Ryland Zweifel/iStock via Getty Images

In 2019, Power REIT (PW) began investing in greenhouse real estate for cannabis cultivation. Since then, the company’s funds from operations (‘FFO’) has grown exponentially. Seeking Alpha authors have been bullish on this stock, with all recent authors rating it a buy or a strong buy. However, these authors have failed to cover several key details about David Lesser, who has been the CEO of PW since February 2011. My attention was drawn to these details after a board member’s resignation.

The Board Member’s Resignation

On March 22, 2022, PW board member Paula Poskon tendered her immediate resignation. Paula Poskon had been a board member since July 2020, so her abrupt resignation was something that caught my attention. To understand why she abruptly resigned from her position, I read her resignation letter. In her resignation letter she made the following allegations against the company:

-

She was forced out of the company by the CEO of PW, David Lesser, after she raised ethics concerns over related party transactions.

-

Her replacement is a longstanding personal connection of David Lesser.

Some investors might see Paula Poskon’s resignation letter as a hit job by an angry former board member. But in this article, I will demonstrate that Paula Poskon’s claims are supported by the past actions of PW and by the past actions of its CEO, David Lesser. Throughout my article, I will link my sources so that you can fact-check me as you read.

While researching PW, I reached out to the company via email with a number of questions. I made sure to ask the company to comment on the allegations Paula Poskon made in her resignation letter. After 5 business days, I received no response.

Related Party Transactions

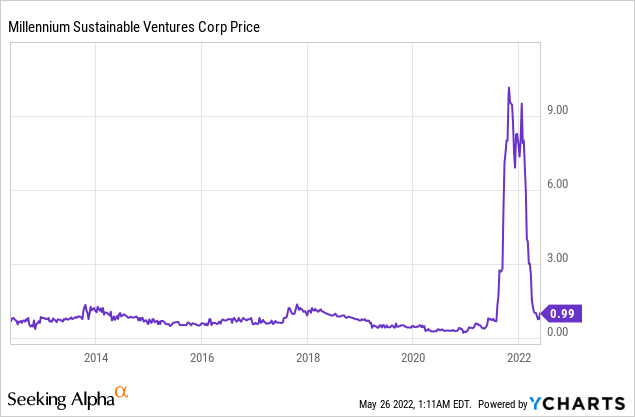

Besides being the CEO of PW, David Lesser is also the CEO of Millennium Sustainable Ventures Corporation (OTCPK:MILC), another publicly-traded company. This is a position he has held since December of 2013. Immediately after Lesser became the CEO of MILC he shifted the company’s focus to developing activated carbon, which is a form of carbon used to filter contaminants from water and air. The company’s activated carbon business is still in the research and development stage to this day.

When David Lesser became the CEO of MILC in 2013, the company traded as a penny stock at only around $1 per share. The lack of progress with their activated carbon business might explain why MILC still trades as a penny stock today and only made $41,000 in revenue in 2021.

Data From YCharts

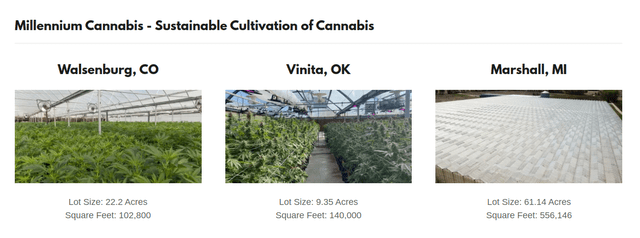

In 2021, MILC began to branch out into cannabis cultivation, which explains the temporary jump in stock price around that time. To kick-start their new cannabis cultivation business, MILC leased three greenhouses from PW. Below is an overview of the properties MILC leases from PW for cannabis cultivation. If you want in-depth details on these properties, I recommend reading pages 5-6 of MILC’s 2021 annual report.

-

In Michigan, MILC leases a 550,000 square foot greenhouse facility from PW.

-

In Colorado, MILC leases a 100,000 square foot greenhouse facility from PW representing $729,000 in annual rent.

-

In Oklahoma, MILC leases a 140,000 square foot greenhouse facility from PW representing $502,000 in annual rent.

