aapsky/iStock via Getty Images

Apollo Investment Corporation (NASDAQ:AINV) is trading at a 32% discount to book value, implying that investors could get a good deal on this business development company as the market prepares for a downturn.

Apollo Investment has a well-diversified portfolio with very few problem loans. The floating rate exposure and investment portfolio composition of the business development company are distinctive.

A BDC With A Twist

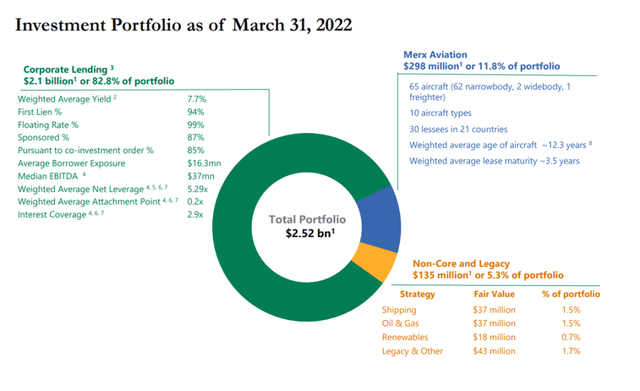

Apollo Investment is not your typical business development company because AINV’s investments include an aircraft leasing business, which accounts for approximately 12% of the BDC’s portfolio. The core portion of Apollo Investment’s portfolio, however, is the corporate lending business, which is worth $2.1 billion and accounts for 83% of the company’s investments.

94% of the corporate lending portfolio is made up of highly rated first liens. The portfolio is generally diverse, with ChyronHego Corporation being Apollo Investment’s largest borrower, accounting for 5.2% of the total lending portfolio with a $110 million investment.

The non-core and legacy businesses of Apollo Investment, which include investments in shipping, oil and gas, renewables, and other, are worth $135 million and account for 5.3% of the BDC’s investments.

Investment Portfolio (Apollo Investment Corp)

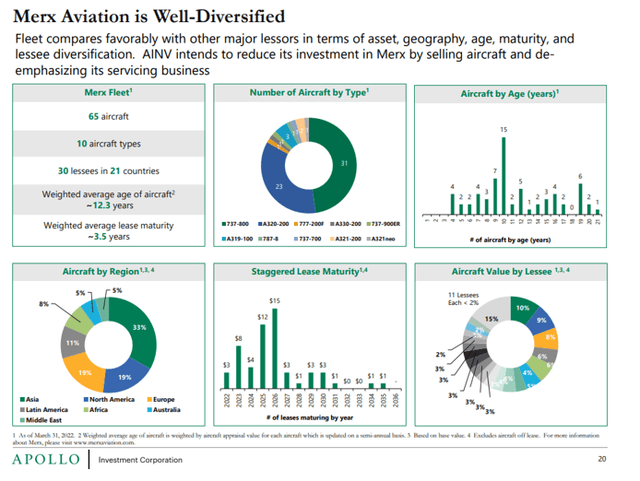

The portfolio of Apollo Investment is unique in that it includes Merx Aviation, an aircraft leasing company with 65 aircraft and operations in 21 countries.

The aircraft leasing business’s core assets are 31 Boeing 737-800s, which are leased to customers primarily in Asia, North America, and Europe who do not want to make the large capital outlay for an aircraft purchase.

Apollo Investment intends to gradually liquidate its aircraft assets and shift its focus to its direct lending business in the future.

Merx Aviation Diversification (Apollo Investment Corp)

Credit Quality

Credit quality is the single most important metric for a business development company. A BDC with poor credit quality will almost certainly have to absorb loan losses, lowering the company’s book value. And business development firms that produce poor book value growth are penalized in the market with a lower P/B multiple.

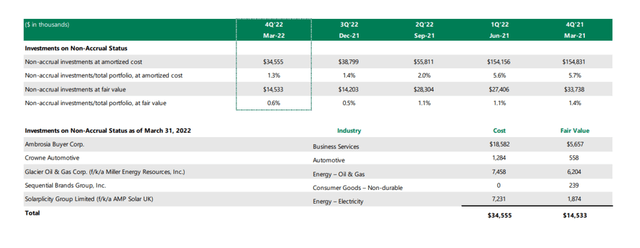

Apollo Investment’s credit quality is nearly perfect, with a non-accrual ratio of 0.6%. The non-accrual ratio indicates how many loans are not performing as expected. Based on fair value accounting, Apollo Investment had five non-accrual investments in various industries as of 3/31/2022, representing a total loan value of $14.5 million.

