PhonlamaiPhoto

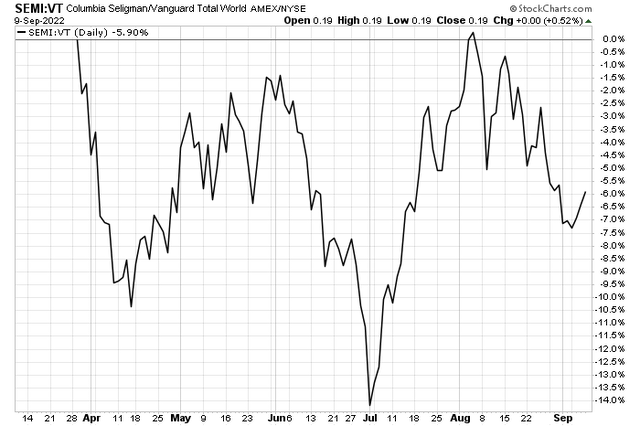

Global semiconductor stocks sharply outperformed the broad international equity market from early July through early August. The recent relative pullback, retracing about half the summer run-up, could be an opportunity to get back in on this cyclical niche of the market. One ADR, based in Taiwan, has endured tough supply chain challenges but features upside through its prime chip assembly and testing business.

Global Semi ETF Dips vs. The Total Stock Market since Early August

Stockcharts.com

According to Bank of America Global Research, established in 1984 and headquartered in Taiwan, ASE Technology Holding (NYSE:ASX) is the no.1 outsourced assembly and testing (OSAT) player globally, in terms of market share by revenue. ASE finalized a merger with SPIL in 2018 and acquired USI in 2010, which became its EMS business segment, providing synergies in system-level packaging. ASX provides a range of semiconductors packaging and testing, and electronic manufacturing services in the United States, Taiwan, rest of Asia, Europe, and internationally.

The $11.4 billion market cap Semiconductor & Semiconductor Equipment industry company within the Information Technology sector trades at just 4.9 times last year’s earnings and pays a massive 9.9% dividend yield, according to The Wall Street Journal. Seeking Alpha notes that the firm is at high risk of slashing its dividend, however.

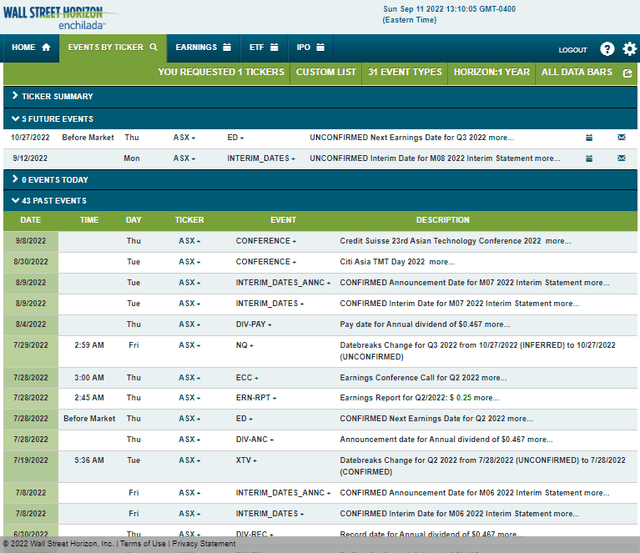

The diversified packaging semi stock grew July revenues by 17% on a year-on-year basis – we’ll get another interim sales report on Monday. In its last full-quarter earnings report, the ASX beat on both the top and bottom lines.

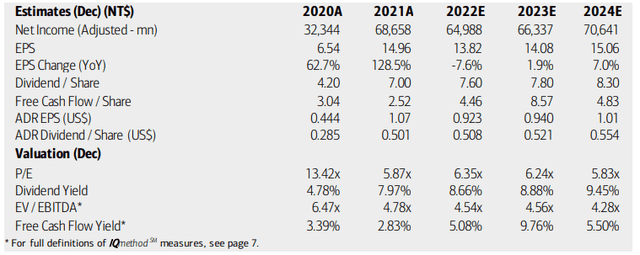

On valuation, earnings are seen as dipping this year amid the tough supply chain environment, but profits per share should then grow in 2023 and accelerate in 2024. BofA sees the dividend increasing as free cash flow remains solid in the years ahead. Given a high yield, low P/E, and attractive EV/EBITDA multiple, valuation looks great here.

ASX: Earnings, Valuation, Dividend Forecasts

BofA Global Research

As mentioned earlier, ASE Technology has its monthly revenue report tomorrow. Interim data is critical to pay attention to as it presents the latest information about a firm and even an industry. Wall Street Horizon’s data also show an unconfirmed Q3 earnings date of Thursday, Oct. 27 BMO. The company just recently presented at two sector conferences.

Corporate Event Calendar: August Sales Data Comes Out Monday

Wall Street Horizon

The Technical Take

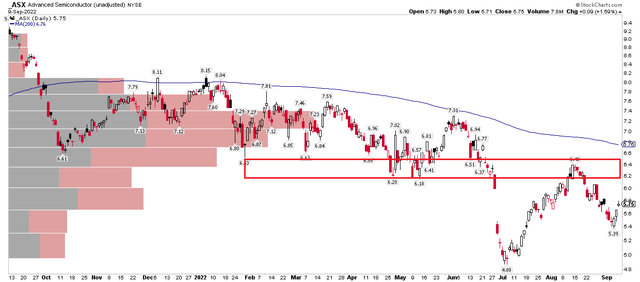

ASX shares bottomed in early July – well after the broad market’s June low. Following a rally from under $5 to above $6, the stock gave back about two-thirds of the July-August rally on its recent dip to $5.39. Three straight positive days with intraday buying (as indicated by the white real body candles) suggests the bulls are making another run here.

It wasn’t surprising that ASX sold off in the mid-$6s – there’s significant volume in the $6.20 to $7.50 range that it must fight through. I think the stock can get back to the August high, but then a pause is warranted from a technical perspective. Long here with a stop under $5.39 makes sense.

ASX: Resistance In the $6 to $6.50 Area

Stockcharts.com

The Bottom Line

ASE Technology is a buy to me. A compelling valuation and big dividend offset a mixed technical picture. An improving supply chain market should also be a tailwind for ASX, but there are risks should a global recession take hold. Bulls will want to check themselves if the stock breaks under last week’s low.

Be the first to comment