Jorge Villalba

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) is facing growing EBITDA and margin pressure in the fourth-quarter as cargo shipping rates made new 1-year lows last week. With economic clouds gathering over the global economy, shipping companies servicing global shipping lanes appear set for more pain in 2023. Although ZIM Integrated Shipping Services has a strong balance sheet and a favorable leverage ratio, investors are likely going to continue to catch a falling knife here if economic conditions worsen and the container freight industry experiences an earnings recession in 2023 – which appears increasingly likely!

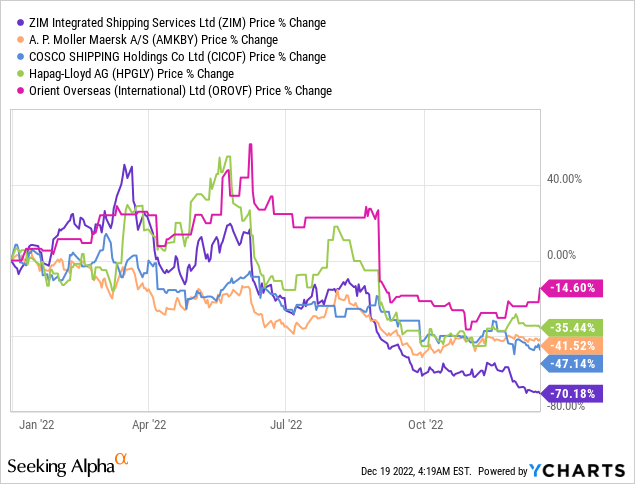

ZIM Integrated Shipping Services’ Stock Price Performance

Shares of ZIM Integrated Shipping Services have done exceptionally poorly in 2022, losing about 70% of their value. Since reaching an all-time high at $91.23, ZIM has corrected 81% to the downside, inflicting huge losses on investors that bought into the container shipping company at the height of the shipping boom when cargo freight rates exceeded $10 thousand per 40-foot container. Other companies in the shipping industry have also done poorly, which attests to the weakening fundamentals in the sector. By losing 70% of its value in 2022, ZIM has already been a falling knife…

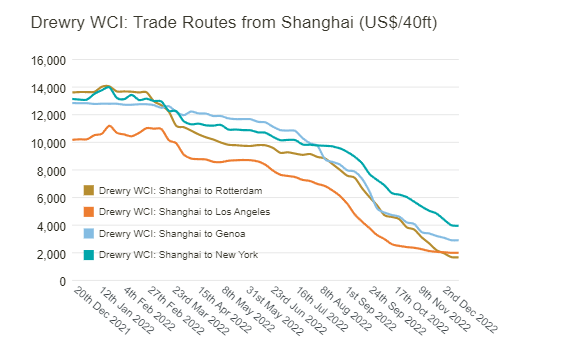

Container freight rates for global trade routes continue to be under pressure

The big driver of ZIM Integrated Shipping Services’ decline has been the drop in container freight rates which, as of Dec. 15, 2022, dropped to $2,127 per 40-foot container. Freight rates skidded only 1% week-over-week, however, which may indicate that the decline in shipping rates is at least somewhat moderating. Since shipping rates peaked in September 2021, the price of shipping a 40-foot container has decreased by a massive 80%, which is fundamentally reshaping the industry’s prospects for EBITDA and earnings growth.

Cargo rates for popular shipping routes have all been in free-fall in 2022, and things may even get worse in 2023 if a global recession materializes, which I believe is likely.

Source: Drewry

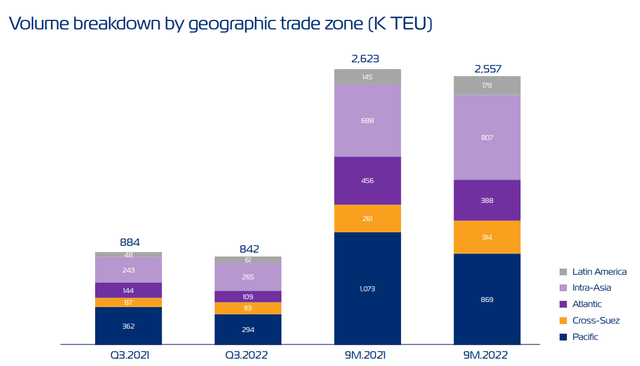

What is concerning to me is that the market has seen a steep decline in cargo freight rates, but ZIM Integrated Shipping Services’ shipping volumes have started to contract as well. In the third-quarter, ZIM Integrated Shipping saw a decline of 5% in shipping volume compared to the year-earlier period, with declines presenting themselves especially in the Atlantic and Pacific trade.

