97

With market volatility top of mind, some investors may be attracted by defensive sector funds like the Consumer Staples Select Sector Fund (NYSEARCA:NYSEARCA:XLP).

While the XLP ETF’s long-term historical performance has been good, I am concerned about the valuations in the consumer staples sector in general. Furthermore, there are increasing signs of earnings headwind from inflation. Therefore, I am recommending a hold on this ETF.

Fund Overview

The Consumer Staples Select Sector Fund is a quick and easy way for investors to get exposure to companies in the consumer staples sector. It has $15.4 billion in assets.

Strategy

The Consumer Staples Select Sector Fund aims to provide returns that correspond to the Consumer Staples Select Sector Index, which is effectively the Consumer Staples sector of the S&P 500 Index. The index includes companies that are identified as Consumer Staples companies as defined by the Global Industry Classification Standard (“GICS”) and is market cap weighted (larger companies have a larger weight).

Portfolio Holdings

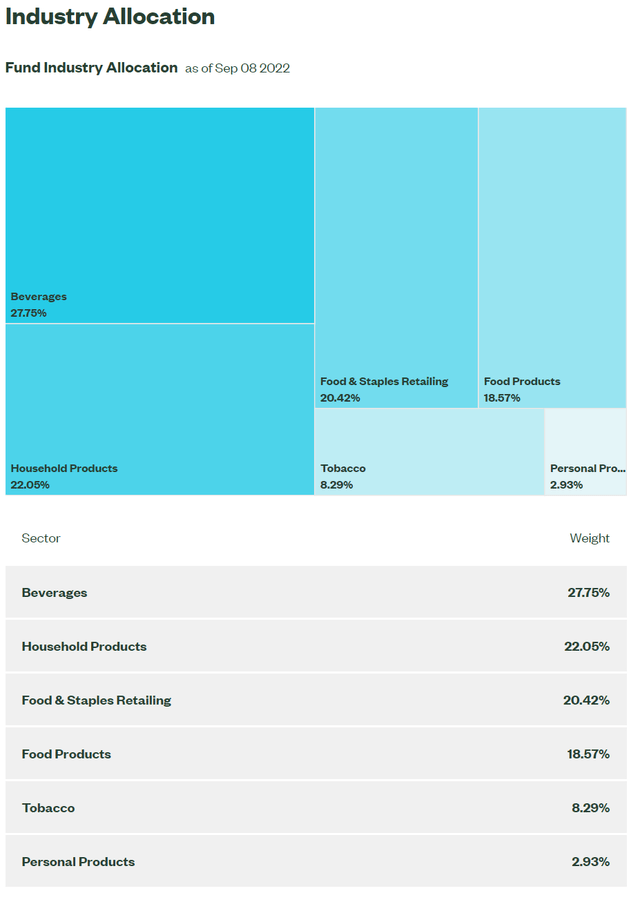

As the name suggests, the fund is made up of companies in the consumer staples sector. Its sub-industry allocation is shown in Figure 1.

Figure 1 – XLP sub-industry breakdown (ssga.com)

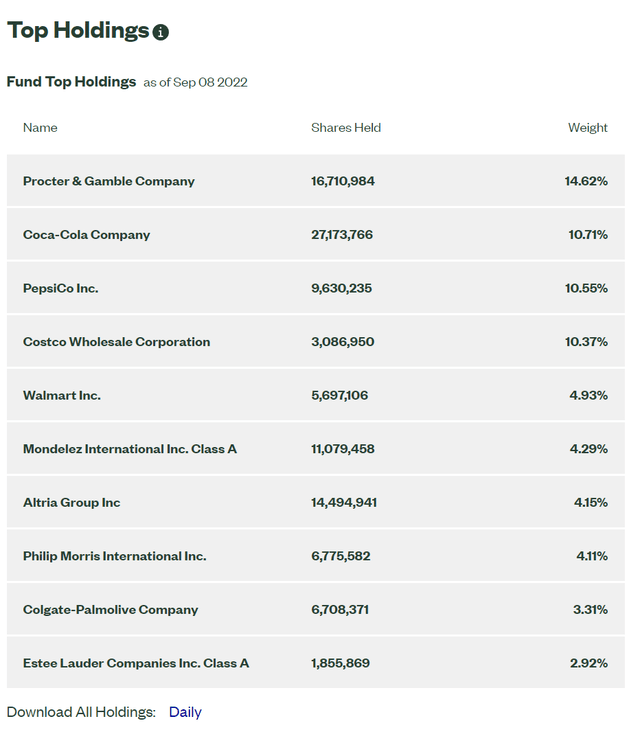

The fund is dominated by four companies: Procter & Gamble (PG), Coca-Cola (KO), PepsiCo (PEP), and Costco (COST), which collectively make up 46% of the fund (Figure 2). The top 10 holdings make up 70% of the fund.

Figure 2 – XLP top 10 holdings (ssga.com)

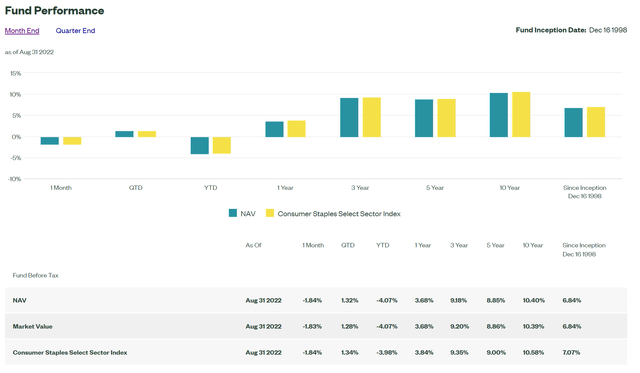

Returns

The XLP ETF has had decent historical returns, with 3/5/10 year annual returns of 9.2%, 8.9%, and 10.4% respectively (Figure 3). This is lower than the S&P’s returns of 12.4%, 11.8%, and 13.1% in the same time frames. YTD, the fund is only down 4.1% vs. the S&P 500 which is down 16.1%.

Figure 3 – XLP historical returns (ssga.com)

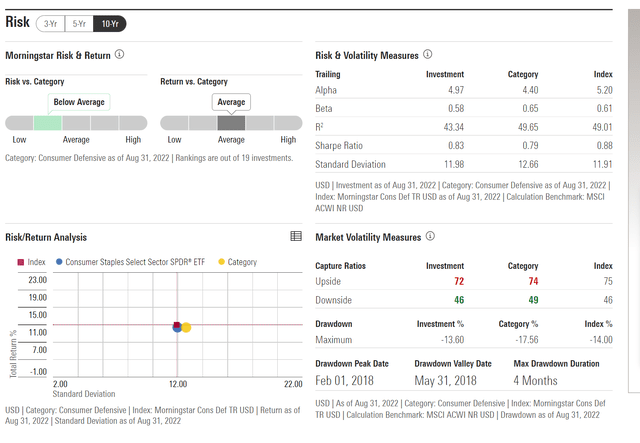

However, the XLP does have significantly lower risk metrics, with 10-Yr Standard deviation (Stdev) of returns at 12.0% and max drawdown of 13.6% vs. the S&P 500 at 14.0% Stdev and a 20.0% drawdown respectively (Figure 4). The XLP has a 0.58 beta to the market.

Figure 4 – XLP risk metrics (morningstar.com)

Distribution & Yield

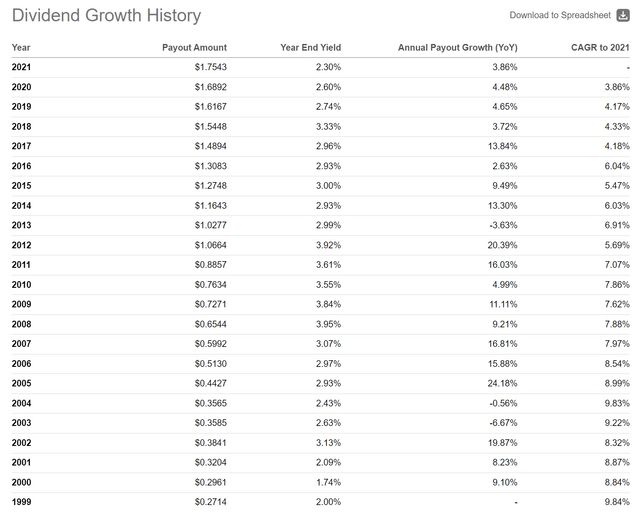

The XLP ETF pays an above market current yield of 2.5% vs. 1.7% for the S&P 500. Its distribution amount is variable and is dependent on the underlying securities. The distribution has been on an upwards trend with a 6% 5-Yr CAGR (Figure 5). The distribution is paid quarterly and the latest distribution amount of $0.5129 / share was paid on June 24, 2022.

