Jacek_Sopotnicki/iStock via Getty Images

The Q1 Earnings Season for the Gold Miners Index is just around the corner, and one of the first miners to report its results will be Yamana Gold (NYSE:AUY). Given the gold price performance year-to-date and similar production levels, I would expect higher sales in H1 2022. If we look out longer-term, there’s significant upside to this story, with a project pipeline capable of producing more than 2.2 million gold-equivalent ounces per annum with MARA. Given this upgraded outlook and Yamana’s limited cost creep relative to peers, I continue to see the stock as a top-5 gold producer.

Yamana Gold Operations (Company Presentation)

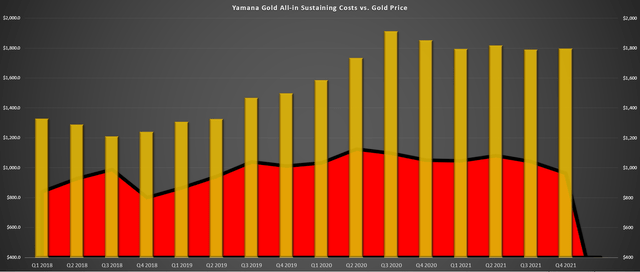

Yamana Gold just came off a strong quarter, reporting production of ~281,000 gold-equivalent ounces [GEOs] at all-in sustaining costs of $962/oz. This was a meaningful improvement on a year-over-year basis and helped the company report annual production just north of 1.0 million GEOs in FY2021. While this was flat vs. pre-Covid-19 levels, the company managed to keep its costs down relative to peers and was one of the few producers in the space to report lower costs on a year-over-year basis. The solid cost performance is evidenced by the below chart, which shows consistent margin expansion, helped by the higher gold price.

Yamana Gold – All-in Sustaining Costs vs. Gold Price (Company Filings, Author’s Chart)

If we look ahead to FY2022, some investors might be disappointed by the outlook for flat production, based on Yamana’s guidance of ~1.0 million GEOs at a cost mid-point of $1,055/oz. However, there are a few key points worth highlighting that suggest there’s no reason to get hung up on the lack of growth this year:

The first is that costs are trending much better than peers, helped by Yamana’s portfolio of high-grade, lower-volume underground operations that use less consumables. The second is that Yamana will see steady growth in production looking out to FY2026, and the company has a habit of under-promising and over-delivering lately. Finally, while the 3-year outlook suggests only single-digit growth, the long-term outlook looks nearly unrivaled among its peers, suggesting that Yamana is a ‘hidden’ growth story for investors looking out over solely the next two years.

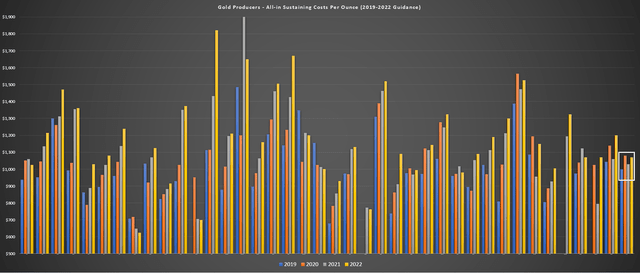

Operating Cost Progression Relative to Peers

Gold Producers – All-in Sustaining Costs (FY2019 – FY2022 Guidance/Estimates) (Company Filings, Author’s Chart)

Beginning with costs, we can see Yamana’s progression of all-in sustaining costs [AISC] on the right side of the chart (white box) and the cost profiles of more than 40 other gold producers. As is clear, inflationary pressures have wreaked havoc on the cost profiles of many producers due to higher labor, consumables, fuel, and materials costs. However, Yamana’s costs are projected to increase less than 8% from FY2019 levels vs. a more than 15% increase for the industry average. This is a huge differentiator for the company.

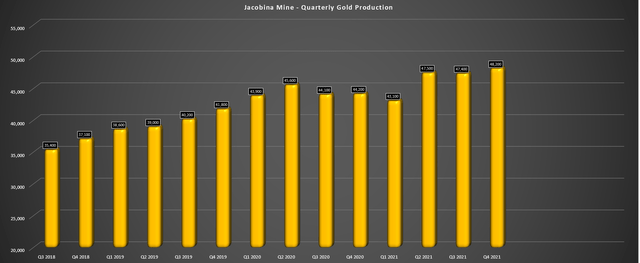

Jacobina Quarterly Production (Company Filings, Author’s Chart)

