DSCimage/iStock via Getty Images

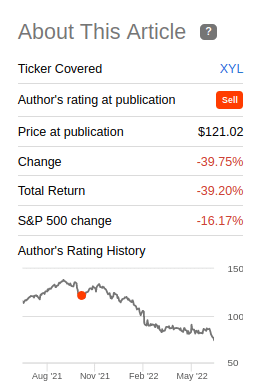

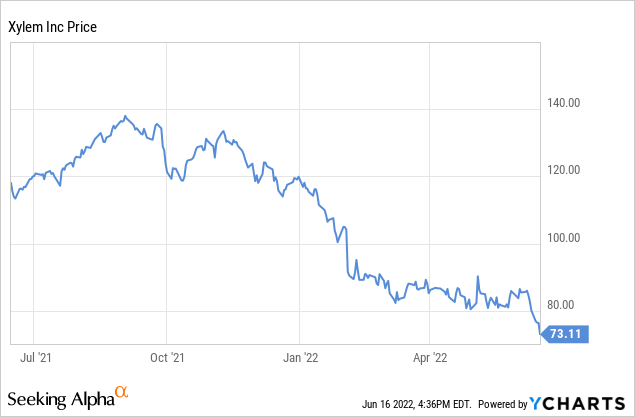

Despite Xylem (NYSE:XYL) being one of our favorite water infrastructure companies, we rated them a “Sell” based on valuation when we first wrote about them in October last year. Since then, shares have greatly under-performed the market, by more than a factor of two. In this article, we’ll analyze if the valuation reset has made shares attractive enough to buy, or if they still have some way to go to reach intrinsic value.

Seeking Alpha

What makes the drop in price more surprising is that this company is supposed to be relatively resistant to economic recessions, we are therefore attributing most of the share price decline to a much-needed valuation adjustment.

Financials

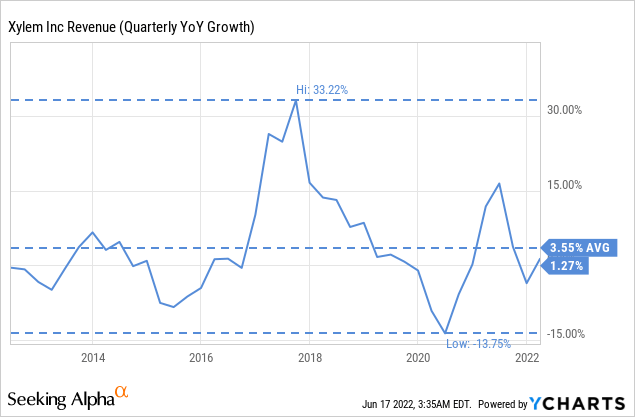

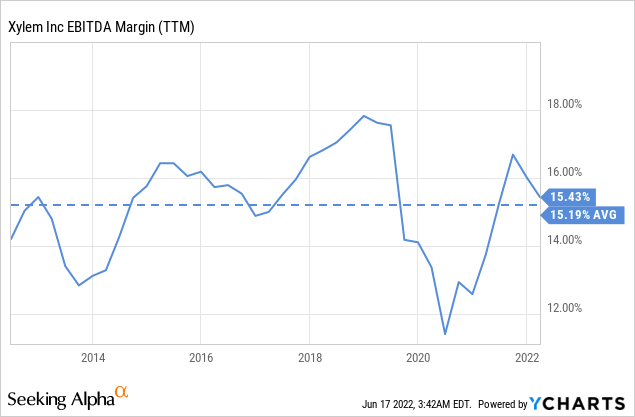

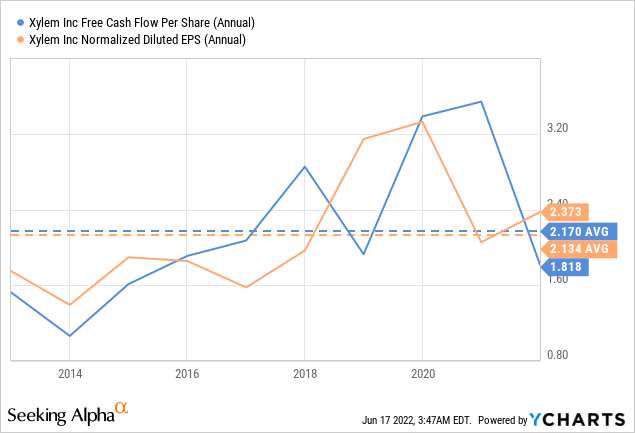

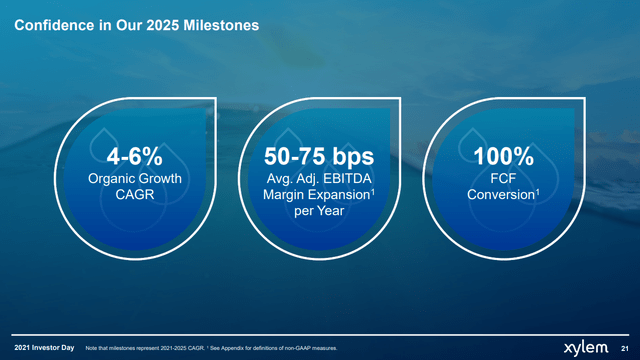

Xylem has three important financial targets as part of its 2021-2025 financial plan, those include 4-6% organic revenue growth, 50-75 bps in adj. EBITDA margin expansion per year, and to convert 100% of earnings into free cash flow.

