Extreme Media

Description

I recommend buying Xometry (NASDAQ:XMTR). XMTR uses AI to power its on-demand manufacturing marketplace. It provides a marketplace where businesses can quickly and easily locate reliable manufacturers of unique parts and assemblies. Problems, such as increased demand, new technologies, and shifting supply chains, are plaguing the manufacturing sector. XMTR’s goal is to solve these problems by using AI to improve the way manufacturers find and connect with potential buyers and suppliers.

Company overview

XMTR is an on-demand manufacturing marketplace powered by artificial intelligence. With the help of its proprietary technology, XMTR has created a marketplace where buyers can easily find suppliers of custom manufactured components and assemblies on demand, and suppliers of manufacturing services can expand their operations.

The manufacturing industry has several inefficiencies that need to be solved

It’s no exaggeration to say that the manufacturing sector around the world is crucial to global economic growth. Several global thematic shifts, in my opinion, are priming the industry for accelerated digitization. The manufacturing sector faces a number of challenges, including high manufacturing demand, modern manufacturing technological advances, and changing supply chains, but there is a need for solutions that will boost efficiency and take advantage of these trends.

Further, SMEs account for the bulk of companies in manufacturing, and these SMEs have to contend with larger manufacturers. To give you an idea of how dispersed the industry is, consider that 98.6% of American manufacturers are considered to be small businesses, and that there are over 718,796 manufacturing businesses in the United States alone.

In my opinion, there are substantial hurdles for new SMEs manufacturers to overcome before they can succeed in the manufacturing sector. Examples of such obstacles include a lack of available funds and materials, isolation from other businesses, outmoded methods of marketing, and a lack of exposure to potential buyers. Due to the high level of concentration and time commitment needed for precision machining, I believe that most small manufacturers don’t have enough of either time or money to put into marketing in order to attract more customers or into improving their back-office capabilities in order to run their businesses more efficiently.

In addition, as more sectors move toward online purchasing, companies are searching for digital solutions to meet their needs in on-demand production. They actively seek out and consume material about developments in the manufacturing industry and related technologies, particularly material that can help them determine the most efficient and effective means of producing their products.

It is a complex and time-consuming process to source for manufacturing opportunities

I believe that the manufacturing sourcing and procurement process is complicated, ambiguous, costly, and time-consuming, for even the most shrewd purchasers and sellers.

Buyers typically commission unique designs as the first step in the classic manufacturing process. Regardless of the size of the order, the sourcing process for potential sellers still requires extensive research via traditional channels like phone calls and face to face meetings. After narrowing down their list of prospective vendors, buyers request for formal quotations, review the responses they receive, negotiate terms and prices with the best bidder, and finally formally inform the winning vendor of the opportunity. Price and delivery time estimates for individual orders often require several days or weeks to be finalized. Once these are done, the buyer is at the mercy of the seller and manufacturing process in terms of when the products will be shipped. The problem is, even though there may be a plethora of manufacturers to select from, buyers are often left feeling overwhelmed due to a lack of assistance or industry uniformity in areas such as project complexity, design, timeline, and cost.

For sellers, finding potential buyers through numerous marketing and sales channels is the first step in the conventional production process, followed by a number of preliminary checks and inquiries into the business. After obtaining and replying to quotations request, sellers must wait for responses before addressing any follow-up inquiries. Once the final price and terms have been negotiated and the awarded opportunity has been formally communicated, the seller is responsible for ensuring that all necessary equipment and materials have been ordered and reserved in time to complete the order. The problem is, selling to new customers and keeping existing ones is a time-consuming and resource-intensive process that can take focus away from production and ultimately cost more money.

Buyers and sellers are constantly on the lookout for more efficient ways to source demand and finish production, and I believe this presents a significant opportunity to simplify the complex, labor-intensive, and time-consuming sourcing process.

The company’s platform was built to solve inefficiencies with a strong flywheel effect

The XMTR platform caters to the needs of both buyers and sellers by providing them with a centralized location for price comparisons and product research, as well as access to a wide variety of sellers who can provide a wide range of customizable manufacturing processes.

