Derick Hudson

The following segment was excerpted from this fund letter.

Meta Platforms (NASDAQ:META)

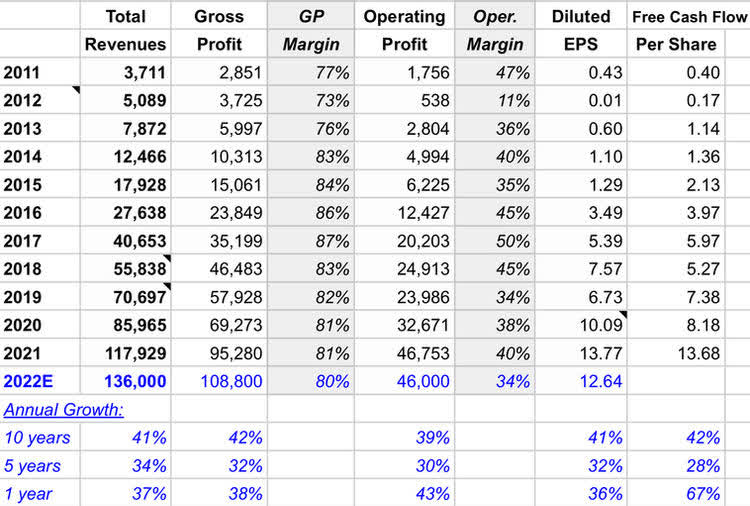

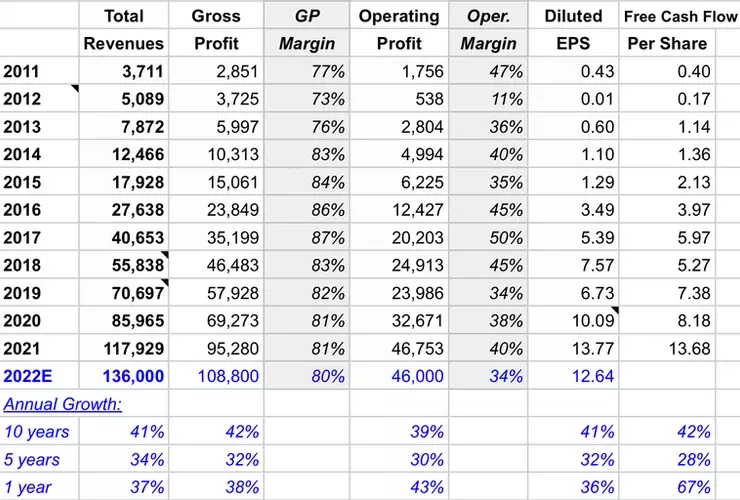

Please take a look at the results below and ask yourself if this would be a good business to be invested in?

-

Total revenues increased 37% in 2021 to $118 billion and are estimated to grow 15% this year

-

Operating profits increased 43% in 2021 to $47 billion (operating margin was 40% — how many businesses do you know that post these kinds of margins?)

-

EPS increased 36% in 2021

-

Free cash flow per share increased 67%

Now let’s take a look at META “The Stock”. It was +33% in 2020 and +23% in 2021, and this year it is down almost -50%. Do the fundamentals of the business (shown above) reflect this kind of volatility?

Now, there are valid concerns around META‘s business like competition from TikTok, Apple (AAPL) privacy update on iOS (reduced effectiveness of targeted ads), and heavy capital investments in the Metaverse (Reality Labs Division).

Meta’s revenue growth slowed to just 7% in recent quarter, and it ramped up its spending at the same time on new short videos for Facebook and Instagram, which could eventually widen its moat against TikTok; and its unprofitable Reality Labs segment, which produces its virtual reality (VR) and augmented reality (AR) devices. The combination of slowing sales and rising expenses spooked investors, and the bears were convinced that Meta’s high-growth days are over.

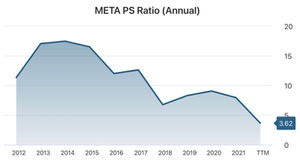

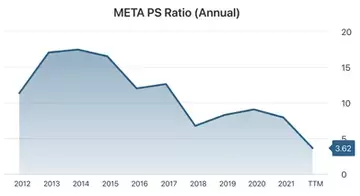

Combine that with the mounting macro concerns and a huge sell-off in growth stocks and we have Meta currently trading like a cyclical energy stock selling at just 14x this year’s earnings and 12x 2023 estimated earnings. In 2021, they generated $13.68 in free cash flow per share, which translates to ~10% free cash flow yield based on trailing numbers (obviously their cash flow can decline). On a price-to-sales basis, stock trading at just 3.6x (see below) — all-time low.

Current market’s expectations for Meta are now so low that any positive development — including a stabilization of its advertising business, tighter spending measures at its Reality Labs division, cooler inflation, or other positive macroeconomic developments — will likely drive its stock higher.

We have owned the stock since 2018 and it had climbed many walls of worries since then, and we believe it will this time as well.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment