Scott Olson/Getty Images News

Investment Thesis

In this article, I would like to share the research I have made so far to assess where exactly The Kraft Heinz Company (NASDAQ:KHC) is as it tries to complete a turnaround in its business model to become a more profitable and more reliable company. In fact, Kraft Heinz has been on a rollercoaster over the past years and many investors, though aware of the iconic brands with wide moats the company owns, are now wary of investing into it. Moreover, the 2019 dividend cut made many dividend investors move away from the stock.

Kraft Heinz: An Overview

Kraft Heinz is the fifth-largest food company in the world, with a revenue of $26 billion. It is well known that The Kraft Heinz Company was born through the merger of Kraft and Heinz in 2015. It is also well known that none other than Warren Buffett played a big role in this operation through Berkshire Hathaway (BRK.A) (BRK.B) that had a 26% stake in the newly formed company.

If we think about it, the company had many things that fit into the oracle of Omaha’s investing style: both Kraft and Heinz operate in the food industry, a predictable and reliable business, with brands that are renowned all over the world. However, there is something that sounded strange to me once I learned Buffett was in this deal: Kraft-Heinz, although enjoying good EBITDA margins, it is not a company that has a high ROCE, a metric that Buffett usually looks at in order to pick long-lasting compounders.

In any case, it is also known by everybody that Warren Buffett admitted in 2019 that he overpaid for the company. In fact, the restructuring program led by Brazilian private equity firm 3G Capital didn’t bring the company to the goals meant to be achieved in order to obtain better profitability through cost reduction. This is why in 2019 the company changed its CEO and appointed Miguel Patricio, who is leading the company according to another strategy. Instead of focusing only on costs, Patricio is working on Kraft-Heinz portfolio, divesting from low margin brands and increasing the company’s exposure to growth brands in emerging markets. The company is trying to move from being too big to move forward to focusing on scaling in order to achieve better profitability. The name of this renewal program is Agile@Scale.

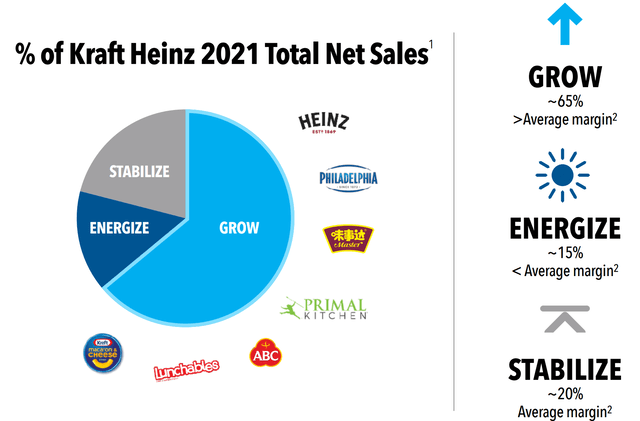

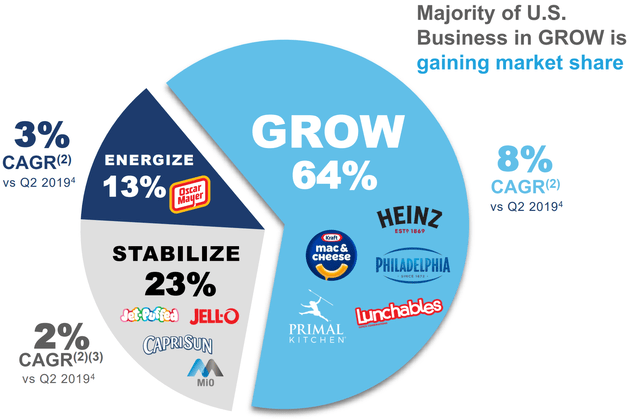

The new business model rebalanced the percentage of Kraft Heinz total net sales, making 65% of total sales coming from grow brands with above industry average margin. Only 15% of total net sales come from brands that need to be energized, as they have below industry average margin. The remaining 20% comes from brands with average margin.

Kraft Heinz CAGNY 2022 Presentation

The company is continuing to divest from brands that don’t fit into this new strategy, and just recently it sold its B2B Powdered Cheese Business to Kerry Group. This is why, given the current portfolio rebalancing, investors should look at both the top and the bottom line of the income statement with some caution since revenues can be seen to go down as some brands are sold. At the moment, I thus prefer to focus on margins and ROCE which gives me an idea of how Kraft Heinz is improving its execution.

Financials

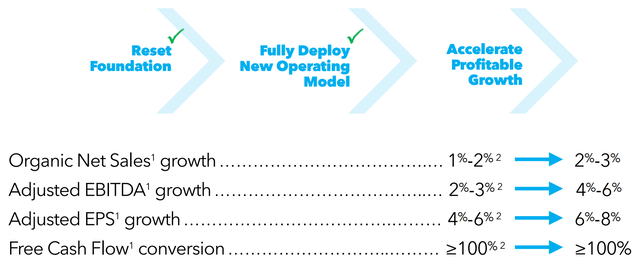

Just a few months ago, the company boasted that it was executing its new operating model so well that it was raising upwards its guidance. As we can see below, organic net sales are now expected to grow at an annual rate between 2% and 3% while the adj. EBITDA growth should be between 4% and 6% and EPS is expected to grow in the range between 6%-8%. Free cash flow conversion will remain above 100%.

Kraft Heinz CAGNY 2022 Presentation

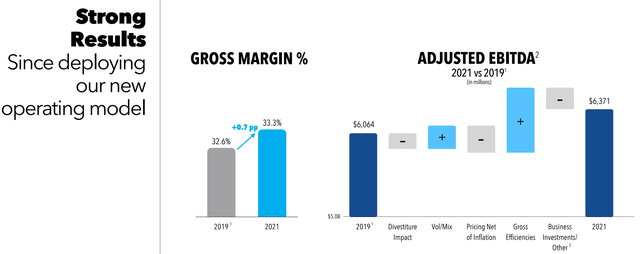

Gross margin as a percentage of net sales have already increased by 0.7 percentage point in the past three year, mainly thanks to gross efficiencies, as shown in the graph below.

