winhorse/iStock Unreleased via Getty Images

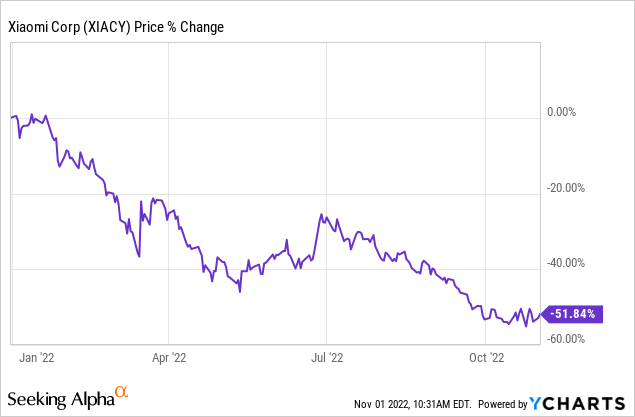

Xiaomi Corp (OTCPK:XIACF, OTCPK:XIACY) is a consumer electronics company that sells smartphones and smart hardware, connected by its IoT platforms. Xiaomi operates a B2C model and sells its products through third-party e-commerce sites and DTC (through its own website and physical stores). Over the past year, its share prices have fell over 50% as a result of geopolitical and macroeconomic factors.

In this article, I will elaborate on why Xiaomi’s core business remains robust and that its fundamentals are quietly improving for long term success. Finally, I will address why I believe that Xiaomi’s strategy is relatively in tune with that of China moving forward, and this should facilitate its value unlocking potential moving forward.

Business Overview & Segments

As a quick introduction, Xiaomi Corp is a consumer electronics company that sells smartphones and smart hardware, connected by its IoT platforms. Xiaomi operates a B2C model and sells its products through third-party e-commerce sites and DTC (through its own website and physical stores).

Xiaomi has three main business segments: smartphones, IoT products and internet services. Xiaomi operates a dual branding strategy for its smartphones – Xiaomi brand produces upper-range phones while Redmi produces entry-level and mid-range devices between 1000-3000 yuan. All phones run on Xiaomi’s own operating system, MIUI. For IoT, Xiaomi sells a wide variety of internet devices ranging from smart TVs, electric scooters, vacuum cleaners. All of these can be controlled from a single Mi Home app. Finally, internet services are earned from preloaded apps on Xiaomi phones, advertising and other digital services like e-commerce & streaming.

Revenue Breakdown

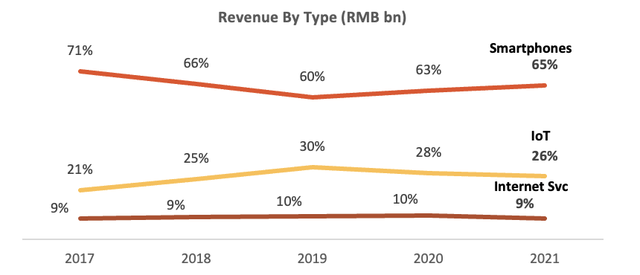

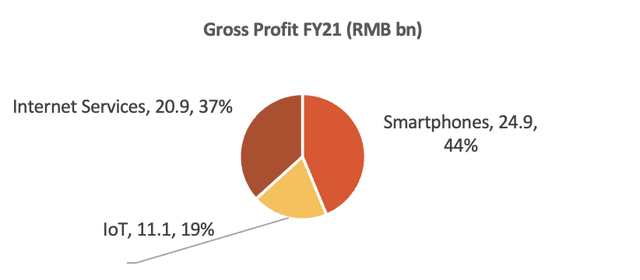

In FY21, smartphones made up the bulk of Xiaomi’s revenue at 63%, followed by IoT products at 26%, more than internet services with 8%. Despite contributing the least revenue, internet services has the highest gross margins at 75% in FY21, consequently being a key driver of gross profits. On the other hand, smartphones & IoT only have gross margins slightly above 10%. Geographically, China and overseas revenue make up almost a 50/50 split with the latter growing at a faster pace than domestic.