Source: ZIM Integrated Shipping Services

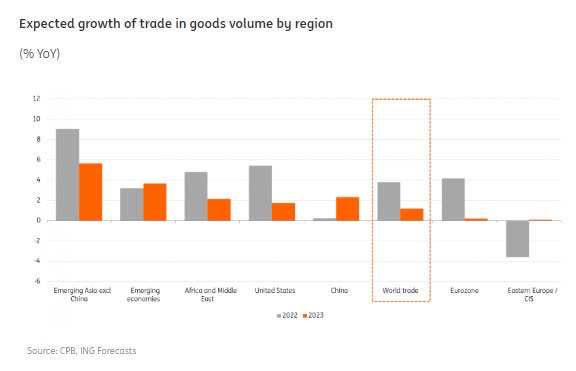

The decline in cargo freight prices and weaker shipping volumes is concerning and indicates more trouble for the industry in 2023. According to bank ING, world trade is expected to contract next year due to a combination of challenges including high energy prices and weakening consumer demand. A recession in FY 2023 likely indicates lower EBITDA and weaker margins for ZIM next year. HSBC recently forecasted that freight rates would bottom out only in mid-2023 and that earnings of shipping companies could drop as much as 80% during an earnings recession. ZIM lowered its EBITDA forecast in Q3’22 by 6% due to sharper headwinds in the shipping industry.

Source: www.hellenicshippingnews.com

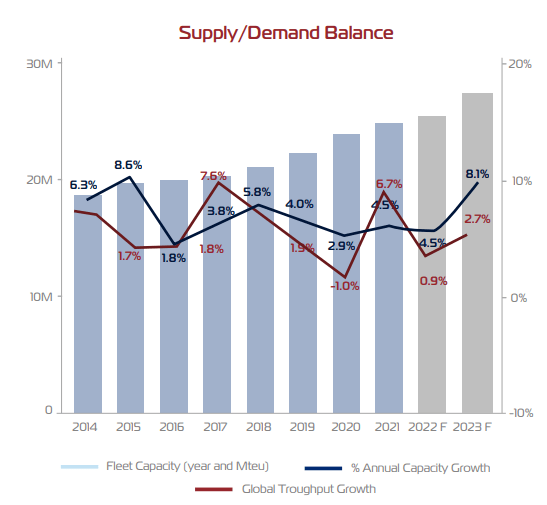

Capacity growth could accelerate market downturn

One of the most compelling reasons to buy ZIM Integrated Shipping Services in the past was the company’s dividend policy which called for the distribution of 30% of its net income. However, with clouds clearly gathering over the shipping economy and new supply expected to hit the market in 2023, ZIM Integrated Shipping’s financial trends may continue their down-trend next year. According to Alphaliner — a data service in the container shipment industry — capacity supply is expected to grow 8% next year which could further pressure cargo freight rates as growing supply comes to market just as consumer demand is expected to continue to recede.

Source: ZIM Integrated Shipping Services

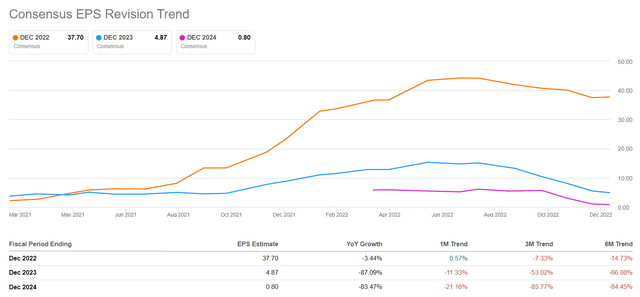

ZIM’s P/E ratio can’t be trusted right now

The shipping industry has material earnings risk as both weaker freight rates and lower shipping volumes are set to further pressure the bottom line of cargo shippers in 2023. The average 2023 earnings estimate for ZIM is $4.87, which implies a year-over-year drop of 87% and a forward P/E ratio of 3.6 X. The earnings estimate trend is very negative, and forecasts for FY 2024 indicate expectations for a deep earnings recession. Based on the FY 2024 EPS estimate of $0.80, ZIM has a P/E ratio of 21.8 X which might make the shipping company still expensive.

Risks with ZIM Integrated Shipping Services

ZIM Integrated Shipping Services has almost no debt which makes the shipping company much better prepared for a cyclical down-turn in the cargo shipping industry than some of its rivals. However, this does not mean investors should rush to buy ZIM, especially because a bottom has not yet materialized for cargo freight rates. The fourth-quarter is also likely to see a continual contraction in shipment volumes. Going forward, investors have to expect material earnings estimate revisions for ZIM and prepare for bad news for the shipping industry, especially related to capacity growth.

Final thoughts

I believe shipping rates could drop back to a level that we haven’t seen since before the pandemic. Shipping rates around $1,000 and below for the shipment of a 40-foot container prevailed then, and there is no reason why cargo freight rates couldn’t drop back to this level in 2023 if the global economy experiences a recession.

For this reason, ZIM Integrated Shipping has likely not seen its lowest price/valuation yet, which exposes investors who “buy the drop” to the risk of catching a falling knife. Given that ZIM Integrated Shipping lowered its FY 2022 EBITDA forecast due to crashing shipping rates, I believe investors may want to wait with buying ZIM until a bottom has emerged in both ZIM Integrated Shipping Services Ltd.’s stock price as well as in cargo freight rates!

Be the first to comment