Kraft Heinz CAGNY 2022 Presentation

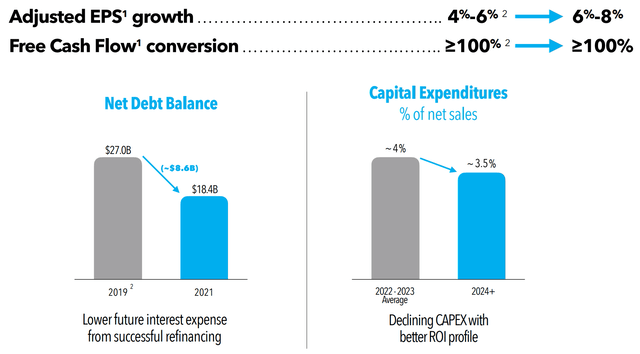

Now, regarding the EPS growth and the free cash flow conversion, Kraft Heinz is confident it will reach its goals because it has already reduced its debt by more than $8 billion while keeping capex under control as a percentage of net sales.

Kraft Heinz CAGNY 2022 Presentation

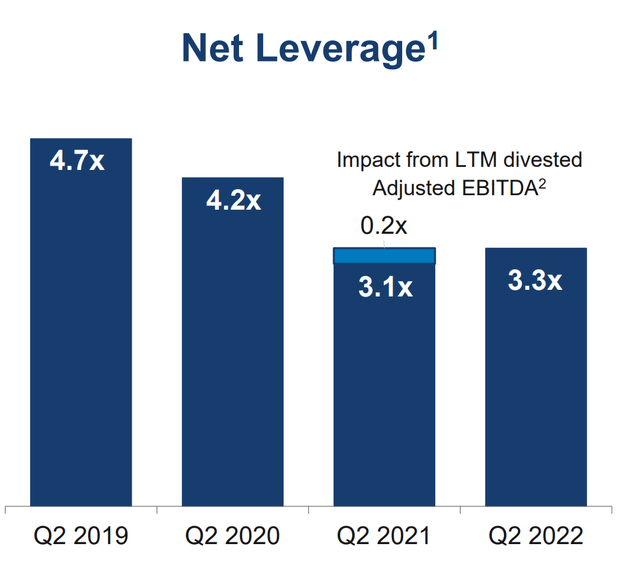

Another important aspect Kraft Heinz is committed to is bringing down its net leverage. Over the past three years, the net debt/EBITDA ratio has come down substantially, and it is now close to 3x. With a net debt of $19 billion and an EBITDA of $6.3 billion, the company is getting close to a ratio of 3 that many investors use as a filter in order to decide whether or not to be invested into a company. I do expect that when Kraft Heinz brings this ratio below 3, there might be an increasing interest for the stock from some of these investors.

Kraft Heinz Q2 2022 Results Presentation

Some Takeaways from Q2 Results

Looking at the last earnings report, we can find a few takeaways to understand how the company’s business model turnaround is performing.

First of all, the portfolio rebalancing is helping the company raise its targets, since the grow section is in fact growing faster than the market at an 8% CAGR vs. Q2 2019. The energize part has done better than the stabilize portion, and this makes sense since the former needs indeed to be “energized”.

Kraft Heinz Q2 2022 Results Presentation

During the quarter, net sales decreased 0.9 percent YoY to $6.6 billion. However, this includes a negative 9.3 percentage point impact from divestitures net of acquisitions and a negative 1.7 percentage point impact from currency. This is why, as I already said, at the moment, I don’t think looking at revenues and net income is the best way to assess the company.

On the other hand, organic net sales increased 10.1 % YoY and the CAGR since 2019 is now at 5.2%. More importantly, the company proved to have enough pricing power to offset inflation, since pricing was up 12.4 percentage points YoY.

Dividend

Kraft Heinz was poised to become one of the best dividend paying stocks. However, it failed to deliver up to the market’s expectations when it had to cut its dividend by 36% in 2019. However, since then, the company has brought its dividend payout to a more reasonable 58%. The current dividend yield is 4.29% which is indeed high and could make the stock seem undervalued. However, while the company has so far stated that it plans on keeping its dividend stable, since 2019 the quarterly dividend has never been raised and it still is $0.40. In fact, the company is still mainly focused to deleveraging, which is another reason why, at the moment, there is no ongoing share repurchase program.

Valuation

Though the PE is a metric that is seeing a decreasing investors’ consideration, I think that in this case is it a useful metric to start with. Currently, the company’s fwd PE is almost 14 which, according to Seeking Alpha, is 26% below the industry average. More in line with the industry’s average is the fwd EV/EBITDA of 11, which is discounted by only 4% compared to the industry. I think both of these metrics show that investors are still a bit cautious about the company, as they need to see that its transformation does push it towards better profitability. In fact, the ROCE of the company is still a low 4.38%.

I think this explains why the dividend yield is so high at the moment. In order to be invested in the stock, investors need at least a partial safety that assures of a 4% annual return on the capital invested. It is not much, but it is more than other companies are paying in terms of dividend yield.

Conclusion

At the moment, Kraft Heinz will just sit in the watchlist I used to pick stocks for my dividend growth portfolio. The company still needs to improve its leverage, and needs to show me it can raise its ROCE. When this will happen, I do expect the company to start raising its dividend, too, making it a perhaps suitable addition to my portfolio. But, as far as I am concerned, I currently rate the company as a hold.

Be the first to comment