Credit Quality (Apollo Investment Corp)

Interest Rate Exposure

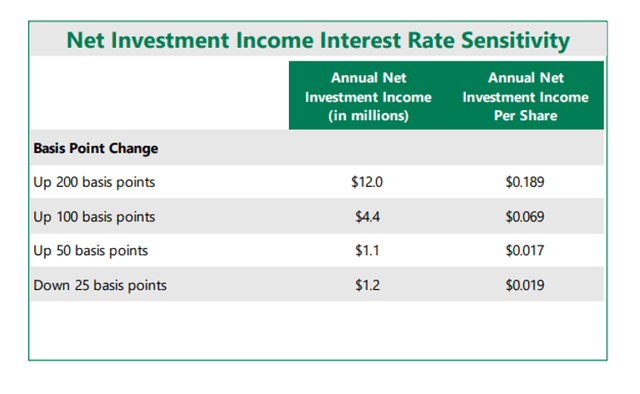

Because 99% of loans in the core lending portfolio are floating rate, Apollo Investment will see an increase in interest income if interest rates in the economy rise. However, because Apollo Investment has legacy assets unrelated to business lending in its portfolio, only 81% of assets are floating rate, implying that the BDC has less interest rate upside than a BDC fully invested in the lending industry.

Having said that, Apollo Investment still has significant net investment income growth potential if the central bank continues to raise benchmark interest rates. A 100 basis point increase in interest rates is expected to increase net investment income by $4.4 million.

Net Investment Income Interest Rate Sensitivity (Apollo Investment Corp)

Net Investment Income

In the previous year, Apollo Investment’s pay-out ratio was 96.6%, indicating that the BDC covered its dividend payments with net investment income. In the previous year, the company’s net investment income ranged from $0.33 to $0.42 per share, which was more than enough to cover the $0.36 per share quarterly distribution. Last year’s quarterly payments of $0.36 per share included $0.31 in regular cash dividends and $0.05 in supplemental cash.

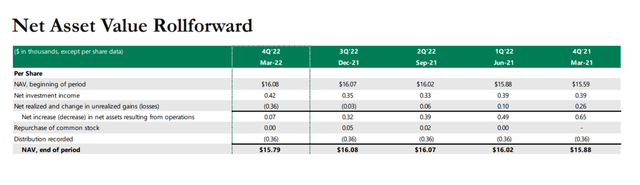

Net Asset Value Rollforward (Apollo Investment Corp)

P/B Multiple

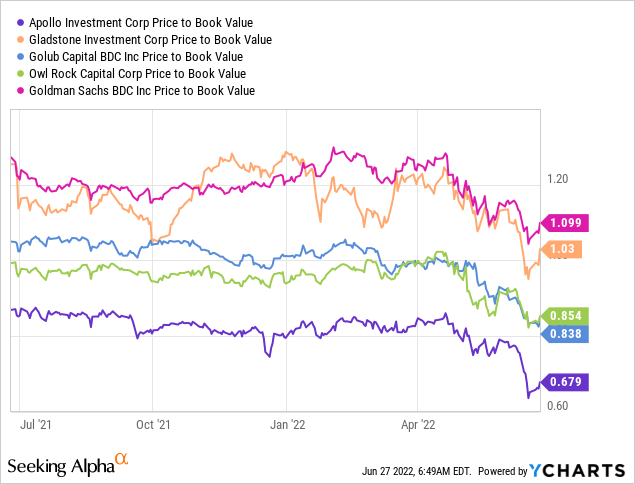

Apollo Investment’s book value discount has widened, as has that of other business development companies. The reason for this is likely that investors expect the United States economy to enter an official recession, but higher interest rates may also have contributed to the widening of Apollo Investment’s book value discount.

AINV trades at a 32% discount to book value, with a current price of $10.74 and a book value of $15.79 per share. Purchasing AINV stock today implies a dividend yield of 11.6% based on regular cash distributions.

Why Apollo Investment Could See An Even Lower Valuation

Discounts to book value can quickly spiral out of control if the market anticipates a major recession that will result in significant loan and book value losses. Although Apollo Investment has a diverse portfolio, market risk cannot be diversified.

In the short term, the book value discount could grow even larger if investors factor in a recession, higher non-accruals, and book value losses when valuing Apollo Investment.

My Conclusion

A number of business development firms are currently for sale, including Apollo Investment.

The BDC is well-managed, has a diverse portfolio with a focus on highly secured debt, and Apollo Investment pays out dividends with net investment income.

The significant discount to book value is probably the best reason to consider Apollo Investment for a yield-focused investment portfolio designed to generate recurring income.

Be the first to comment