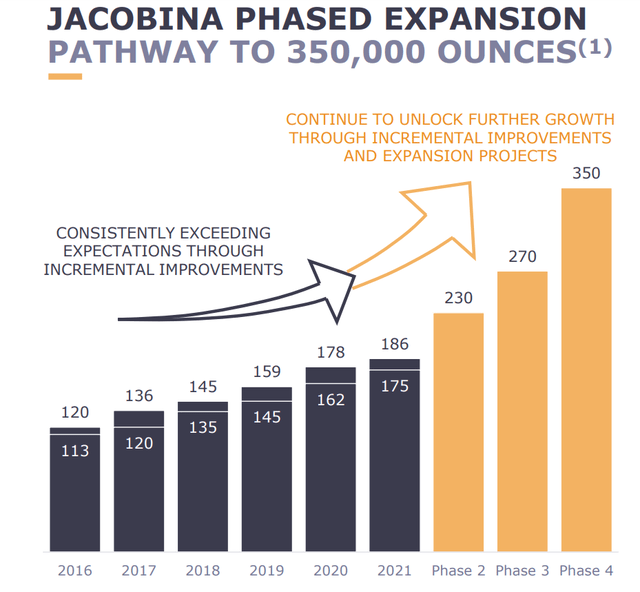

The great news is that costs should continue to improve as production ramps up at the company’s low-cost and growing Jacobina Mine. During FY2021, this mine produced ~186,000 ounces of gold at all-in sustaining costs of $738/oz., more than 25% below the industry average. However, with the Phase 2 Expansion set to push production to 230,000 GEOs in FY2023, this low-cost operation will continue to help pull down the company’s consolidated costs. Longer-term, Phase 3 will increase production by 45% from FY2021 levels, while Phase 4 could nearly double annual production from last year’s levels.

Jacobina Phased Expansion (Company Presentation)

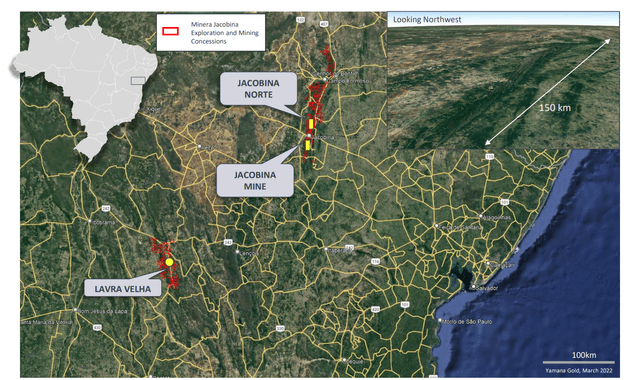

This expansion is easily supported by the company’s growing reserve base at Jacobina, which currently sits at ~2.94 million ounces of reserves, backed up by a significant resource base. However, this asset could have an even brighter future than the ~350,000-ounce per annum potential long-term, with Jacobina controlling the whole Jacobina Gold Belt in Brazil. This includes Jacobina Norte, which lies directly north of the current mining area, shown on the below map, with the property shaded in red.

Jacobina Mine, Jacobina Norte, and Lavra Velha (Company Presentation)

According to the 2020 Technical Report, the favorable stratigraphy hosting the gold mineralization at Jacobina has been traced along a strike length of more than 100 kilometers, and 2.4+ million ounces have been produced from Jacobina since 1983. Given the impressive mineral endowment of this asset already and the potential extensions to the north to support a higher production rate, Yamana’s strategic objective to grow Jacobina into a ~400,000-ounce producer long-term does not look all that far-fetched.

Medium-Term Outlook

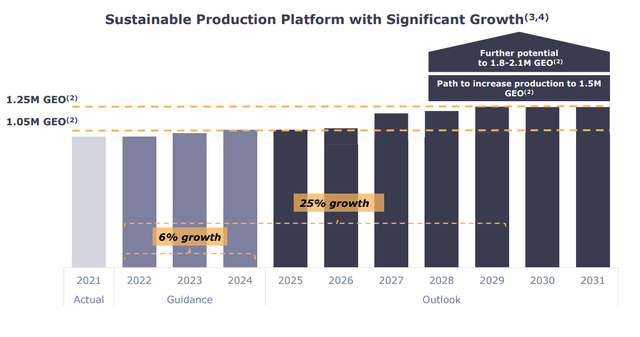

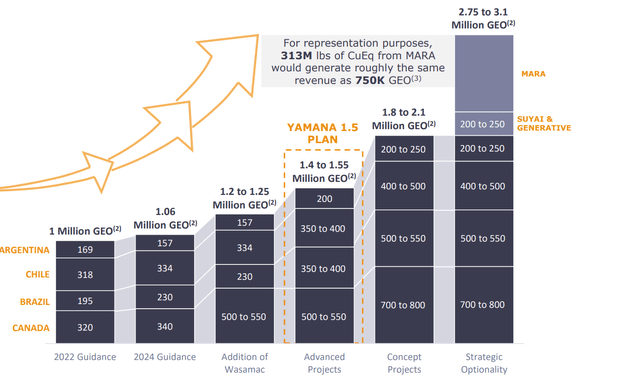

For investors looking solely at the short-term outlook, Yamana’s growth profile may leave a lot to be desired compared to some of its peers. This is because the company expects just ~6% production growth looking out to FY2024 based on its FY2024 guidance of ~1.06 million ounces. However, looking out further to 2026/2027, the outlook turns from satisfactory to extremely attractive. The shift from low-growth to high-growth is based on the opportunity to pull forward the Phase 3 Expansion at Jacobina (10,000 tons per day) and the start of production at the company’s newly acquired Wasamac Project in Quebec.

Yamana Gold – 10-Year Outlook Base Case (Company Presentation)

Combined, these two assets can add more than 270,000 ounces per annum to the production profile, or roughly 30% growth. Importantly, this growth will be combined with higher margins, given that Jacobina is Yamana’s lowest-cost asset by a wide margin. Meanwhile, Wasamac should have industry-leading costs as well as a mid-grade underground mine, with its life of mine AISC estimated at $830/oz. Given that these two low-cost assets contribute to incremental growth over the next five years with costs closer to $800/oz., this should translate to healthy margin expansion.

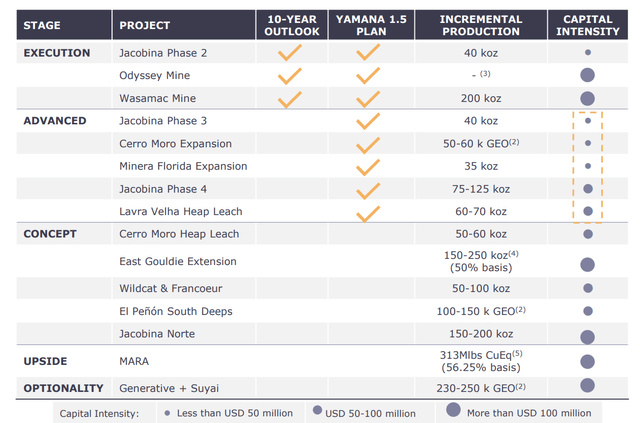

Yamana Project Pipeline (Company Presentation)

Just as important as growth is capital expenditures, and as the table above shows, Yamana is focused on relatively low-capex and low-risk projects with a rapid payback. If we look at the above table, we can see that the projects in the Yamana 1.5 Plan (1.5 million GEOs per annum) require modest spending, with low capital intensity at Jacobina Phase 3, the Cerro Morro Expansion, the Minera Florida Expansion, Jacobina Phase 4, and the Lavra Velha Heap Leach Project, also in Brazil. This is because most of this incremental growth focuses on expansions at existing producing assets.

When it comes to Wasamac and Odyssey, these are higher-cost projects that will also contribute to its growth. However, in Odyssey’s case (Canadian Malartic), the costs are being split with another senior producer: Agnico Eagle (AEM). Meanwhile, at Wasamac, the project has a very impressive ~24% after-tax internal rate of return at a $1,850/oz. gold price, with an average annual production of 184,000 ounces over the first five years at industry-leading costs. The Wasamac projections are based on the recently completed Feasibility Study, with Yamana looking at a higher throughput rate of 7,000 tons per day vs. Monarch’s slightly smaller profile.

While 30% growth might not seem like much, especially given that investors have to wait several years to see that growth, it’s important to note that this is a base case assumption, and it looks more than achievable. However, the upside case which Yamana has laid out is very exciting and shows that this company has a lot to offer above its medium-term guidance outlook. This upside case is shown below, and if the company can deliver on even 80% of this growth, it will command a much higher multiple than it currently does relative to peers.

Long-Term Upside

Yamana – Long-Term Upside To Production Profile (Company Presentation)

As shown above, Yamana Gold has a portfolio capable of producing over 2.8 million GEOs per annum, meaning that the company can sit back and advance its portfolio without the need for acquisitions. This is an enviable position to be in, and a similar one to Agnico Eagle, which also has significant growth and a very enviable project pipeline. However, in Yamana’s case, the potential is even higher, which is related to the massive MARA Project, where Yamana Gold holds a ~56% stake. The more attractive relative project pipeline and long-term growth profile for Yamana is mostly because it’s much easier to go from being a ~1.0 million to ~2.5 million GEO producer than a ~3.5 million GEO to ~8.7 million GEO producer.

