benkrut

The loan growth of Midland States Bancorp, Inc. (NASDAQ:MSBI) will likely decelerate in the second half of 2022 partly due to high interest rates. Nevertheless, acquisition plans and initiatives will likely keep loan growth at a decent level. Further, the net interest margin will likely continue to expand in the remainder of the year thanks to the large balance of variable-rate loans. As a result, I’m expecting earnings to grow by 5% year-over-year to $3.75 per share in 2022. Compared to my last report on the company, I’ve increased my earnings estimate mostly because I’ve revised upwards the loan growth estimate. For 2023, I’m expecting the company to report earnings of $3.82 per share, up 1.8% year-over-year. The year-end target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Midland States Bancorp.

Loan Growth to Decelerate

Midland State Bancorp’s loan portfolio grew by 11% in the first half of 2022, or 22% annualized, which beat my expectations. Loan growth will most probably slow down in the second half of the year due to heightened interest rates. As interest rates are likely to start declining after a year, potential borrowers are likely to put off less urgent plans until borrowing costs are lower. Further, loan growth will decelerate as loan pipelines are not as plump as before. The management mentioned in the latest conference call that the loan pipeline remained strong but smaller than it was at the start of the second quarter.

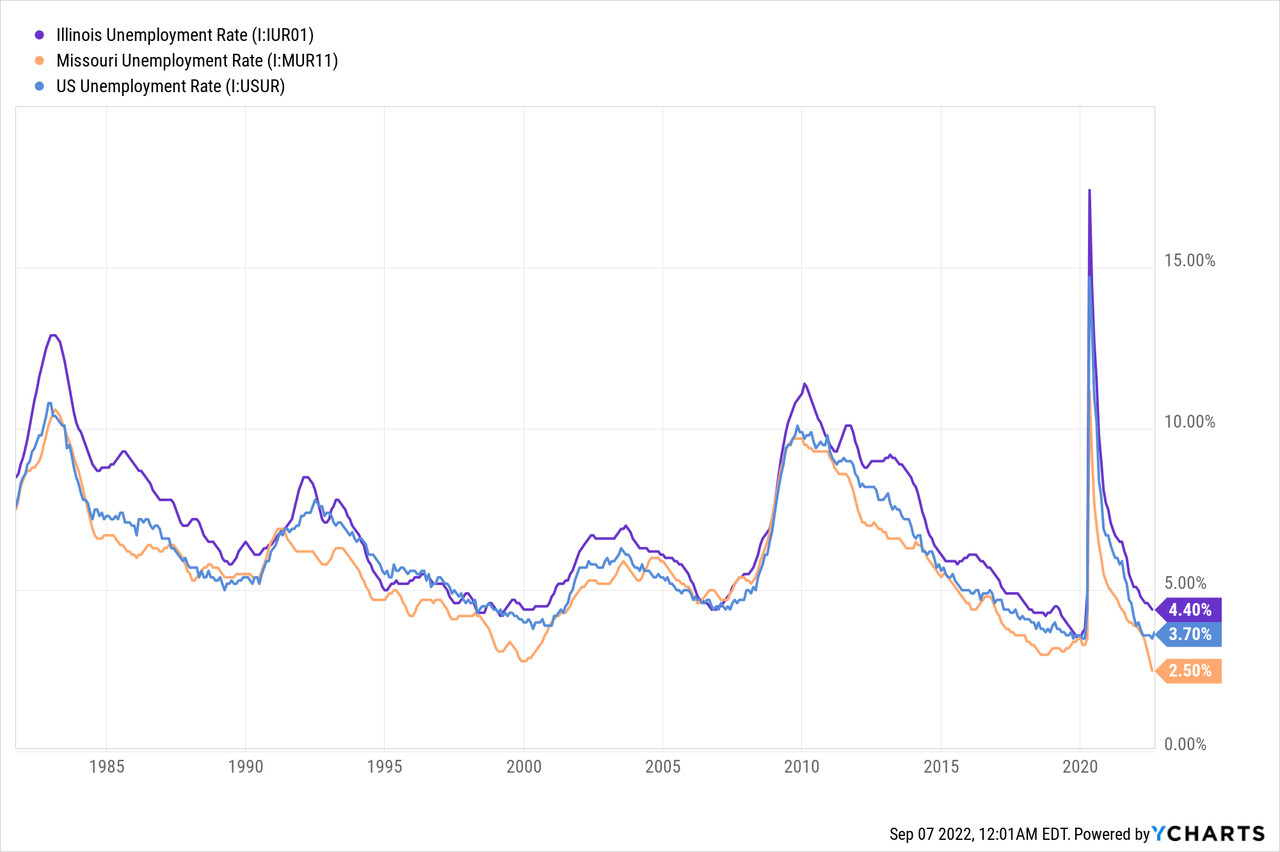

Meanwhile, economic factors paint a mixed picture for the loan growth outlook. Midland State Bancorp’s loan portfolio is mostly concentrated in commercial real estate loans (“CRE”). Further, the company mainly operates in Illinois and Missouri. While Missouri’s job market is much stronger than the national average, Illinois’s labor market is much weaker.

