Torsten Asmus

Intro

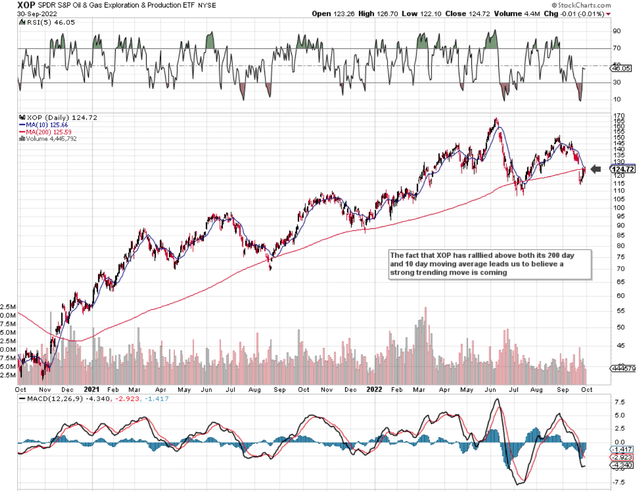

Shares of SPDR S&P Oil & Gas Exploration & Production ETF (NYSEARCA:XOP) are about to break above both the fund’s 200-day moving average and the 10-day moving average. This is noteworthy given both of the above-mentioned moving averages currently reside around the $125 mark. As we can see from the chart below, the 200-day moving average has provided solid support in XOP for quite some time now and the ETF is also in its timing band to reverse higher from short-term oversold conditions. History tends to repeat in markets which is why we expect XOP to push on from its present level. Risk-averse traders here can wait for a bullish crossover of XOP’s MACD indicator which should coincide with the associated Histogram moving into positive territory.

XOP In Bullish Mode (Stockcharts.com)

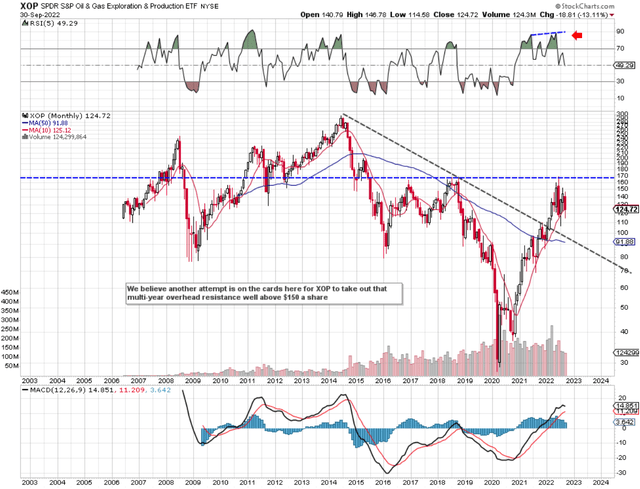

Our bullish expectations in XOP essentially come from its long-term chart. Although long-term charts are not useful for determining entry and exit points, they are useful for determining the major trend due to the sizable amount of information one is able to digest. As we can see on the chart below, shares convincingly broke through their multi-year downcycle bearish trendline around the start of the year before finally topping out at the fund’s 2018 highs in June of this year. However, the bullish RSI divergence leads us to believe that another assault is coming at that overhead multi-year resistance. Momentum in the fund is actually accelerating with the fund delivering a 30%+ return over the past 12 months which is well ahead of the three-year average return which comes in just below 18% at present.

XOP Long-Term Chart (Stockcharts.com)

Momentum

The strong momentum in XOP stems from the fund’s increase in assets under management. AUM has increased by almost 14% over the past 30 days alone which is actually a higher percentage when compared to the past six months. Suffice it to say, this momentum is driving the fund forward, and with the technicals in alignment, we believe a strong trending move will ensue from here.

