peterschreiber.media

The important thing is not to stop questioning. Curiosity has its own reason for existing. ― Albert Einstein

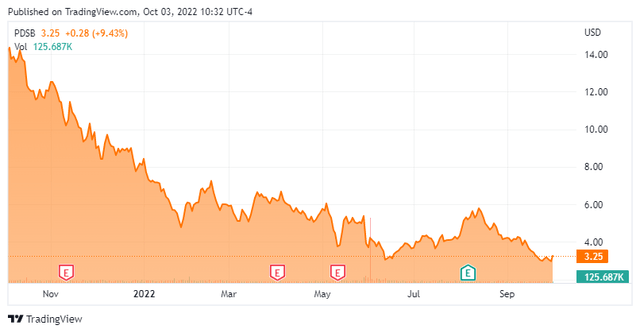

Today, we take our first look at PDS Biotechnology (NASDAQ:PDSB). The stock is down some 75% over the past year even with some positive analyst coverage as the company advances its oncology focused pipeline. An analysis follows below.

Company Overview:

PDS Biotechnology is a clinical-stage biopharmaceutical company based just outside of New York City in Florham Park, NJ. The company is focused on developing multifunctional cancer immunotherapies. The stock currently trades just over three bucks a share and sports an approximate market cap of $85 million.