Xiaomi Revenue By Business Segment (Xiaomi Annual Reports)

Xiaomi Gross Profit Breakdown FY21 (Xiaomi 2021 Annual Report)

Therefore, we can see that at the heart of Xiaomi’s business model, driving long term growth in internet services is key to margin expansion of the business. With a self-imposed 5% profit margin cap on hardware (smartphones & IoT), this makes Xiaomi’s products affordable to the masses, creating a low barrier to entry to Xiaomi’s ecosystem. Once customers are accustomed to Xiaomi’s products or find value in them, they would subsequently purchase more hardware (e.g. various smart home devices, watches, upgrade a new Xiaomi phone) which further locks them into the ecosystem. Eventually, Xiaomi aims to bring more users into this ecosystem and monetise user time on their Xiaomi devices through methods like advertising. Given high internet services margin, this will be the true long term profit driver for the company.

Industry Analysis & Competitive Positioning

Xiaomi operates in two key industries:

- Global & China Smartphone

- Global & China Consumer IoT

For the former, global smartphones are expected to fall 6.5% in 2022 as consumer demand for technology dips amidst inflation and poor macroeconomic conditions. However, demand is expected to recover from 2023 and grow at a CAGR of 4% through 2026. Average Selling Price [ASP] of smartphones will rise 6% in 2022 and fall at a 2.5% CAGR till 2026 as 5G smartphones start to become more affordable as more players ramp up 5G production. In China, the smartphone industry has also seen weakness in 2022, with shipments falling by over 10% in 3Q22, setting the tone for the final quarter. However, smartphone demand is expected to recover and grow at a 13% CAGR through 2029, largely driven by demand for premium smartphones.

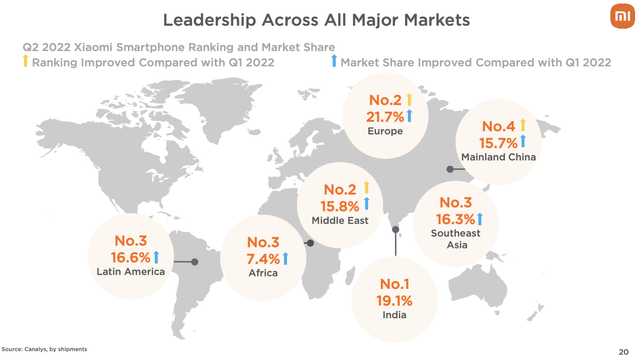

Xiaomi is respectively the 3rd and 4th largest smartphone manufacturer globally and in China, with Apple and Samsung the two key rivals internationally, and Chinese companies like Huawei, Vivo and Oppo putting strong pressure in China and India.

Xiaomi Global Market Position (Xiaomi 1H22 Investor Presentation)

For the consumer IoT segment, I will include both the smart home and wearables industry for my analysis given that most of Xiaomi’s IoT products fall under these two categories. When combined, both industries will grow at an average CAGR of 17% through 2028. Individually, smart homes has an industry CAGR of 20% whereas wearable tech has a CAGR of 13%

The consumer IoT sector is currently still very fragmented, as many companies only target one particular area of the market. For example, wearable tech competitors include other smartphone giants like Apple and Huawei, while smart electronics rivals include Midea, Honeywell and LG. Xiaomi also faces different competitors for different product e.g. it competes with Dyson for their vacuums but does not have any other similar products. Therefore, in terms of product breadth, Xiaomi does not have any strong competitor that can compete across all product lines given its over 5000 products consumer IoT portfolio.

