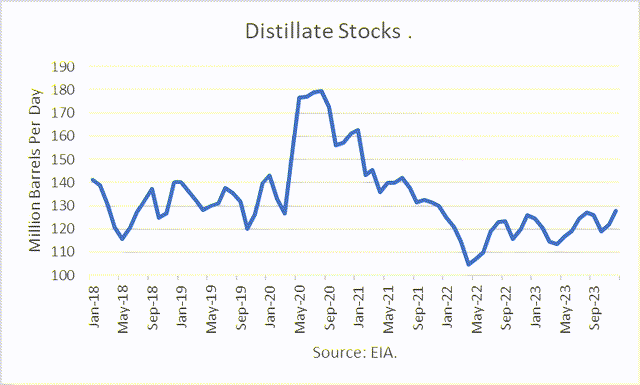

And distillate stocks, divided between diesel fuel and home heating oil, also remain at seasonal lows.

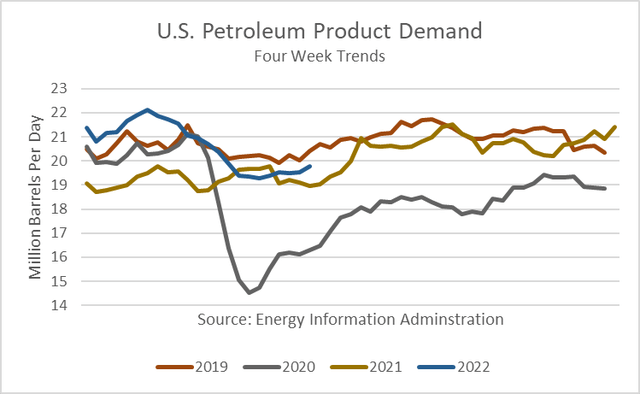

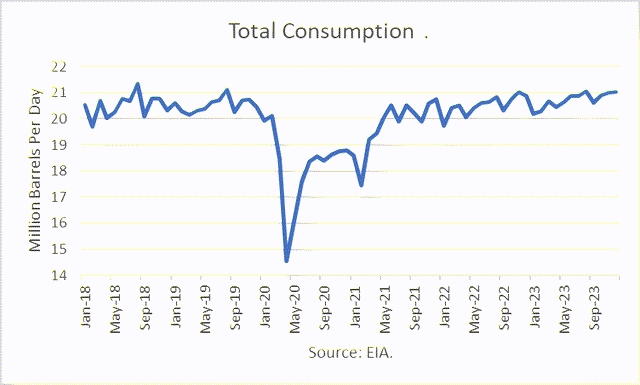

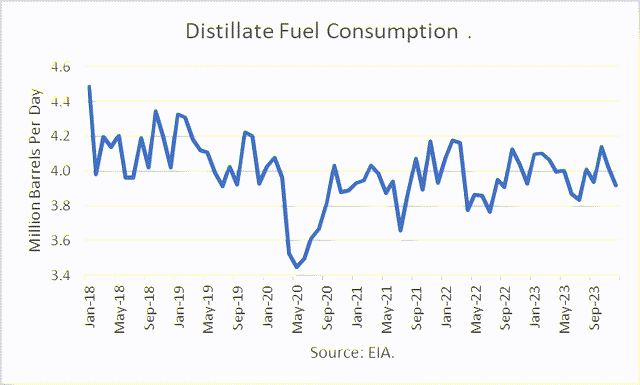

But total petroleum product demand remains below where it was in 2019, prior to the onset of Covid.

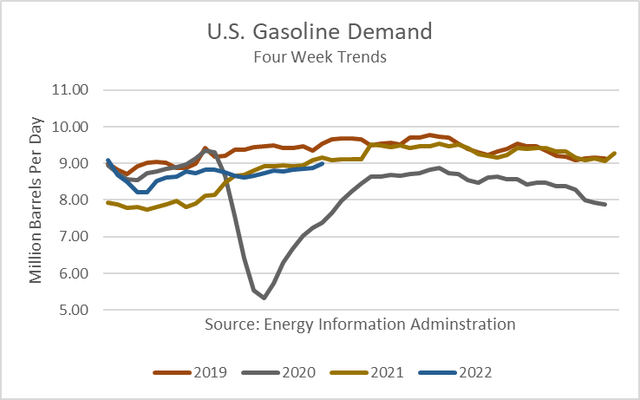

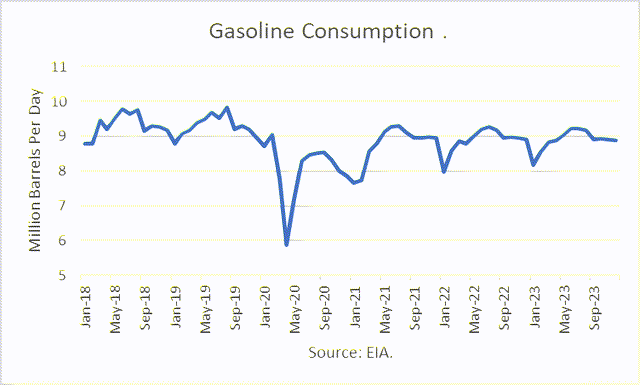

And gasoline demand is also below 2019 and 2021, due to record-high U.S. gasoline retail prices.

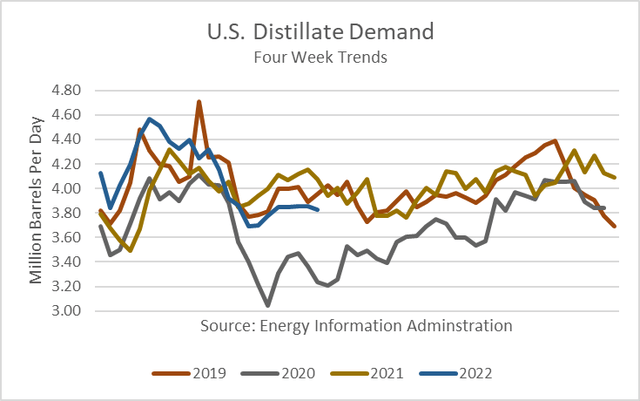

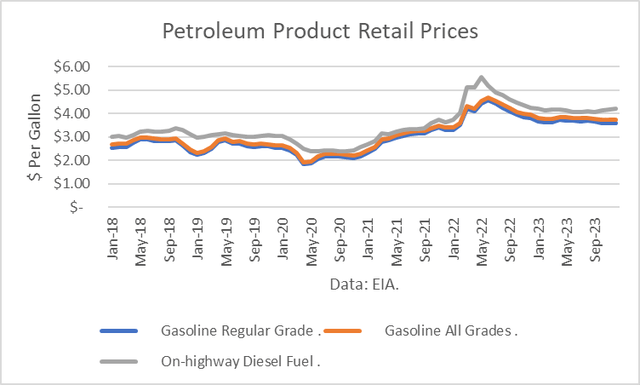

Distillate demand also remains below 2019 and 2021, as diesel fuel prices are also at record highs.

Market Outlook

The Energy Information Administration (“EIA”) publishes its Short-Term Oil Outlook (“STEO”) monthly. For June, it projects that total product consumption in 2022 will average 20.53 million barrels per day (“mmbd”), just below 2019. And for 2023, it will rise by just 1.0%.

However, the EIA assumes that GDP growth will average about 2%, while many economists see risks of a recession.

I think a recession is almost inevitable, probably a 75%, 80% chance within the next two years, and there’s certainly a real risk that it will come sooner,” former U.S. Treasury Secretary and past president of Harvard University Larry Summers said June 26th.

The EIA projects that gasoline consumption will rise by 1.2% in 2022 and by 0.1% in 2023.

But that is based upon an assumption that retail gasoline prices will come down from current levels.

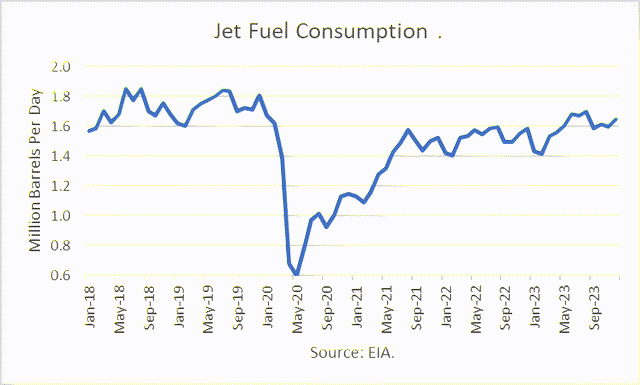

Its prognosis for jet fuel is a rise of 11.5% and 4.0% in 2022 and 2023, respectively. However, the 2023 level would still be below the pre-pandemic average in 2019.