June Company Presentation

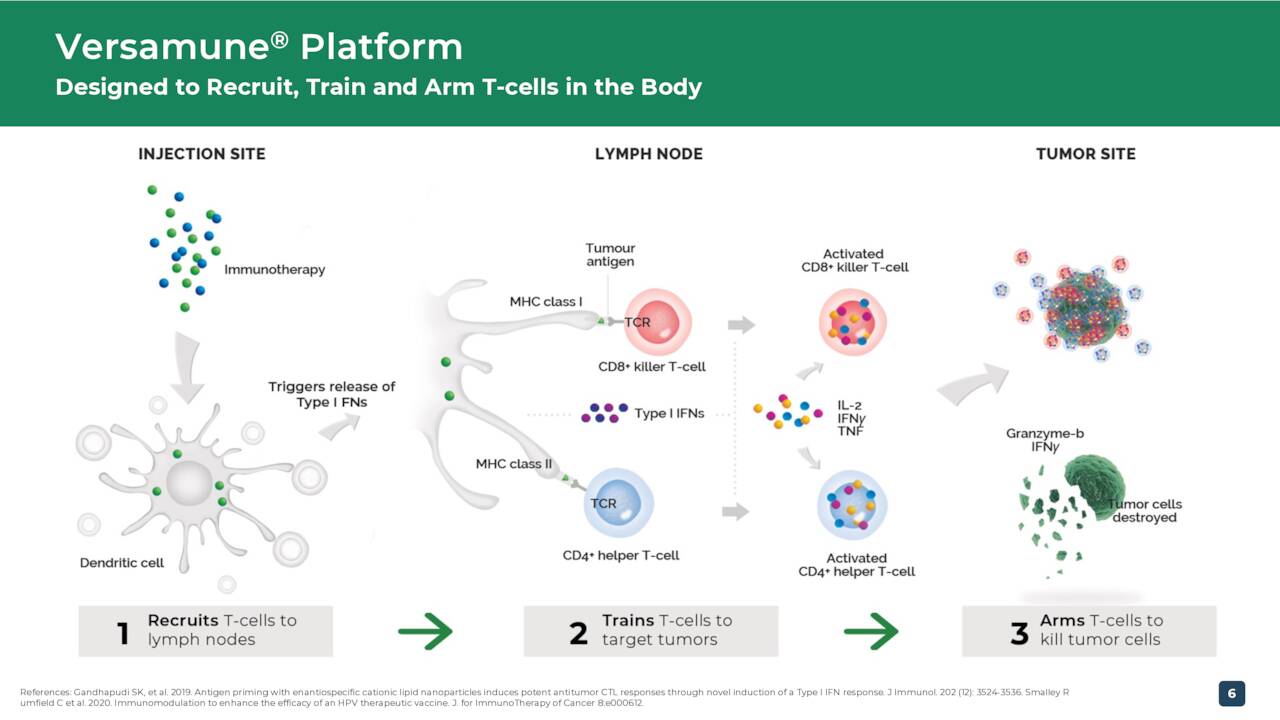

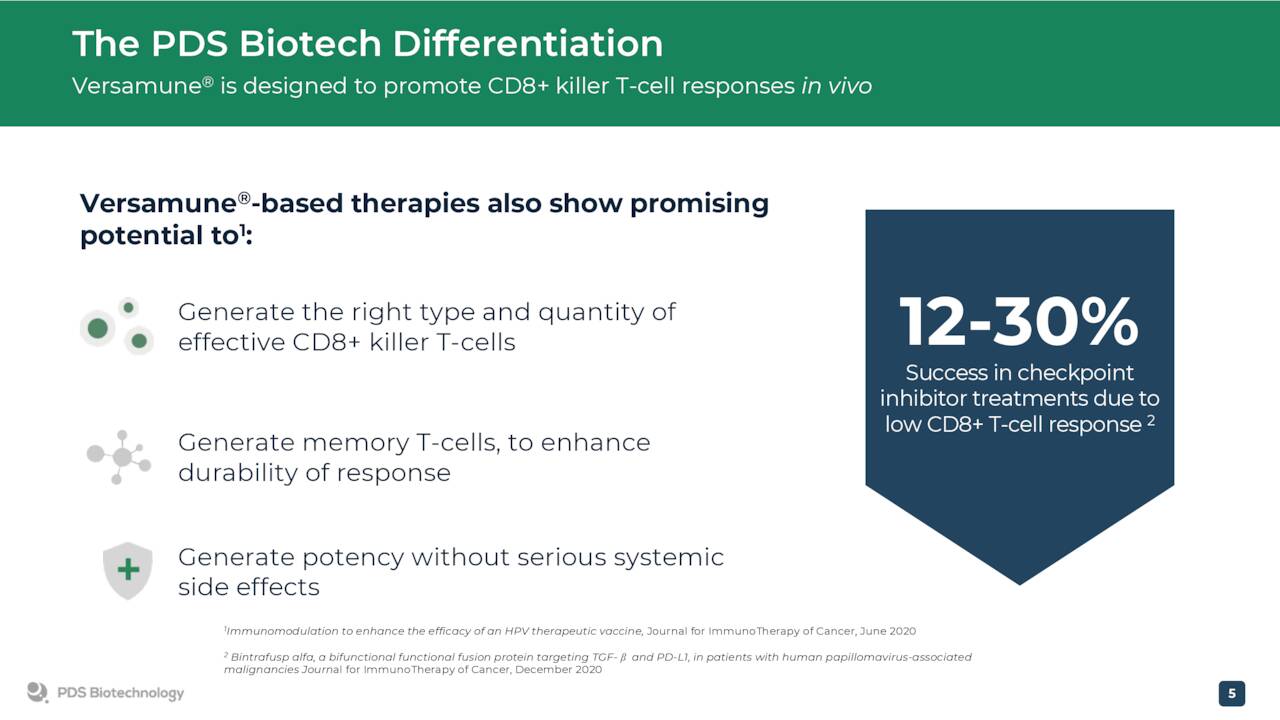

The company is developing product candidates off its proprietary Versamune platform which ‘trains’ the immune system to unleash a powerful and targeted T-cell attack which managements can dramatically improve treatment and patient outcomes across the cancer spectrum.