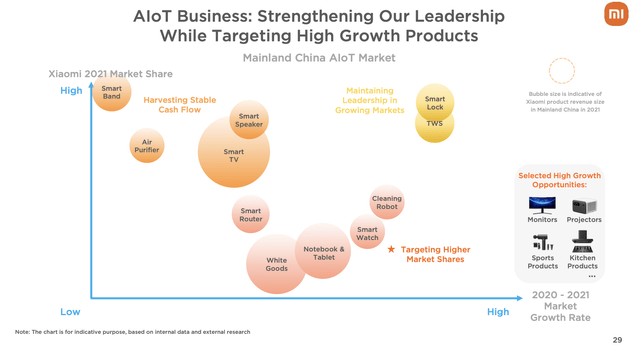

Selected IoT Products & Their Market Positioning (Xiaomi FY21 Investor Presentation)

Thesis 1: Xiaomi’s well established value for money proposition and strong brand loyalty will result in resilient hardware sales amidst a poor macroeconomic environment

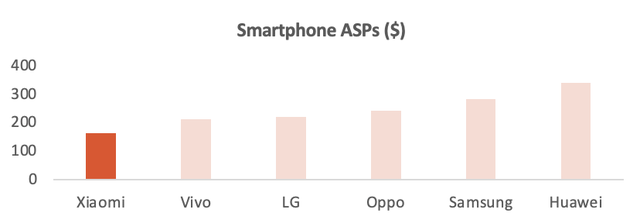

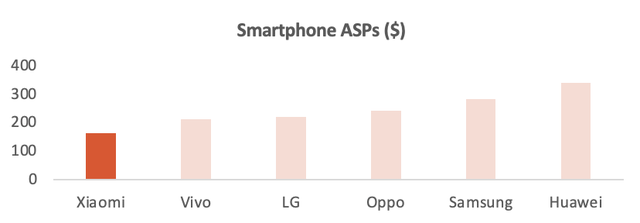

Now, I will begin to elaborate on my thesis. As mentioned, Xiaomi has a self-imposed 5% profit margin cap on its hardware. Consequently, Xiaomi has the lowest ASP among top smartphone brands.

Smartphone ASPs Across Brands (Compiled From Strategy Analytics)

Despite low prices, Xiaomi is still known for producing high quality products. Based on consumer feedback on Tmall, smartphones are known for durability, strong MIUI OS while IoT devices are sleek and sturdy. This is further reflected by Xiaomi having the highest Net Promoter Score (NPS) against its both smartphone & IoT rivals, trailing only Apple. Data is obtained from Comparably.

|

Brand |

Score |

1Y Trend |

|

Xiaomi |

48 |

Increasing |

|

Huawei |

41 |

Decreasing |

|

Oppo |

20 |

Constant |

|

Vivo |

34 |

Decreasing |

|

Samsung |

23 |

Decreasing |

|

Apple |

52 |

Constant |

|

Honeywell |

14 |

Constant |

|

LG |

10 |

Constant |

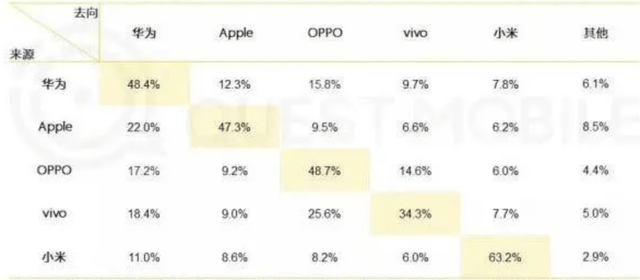

Beyond a value for money product, Xiaomi has also nurtured a growing grassroots fanbase, constantly being connected with them and co-designing products together. This has resulted in very strong brand loyalty, with 63% of Xiaomi users planning to purchase Xiaomi again as their next phone – the highest among all brands including Apple!