PW also leases a 1.1 million square foot greenhouse to MILC for the purposes of growing tomatoes. This greenhouse is part of MILC’s new produce cultivation business, which was created in early 2022. This single lease provides PW with $1,099,000 in annual rent, which is around 12% of PW’s total FFO. For in-depth details on this lease, I recommend reading page 17 of PW’s May 2022 quarterly report.

Since David Lesser is the CEO of both PW and MILC, this puts him on both sides of these transactions. So David Lesser is essentially leasing these greenhouses to entities he has a beneficial interest in. To be fair, this is something that MILC is very upfront about. On page 20 of their 2021 annual report they speak about how this risk may impact their business:

In addition, on occasion, our management may have financial interests that conflict, or appear to conflict with MILC’s interests. For example, as of December 31, 2021 three of MILC’s greenhouse facilities are leased from subsidiaries of Power REIT (ticker: PW). David H. Lesser, Power REIT’s Chairman and CEO, is also Chairman and CEO of MILC. MILC established cannabis cultivation projects in Colorado, Oklahoma, and Michigan which are all leased from subsidiaries of Power REIT. Although a majority of our disinterested directors must approve, and in those instances did approve, MILC’s involvement in such transactions or any such circumstance, could lead to conflicts of interest between MILC on one hand, and Power REIT, Mr. Lesser and his affiliates and interests on the other hand, and such conflicts may be unfavorable to us.

But since MILC made only $41,000 in revenue in 2021, this means that to pay the lease on their three greenhouses they have to take out debt. In 2021, $43 million in long-term debt appeared on MILC’s balance sheet. So a decent part of PW’s FFO comes from debt taken out by another company that is run by PW’s CEO. If MILC fails to pay rent for any number of reasons, this can result in a decent chunk of PW’s FFO disappearing instantly.

Related party transactions like these are legal. However, they present a significant risk for investors because the line between what is legal and what is illegal can be crossed very easily. It is also possible that David Lesser may make transactions that favor one entity more than the other. MILC giving rent money to PW also boosts PW’s funds from operations, which may cause PW stock to be valued higher than it would otherwise be.

It is also worth noting that MILC has never paid any rent to PW on its Michigan property. This is because PW has failed to get a license to grow marijuana on the property due to a legal dispute with the city the property is located in. The city believes that the property is an industrial property, and therefore requires different permits and building codes. PW, however, maintains that the property is a greenhouse. See their April 2022 current report for complete details.

In April 2022, PW filed a legal complaint against the city the property is located in an attempt to clear the situation up. On page 15 of its May 2022 quarterly report, the company explains its complaint against the city:

The Complaint is an action for equitable, declaratory and injunctive relief arising out of Township’s false promises, constitutional violations by the Township’s deprivation of Plaintiffs’ civil rights through its refusal and failure to comply with its own ordinances and state law as well as a common dispute resolution mechanism.

The failure to get a license for this property and the legal complaint that arose from it further complicates this related party transaction. This massive property sitting dormant means MILC cannot grow their marijuana crops and that PW is not collecting rent money. This hurts both companies financially so it is something that investors should be aware of.

Related Party Transactions Part 2

David Lesser is also the CEO and Chairman of Hudson Bay Partners LP (‘HBP’), an investment firm focused on renewable energy. David Lesser owns 100% of HBP. Searching through PW’s annual reports I have found several related party transactions between PW and HBP that investors should be aware of.

The earliest related party transaction occurred in 2012, when a subsidiary of PW (‘PWSS’) borrowed $1.65 million from HBP to buy land for a solar project. PW paid back the loan with interest over the following 5 years. Page 25 of PW’s 2018 annual report states that:

In December 2012, PWSS acquired the approximately 54 acres of land in Salisbury, Massachusetts that it leases to a 5.7 MW operational solar farm. That acquisition was financed in part by a bridge loan extended by Hudson Bay Partners, LP (“HBP”), an affiliate of our Chairman and CEO, Mr. David Lesser.