June Company Presentation

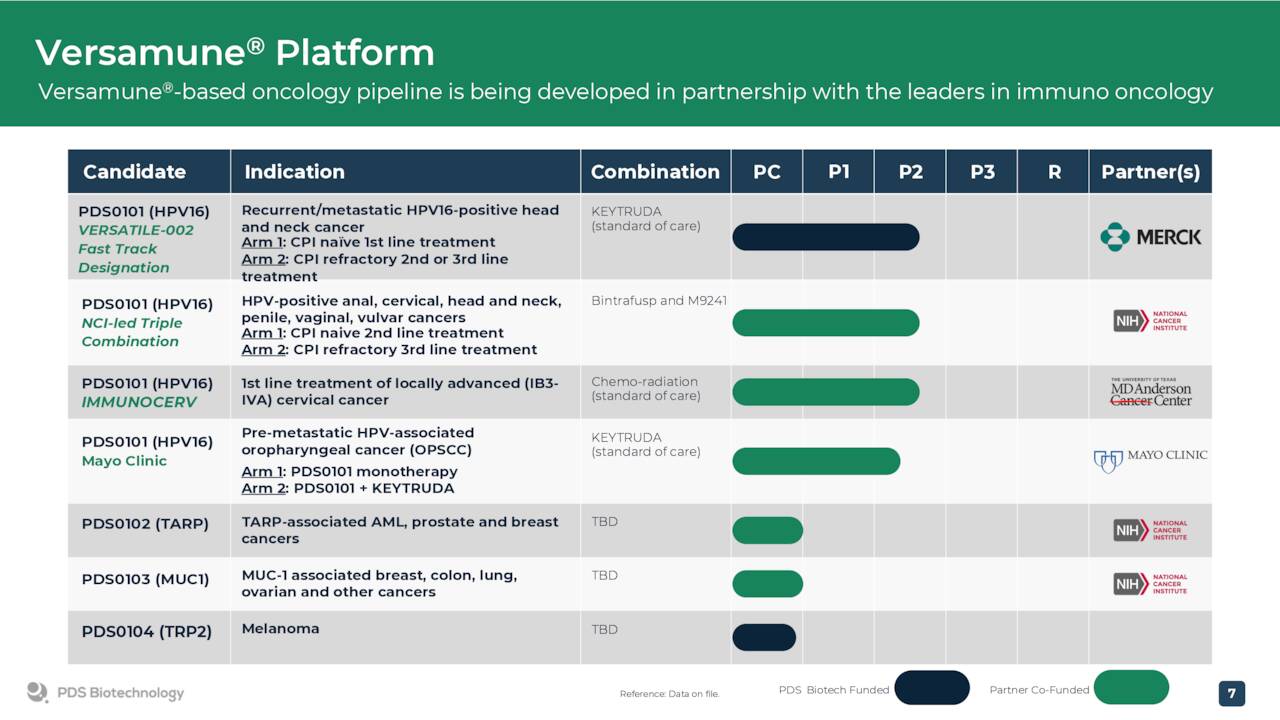

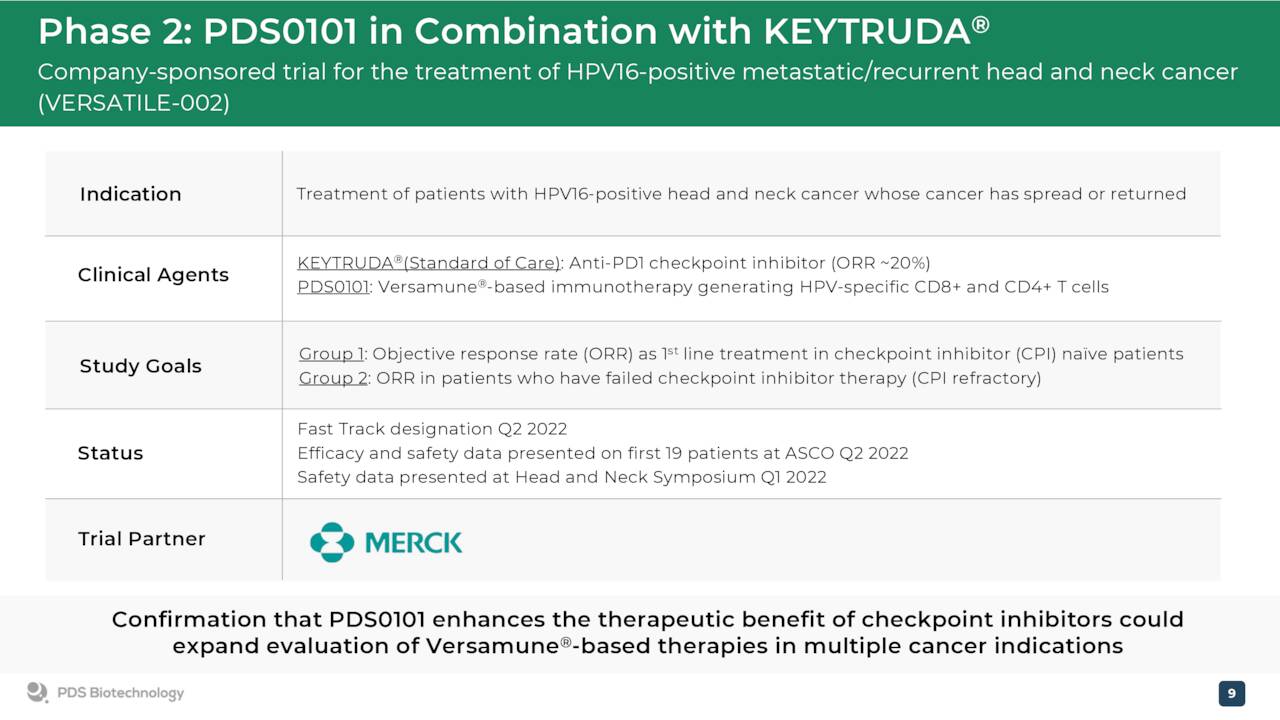

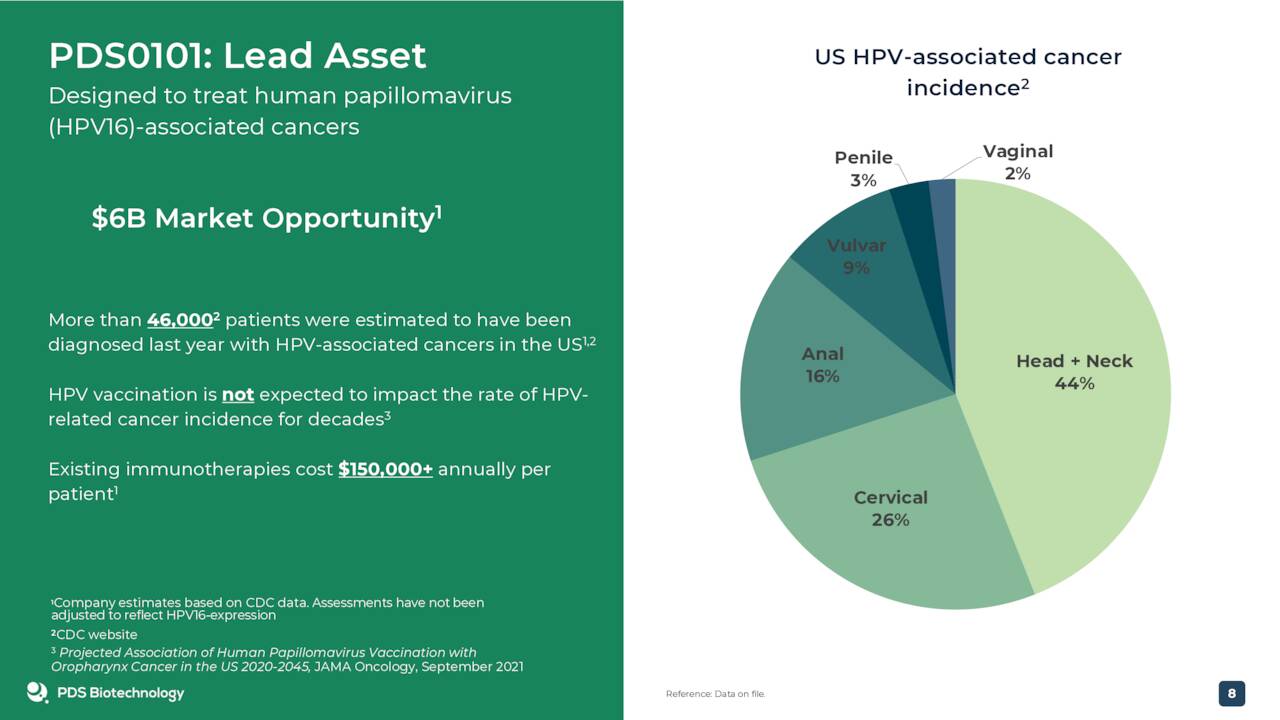

The company’s primary drug candidate is dubbed PDS0101. It has Fast Track designation within as a combo therapy with Keytruda for recurrent or metastatic HPV16-positive head and neck cancer. PDS0101 was created by combining the company’s proprietary human papillomavirus, HPV16 antigens (the most prevalent HPV type in HPV-associated cancers) with the Versamune platform.