Figure 5 – XLP Distribution history (Seeking Alpha)

Fees

The XLP ETF is a low-cost fund, with gross expense ratio of only 0.10%.

Consumer Staples Are Overvalued

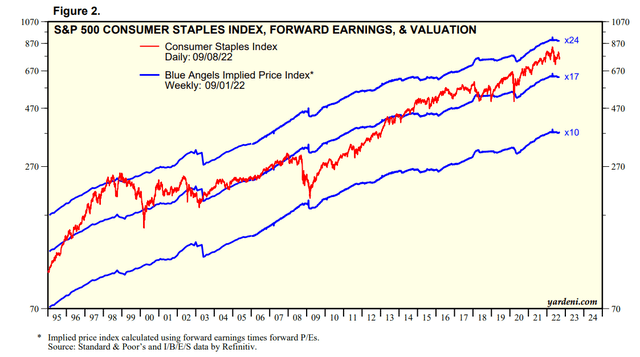

While the XLP ETF has delivered fine historical performance, my main concern regarding the fund is the valuation of the underlying securities. On a forward basis, the consumer staples sector is trading at ~20x P/E, which is high historically. This level of valuation was only exceeded in the late 90s, before the dot-com crash took it much lower.

Figure 6 – Consumer Staples sector valuations (yardeni.com)

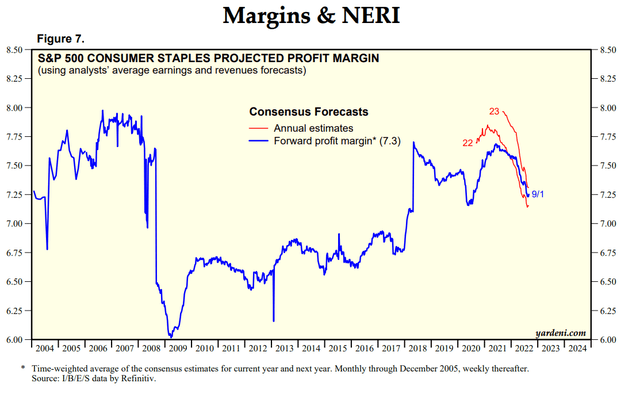

Furthermore, we can see that the XLP’s strong 10-year performance of 10.4% is really a combination of the low starting valuation (P/Es were in the low teens after the Great Financial Crisis in 2008/2009), and expanding profit margins leading to earnings growth (Figure 7).

Figure 7 – Consumer Staples sector profit margins (yardeni.com)

Earnings Headwind From Inflation

Unfortunately, future returns may be harder to come by. First, as we mentioned above, valuations are ~20x now vs. 12x a decade ago. More importantly, profit margins, and hence earnings growth, is under pressure from soaring inflationary pressures.

For example, take the recent earnings release from Clorox (CLX). Clorox’s FY2022 gross margins fell 780 basis points to 35.8% on the back of higher manufacturing (i.e. labor), logistics (supply-chain), and commodity costs (energy, raw material inputs). 35.8% is the lowest gross margin the company has ever reported, judging from the data from roic.ai that goes back to 1986!

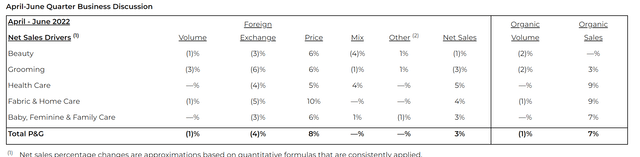

Furthermore, consumers are increasingly switching to private label brands, as their wallet gets squeezed from inflation. From Procter & Gamble’s latest earnings report, we see a worrying trend of name brand manufacturers trading volumes for price increases (Figure 8).

Figure 8 – P&G Q4 volume vs price summary (pginvestor.com)

While taking price works in the short-term in maintaining sales growth and margins, if inflation persists, there may come a point when incremental price increases will lead to net sales declines, as consumers are increasingly forced to switch to private label products or trade down to cheaper products.

Realistically, do we really need to buy bleach from Clorox, or will private label bleach that’s 30% cheaper do the job?

Conclusion

The Consumer Staples Select Sector Fund is a solid defensive fund that may appeal to investors worried about market volatility. It has delivered good long-term historical performance, with an above market yield. However, I am concerned about the valuation of the consumer staples sector, which may not bode well for future returns. Furthermore, there are increasing signs that consumers are switching away from name brands, which may hurt consumer staples companies’ ability to offset inflation. Therefore, I am recommending a hold on this ETF.

Be the first to comment