Consumers Next Smartphone Preference (GizChina)

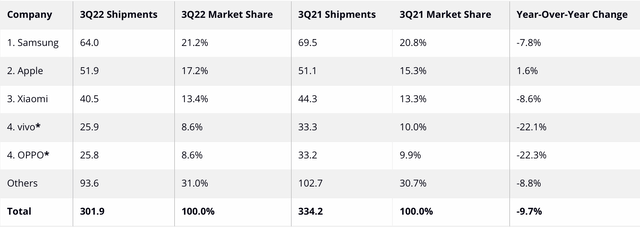

As macroeconomic conditions worsen around the world, I believe that these two factors could help Xiaomi withstand falling demands. McKinsey noted that in 2009, the recession had let to consumers purchasing lower priced items, only to realise that they were value for money and stuck with those brands post-recession. The best performing phones in that period was also the lower priced Nokia & Blackberry, which allowed both companies to beat earnings expectations. Similarly, Xiaomi’s smartphone sales has also shown resilience in the past quarter. In 3Q22, IDC reported smartphone shipments down 9.7% y-o-y. While Xiaomi’s shipments also fell, it dipped to a lower extent than the market by 8.6%, gaining market share in the process. On the other hand, its Chinese rivals like Oppo and Vivo saw over 20% decreases in shipments.

3Q22 Smartphone Shipments (‘IDC’)

In the longer run, Xiaomi’s lower price points and strong brand name would facilitate expansion into underpenetrated smartphone regions such as Western Europe and India, which generally have lower consumer spending. This consequently increases Xiaomi’s smartphone shipments and market share and enables them to bring in more consumers into their ecosystem, where they can subsequently monetize through upselling IoT products and/or their higher margin internet services. Hence in my model which will be discussed below, I will forecast growing smartphone and IoT market share from 13% in FY22 to 16.5% in FY31 and 5.6% to 6.5% respectively. This is still conservative as Xiaomi will only become the 2nd largest smartphone maker by FY31 despite its goals to become the largest within 3 years. IoT market expansion is also smaller due to the unconsolidated nature of the market.

Thesis 2: Success of smartphone premiumisation strategy will expand Xiaomi’s TAM drive higher ASP in the long term

Next, Xiaomi has embarked on a smartphone premiumisation strategy, aiming to produce higher end smartphones to gain a foothold on Apple and Samsung in this rapidly growing sub-market. This is a logical move, given that Xiaomi has historically been producing lower-end phones, and its wavering market share in recent years can be attributed to growing demand for premium phones with top notch features (e.g., high quality cameras) in which they did not really focus on.

Most recently, Xiaomi launched its Mi 12 series, priced from CNY 3900. Its ultra version features a 200 megapixel camera in partnership with Leica, amidst bigger displays and ultra-fast charging – key functionality upgrades of premium phones. The line has shown strong success, exceeding 1.8 billion yuan in sales within 5 minutes. In the 2Q22 call, management also noted premium market share gains ~3%.

Independent tech journals from abroad touted Mi 12’s speed, screen and computing power and noted that Xiaomi could easily compete with Apple and Samsung in these aspects. Some extracts include:

Xiaomi can compete with the best mobile phones on the market in terms of speed, feel and screen, and it is a real rival of Samsung … with all-round success!” – German media ComputerBILD

… the phone’s chip and GPU computing power are stronger, we have reason to believe that Xiaomi The 12 Pro has probably the best imaging system out there.” – Spanish media “Pioneer”

Therefore coupled with the two key advantages in Thesis 1, I believe that Xiaomi’s premiumisation strategy will succeed and this will increase the average ASP since the base price of Mi 12 is triple that of the overall ASP. Hence, Xiaomi’s dual branding strategy will drive growth in two areas. Lower priced Redmi will drive volume, while higher priced Xiaomi will grow ASPs, and this will be material given that Xiaomi’s ASP starts from a very low base. Hence, I will project smartphone ASP growth to increase from 2% in FY22 to 7% in FY26 as premiumisation succeeds, and taper back to 2% in the terminal year (Figure 5). 7% is a reasonable and conservative target as it is the growth rates recorded by Xiaomi pre-pandemic, which has not even included the effects of premiumisation!

Xiaomi Historical & Forecasted ASP (Xiaomi Annual Reports, Author’s Estimates)

Thesis 3: Overseas and premium smartphone users will increase the monetisation potential of Xiaomi’s high margin internet services segment, which will result in segment ARPU growth and company margin expansion

Finally, as Xiaomi continues to grow smartphone and IoT shipments, this will eventually bring in more consumers to the high margin internet services segment. With over 70% of revenue derived from advertising, internet services gross margins have the potential to exceed 80%, when referring to the advertising segment of Meta (META) and Pinterest (PINS).

