Diy13/iStock via Getty Images

Utility stocks are often the go-to sector for investors looking for moderate dividend yields with less exposure to cyclical risk factors. Typically, utility companies earn profits consistently since most operate as local monopolies, subject to regulations that nearly guarantee a small profit margin. Utility stocks, such as those in the ETF (NYSEARCA:XLU), are typically more correlated to bonds due to their interest rate sensitivity. Since bonds usually rise as stocks decline, this factor often causes utility stocks to outperform by wide margins during recessions. In fact, the utility sector has outperformed during nearly all recessions over the past forty years.

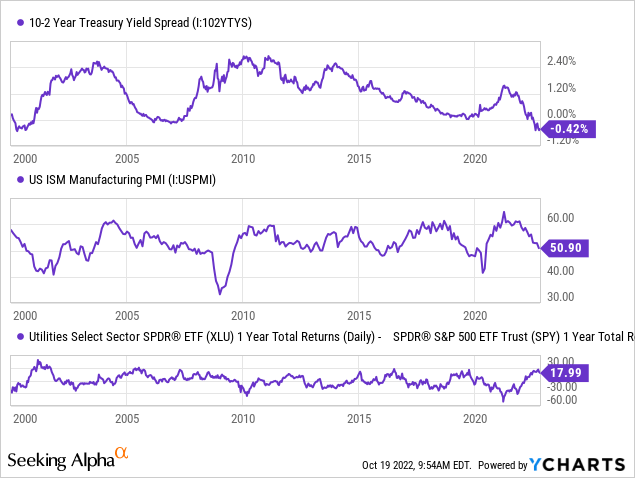

The stock market is in a bear market today while the economy is in a recession if we use the traditional two-quarters negative GDP measurement. The yield curve has become extremely inverted, signaling that the negative economic trend dynamic will likely last. The same is true of the manufacturing PMI – an excellent leading indicator of business growth and decline. See below:

Historically, such as in 2001, the period of 2006-2008, and brief periods in 2016 and 2019, the yield curve and PMI were low, leading to outperformance in the utility sector ETF XLU. This pattern is most prominent in 2001 and today, with the most extreme yield curve inversion combined with a low manufacturing PMI. While XLU has declined by around 10% this year, it has outperformed the S&P 500 by a significant degree due to its somewhat counter-cyclical nature.

Stocks have continued to see the strain and, in my view, based on a wide degree of technical and fundamental factors, believe the stock market has yet to see its final bottom. With that in mind, the utility sector ETF may be seen as a target investment for those wishing to remain long but looking to reduce exposure to further downside risks. That said, I believe the sector faces a few critical risks related to rising inflation and fuel costs and a blue-collar labor shortage. I think these factors may threaten many utility companies’ profit margins, while increasing interest rates may strain valuations. Overall, the utility sector ETF may no longer be the great “safety trade” it has been this year and in historical recessionary periods.

How Safe Are Utility Stocks?

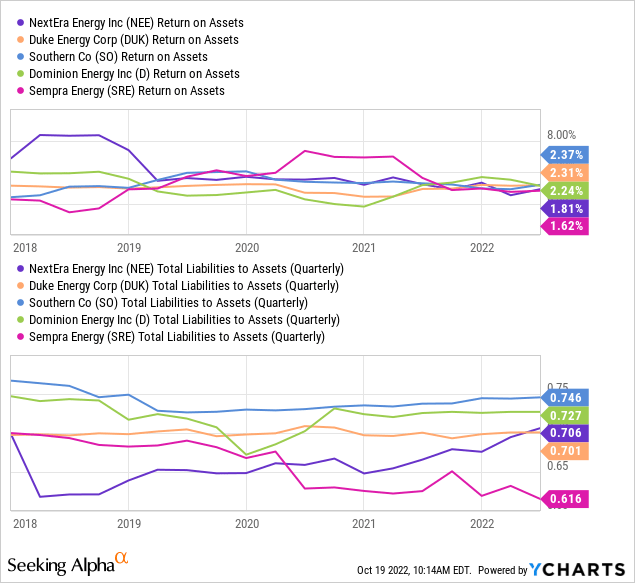

The utility sector operates in a business model outside the general capitalist free-market structure. Technically, they do not and generally cannot earn a profit on the products they sell (water, electricity, etc.) and are supposed to (by regulation) sell products “at cost,” only charging a premium to fund infrastructural investments. Accordingly, most large utility companies earn a return on assets of around 1.5% to 2.5% and magnify those figures for shareholders through debt leverage. Typically, many major utility companies use total liabilities-to-assets of about 70% (meaning equity is leveraged around 3X). See the data for the top five holdings in XLU below:

While “ROA” levels for these firms have fluctuated individually throughout recent years, the average level has almost always been 2.25%. Leverage levels have also fluctuated but still average around 70% liabilities-to-assets across the board. The same can be found if we consider the five remaining top ten firms in XLU, but doing so would obfuscate the chart. This data paints a picture of the certainty and clarity found in most utility stocks. Returns are relatively predictable and constant, mainly if we use an ETF like XLU that averages out idiosyncratic fluctuations.

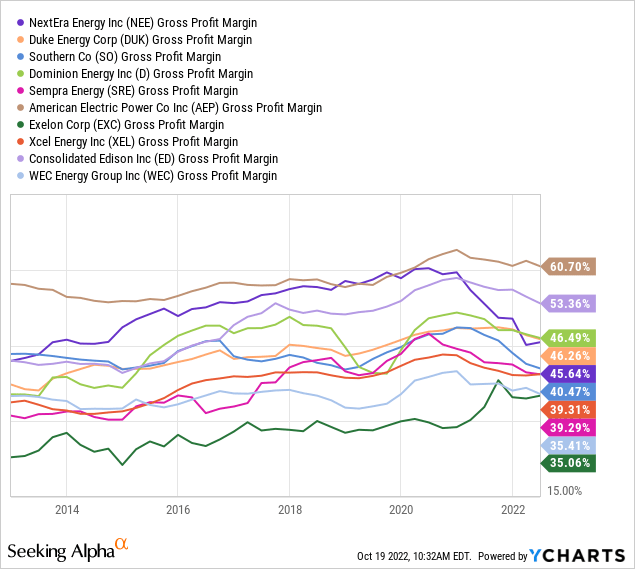

That said, when we take a closer look, there appears to be some strain within many of these firms. Nine of the top ten firms in XLU have seen their gross profit margins decline since 2020. See below:

The slight decline in gross profit margins indicates some strain in funding rising natural gas and other fuel or electricity costs. Even more, most utility companies are experiencing an immense labor shortage, with many skilled workers approaching retirement age and few joining the utility workforce. These rising input costs may strain margins over time as utility companies generally increase prices based on past expenses and not future expected costs. Thus, if input costs rise consistently over time (due to the growing inflationary dynamic), then profit margins can see some strain.

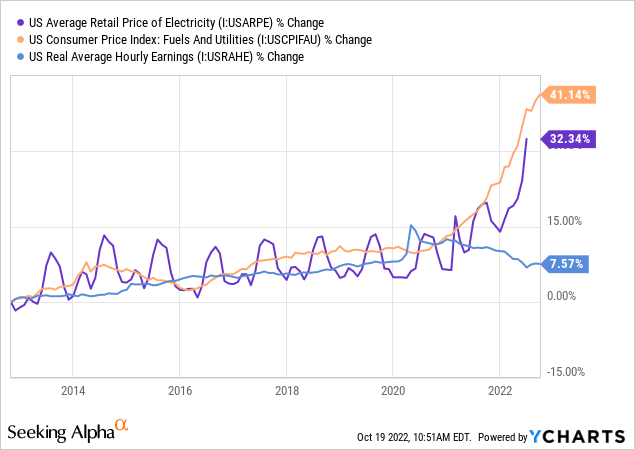

Further, we must consider that electricity prices are rising extremely fast compared to personal wages, making it difficult for some people to pay utility bills. See below:

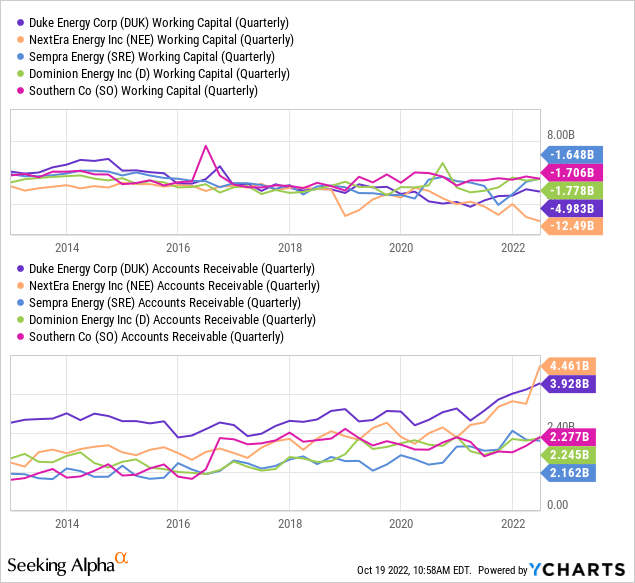

Household utility costs have risen by around 40% since 2020 and have accelerated higher in 2022 due to the sharp rise in natural gas. At the same time, real hourly wages, and the general economic trend, have declined. This situation has caused a surge in the number of Americans behind on utility bills to a record level of 20 million. This situation has led to a relatively sharp rise in accounts receivable for the top two utility giants, Duke Energy (DUK) and NextEra (NEE), combined with rather significant declines in net working capital. See below:

Most utility companies operate with negative working capital, but for some, such as NextEra, negative working capital has become so large that it could create liquidity issues if customers continue not to pay. At this point, the rise in non-paying customers is not so problematic that the financial stability of these companies is at risk. However, a growing portion of income may never become cash flow as rising electricity prices cause many customers to fall behind on utility bills.

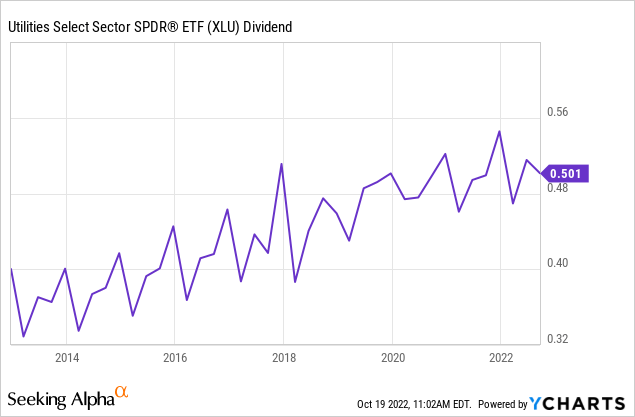

XLU’s dividend has increased at around 2.5% per year over the last decade but has stopped rising since 2020 – just as utility firms experienced margin strain. See below:

XLU’s dividend rose consistently through the 2007-2009 recessionary period but has not increased over the past two and half years. Utility firms see margin strain as fuel prices, labor costs, and, most recently, interest expenses cut into profit margins. Over the long run, utility companies can increase rates to meet fuel and labor costs but have minimal protection against rising interest rates (particularly those with variable or short-term debt). Further, while utility companies can increase rates to meet expenses, that may not improve cash flows if customers fail to pay higher utility bills.

Utility bills have surged around 30-40% over the past two years while economic activity has slowed. If this trend continues, we may see a much more significant increase in non-paying customers, leading to potentially large cash flow and liquidity issues. Utility companies can turn off power to such customers but considering 1-in-6 US households are behind on utility bills, doing so could spur a political and social crisis. As such, utility companies have a relatively high degree of regulatory risk as there is likely to be growing pushback from regulators against rate increases. Some states have already seen calls for utility rate increase moratoriums – a trend that I expect will continue if electricity rates do not slow soon.

Rising Interest Rates Create Valuation Strain

Overall, I believe it is clear that utility companies are unlikely to raise their dividends in line with inflation. Indeed, growing strains may force some to reduce their dividends for a time as cash flows and input costs pressure profit margins. Accordingly, utility companies are not necessarily the “risk-free” investment they were in years past, particularly considering growing global natural gas and fuel shortages.

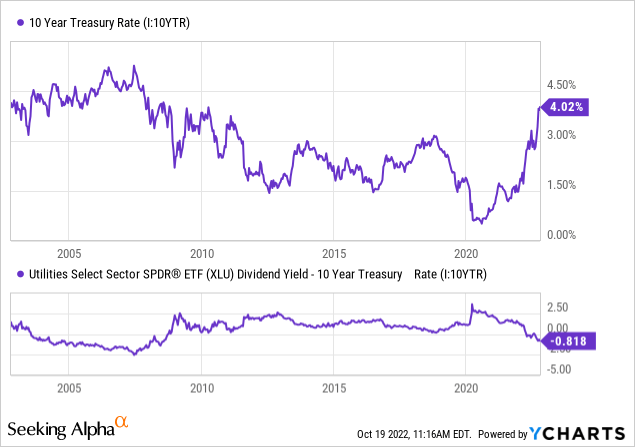

Rising interest rates may lower the fair value of many utility stocks, creating further pressure on utility stock prices. Over the past two decades, XLU’s dividend yield (currently ~3.2%) has averaged very close to the 10-year US Treasury bond yield. Of course, its yield was far above or below that of Treasury bonds during some periods. The 10-year Treasury bond rate is currently at 4%, the highest since the 2000s. XLU’s yield has not kept up with its increase, causing this spread between its yield and that of the Treasury bond to decline to a shallow historical level. See below:

The last time XLU’s dividend yield spread to the Treasury rate was this low was around 2007. XLU lost around 40% of its value over the subsequent two years, eventually causing its yield to be about 2.5% above that of the Treasury bond. In my view, this paints a generally negative outlook for XLU today. The fact that Treasury rates are rising despite the recessionary dynamic (due to stagflation) and XLU’s dividend is no longer keeping up with inflation may exacerbate this pressure.

The Bottom Line

Overall, I am bearish on XLU and believe the fund will decline in value over the coming year. There are two critical reasons for this. One, growing secular forces in the utility industry may cause its cash flows to decline and remain impaired for some time. I believe this is a significant risk as it is very rare for utility companies to experience financial strain. However, with no signs indicating an end to the fuel and labor shortages, I believe utility firms may soon see more significant financial pressure than they have in many decades.

The second reason I suspect XLU will decline is the rise in Treasury bond rates. XLU’s dividend is now well below that of a Treasury bond which is technically a risk-free asset. Considering XLU’s dividend is stagnant, there is little reason to purchase it over a risk-free asset with a higher yield. This risk will increase if long-term interest rates continue to rise, as I suspect, either due to a rise in the yield curve or the inflation outlook (or both).

Finally, if the stock market recovers from now, XLU may not decline but will likely underperform by a large margin, as is historically the case. Utility stocks are typically best during a bear market’s initial phases and worst during recoveries. While I do not believe this bear market is over, it is certainly not in its initial phase and is likely closer to bottoming than it is from peaking (time-wise). Utilities have outperformed this year as expected, but I suspect the sector will decline in line with stocks if it continues or underperform if the bear market ends. As such, I am bearish on XLU and believe it is generally a poor risk-return investment today.

Risk-averse investors may find much better opportunities in inflation-indexed Treasury bonds such as the iShares TIPS Bond ETF (TIP). As detailed in “TIP: US Dollar Liquidity Crisis Signals Bottom In Real Rates,” I believe these Treasury bonds are near their bottom and may pay double-digit yields over the next year (or more) if inflation remains high. Further, Treasury bonds are typically tax-advantaged when it comes to state taxes. In my view, this situation makes TIP a far superior investment to XLU in the current economic environment.

Be the first to comment