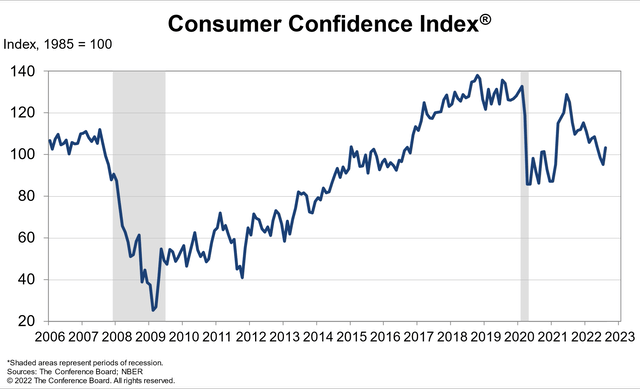

Midland States Bancorp also has a sizable consumer portfolio under the brand name of GreenSky. Apart from the unemployment rate, the consumer confidence index is a good gauge of consumer loan demand. The index grew by 8% month-over-month in August 2022, according to the Conference Board.

The Conference Board

The lukewarm outlook on organic loan growth will likely be compensated by M&A growth. Midland States Bancorp has historically relied on acquisitions for growth. The company has made 16 acquisitions since 2008, as mentioned in the September presentation. Accretive acquisitions remain a core growth strategy for the company this year, as can be gleaned from the presentation.

Loan growth can also receive a boost from the newly launched banking-as-a-service, BaaS, initiative. Midland States Bancorp is currently making efforts to partner with different fintech companies. The management expects this initiative to bear fruit in 2023, as mentioned in the conference call.

Considering these factors, I’m expecting the loan portfolio to grow at an annualized rate of 8% every quarter till the end of 2023. Compared to my last report on Midland States Bancorp, I haven’t changed my loan growth estimate for the second half of 2022. However, I have significantly increased my earnings estimate for the full year because loan growth surprised me in the first half of the year.

Topline is Only Moderately Rate-Sensitive

Around 55% of the loan portfolio is based on fixed rates with the remaining being variable, as mentioned in the conference call. Therefore, the average loan yield is only moderately rate-sensitive. The liability side is also moderately rate-sensitive. Deposits that reprice regularly, namely interest-bearing checking, money market, and savings accounts, made up 58% of total deposits at the end of June 2022.

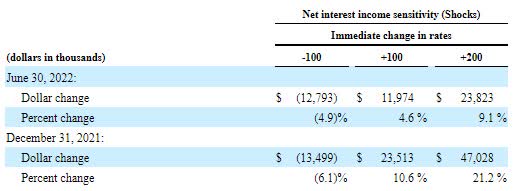

The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing showed that a 200-basis points hike in interest rates could boost the net interest income by 9.1% over twelve months. However, the model incorporates an immediate change in rates. In reality, the rate hikes this year have been gradual; therefore, the impact will be less than 9.1%. The topline’s rate sensitivity has considerably declined over the last six months, as shown by the results of the management’s rate sensitivity analysis given below.

2Q 2022 10-Q Filing

Considering these factors, I’m expecting the net interest margin to increase by 15 basis points in the second half of 2022 before stabilizing in 2023.

Above-Normal Provisioning to Restrict Earnings Growth

Provisioning for expected loan losses will likely keep earnings growth in check. The anticipated loan additions will likely drive provisioning. Further, the existing loan portfolio will also likely result in higher provisioning. Non-performing loans were 0.98% of total loans, while allowances were 0.95% of total loans at the end of June 2022. As there were more non-performing loans than allowances, Midland States Bancorp will likely have to significantly build up its loan loss reserves in the coming quarters.

Overall, I’m expecting the net provision expense to make up 0.47% (annualized) of total loans in the second half of 2022. For 2023, I’m expecting the net provision expense to make up 0.37% of total loans, which is the same as the last five-year average.

Expecting 5% Earnings Growth

The anticipated loan growth and margin expansion will likely drive earnings growth this year. On the other hand, higher provisioning will likely limit earnings growth. Overall, I’m expecting Midland States Bancorp to report earnings of $3.75 per share for 2022, up 5% year-over-year. For 2023, I’m expecting earnings to grow by a further 1.8% to $3.82 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||

| Income Statement | ||||||||

| Net interest income | 180 | 190 | 199 | 208 | 250 | 280 | ||

| Provision for loan losses | 9 | 17 | 43 | 3 | 24 | 24 | ||

| Non-interest income | 72 | 75 | 61 | 70 | 60 | 54 | ||

| Non-interest expense | 192 | 176 | 185 | 175 | 174 | 196 | ||

| Net income – Common Sh. | 39 | 55 | 22 | 80 | 84 | 85 | ||

| EPS – Diluted ($) | 1.66 | 2.26 | 0.96 | 3.57 | 3.75 | 3.82 | ||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||

In my last report on Midland States Bancorp, I estimated earnings of $3.37 per share for 2022. I’ve increased my earnings estimate because I’ve raised my loan growth estimate following the second quarter’s performance. Further, I’ve decreased the non-interest expense estimate following the slash in expenses during the first half of the year.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Maintaining a Buy Rating Due to a High Total Expected Return

Midland States Bancorp is offering a high dividend yield of 4.7% at the current quarterly dividend rate of $0.29 per share. The earnings and dividend estimates suggest a payout ratio of 30% for 2023, which is below the 2018-2021 (excluding 2020) average of 43%. Although the payout ratio suggests there is room for a dividend hike, I have incorporated no change in the dividend level for my investment thesis to remain on the safe side.

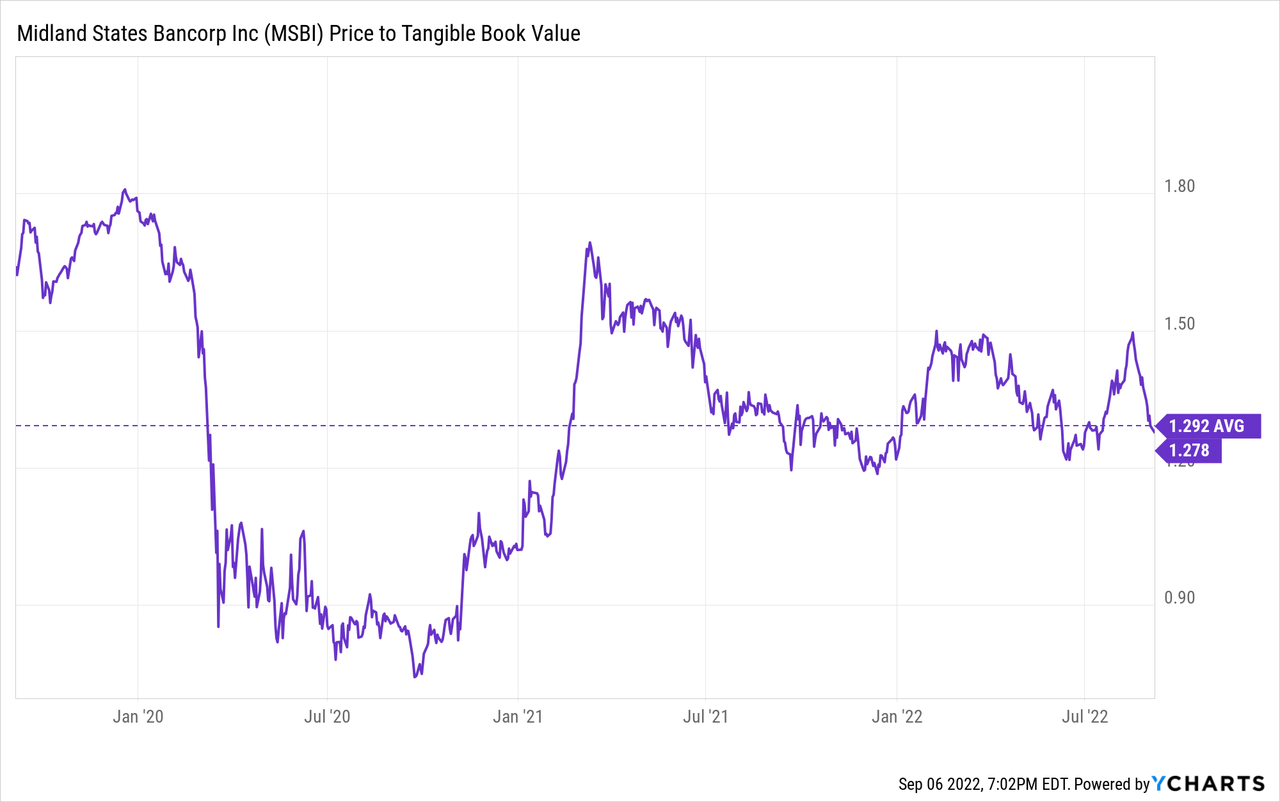

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Midland States Bancorp. The stock has traded at an average P/TB ratio of 1.29 in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $21.4 gives a target price of $27.7 for the end of 2022. This price target implies a 12.3% upside from the September 6 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.19x | 1.24x | 1.29x | 1.34x | 1.39x |