It projects distillate fuels will rise by 0.6 % and 0.8% in 2022 and 2023, respectively. But 2023 demand will also be lower than in 2019.

The EIA forecasts that commercial crude stocks are likely to drop this summer. And its recovery will be relatively muted.

It projects that gasoline stocks will fall further over the driving season, bottoming at 215 million barrels in October.

Distillate stocks have likely bottomed but will not stage much of a pre-heating season build, as is more typical.

The NYMEX futures market does expect the crack spread to peak in July and August at $186.71/bbl. Though the spread would fall from its peak, it will still remain at historically high levels through 2025.

The 3-month moving average will peak in September (Q3’22) at $185.33/bbl, according to NYMEX futures prices as of June 24, 2022.

But futures prices are inherently volatile and have a poor track record of being accurate predictors.

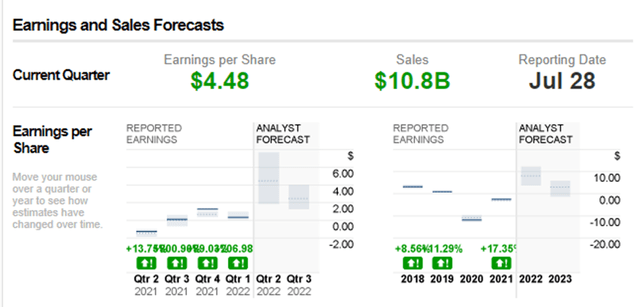

Wall Street analysts project PBF’s Q2’22 EPS will be $4.48/share, to be announced July 28th.

The mean target of 14 analysts over the next 12 months is $34.00/share.

Oil company executives met with the U.S. energy secretary last week. The Biden Administration is still behind the conversion of refineries to bio-fuels. And talk of an oil product export ban was put on-hold.

The White House had announced on June 14th that President Biden will be traveling to Saudi Arabia in mid-July to attend the Gulf Cooperation Council’s summit, at the invitation of Saudi King Salman. One of the topics will be “ensuring energy security.”

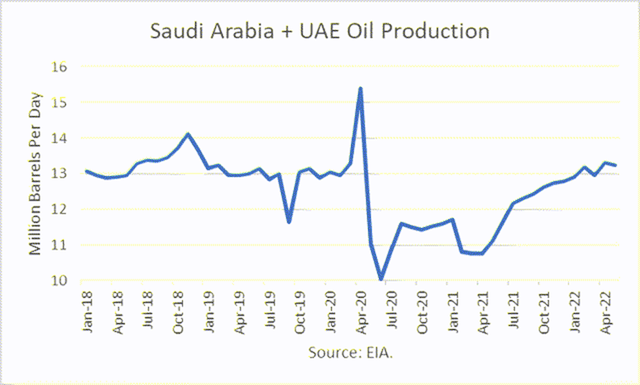

President Biden may ask that the two OPEC members, Saudi Arabia and the UAE, increase their oil production to reduce the oil price-induced threat of recession, and to reduce retail gasoline prices in the U.S., which is hurting him politically. However, during his 2020 presidential campaign, Biden promised to make Crown Prince Mohammed bin Salman (“MbS”) a “pariah.”

It was reported that MbS refused to take Biden’s call in March, which was expected to be a request to increase oil production (Saudi Arabia and UAE leaders ‘reject calls with US President Biden’). Previously, President Obama was not greeted by King Salman on the tarmac upon his arrival, unlike other heads of state, when Biden was vice-president, because the Obama-Biden Administration was seen to be too friendly with Iran, KSA’s arch enemy.

What is not expected is a surge in production from OPEC members Saudi Arabia and UAE, as occurred in late 2018.

Conclusions

Oil fundamentals are supportive of refinery margins since demand is still strong and product inventories are not being replenished. In addition, EIA projections show no signs of much relief.

The major risk is a recession caused by high inflation. How much that and high oil prices would dampen demand is unknown at this point. Due to the inelasticity of oil demand, it is a rough solution to balance oil markets.

If NYMEX crack spreads hold, refiners such as PBF should have many profitable quarters ahead. And so I conclude PBF is a Hold for current owners and a Buy for those who do not have oil refiners in their portfolios, if it meets their investment objectives and risk tolerances.

Be the first to comment