Another transaction that caught my eye occurred on March 1, 2022, when PW’s lease with Sweet Dirt was amended to include $3.5 million in property improvements. Of those property improvements, $2.2 million would be done by IntelliGen Power Systems, a company owned by HBP. It is important to note that PW gave the money to Sweet Dirt for these property improvements in exchange for higher rent. This means that PW’s money went to Sweet Dirt, and then Sweet Dirt gave the money to HBP, causing the money to end up in David Lesser’s private investment company. Page 43 of PW’s 2021 annual report states that:

On March 1, 2022, the Sweet Dirt Lease was amended (the “Sweet Dirt Lease Second Amendment”) to provide funding in the amount of $3,508,000 to add additional items to the property improvement budget for the construction of a Cogeneration / Absorption Chiller project to the Sweet Dirt Property…..

……A portion of the property improvements amounting to $2,205,000, will be supplied by IntelliGen Power Systems LLC which is effectively owned by HBP, an affiliate of David Lesser, Power REIT’s Chairman and CEO.

Finally, in September 2016, PW’s board authorized a $1000 monthly payment to HBP for administrative and accounting support. In February 2021, the board voted to increase this monthly payment to $4000. The board also authorized a special one-time payment of $15,000 to HBP to compensate for time spent on a rights offering. I recommend reading page 69 of their 2021 annual report for in-depth details on these payments made to HBP.

When I reached out to PW, I asked the company to comment on why so much of PW’s money is going to HBP. After 5 business days, I have not received a response from PW.

Between the greenhouses PW rents out to MILC and the payments that PW has made to HBP, PW is engaged in tens of millions of dollars’ worth of related party transactions. These transactions have occurred through many separate events over the last decade. Most publicly traded companies both large and small are engaged in zero-related party transactions, so I find it unusual that PW has so many. I now understand why Paula Poskon raised concerns about PW’s related party transactions. And in my opinion, Paula Poskon being allegedly fired for raising concerns about this is a massive red flag.

I feel that these related party transactions created a lot of value for MILC and HBP, but created a layer of risk for the shareholders of PW. Because of this, I question why the board would approve these related party transactions at all. This brings us to the second allegation that former board member Paula Poskon made in her resignation letter: That she was being replaced with a longstanding personal connection of David Lesser.

Paula Poskon’s Replacement

Paula Poskon is being replaced by Dionisio D’Aguilar, a businessman and political figure from the Bahamas. On page 62 of its 2021 annual report, PW provides a basic overview of D’Aguilar’s business and political history:

From March 1993 through May 2017 and from September 2021 to present, Mr. D’Aguilar served as the President and CEO of Superwash Limited, which is the largest chain of self-service laundries in the Bahamas. From May 2017 through September 2021, Mr. D’Aguilar, having been elected to the Bahamian Parliament, served in the Cabinet of The Government of The Bahamas as the Minister of Tourism and Aviation.

We have no way of knowing how David Lesser knows Dionisio D’Aguilar. But in my opinion, Lesser does have a history of hiring personal connections. In 2011, Lesser hired his spouse’s law firm to represent PW in a lawsuit against Norfolk Southern Railway (NSC).

Norfolk Southern Railway Co. v. Power REIT

One of PW’s assets is a 112-mile railroad track that it leases to NSC. This railroad track is located in Pennsylvania, Ohio and West Virginia and is leased to NSC on a 99-year lease. This lease is held by a subsidiary of PW, the Pittsburgh & West Virginia Railroad (‘P&WV’).

In December of 2011, PW was involved in a lawsuit with NSC for breach of contract. PW alleged that NSC had defaulted on their lease for failing to pay PW $12 million in various fees. Page 12 of a quarterly report shows that PW hired the Morrison Cohen law firm to represent the company. It also shows that one of the partners at the Morrison Cohen law firm was none other than David Lesser’s spouse, Danielle Lesser:

The Trust and its subsidiaries have hired Cohen, LLP (“Morrison Cohen”) as their legal counsel with respect to general corporate matters and the litigation with NSC. The spouse of the Trust’s Chairman, CEO, Secretary and Treasurer is a partner at Morrison Cohen.

After a five-year legal battle, PW lost their case to NSC in 2017. The legal battle cost PW $3.68 million dollars in legal expenses, which were paid directly to the Morrison Cohen law firm. In other words, that’s $3.68 million dollars taken from PW and paid to a law firm that David Lesser’s spouse is a partner in. On pages 20-21 of their 2018 annual report, the company states that:

As of December 31, 2018, P&WV had incurred a total of approximately $3.68 million of cumulative expenses related to the litigation. P&WV believed that the costs associated with the litigation are reimbursable by NSC under the Railroad Lease as additional rent, but the court ruled against it and the appellate court upheld this ruling.