June Company Presentation

The company disclosed good news on the development front Monday. Management announced that the FDA is allowing it to move into a registrational trial ahead of our projected schedule for recurrent or metastatic HPV16-positive head and neck cancer in combination with Keytruda.

June Company Presentation

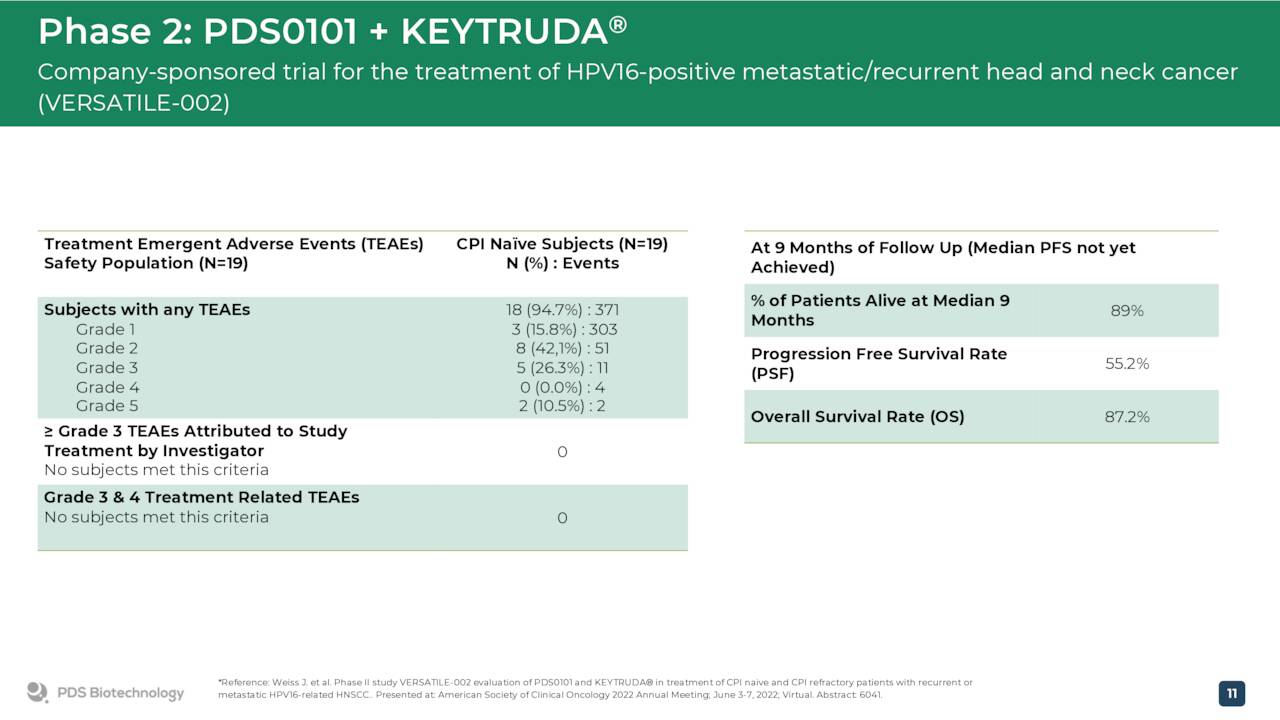

This follows a meeting with the government agency where the company presented interim safety and efficacy data from a Phase 2 trial ‘VERSATILE-002’.

