jiefeng jiang/iStock via Getty Images

SPDR S&P Semiconductor ETF (NYSEARCA:XSD) is an exchange-traded fund that enables investors to get exposure to stocks that constitute the S&P Semiconductor Select Industry Index, XSD’s chosen benchmark index. The benchmark index for XSD is a subset of the S&P TMI (Total Market Index) which is designed to track the broader U.S. equity market, so XSD is basically a U.S.-only semiconductors ETF.

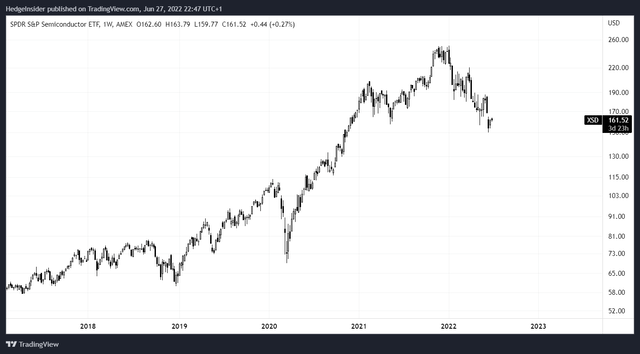

XSD had 40 holdings as of June 24, 2022, with assets under management of $994.8 million as of the same date. The gross expense ratio is reported as 0.35%, which is not cheap but fair given the sector-specific strategy. Since some of the world’s major semiconductor manufacturers are international, such as Taiwan Semiconductor Manufacturing Company (TSM) in Taiwan, it does seem like a slightly odd strategy; to invest only in companies within the U.S. semiconductor industry (as opposed to the global industry). Still, the fund has performed well since the pandemic lows of March 2020. Yet recent equity market declines have hit semiconductor manufacturers and ancillary companies (and thus XSD) like most of the U.S. equity market (see below).

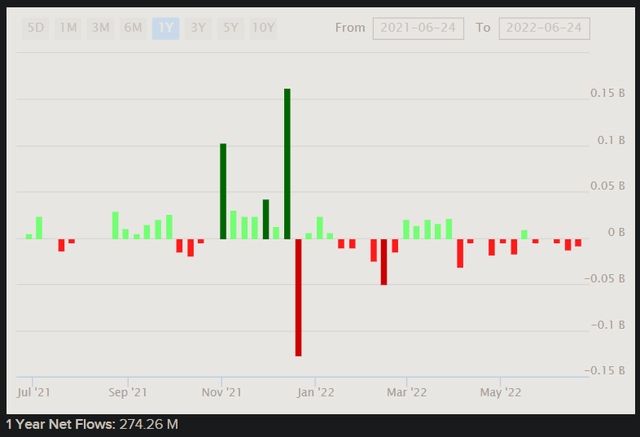

On a more positive note, over the past year, net inflows have been positive into XSD (see below; circa $274 million in net inflows).

