da-kuk/E+ via Getty Images

Mereo BioPharma Group plc (NASDAQ:MREO) is a London-based clinical-stage biopharma focused on the development of therapies for the treatment of cancer and rare diseases. Recently, one of the company’s largest investors since December 2021, Rubric Capital Management (14% stake), wrote a letter to the board urging them to explore strategic alternatives. Specifically, the activist urges management to wind down the clinical operations, find partners to share risks and costs associated with the drug development in Phase 3 trials, and discontinue the development of certain compounds outright.

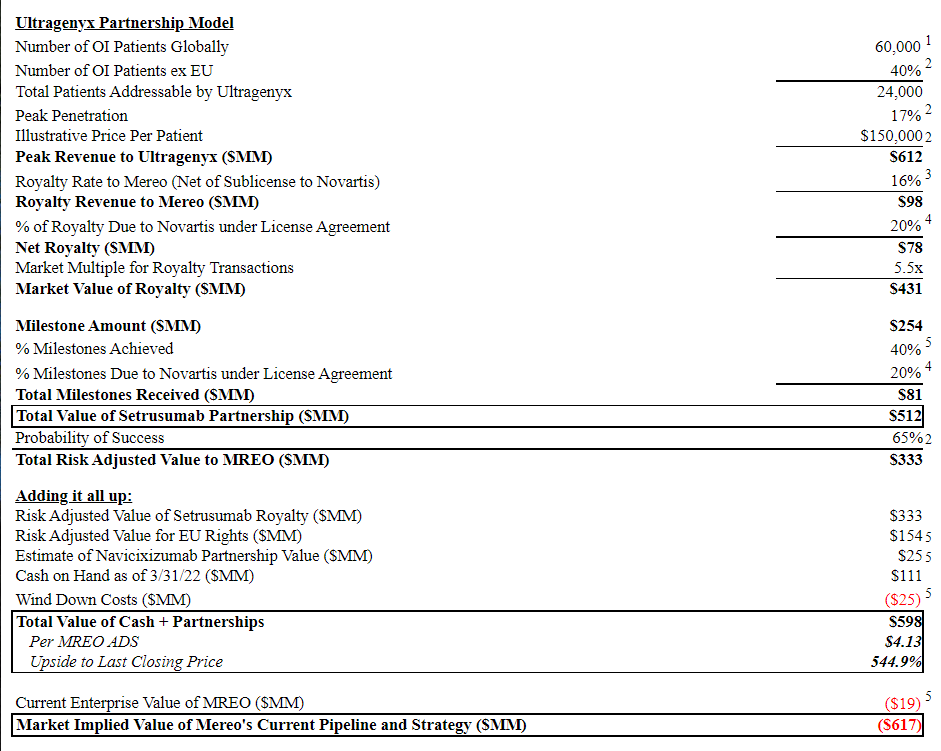

The whole setup is largely a speculative bet on the activist, Rubric Capital, a company without prior activism experience. However, this is a relatively large and experienced asset management firm with over $1bn AUM affiliated with Point72 Asset Management (AUM $24bn) and its infamous CEO Steve Cohen who also happens to be the shareholder of MREO with a 9% stake. The combined stake of 23% seems to be a big positive to the activist’s case. Rubric Capital is estimating that the implied value of MREO today is $4 per ADS, their calculation is largely based on potential royalties from a promising collaboration with Ultragenyx on the development of Setrusumab, a potential treatment for osteogenesis.

Rubric’s Valuation of MREO:

Source: Activist Letter

Currently, the company is trading for $0.80/share vs $0.87 net cash position, only an 8% discount that is not likely meaningful at this point given the quarterly cash burn of approximately 10% of the net cash position. While I was writing up MREO the stock run-up from $0.65/share to $0.8/share took away a significant portion of the leeway provided by a discount to net cash. Consequently, the setup now is more speculative, entirely focused on Rubric’s ability to realize the stated $4/share value. The situation remains fluid with a good chance of discount to net cash increasing again given the current market environment. Despite the recent run-up, investors should keep MREO at least on their watchlist and closely monitor the company’s progress, especially, given the high upside potential. Or add this to a basket of biopharma net-net plays as another high-risk, high-reward stock.