Although internet revenue has stagnated in 2022 due to an advertising slowdown, Xiaomi’s fundamentals still remain strong. MIUI MAUs continued growing by 15% y-o-y, and it will only continue to increase with successful execution of hardware strategies as mentioned in Thesis 1 and 2. While economic conditions may fluctuate over time, growing MAUs is now still the most important health metric for this segment as they will provide a larger monetisation base for Xiaomi in the long run.

There are also two key drivers of internet services ARPU growth beyond just growing MAUs. First, overseas Xiaomi users still have a huge monetisation runway. Despite being 80% of MAUs (547/687m), overseas internet revenue accounts for <25% (1.7/7.1bn) of the segment in 2Q22. This is because Xiaomi has only started active monetisation for overseas devices in the past few years, as its focus has been increasing user adaptation in the early years. This would also explain why ARPU was falling in the past three years as Xiaomi was more focused on bringing in more people into the ecosystem. Moving forward, I expect strong successes in overseas monetisation given that Xiaomi has already seen strong success in China, and the fact that overseas revenue has responded positively, growing 50% in the past two years.

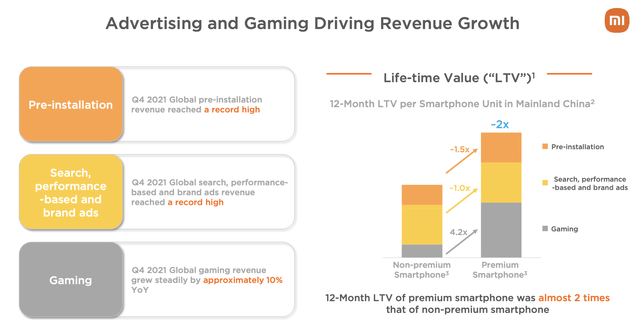

The next driver would be premium users. According to Xiaomi, premium smartphones have shown to have 2x LTV than non-premium, and this will likewise increase internet services ARPU as premiumisation succeeds. Hence while MAU growth rates will inevitably slow, given the huge base, I expect that ARPU will start to grow strongly from FY25 from 5% to 15% as Xiaomi starts to actively monetise across all user types and base. By FY31, this represents ARPU of ~101 RMB of US$18, which is conservative given that Apple’s current services ARPU is already US$36.5.

Xiaomi Premium Users LTV (Xiaomi FY21 Investor Presentation)

Valuation

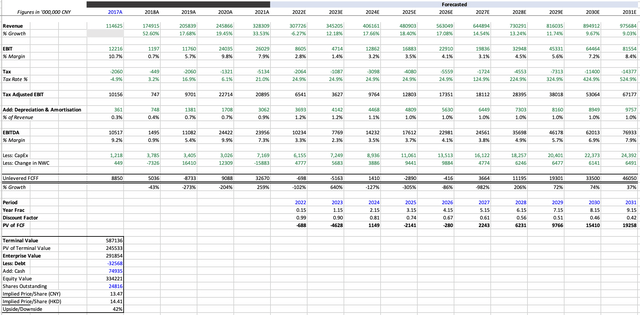

Onto valuation, I used a 10 year Gordon Growth DCF. The forecast period was chosen to be 10 years to allow for monetisation in the internet services segment to play out while smartphone growth comes down to 2%, or long term inflation rate eventually. Xiaomi should also be a relatively mature company in 10 years time to exit at a long term inflation rate. Additionally, other ventures like EVs were not accounted for, to remain conservative.