June Company Presentation

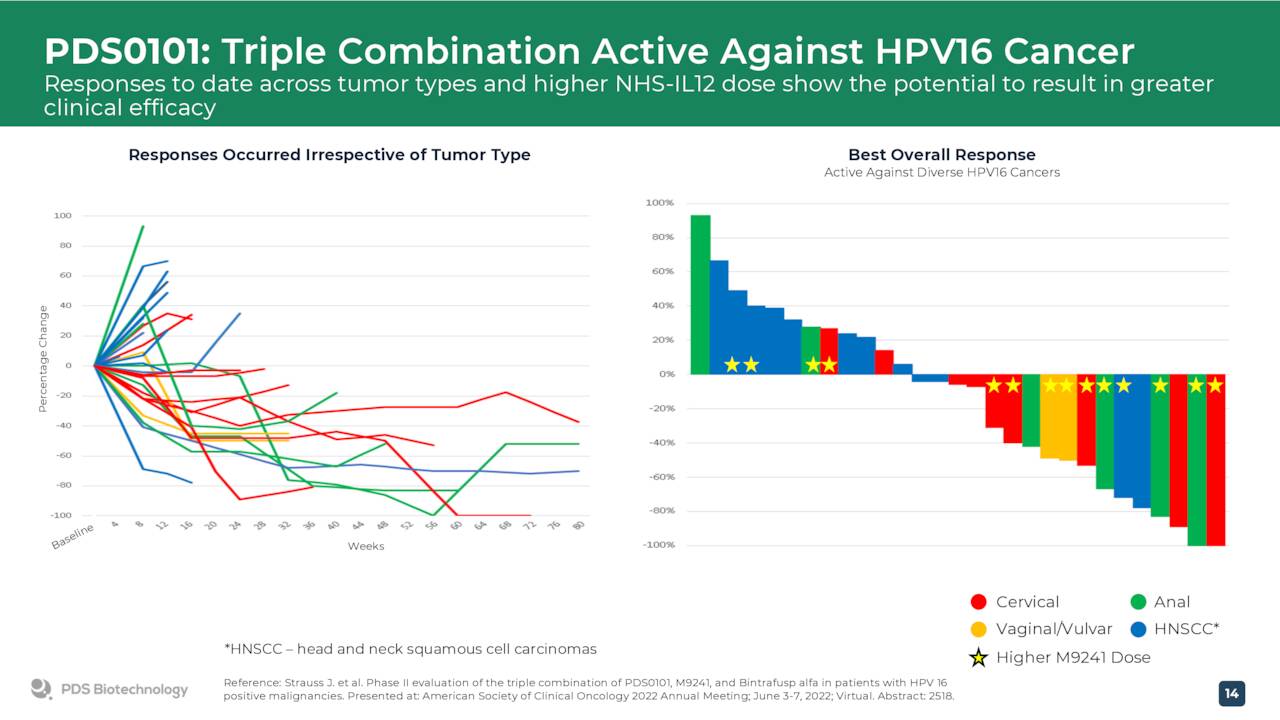

PDS0101 is currently in four total mid-stage trials. In the three most progressed studies, PDS Biotechnology is evaluating PDS0101 as a combination treatment with various anti-cancer agents in advanced and refractory cancers. One of these is a triple combination study that is evaluating PDS0101 in combination with a checkpoint inhibitor and NHS IL-12 in both checkpoint inhibitor naïve and refractory patients in a range of advanced HPV positive cancer patients who have failed prior therapy. Another trial is evaluating PDS0101 as a monotherapy or in combination with Keytruda in early stage oral cancer.