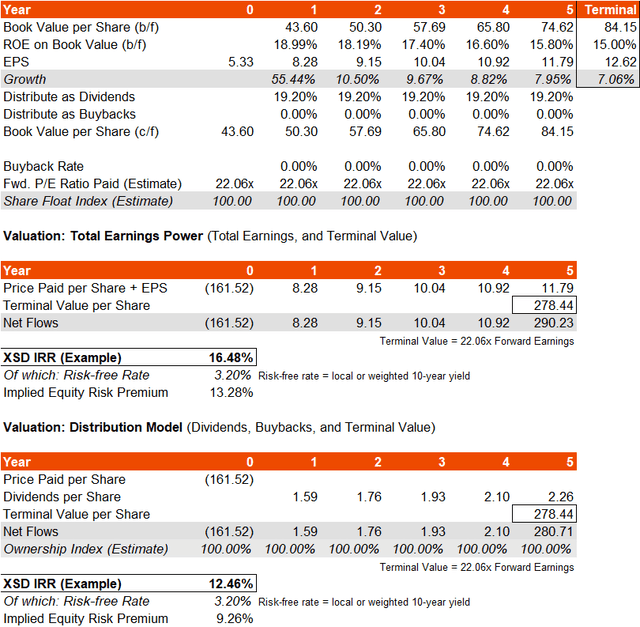

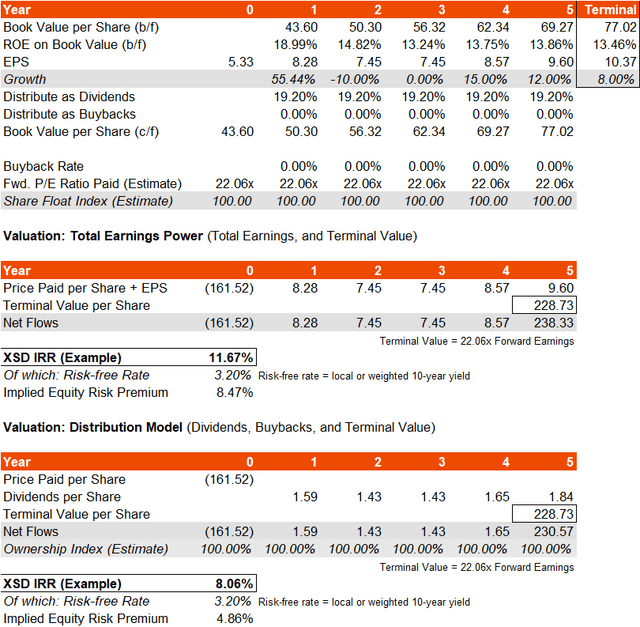

A recent factsheet as of May 2022 month-end, for XSD’s benchmark index (as a proxy for XSD’s portfolio itself), offers trailing and forward price/earnings ratios of 34.29x and 22.06x, respectively. That implies forward one-year earnings growth of 55%. Also, the price/book ratio was stated as being 4.19x, and the indicative dividend yield was circa 0.56%, implying (using the trailing price/earnings ratio given) a distribution rate of profits into dividends of about 20%. Further, SPDR themselves offer a three- to five-year average earnings growth rate (forecast) of 21.17% for the fund’s portfolio. SPDR’s price/earnings data is more favorable, but I will persist with XSD’s benchmark index’s figures (as provided by S&P) instead.

The above data also implies a forward return on equity of 18.99%. If we assumed that the return on equity dropped off to about 15% over the course of six years, that would take our average earnings growth rate for three years to 23.50%, and five years 17.22%. The average of those two numbers is 20.36%, which is about where SPDR’s 21.17% figure sits. In this scenario, assuming no buybacks but a constant dividend rate of 20%, we would find an implied IRR on the fund of circa 16.5% on a total earnings power basis, or 12.5% if we were to value only the dividend distributions and terminal value.

This implies a fairly hefty equity risk premium of 9-13%. Even against an average XSD beta of 1.27x, that would come to an adjusted ERP of 7.29-10.46%, which is a lot more than what I would consider fair for the U.S. equity market of anywhere from 4.2-5.5% (depending on risk sentiment and/or perceived uncertainty). So, on the above perhaps generous EPS growth estimates, XSD looks safely undervalued. It would imply a minimum upside of 22% if we were to assume an ERP of 5.5% but scaled up by 1.27x in line with XSD’s historical beta, and further if we were to keep the risk-free rate constant at 3.20% (the current U.S. 10-year yield).

That would take XSD to circa $198.67, which is over 20% below the fund’s all-time high set at the start of 2022. So, it would not be uncharted territory by any means, although these figures do seem to suggest that XSD was safely overvalued at the start of the year. However, it seems like the pendulum may have swung too far in the other direction, and that XSD is now looking quite attractive.

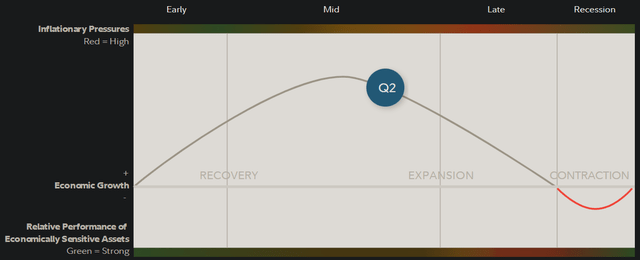

Nevertheless, while the U.S. might not yet be in a recession, Fidelity research would suggest the country is not too far off (as of Q2 2022).

The later stage of the economic cycle is characterized by moderating growth, tightening credit, earnings pressures, potentially misaligned government policies, inventory growth, and sales growth declines. With semiconductor end users including car manufacturers, appliances, etc. (durable goods) as well as smartphones, laptops, and other consumer electronics (semidurable goods), and since those kinds of goods purchases decline during recessions, XSD is likely to take a hit during a full-blown recession. A negative revision to earnings estimates would likely occur. That could happen over the next few years.

So, instead, if we keep our 55% boost forecasted by analysts over the next year, but then assume a recessionary decline in earnings of -10% in year two, followed by flat growth in year three, and then a resurgence into the next business cycle, we get a different result. This is a bumpy ride, but we have had to become more accustomed to sharper business cycle swings lately. The implied IRR in this scenario drops to 8.06-11.67%.

Because the ERP in this scenario is still decent, XSD seems like it does offer good value. Adjusted for the fund’s historical beta of 1.27x, the ERP in the above scenario drops from an unadjusted 4.86-8.47% to an adjusted 3.83-6.67%. On the lower end, that’s a little low. But there is enough room here to justify the present valuation. And this is based on a scenario in which earnings growth rates are about half the current offered consensus figures.

Therefore, while XSD is still likely to face some drawdown during a recessionary scenario, you have a fund that is likely to perform very well without a recession and will most likely bounce back strongly upon a reversal out of any medium-term recession. On a valuation basis, I think XSD has plenty of room to manoeuvre the next five years or so. The products will continue to remain critical to various industries too.

One final risk I would add, though: there is potential for a long-term earnings multiple contraction. The current forward multiple is 22.06x, which would imply a high earnings growth rate to perpetuity. It is possible that the U.S. semiconductor industry will be able to sustain high earnings growth rates over the next few business cycles, allowing it to justify a high multiple over the next few years. However, unless XSD’s volatility (or “beta”) normalizes, this multiple will start to look quite expensive.

A fairer long-term multiple might be closer to 16x based on an ERP of 5%, a risk-free rate of 3.2%, and a long-term earnings growth rate of say, 2%, as an example. While I would not argue 16x is fair right now, given XSD’s earnings growth potential, eventually you would expect the earnings multiple to revert to a broader market average once the industry matures further. This could create a long-term drag on the value of the fund, to the tune of about -1.6% per year over 20 years (for example).

Be the first to comment