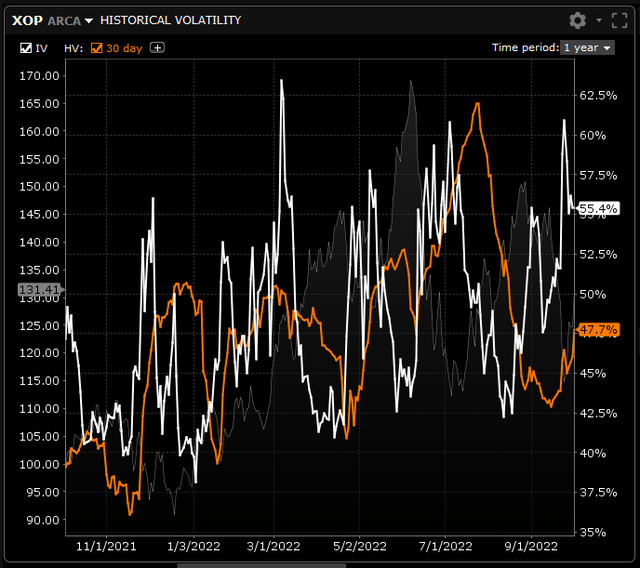

As we can see below, implied volatility in XOP is trading well above historical norms as well as the fund’s historical volatility. This means (if one wants to trade XOP’s options) selling the fund’s options is preferable to buying the ETF’s puts or calls. Therefore, one could simply sell naked puts or put spreads or even put on a broken wing call butterfly to play this expected move in the fund. We have decided though to go the iron condor route which is an excellent way to take advantage of XOP’s implied volatility. Let me explain.

XOP Implied Volatility V Historic (Interactive Brokers)

Iron Condor Option Strategy

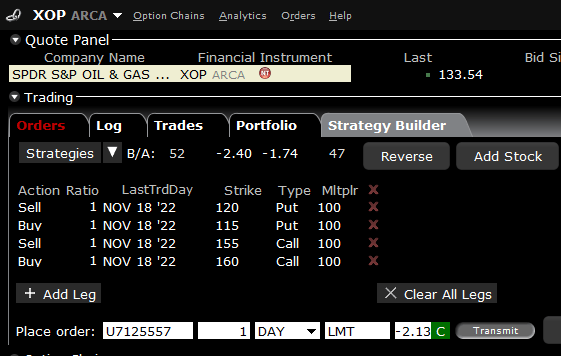

First of all, since an iron condor is the combination of both a put spread and a call spread, its risk is absolutely defined. Although this strategy’s probability of profit is lower than say a put credit spread (due to taking risk on both sides), our overall dollar risk in the position is lower because we take in more premium at order entry. The wider we set up the iron condor, the more it will act like a strangle (an undefined risk position). When it comes down to it, iron condor traders are primarily risk-averse traders.

The advantage of the iron condor is that when it is put on with ample time to expiration (something like two months meaning there is plenty of extrinsic value in the options), it is a very slow-moving position that cannot really hurt us in a significant way as we cannot be wrong on both sides.

Furthermore, in order to justify a bullish stance, we can skew the position to the upside to ensure there are positive overall deltas in the position. In fact, below is a $5 wide iron condor in XOP which expires on the 18th of November and is skewed to the upside (long deltas on the put side surpass the short deltas on the call side). The risk in the position is just under $300 per condor, but because we take our positions off well before expiration, the maximum dollar amount risk on any condor position very rarely gets exercised. Suffice it to say, the iron condor is the perfect strategy for the risk-averse trader who prefers to place vega (volatility) and theta (time decay) before delta (direction) in terms of priority in their trading.

XOP Iron Condor (Regular November Cycle) (Interactive Brokers)

Conclusion

Based on XOP’s technicals and AUM growth, we believe the ETF will keep on rallying from its present levels. Therefore, we are looking at a skewed iron condor that will take advantage of both delta and vega over the next few weeks. We look forward to continued coverage.

Be the first to comment