As pointed out by the company, its attributable production from MARA (~313 million pounds of copper per annum) is nearly equivalent to Barrick’s (GOLD) annual production from all of its copper assets currently (~400 million pounds per annum). This copper production profile would generate similar revenue to ~750,000 GEOs at current copper prices, translating to 75% production growth from FY2022 guidance if MARA were to head into production today. Hence, this is clearly a massive opportunity that Yamana does not appear to be getting enough credit for currently in its valuation.

Finally, there is a clear upside within the portfolio from existing assets, which includes:

- Jacobina Phase 4 (~125,000 ounces per annum)

- Utilizing excess mill capacity at Canadian Malartic (~375,000 ounces per annum / 187,000 ounces attributable to Yamana)

- Cerro Moro Expansion (~50,000 ounces per annum)

- Wildcat/Francoeur at Wasamac (50,000 ounces per annum)

- Plant Expansion at El Penon (~40,000 ounces per annum)

- Minera Florida Expansion (~35,000 ounces per annum)

- Cerro Moro Heap Leach (~55,000 ounces per annum)

- El Penon South Deeps (~125,000 ounces per annum)

The additional 375,000-ounce per annum upside potential for Canadian Malartic assumes just ~7.0 million tons per annum is utilized of an excess ~13.5 million tons per annum of capacity once the project transitions to underground, and assumes conservative gold grades (1.80 grams per ton gold).

I do not expect Yamana to deliver on all of this growth in the upside case outlook (~2.9 million GEO potential) within this decade or even in the next ten years. Still, even if we exclude Suyai, Jacobina Norte, an expansion at Wasamac, and MARA from this outlook, there appears to be a pretty clear path to 55% growth in production from current levels from just a few existing opportunities. After adding in upside from MARA, which has a decent shot at heading into production this decade, there is a path towards ~125% growth in GEO production. A production profile like this is hard to find in the million-ounce producer space, making Yamana a rare breed in the sector.

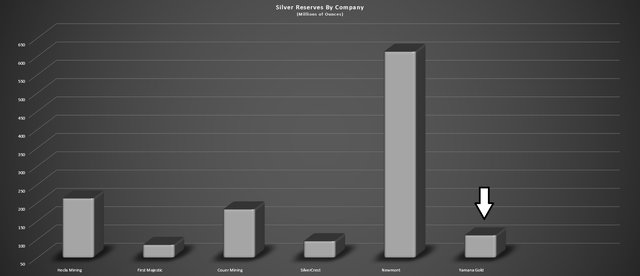

Silver Exposure

Finally, it’s worth noting that Yamana is on track to produce ~9.2 million ounces of silver per year over the next three years, with some upside to this figure if we see a plant expansion at El Penon or Cerro Moro. If we put this figure in perspective, this production profile is only 30% below Hecla’s (HL) guidance of just over 13.5 million ounces of silver per annum in the same period. So, if we stripped Yamana of its gold production, it would be a leading silver producer based on its silver production alone. The major difference is that an investor has to pay more than 2.0x P/NAV to own Hecla to get this exposure to silver.

Silver Reserves by Company (Company Filings, Author’s Chart)

Obviously, Yamana does not have the same torque to silver as Hecla, given that its silver production makes up closer to 13% of total GEO production. Still, this is a nice bonus and differentiator for Yamana. So, for investors are that are hungry for silver exposure, given the metal’s ability to outperform in bull markets but want to be able to invest with a margin of safety, Yamana is one way to gain exposure at a very reasonable price. This is based on the fact that Yamana trades at less than 0.90x P/NAV or half the multiple of larger silver producers like Hecla and First Majestic (AG).

Summary

While I previously viewed Yamana as a top-10 gold producer, given its strong development pipeline (Wasamac, Jacobina) and significant value from its stake in the MARA Project, the outlook has become even better than I initially expected. The upgrade is related to the potential to pull forward Phase 3 at Jacobina, the significant upside from continued resource growth at Malartic, and the additional upside from smaller assets in its portfolio.

Based on this outlook, I have revised my view, and I now see Yamana as a top-5 gold producer sector-wide. This is based on its strong base case growth profile, industry-leading growth if it can deliver on upside projects, and its impressive cost control helped by its lower-volume, high-grade underground mines. Given this favorable outlook, I continue to see upside for the stock even after its impressive rally, and I would view sharp pullbacks as buying opportunities.

Be the first to comment