In addition, the XMTR platform is powered by artificial intelligence. By carefully facilitating and analyzing the numerous interactions between both side of the platform, this technological platform is able to provide a superior experience from beginning to end. Machine learning algorithms developed by XMTR are fed information about completed marketplace orders in order to improve their cost and time estimations for future customers. The beauty with XMTR AI-powered platform is, the more customers there are on the marketplace, the more opportunities there are for sellers to make a profit, which in turn attracts more customers and accelerates the platform’s expansion. This is significant because as the XMTR platform expands, more data is fed into its machine learning algorithms, allowing the AI to continually learn and enhance the buying and selling experiences for both buyers and sellers. In addition, as the number of buyers and sellers on the XMTR platform grows, XMTR is in a better position to develop the specialized products and strategic alliances necessary to sustain the expansion of their business, thereby increasing both engagement and the effectiveness of the marketplace. Due to AI’s ability to reinforce itself, business opportunities for both buyers and sellers grow over time.

Also, the XMTR platform’s seller network provides a wide range of established and cutting-edge production techniques. In my opinion, XMTR is set up to rapidly scale and absorb any new processes that are brought to the platform by sellers, giving buyers the opportunity to gain access to highly tailored manufacturing solutions that are specifically designed to meet the demands of their specific industries.

Largest player in the industry with strong seller network

In terms of on-demand production, XMTR is superior to all other platforms in my view. XMTR benefits from a virtuous cycle as it grows because the marketplace’s activities produce data points and insights that strengthen XMTR platform, boosting strong unit economics. With the help of its global network of thousands of retailers, all of whom are well-versed in a variety of production techniques, XMTR has managed to maintain its dominant position. This, in my opinion, expands the demographic of potential XMTR customers.

Valuation

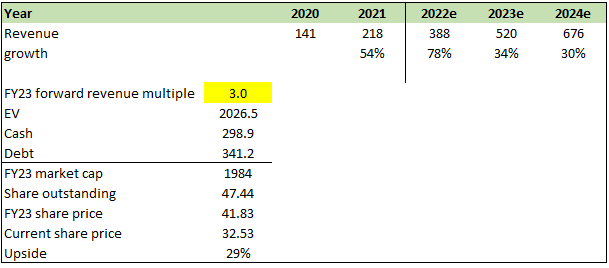

I believe XMTR is worth USD41.83 in FY23, a 29% increase from the time of writing. This graph is based on my model and the following assumptions:

- Revenue will meet expectations in fiscal year 2022 and will continue to grow at a healthy clip in fiscal years 2023 and 2024. I believe XMTR’s growth momentum will continue because it is the market leader and there are numerous opportunities for it to seize. However, due to the law of large numbers, I do not expect XMTR to grow as quickly as it has in the past.

- XMTR is currently valued at 3x forward revenue. If growth accelerates faster than consensus and I anticipate, the multiple could be higher. However, to be conservative, I use 3x forward revenue in my model.

Own estimates

Key risks

Supplier capacity

Many retailers rely on XMTR to bridge the gaps in their manufacturing schedule. Simply put, many machine shops strive for full utilization of all available production time in order to maximize profits. As the economy as a whole expands, there is a chance that regular customer orders will eat up more of that capacity, resulting in less time to work on XMTR new orders.

Execution risk

Companies that have recently gone public are typically younger and growing at a faster rate than more established businesses, making it all the more crucial to have appropriate recruitment, mentoring, remuneration, and management oversight in place. When sales aren’t closed as planned, it can lead to a drop in revenue that wasn’t anticipated, which in turn can drag on the stock price.

Summary

I think Xometry is worth more than its current share price. Many inefficiencies exist in the manufacturing industry, particularly among SMEs, which account for the vast majority of manufacturers. These SMEs frequently face obstacles such as a lack of funding and resources, isolation from other businesses, antiquated marketing methods, and a lack of exposure to potential buyers. For both buyers and sellers, the manufacturing sourcing and procurement process can be complicated, costly, and time-consuming. XMTR aims to address these issues by providing a platform that simplifies the process of finding and connecting with manufacturers, allowing both buyers and sellers to find opportunities and expand their operations more easily.

Be the first to comment