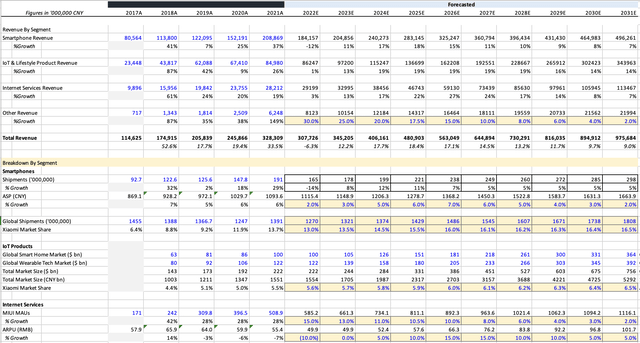

The revenue growth assumptions have been stated along with my thesis and flow down into my revenue model as follows:

Xiaomi Revenue Model (Author’s Estimates)

Smartphone segment was broken down into shipments multiplied by ASP, and Xiaomi’s shipments would be estimated by their forecasted market share. Similarly, IoT revenue is calculated using Xiaomi’s forecasted market share of the combined smart home and wearable tech industry. Finally, internet services revenue is calculated using MAUs multiplied by ARPU.

Other Assumptions & Inputs

Beyond revenue assumptions, the following are some other key inputs used in my model. Free feel to chat with me should you want to know more about each of these data.

- FY22 costs as a percentage of sales were taken to be the 1H22 figures to be conservative. In reality, costs should dip slightly in 2H as supply chain and chip pressures slowly subside

- Gross margin for smartphone, IoT, internet services fell 350bps, 400bps and 500bps respectively from FY22 to terminal year

- Operating expenses as a % of revenue spike in FY22 as revenue falls, but tapers down to terminal year. Selling & marketing remains elevated to pre-covid due to Xiaomi’s offline expansion while R&D expenses account for Xiaomi’s planned 100bn expenditure over the next five years

- Risk free rate of 2.7% was used (China 10Y bonds)

- Equity Risk Premium of 6%, the highest rate in 2022 to be conservative

- Beta of 1.31

- Cost of Debt was taken from Xiaomi’s most recent 10Y bond issuance at 3.38%

Finally, a WACC of 9.65% was obtained but I used 10% in my model for added conservativeness. Through the DCF, a target price of HKD 14.41 was obtained, representing a 42% upside. Note that this TP is for the Hong Kong listing, HKG:1810.

Xiaomi DCF (Author’s Calculations)

The Chinese “Risk”

Although the upside is high, I believe that many investors would still have some level of concern surrounding the fact that Xiaomi is a Chinese company. However, I believe that Xiaomi’s business model and strategy does not go against the direction of the authorities hence they should be relatively safer than other tech stocks, for investors to ride on a potential China market recovery.

There are a number of reasons. First, Xiaomi is listed in Hong Kong hence has no US delisting risk. Next, Xiaomi has over 90% of its suppliers in the mainland, isn’t a monopoly in any market and has the most competitively priced hardware for phone & IoT. This makes Xiaomi less likely to be affected by anti-monopolistic laws and potential geopolitical supply chain issues. Finally, Xiaomi would directly benefit from Common Prosperity and economic stimulus measures. Given that Xiaomi is a consumption dependent company with different tiered products, it should benefit from rising income levels of the lower to middle class as they would start to trade up smartphones and purchase more home improvements like IoT products. Given that China is moving away from real estate as a driver of growth, towards consumption, economic stimulus would directly increase the spending power of Xiaomi’s consumers, resulting in higher demand for hardware.

Conclusion

In summary, amidst an unfavourable economic condition and sentiment towards Chinese companies, I believe that Xiaomi remains a very resilient company that is poised for long term margin expansion and growth, given that their user base is still growing. While short term pain may persist, both in terms of income and sentiment, Xiaomi is a company that will do well in the long run. Using a very conservative DCF, the company still has an upside of over 40%, which provides a huge margin of safety.

Finally, key metrics I would be looking at to continue monitoring Xiaomi’s fundamentals would be: 1) Market share growth in smartphones & IoT, 2) Increasing ASP of smartphones, 3) Internet ARPU growth.

Be the first to comment