| TBVPS – Dec 2022 ($) | 21.4 | 21.4 | 21.4 | 21.4 | 21.4 |

| Target Price ($) | 25.6 | 26.6 | 27.7 | 28.8 | 29.8 |

| Market Price ($) | 24.7 | 24.7 | 24.7 | 24.7 | 24.7 |

| Upside/(Downside) | 3.6% | 8.0% | 12.3% | 16.7% | 21.0% |

| Source: Author’s Estimates |

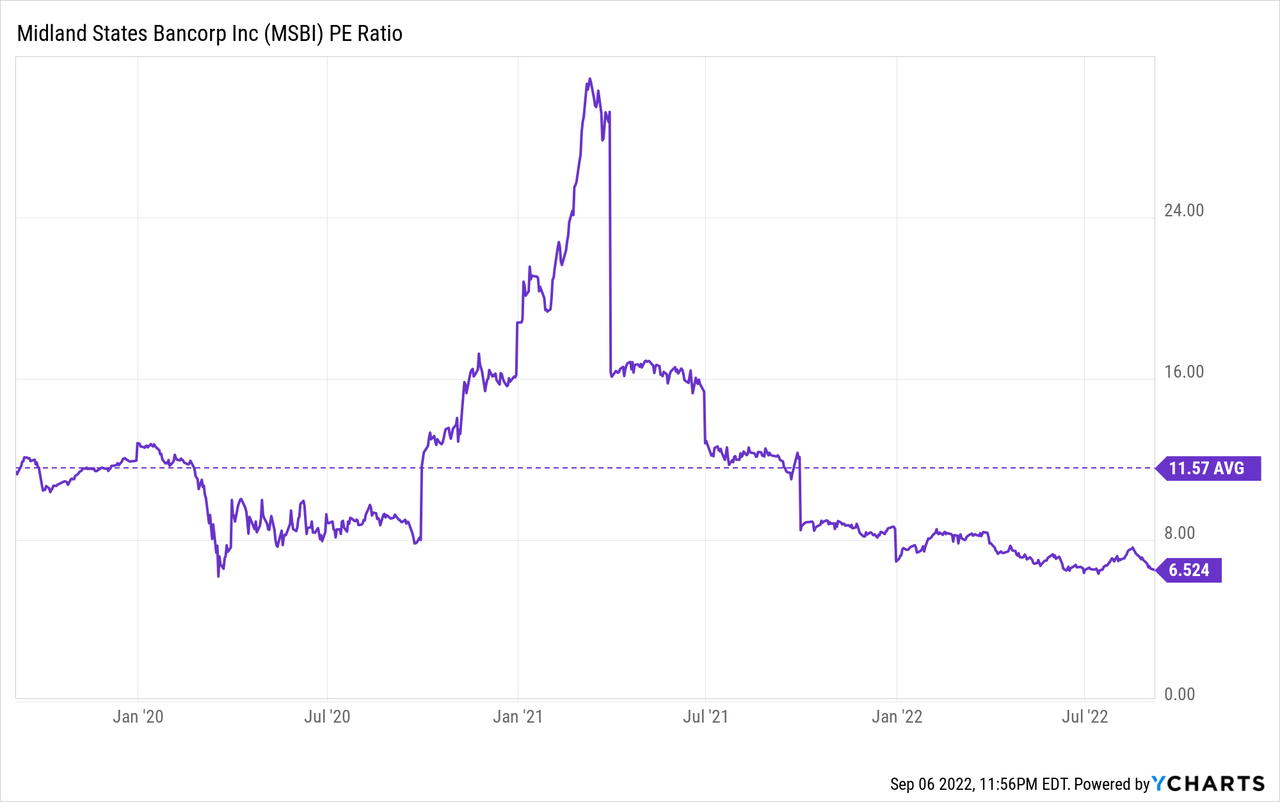

The stock has traded at an average P/E ratio of around 11.57x in the past, as shown below. Excluding the outlier in the early part of 2021, the P/E multiple has tended towards 10.0x in the past.

Multiplying the average P/E multiple with the forecast earnings per share of $3.75 gives a target price of $37.5 for the end of 2022. This price target implies a 52% upside from the September 6 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.0x | 9.0x | 10.0x | 11.0x | 12.0x |

| EPS 2022 ($) | 3.75 | 3.75 | 3.75 | 3.75 | 3.75 |

| Target Price ($) | 30.0 | 33.7 | 37.5 | 41.2 | 45.0 |

| Market Price ($) | 24.7 | 24.7 | 24.7 | 24.7 | 24.7 |

| Upside/(Downside) | 21.6% | 36.8% | 52.0% | 67.2% | 82.5% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $32.6, which implies a 32.2% upside from the current market price. Adding the forward dividend yield gives a total expected return of 36.9%. Hence, I’m maintaining a buy rating on Midland States Bancorp.

Be the first to comment