Its drivers to expand margins include the operating leverage from revenue growth, a portfolio shift towards digital solutions, and pricing and continuous improvement that outpaces inflation. Xylem also expects to complete some growth investments that should further help to achieve these targets.

So how has the company been doing in relation to these goals? In relation to revenue growth, it has been averaging ~3.5% for the last decade, so it will need to accelerate the next few years to reach its goal. Some of the tailwinds that could help the company get there include faster growth from emerging markets and increased sales of digital products.

Trailing twelve months EBITDA margin is barely above its 10-year average, but we have to consider that the company has some impact from the COVID crisis, and that it is just coming out of it. This will be an important metric to monitor going forward to see if the company delivers on the 50-75 basis points improvement per year they have promised.

The free cash flow conversion target should not be too difficult to accomplish given that historically the company has delivered very close to a 100% FCF conversion. In fact, for the last ten years, free cash flow has slightly exceeded normalized diluted earnings per share.

Balance Sheet

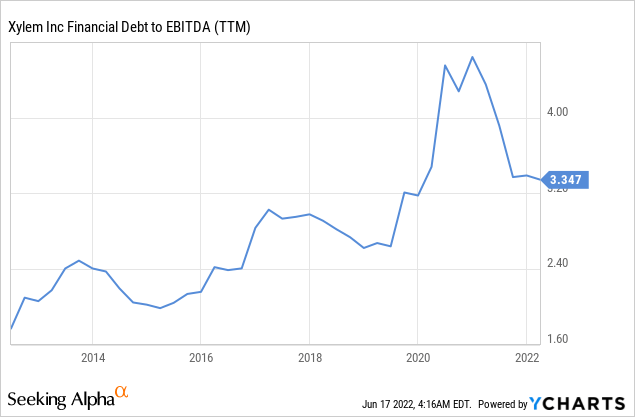

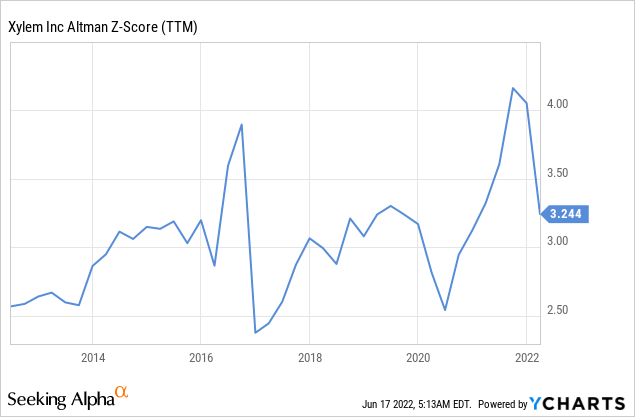

While Xylem does carry a considerable amount of debt, its leverage is not excessive, its debt/EBITDA stands at ~3.3x. We would like this to come down a little bit more but are not overly worried at this point.

Capital Deployment

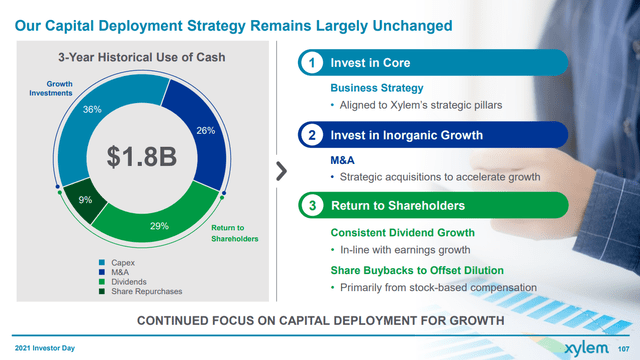

The company has had a very balanced capital deployment strategy, returning the last three years ~38% of cash generated to shareholders, using ~26% for M&A, and the balance reinvested in the business.