Main risks

-

Given the management’s low ownership and high compensation, incentives are to continue clinical operations for as long as possible

-

Rubric has no prior activism background

-

No discount to net cash (margin of safety gone)

-

Rubric’s valuation is largely speculative

Business Background

Mereo BioPharma is a relatively young company founded in 2015 focusing on the funding and development of potential therapies that are not being progressed in big pharma and biotech companies. The main strategy is to acquire or license candidates that already have gone through sufficient clinical testing to save on the preliminary testing expenses. This way company acquired three product candidates from Novartis in 2015 and one more from AstraZeneca in 2017. In April 2019, the company got listed on Nasdaq through a reverse merger with OncoMed further diversifying its portfolio. The company currently has six candidates in its portfolio which are either being developed in-house or are out-licensed to partner companies.

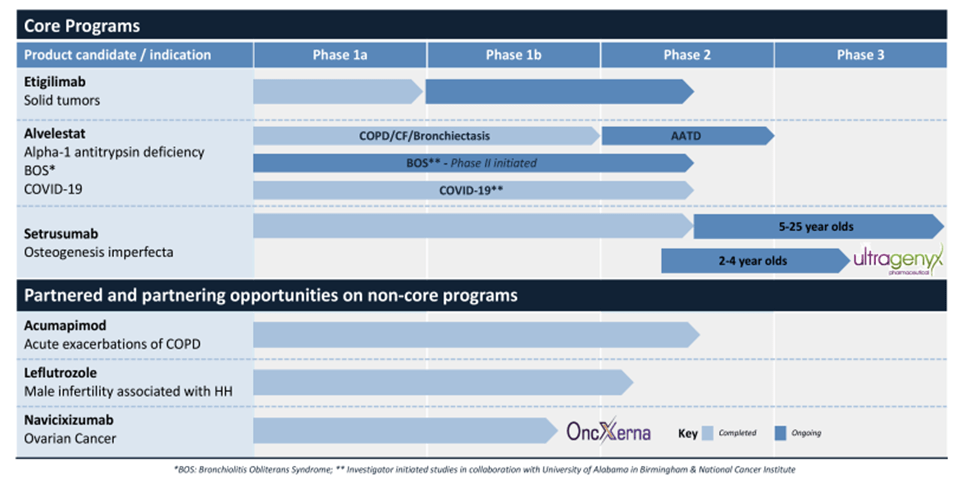

MREO’s existing pipeline:

Source: Annual Report

All of the six projects are still under development and seem to be progressing. However, the majority of the company’s candidate compounds are far away from commercialization and still are only in either phase 1 or phase 2 development stages. The most notable asset of the company seems to be Setrusumab, a drug used for the treatment of Osteogenesis imperfecta a rare genetic disease for which there is no approved therapy currently. The most notable update on the drug is the partnership with Ultragenyx in 2020. The partnership significantly boosted MREO’s financial health, obtaining a $50 million upfront payment from Ultragenyx with additional attributable payments payable on completion of certain milestones.

On the wave of positive developments such as the Ultragenyx partnership, the company opportunistically raised $100m in net proceeds in February 2021 at $2.9/share per ADS. The equity raise diluted the shareholder base by more than 60%. However, a combination of the upfront payment and subsequent equity raise provided the company with a large cash runway into 2024.

In 2021, R&D expenses amounted to $24m, while G&A stood at $16m. Management is quite well paid here with CEO’s total compensation in 2021 at $700k and most of it with cash. Management owns only a negligible amount of shares, so there’s a major risk that they will opt to continue the business as usual instead of choosing to wind down clinical operations and license out most of the drugs to maximize shareholder value.

Recently, the company completed a strategic review in light of current market conditions. As a result of the review, the company decided to focus on several of its lead candidates and evaluate the investments in others. According to the company, the cost cuts associated with the review will extend the MREO’s runway to the end of 2024 instead of the start of 2024. However, the activist did not think that the actions proposed by the management were sufficient enough, releasing the above-mentioned letter criticizing the board and management shortly after.

Activist Background

Information on Rubric Capital is rather limited. However, it seems to be a well-established and known hedge fund on Wall Street with deep ties to one of the prominent hedge fund and its manager. Rubric Capital Management was established by David Rosen a former analyst at Steven Cohen’s SAC Capital. At first, Rubric Capital was formed as a separate division within SAC with Rosen in charge. Since 2016 Rubric Capital Management is an independent firm managing more than $1bn in assets under management. Despite the carve-out, the relationship between Rubric and SAC, today known as Point72 Asset Management, still should be close and highly beneficial to the case.

Conclusion

The situation remains fluid especially in the current market environment with a discount to net cash possibly increasing again. Despite the recent run-up, investors should keep MREO at least on their watchlist and closely monitor the company’s progress given the potential upside if the activist campaign is successful. Moreover, this seems to be a good high-risk/reward candidate to add to the basket of biopharma net-net plays.

Be the first to comment