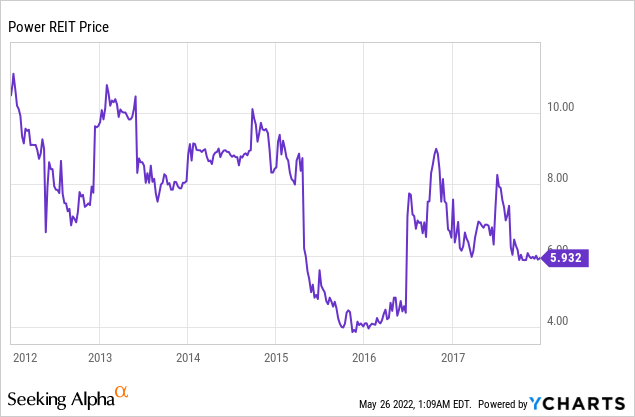

To make matters worse, in 2013 David Lesser suspended the dividend on PW’s common stock to help pay for this litigation. With the dividend suspended and the lawsuit ongoing, PW’s stock price went from around $10 at the start of 2013, to just $6 by the end of 2017. This was destruction of shareholder value on a massive scale.

Data From YCharts

When I reached out to PW, I asked why the company decided to hire the Morrison Cohen law firm to represent the company in its lawsuit against NSC. I also asked if the Morrison Cohen law firm was representing PW in its current legal dispute involving the Michigan greenhouse it leases to MILC. After 5 business days, the company has not responded.

In my opinion, David Lesser hiring his spouse’s law firm shows that he has hired personal connections to handle PW’s business in the past. I feel that this adds validity to Paula Poskon’s claim that she is being replaced by a personal connection of David Lesser.

Plain Talk About Risk

Because of all the factors I have discussed, I feel it would be extremely risky to invest in PW. I believe the complex web of related party transactions outweighs any positives that PW as a company might have. For these same reasons, I choose to own Innovative Industrial Properties (IIPR) and NewLake Capital Partners (OTCQX:NLCP) instead of investing in PW.

However, I also feel that it would be extremely risky to short PW. The company has a lot of negative aspects, but none of these aspects guarantee the downfall of the company.

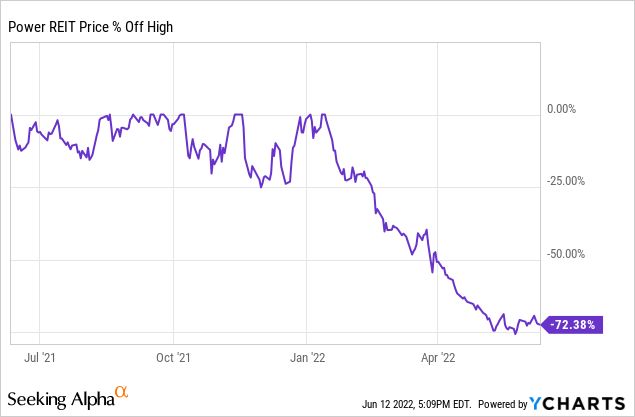

We should also take into account that PW’s stock price has already fallen 72% since its all-time high in January 2022. In my opinion, betting on additional downside is an extreme risk not worth taking.

Data By YCharts

Conclusion

To sum up the points I have made in this article:

-

A large part of PW’s FFO comes from related party transactions funded by debt.

-

A lot of PW’s money has gone to Hudson Bay Partners LP, a private investment company owned 100% by PW’s CEO.

-

PW paid the Morrison Cohen law firm $3.68 million in legal fees. The CEO’s spouse is a partner at Morrison Cohen.

These related party transactions do not give me confidence in the company’s CEO or the future of the company. Because of this, I consider PW to be a strong sell.

Thank you for reading my analysis on PW. As I mentioned earlier, I encourage you to read the sources I have cited throughout my article. If you feel I have missed anything, please direct your constructive criticism to the comments section below.

In addition, I would like to thank Seeking Alpha for allowing me to publish an article of this nature. This article may be controversial, but it contains information that I feel shareholders have a right to know.

Be the first to comment