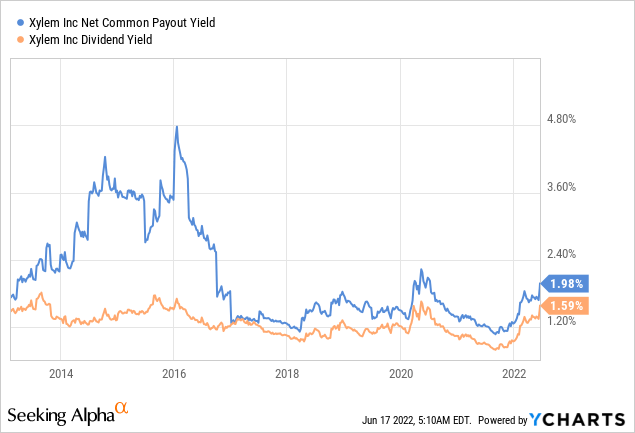

Unfortunately, given the high valuation at which shares trade, the dividend does not yield very much, currently ~1.59%. Even adding share repurchases, the total common payout yield does not reach 2%.

Valuation

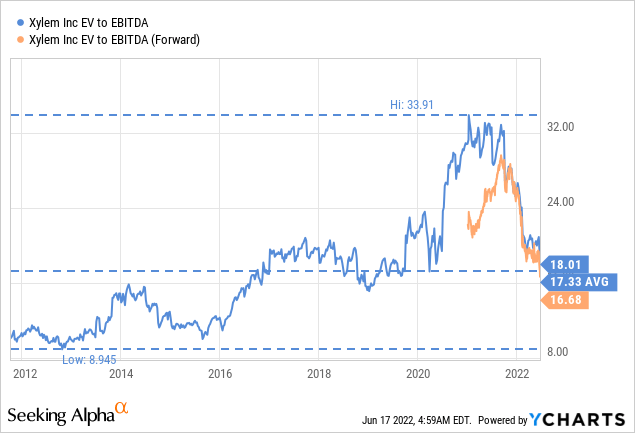

At least, the valuation appears significantly more reasonable after the stock price correction, with EV/EBITA now close to its 10-year average of ~17x.

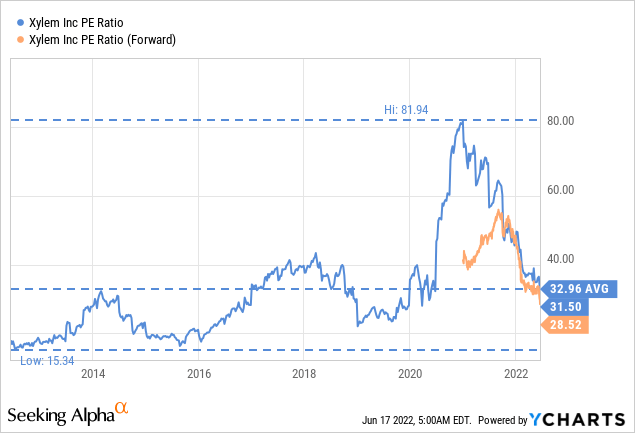

The price/earnings ratio has come down as well and is also close to the 10-year average. Still, we would argue it is not a bargain around 30x.

To get a sense of the intrinsic value of the company we did a simple discounted cash flow model, using analyst estimates compiled by Seeking Alpha for the next three years, and after that, we assume a 6% growth rate. We are using 6% because it is the upper range of the organic revenue growth target of the company, and we are not making any assumptions of extra earnings growth from operating leverage nor from M&A. We assume a 5% terminal growth rate and discount everything by 10%, which is our minimum target return. The net present value that we get is still a little below the current share price. We, therefore, believe shares are still somewhat overvalued. We have to reduce the discount rate to ~8.5% to get close to the current share price, so we think investors buying at current prices can expect something like an 8-9% rate of return.

| EPS | Discounted @ 10% | |

| FY 22E | 2.56 | 2.33 |

| FY 23E | 3.20 | 2.64 |

| FY 24E | 3.76 | 2.82 |

| FY 25E | 3.99 | 2.72 |

| FY 26E | 4.22 | 2.62 |

| FY 27E | 4.48 | 2.53 |

| FY 28E | 4.75 | 2.44 |

| FY 29E | 5.03 | 2.35 |

| FY 30E | 5.33 | 2.26 |

| FY 31E | 5.65 | 2.18 |

| FY 32 E | 5.99 | 2.10 |

| Terminal Value @ 5% terminal growth | 119.86 | 38.19 |

| NPV | $65.19 |

Risks

We are not too worried about the business itself, even considering the balance sheet which is somewhat leveraged. The Altman Z-score is comfortably above 3.0, and the company operates in a relatively stable industry. Our main concern is the stretched valuation, which could go from overvalued to undervalued. Right now we believe the company is only slightly overvalued, and priced to deliver 8-9% returns, but it could go down with the market and become undervalued in the future.

Conclusion

We are upgrading our opinion of Xylem to ‘Hold’ from ‘Sell’ after the share price correction, and now that the company trades at a more reasonable valuation. The company operates in the attractive water infrastructure industry, and we do not see any reason why it couldn’t meet its objective of growing organic revenue 4-6% per year. At current prices, we estimate shares could deliver around 8-9% for the next few years. Investors might want to consider waiting to have a margin of safety before purchasing the shares.

Be the first to comment