June Company Presentation

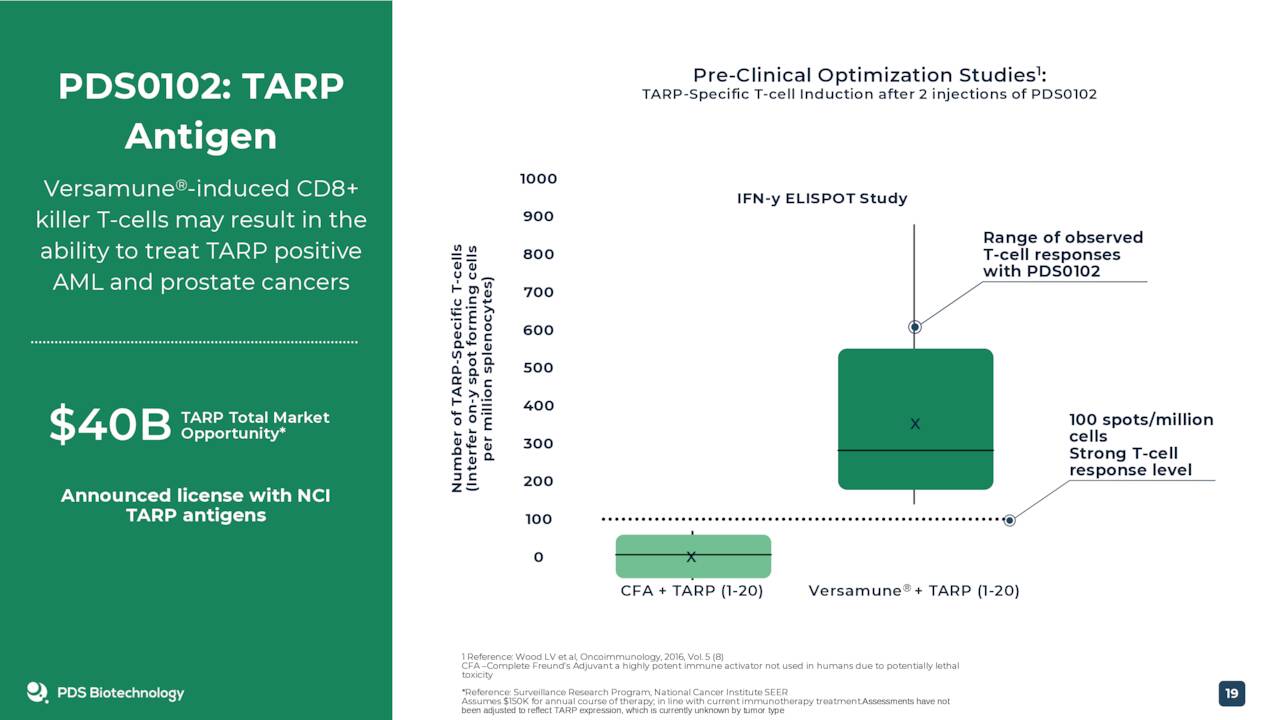

Two other compounds, PDS0102 and PDS0103, are currently in clinical stage manufacturing. However, these compounds are very early stage and development might be pushed as the company focuses on getting PDS0101 to commercialization. Therefore they are not germane to this analysis even if management believes they have great long term potential. The same goes for PDS0202, a potential flu vaccine in early stage development.

June Company Presentation

Analyst Commentary & Balance Sheet:

The analyst community is currently sanguine around the company’s prospects. Over the past five months, five analyst firms including Oppenheimer and Chardan Capital have reiterated Buy or Outperform ratings on PDSB. Price targets proffered range from $15 to $25 a share.

Approximately five percent of the company’s outstanding float is currently held short. There has been no insider selling in the stock so far in 2022. The company ended the second quarter with just over $50 million in cash and marketable securities on its balance sheet after posting a net loss of $5.8 million. PDS Biotechnology recently filed the prospectus for a $150 mixed shelf offering. The company has no long term debt.

Verdict:

June Company Presentation

PDS0101 lead indication for which it has fast track designation in combination with Keytruda has significant potential and now will be moving on into a registrational trial and hopefully future commercializing. Funding in place is sufficient for now given PDS Biotechnology’s quarterly burn rate, which it keeps low by partnering with other concerns like Merck (MRK) and the Mayo Clinic. Those costs will likely increase in coming quarters as the company moves closer to potential commercialization. I would not be surprised if the company does raise additional funding within in its recently filed shelf offering prospectus at some point in 2023.

Given its potential, technology platform, partnerships, analyst firm support and multiple ‘shots on goal‘, the company seem better than a dart throw and worthy of a small ‘watch item‘ position as this story develops.

Wonder is the beginning of wisdom. ― Socrates

Be the first to comment